“Home Unaffordable Home” (Harvard Magazine, Nov-Dec 2024, remarkably un-paywalled) is an interesting window into the minds of the elite.

If present trends continue, nearly every American will become eligible for taxpayer-subsidized housing (not “welfare”, certainly!):

In many metropolitan areas, the annual income required to afford the median-priced home exceeds $150,000, about double the national median income of $75,000. Among renters, the number of cost-burdened households—those spending more than 30 percent of income on housing and utilities—in 2022 hit a record high of about 22 million, of which middle-income households represent an increasing share. Rental assistance, reserved for the lowest-income households, cannot keep up with demand: between 2001 and 2021, the number of assisted households increased by 0.9 million, while the number of income-eligible renter households rose by more than 4 million.

The “housing crisis” was intensified by Coronapanic:

The current housing crisis is broader than prior episodes, according to JCHS managing director Chris Herbert, Ph.D. ’97, who says, “For many years, housing affordability was really a problem of the poor.” Even when home mortgages became unaffordable for moderate-income earners—for example, as interest rates rose into the double digits in the early 1980s—rents did not rise in lockstep. The same was true during the housing bubble of 2006 and 2007: rents remained affordable, and home purchases by would-be first-time buyers could be deferred until the cost of borrowing moderated.

But after the Great Recession that began in 2008, he says, “Rents started to grow astronomically, faster than incomes, and we went from about 39 percent of renters cost-burdened in 2000 to 50 percent in the early 2020s.” In high-cost cities such as Boston, Washington, and San Francisco, people working year-round at decent jobs—making perhaps $50,000 a year—could no longer find a place to live that fit within their budget. Initially, says Herbert, this broadening of unaffordability into the ranks of the middle class was confined to rental properties. Homeownership remained within reach thanks to historically low mortgage interest rates.

During the pandemic, though, both housing prices and rents spiked. “We had an enormous demand for housing,” he notes, “and people weren’t spending money on anything else. Home became all-important.” Interest rates were low, and twenty-somethings who had been renting with roommates suddenly realized “they needed their own place to work from home.” They flooded into the market, pushing up prices of houses and apartments alike to new multiples of median income.

Could the problem be that U.S. population was 226 million in 1980 and it is now 338 million? (the growth is almost entirely because of low-skill immigration; native-born Americans can’t have big families because they can’t afford housing (see above) and they aren’t willing to pack 6 people into a 2BR apartment; see “Recent Immigration Surge Has Been Largest in U.S. History” (NYT), for example, regarding the Biden-Harris years) Harvard doesn’t consider this possibility. The words/phrases “immigration” and “population growth” don’t appear in the article.

Despite the fact that population growth isn’t mention, Harvard says that we need to learn to live like the Shanghainese and Israelis:

Adjusting for inflation, the cost to build a house today is about the same as it was 40 years ago. But inflation-adjusted prices have nearly doubled because there is not enough buildable land to satisfy demand. “We can’t make more land,” Herbert points out, “but we can make better use of it by increasing the density of housing…putting four units on a lot instead of one. So zoning reform gets a lot of attention as a means of increasing housing production.”

