Five years ago… Investing in the time of plague?

Thought experiment: What stocks will go up in response to the coronavirus plague?

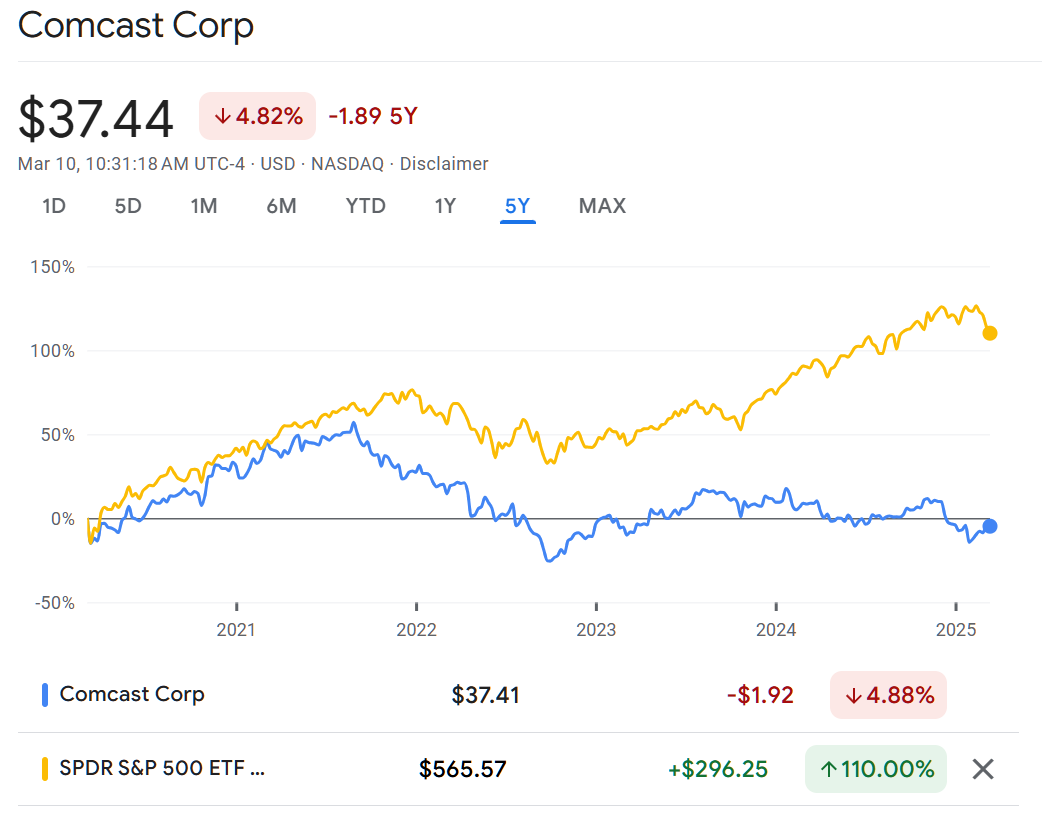

One idea: Comcast and similar cable TV stocks. If people are stuck at home they won’t mind paying for premium channels and will be less likely to cut the cord.

