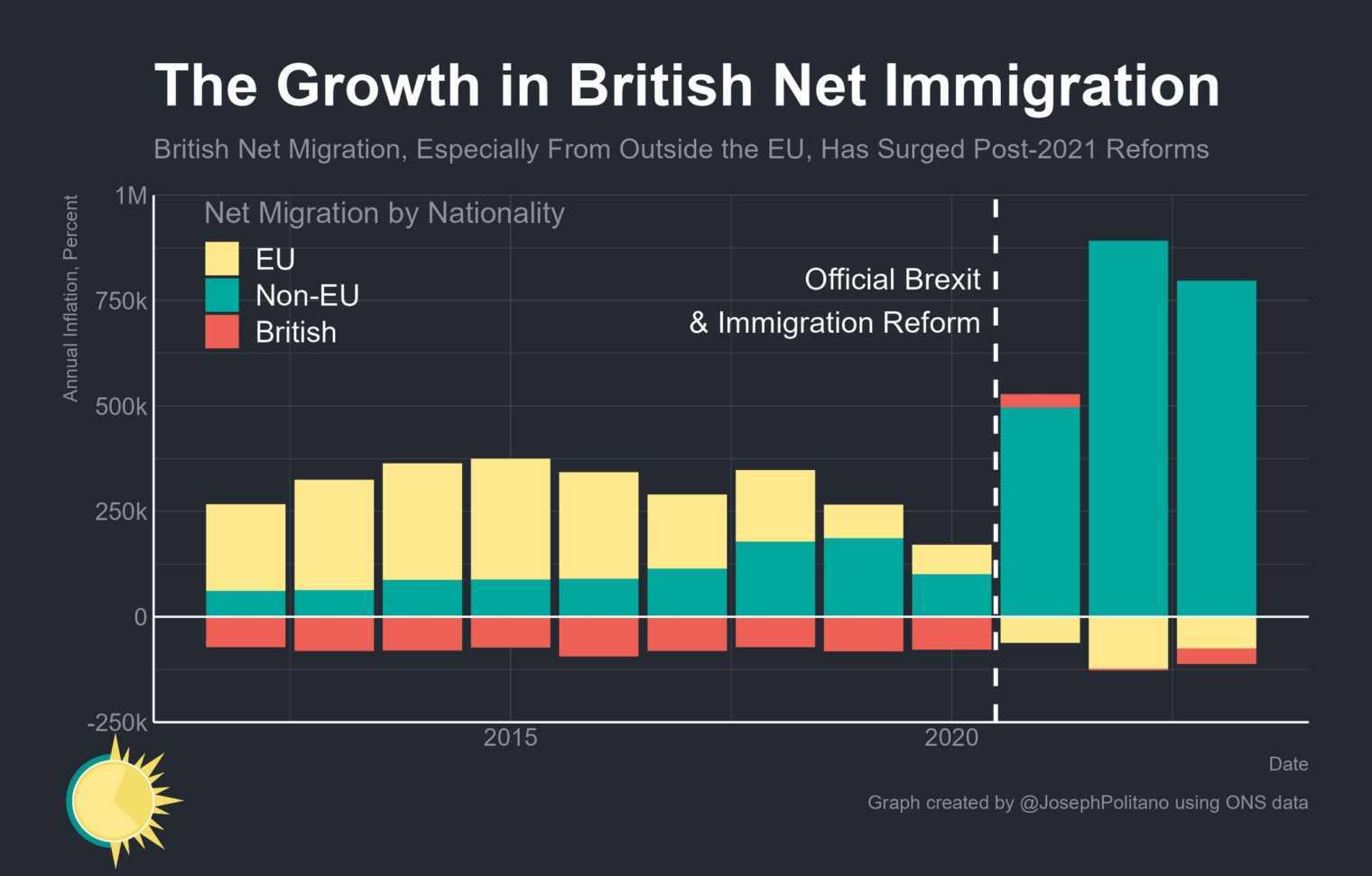

The British voted for Brexit and Conservative rule so that they wouldn’t be replaced by low-skill migrants. Rather than say “Sorry, asylum is no longer available in the UK,” the government that they elected presided over record-high immigration, but no longer of skilled carpenters from Poland and math wizards from Hungary (Wikipedia says “Net migration into the UK during 2022 is reported to have reached a record high of 764,000”).