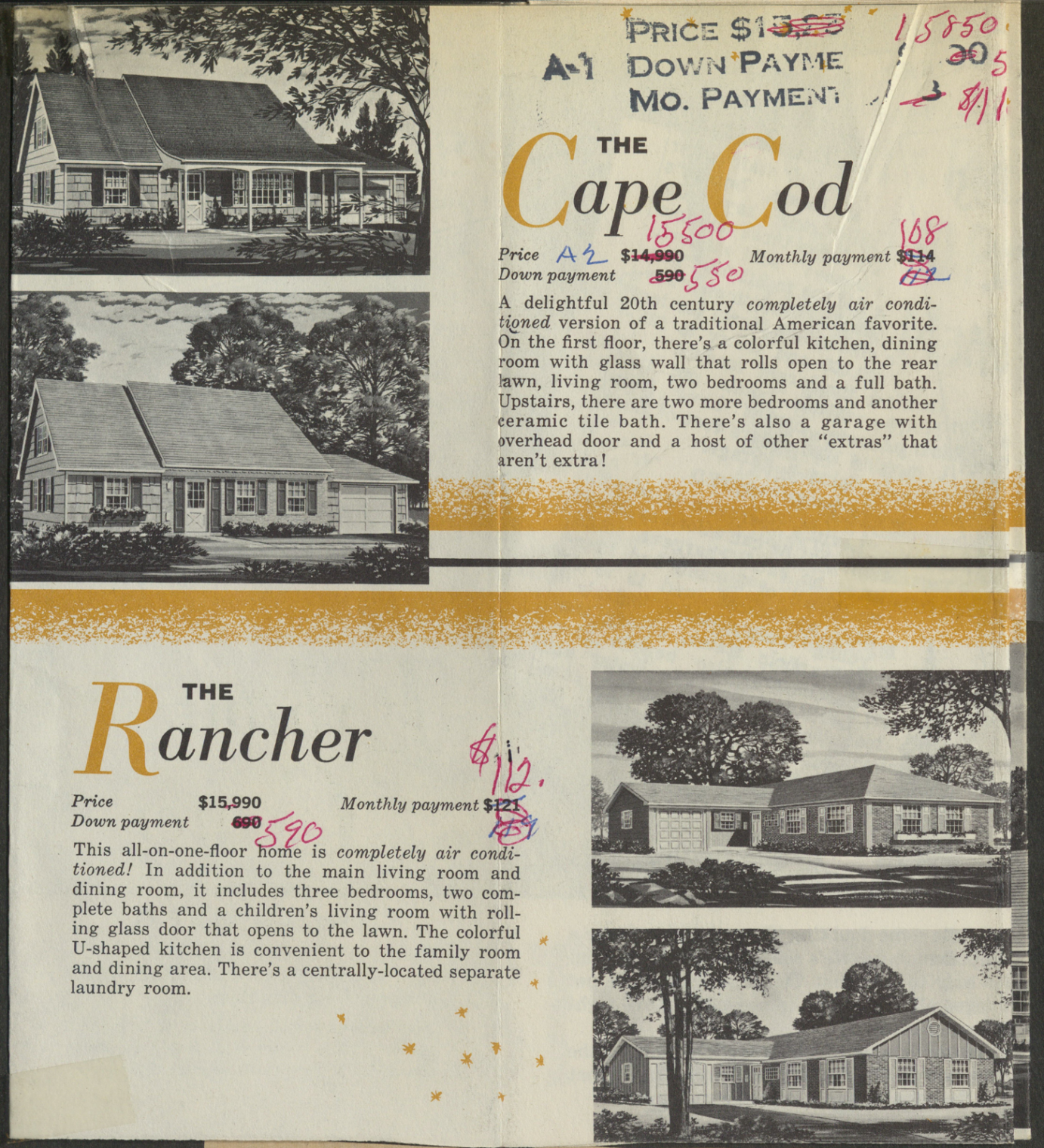

Can Harvard’s statement that housing isn’t more expensive to build be correct? My parents bought a brand-new three-bedroom house with central AC in the D.C. suburbs in June 1962 for about $15,990 (previous post). Adjusted to Bidies at official CPI, that’s about $167,000 today. If we assume that the land underneath the house was worth 15 percent of the total, the cost of building the house was no more than about $125,000 in 2024 Bidies (that would give the developer roughly 10 percent profit). I would love to see someone build a normal-sized house today, even to the lower 1962 standards, for $125,000, the price of a high-end car. (My parents could have bought a 4BR house for about the same size; see below.)

The same people who tell us that we need high minimum wages to keep the low-skilled peasants out of places such as Maskachusetts and California also say that we need cheap housing to bring them in:

“People used to move to higher-income states,” Glaeser continues. But middle-class migration stalls when housing becomes unaffordable. “The tragic part,” he says, “is that we’re both making America less productive—by not enabling people to move to places like Boston or Silicon Valley, which are among the most productive places in America—and ensuring that lower-skilled people, people who are less fortunate, can’t afford those places.” Denying them the economic opportunity afforded by mobility “just feels profoundly wrong,” he adds, “as well as being probably inefficient” (see “Immobile Labor,” January-February 2013). By excluding lower-paid workers from high-wage cities, the downstream effect of high housing costs is greater inequality.