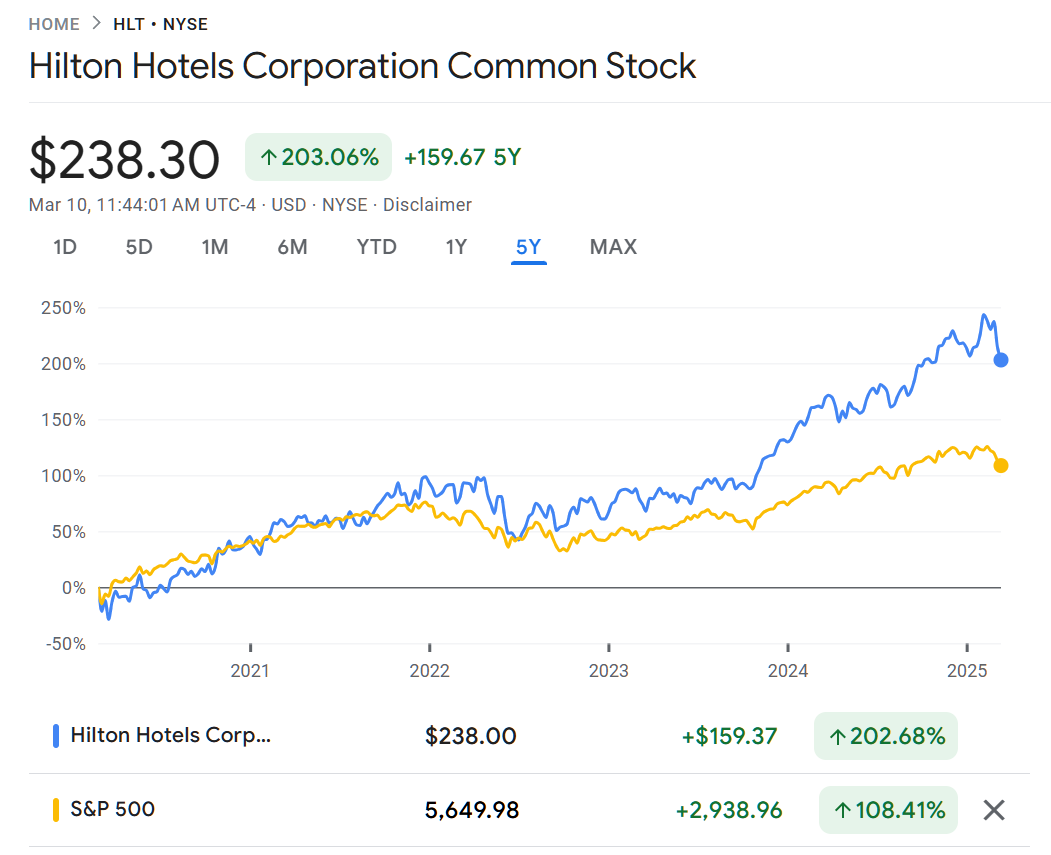

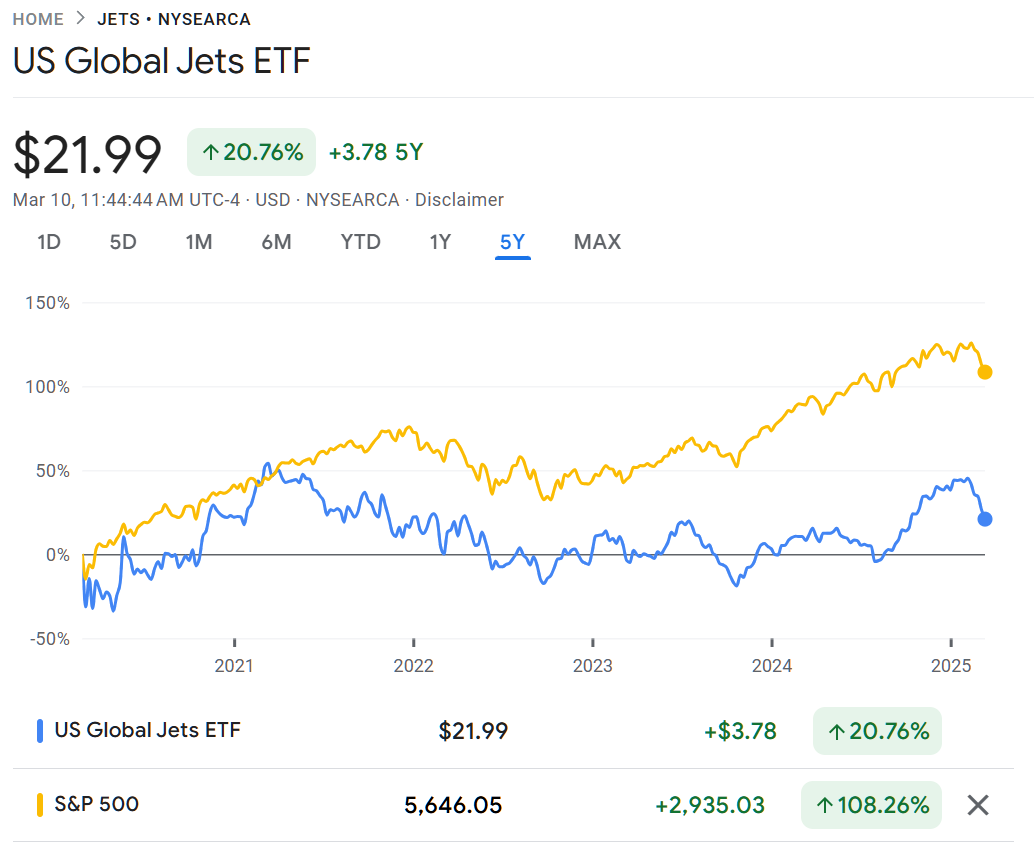

Second idea: airlines and hotel stocks. “Buy on bad news” is the theory here.