So perhaps it isn’t surprising that the handful of non-immigrant voters left in the UK booted the Conservatives out. (Note that Labour won 34 percent of the vote, which means they’re far less popular among Brits than Hamas is among Palestinians. (BBC: “The latest survey in June said that almost two-thirds of Gazan respondents were satisfied with Hamas – a rise of 12 points from December – and suggested that just around half would still prefer Hamas to run Gaza after the war ends, over any other option.”))

But what will the Labour Party do? Could Labour conceivably further expand low-skill immigration? Britain is already an Islamic country if we measure by the number of hours devoted to religious activity. How about taxes? Britain offers low taxation for those who start and run companies (see Move to the UK if you’re an entrepreneur? (10 percent capital gains tax)). Will Labour raise those rates? The UK is kind of a basket case economically (maybe a year of coronapanic lockdowns and restrictions wasn’t such a great public health idea, given that wealth and longevity are correlated?). Can an underperforming economy like the UK’s be squeezed to send more tax revenue to Labour’s wise central planners in London?

In the UNESCO World Heritage town of Guimarães, Portugal we found that popular enthusiasm for seizing the means of production was still alive in Europe:

But how could the means of production be seized in the UK when the country hardly produces anything anymore?

The Labour Party’s platform says what they want, but not how they’ll do it:

In their “first steps” document, they actually sound rather, um, conservative in many respects:

They’re going to secure the border and get tough on criminals while keeping taxes low! What did the “Conservative” party actually do, then?

I think that steps 1, 3 and 5 would make it on US conservative Republican political program.

What about Ukraine? I assume that Labor is not in same bed with national capitalist reformer president for life Putin.

Nothing about Middle East? already better then US Democrats

The Middle East was certainly not mentioned because the Labour leadership’s support for Israel was opposed by some Muslim voters and other terrorist sympathisers who might otherwise have supported Labour, and actually cost at least 2 seats. A major part of the overhaul of the Labour party since 2019 was removal of antisemitic (anti-Zionist?) elements, including the former leader. The current leader’s wife has Jewish heritage and the family take Friday Night dinner, but that may be unrelated.

The Labour platform was designed to avoid promising anything apart from not being the Conservatives, which you might think was impossible to avoid fulfilling; but we may soon enough be reminded of the football chant that celebrates a dire opposing team “Are you Scotland in disguise?”.

One area where Labour can attempt what was politically impossible for the Conservatives, a Nixon-goes-to-China scenario, is the necessary radical reform of the health system’s finances. The first test for the new Health Secretary, a fan of the system in Singapore, will be the absurd pay demand that has brought “junior” doctors out on strike.

Hoping they raise taxes on the rich, who didn’t really earn it, and shower the proceeds on the majority of hard-working folks. Also, a four da work week and retirement mandated at 50.

For hardworking folks, 4 day workweek.. retirement at 50.

Did you mean to write “for hardly-working folks?

I presume early retirees will also need income for travel, during lo g weekends and after 60, and other luxuries? Or do you suggest to house them in 15-minutes neighborhoods? If later then the royals will their Australia penal colonies were way more humane.

perplexed: I don’t think that taxing the rich can work in the UK because, unlike the US, the UK doesn’t tax citizens who’ve moved to another country. A rich Brit always has the option to move to a low-tax or no-tax country and stop paying anything to the UK. He/she/ze/they could move to Italy, for example, and pay 100,000 euros per year on an unlimited amount of income. Or copy the Irish/English rock stars and move everything into a Dutch offshore trust. Like other countries in that part of the world, the only way to fund dreams of Bigger Government is to stick it to the peasants with a value-added tax.

Phil, thanks for highlighting that tax escape hatch for the idle rich. Labor should clearly close the door on that scam first thing.

Philip, they can try… UK has largest debt to GDP ratio, dwarfing even US, and unlimited liabilities to fund sinking government health program. Labor said they going to reduce wait for medical procedures, hire teachers… The say nothing how they are planning to raise money. More debt?