Here’s a fascinating example of counterintuitive reasoning… a higher-density lifestyle has “downsides” for anyone living in a higher-density environment, but when every person’s local lifestyle is degraded by congestion the overall effect is everyone becoming better off.

Although additional restrictions render that [2021 California law trying to force cities to permit additional building on single-family lots] largely “toothless,” says economist Rebecca Diamond, Ph.D. ’13, state or regional legislation is probably the most effective means of addressing the housing crisis.

That, she explains, is because “the downsides of building more housing—in terms of congestion, too many kids in your schools, too many cars on your streets, and expanded infrastructure—are borne at the local level. But the benefits are diffuse. If you build more housing in Palo Alto,” continues Diamond, the Class of 1988 professor of economics at Stanford Business School, “it’s probably going to make housing prices a little bit cheaper in many parts of the Bay Area, not just in Palo Alto. So, Palo Alto gets all of the negatives, and only a tiny share of the benefits. Palo Alto has no incentive to build more housing.”

My personal opinion is that housing will continue to get more expensive relative to incomes as long as U.S. borders remain open. U.S. population is growing via the addition of people who don’t earn enough to fund the construction of new houses or apartments at present prices with present technology. The only thing that would bring down the cost of housing is, I think, a method of factory-producing houses that is dramatically cheaper than on-site construction (this has been the Holy Grail for a lot of developers for at least 75 years and it never seems to work on a large scale). A recent WSJ article says that the savings are only 5-10 percent, however, which isn’t enough to enable low-skill Americans to live in as-seen-on-TV homes.

As usually, WSJ notices, it just takes time, in this case decades. Rental “garden” apartment “buildings” built from 6x6s, veneer and drywall were all rave in east coastal rental market of 1990th.

Lions ponder how the entire habitable zone where highs stay 60-80F all year is developed. Anyone who owns a house in that zone is a god. The last of it was developed during the last housing boom of 2005. It always refuted ideas that we can keep growing by terraforming another planet. The only we we’re going to grow is by creating new land in space colonies.

I don’t buy argument that there is not enough land. Have you driven across America? There is nothing but land. Of course there is not enough land in Manhattan for new housing, but there is more than enough virtually everywhere else.

Compare it to driving around Europe – every corner is populated.

Then American companies try to re-invent the wheel with building. In Europe for cheap housing they make concrete panels at factories and then build godzillion of similar cheap high-rises out of them. To be fair, don’t know if it’s cheaper than American way of building onsite per sq ft.

SK: You’re responding to the quote from the Harvard article “inflation-adjusted prices have nearly doubled because there is not enough buildable land to satisfy demand”? I agree with you that there is plenty of land in Nebraska on which a house could be built. And as I wrote in https://philip.greenspun.com/blog/2019/03/25/city-rebuilding-costs-from-the-halifax-explosion/ even when the land is free and the builder gets no profit the cost of constructing an apartment building yields apartments that cost much more than what a median American earner can afford. On the other hand, I think we might indeed be running out of land that is close to jobs, transportation, and other things that people want to live near.

There may by not enough land in Manhattan, but when I visit every few years I see updated skyline, with skyscrapers popping out in unexpected places, on lots not sufficient to fit my backyard.

> philg: I think we might indeed be running out of land that is close to jobs, transportation, and other things that people want to live near.

You can’t have everything you want in this world when you want it. Also, if you build the housing, the amenities will follow; for proof compare any neighborhood pre-gentrification and post.

> people working year-round at decent jobs—making perhaps $50,000 a year

In New Jersey, a full-time minimum-wage employee will make over $32,200 a year in 2025. Now most of this is captured by housing costs but for someone who has the benefit of living with their parents, this is quite the haul

Demand is always going to be a factor, but the timescale under consideration also coincides with the creation of Airbnb and its like, causing the efficient market price for rental accommodation to approach that of hotels, and diverting supply away from tenants to visitors.