Some ideas from readers in the comments:

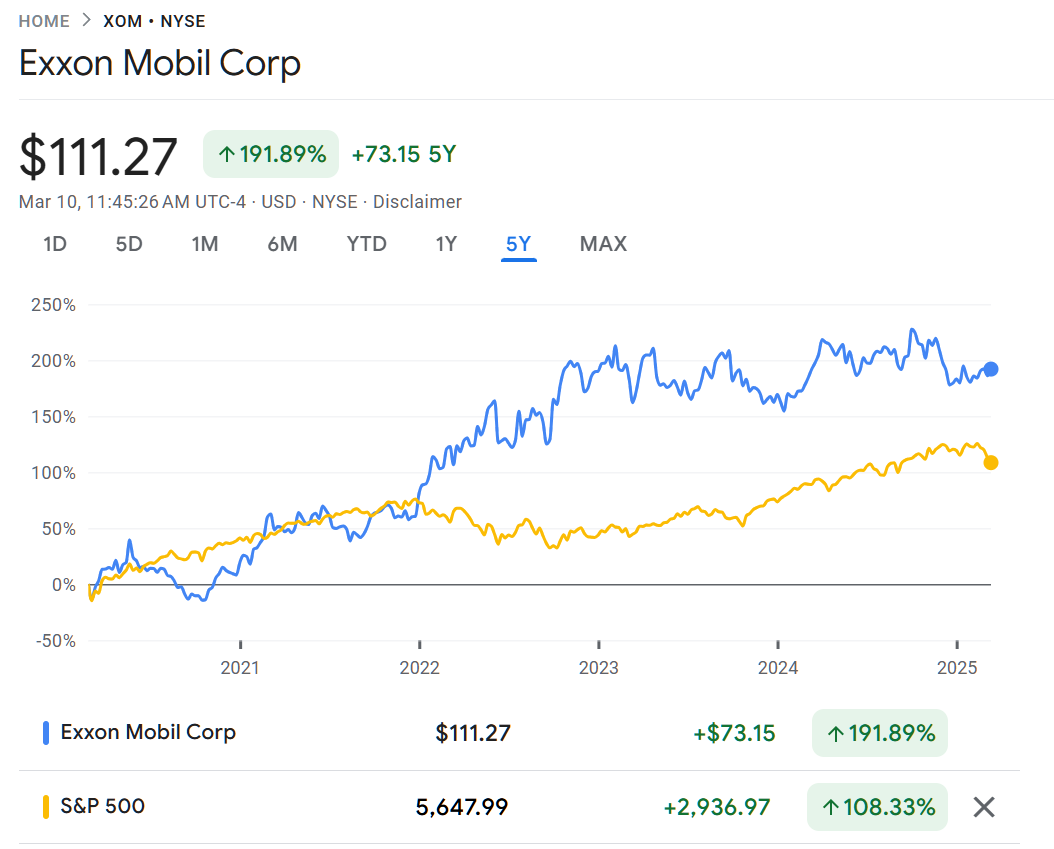

- Oil ETFs and/or Exxon/Mobil (XOM)

- Valero (VLO) for diesel fuel

- telephone stocks (Verizon?)

- an index fund of Japanese pharma companies

- carnival cruise stock

- short Boeing and Airbus (BA, EADSY)

Let’s see if my ideas are reliably terrible. Comcast is about flat today (dramatically lower, if adjusted for Bidenflation) than it was five years ago while the S&P 500 has roughly doubled:

How about Hilton (HLT) as a proxy for the hotel industry? It has outperformed the S&P 500.

For airlines, JETS seems to be the ETF that holds U.S. airline stocks. It hasn’t done great.