Anon: Supposedly there are only three countries that tax citizens who aren’t resident. These are the U.S., Eritrea, and Myanmar (source: https://en.wikipedia.org/wiki/Expatriation_tax ). I’m not sure what stops UK/European nations from going the U.S./Eritrean route.

The U.S. clearly needs to do much more in terms of aggressive taxation of the idle rich like Musk, Bezos etc. These guys are like the robber barons of a hundred years ago and should be aggressively taxed so they earn the same as hard-working folks.

Anon: No need to wait for the entire country to come around to your point of view. This can be done in California immediately. The state has one-party rule and even the rich residents agree that inequality is bad. California is sovereign and can impose any taxes that it deems fair, including a wealth tax.

“I’m not sure what stops UK/European nations from going the U.S./Eritrean route.”

You forgot Myanmar! One of the things that stops them is Ireland. All reach Europeans can move to Ireland.

Britain seems to suffer from the same issues as the rest of western Europe, an aging population unable to finance the ever popular welfare state, in the case of Britain NHS. And therefor the need to open immigration to younger workers from very different societies. And it seems that forced to choose between the loss of free stuff or the loss of traditions and culture the Brits and the rest of western Europe will choose free stuff over culture and traditions.

JDC: Brilliant minds do assert that a flood of low-skill immigrants can shore up a welfare state’s finances, but where has it actually happened? What’s an example of a country with a cradle-to-grave welfare state that has experienced a lower debt-to-GDP ratio, for example, after a period of open borders?

“The fiscal impact of immigration to welfare states of the Scandinavian type” (2017) says “The main conclusion is that immigrants from Western countries have a positive fiscal impact, while immigrants from non-Western countries have a large negative one, which is also the case when considering only non-refugee immigrants.” https://link.springer.com/article/10.1007/s00148-017-0636-1

Nearly all of Britain’s immigrants recently are from the “very different societies” that you mention. So they’re not going to “finance the welfare state” as you say, but drain it (if the above-cited paper is correct).

https://tradingeconomics.com/united-states/government-debt-to-gdp

shows a rise in US federal debt to GDP from about 37 percent of GDP in 1970 (when JFK’s/Lyndon Johnson’s open door for non-Europeans began to take effect) to about 120 percent today.

I heartily question assumption that these non-EU migrants will be net taxpayers. On the whole, it seems that most of them will be burdens on the system, while many Britons are leaving (LinkedIn tells me that many take teaching jobs in the Middle East). In New York, less than 2% of the migrants even applied for work permits:

https://nypost.com/2023/11/10/metro/2-of-the-140k-migrants-who-came-to-nyc-have-applied-for-work-permits/

What actually is the purpose? Neil Oliver discusses it (but doesn’t seem to offer a concrete reason):

There is immense wealth in the UK (and same in U.S.) that can and should be taxed and/or transferred by government to hard-working folks. Think of the immense assets of Warren Buffett, who will never pay any taxes on it (and who frequently discusses minimizing the taxes of Berkshire Hathaway). The idle rich should have their assets taxed at 90%+ rates to eliminate government debt and to be fair to hard-working folks.

Anon: I’ll repeat my response to your similar statement in another comment…

No need to wait for the entire country to come around to your point of view. This can be done in California immediately. The state has one-party rule and even the rich residents agree that inequality is bad. California is sovereign and can impose any taxes that it deems fair, including a wealth tax.

Anon, someone already implemented your idea in the past. Lenin for example, and it was start of huge famine in former USSR, from which USSR never really recovered. In the West Hitler did similar thing, but only to Jews. This helped to finance WWII but failed to stabilize German economy. https://en.wikipedia.org/wiki/Judenverm%C3%B6gensabgabe

Actually it was just most recent example of expropriation of property of Jews in Europe.

It usually failed, with expelled Jews being invited back when money run out.

You think it would work better if executed in equatable manner, when al wealthy people of all ethnic/religious backgr6unds are expropriated?

What the conservatives did, was asked.

Boris Johnson made an emergency expedition to keep the war in Ukraine going.

Liz Truss made a libertarian budget that resoundingly failed (at a guess UK companies and government strongly preferred the sweet embrace of corporatism).

I’m not sure what, if anything, Rishi Sunak actually did now that I think about it.