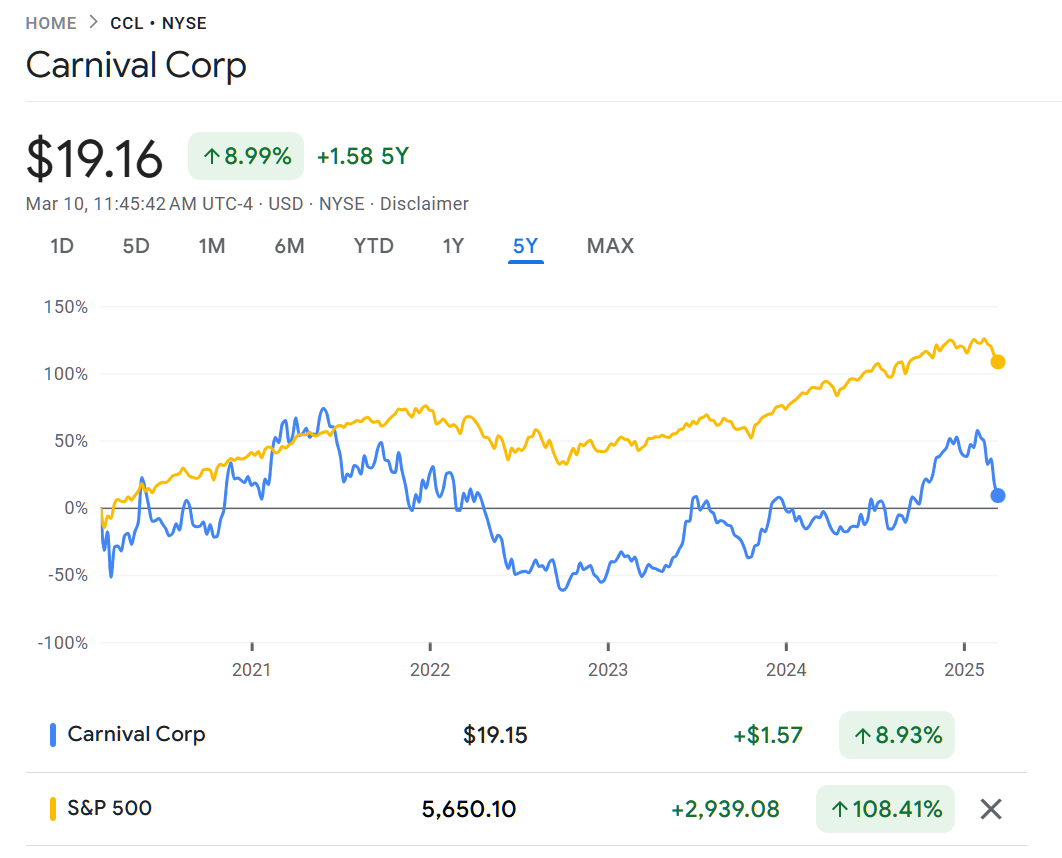

Reader ideas? XOM and CCL (Carnival cruises) would balance each other out:

Conclusion: it is difficult to beat the index.

Chevron & USO tripled from bottom to top, but you had to stay in until the latest forever war & it was a bumpy ride. There was a lot of thinking about Bide’s green revolution & remote work crushing oil in those days. Here we are, with most top tier companies back to a 5 day commuting.

Not even the best investors can beat the market in the long run. The few that appear to do so are cases of extraordinary luck, not skill.

It does not require a genious to realize that energy stocks are going to rise on long run and that Comcast, founded and run by politically connected lawyers, sucks. It indeed would be very unlucky to loose money in energy ETF on long run, let’s say if cold fusion electric generators became reality or entire world population become boy scouts or hippies. Can beat general market if investing in right market segment.

So what should we be doing now? Effect of tariffs? Threat to Iran oil supply from military action (not a large component of world oil supply, but still). Defense contractors? Elbit?

Related – inventor of the optical mouse, and MIT MSc EE alum (do you know him, @philg?), Steve Kirsch thinks he can beat Wall St, claiming “5-year combined performance of our portfolio: 32% average per year”

https://kirschsubstack.com/p/kirsch-capital-update

Anon: In an age of rampant inflation and deficit-spending-fueled economic boom (i.e., the last five years), anyone can beat the market by taking a lot of risk, e.g., “bet it all on Apple” or “buy the S&P with leverage”. He doesn’t offer a comprehensive risk-adjusted return analysis. He invests in tiny funds (“We invest in a portfolio of funds run by stellar investment managers all with $100M or more assets under management”; I’m not sure that’s large enough for Morningstar to bother to rate, for example; https://fundresearch.fidelity.com/mutual-funds/summary/316390202 is an actively managed fund with awesome performance (due to high risk and concentration by design) and it has $16 billion under management). Kirsch’s “fund of funds” approach is almost guaranteed to result in super high fees. It looks as though nobody is buying: “We’ll be able to lower the minimum investor net worth requirement to $1M in the near future (after we exceed $25M AUM).” This is a web page, not a business, if there aren’t even $25 million in assets being managed. He says that he charges an insane 1% fee for himself (plus all of the fees from the underlying funds). That’s $250,000 in annual revenue to his purported financial institution. He gets a 10% fee for “performance” (i.e., inflation). He is so small that he hasn’t been able to negotiate a better deal than the old confiscatory 2 and 20 fees for the underlying funds. So his investors lose 3% of their real return guaranteed and then another 30% of their returns that are a combination of actual return and inflation illusion. This is all laid out in https://www.skirsch.com/kirschcapital/KirschCapitalMar2025.pdf

I guess he can beat and has beaten Wall Street in one sense since there aren’t any Wall Street firms that charge this scale of fees to retail investors.