A Ukrainian immigrant friend has been (understandably) expressing rage at Donald Trump for wanting to shut down U.S. support of Ukraine’s military. He also recently texted us that he was enraged with Trump’s tariffs (that never actually happen? I can’t keep track) tanking the stock market. As an index investor who worships at the Church of the Efficient Market Hypothesis I don’t trade and, therefore, don’t check the market.

Not having previously checked, I proposed the following:

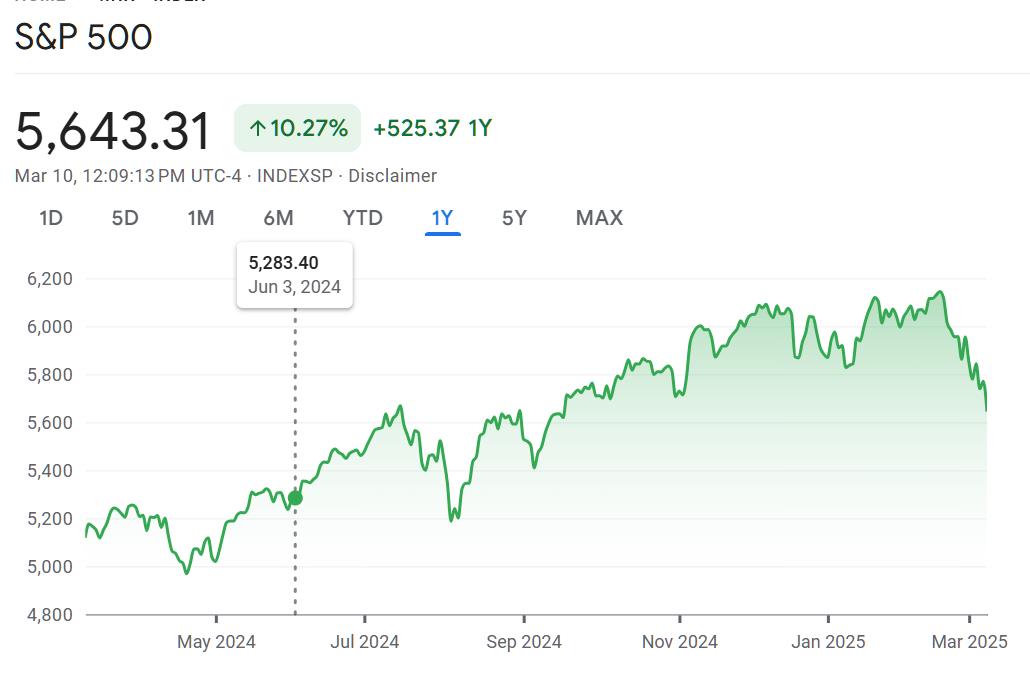

Compare to June 1, 2024 so that we filter out some of the noise (back in June the market thought that we’d have continuity with Genocide Joe)

I don’t think we can count the market’s optimistic run-up when it looked like Trump was going to win

Then I looked at a one-year chart:

The Google says that we’re up

adjusted for inflation, perhaps not

5643/5283 [the March 10 price divided by the June 3, 2024 price] compared to around June 1 that’s up 7%

actual inflation (not the government’s fake number) is 4%/year (3% in 9 months)? so we’re up about 4% real in 3/4s of a year, which means the market is on track to deliver a 5% real return (more like 6% if we accept the government 3% annual inflation stat)

that’s not too different from normal (7.5 percent real annual return over the past 20 years using the government’s understated inflation figures, so probably closer to 6 percent if we adjust for inflation by looking at the stuff that an investor might want to buy (houses in decent neighborhoods and upscale vacations, not DVD players at Walmart))

Eh, the S&P 500 has been through the roof for a number of years. Wobbles don’t bother me.

That said, these tariff’s seem more than a little off the wall. Every day, some new one.

Unless we are trying to convince the rest of the world that the US is completely unhinged, I don’t see the goal of these tariffs.

Down 10% from all time highs, so not really tanking by gen X standards. If any of us thought it was going to stay at its all time high, we would have been 100% in. Someone holding since the top in 2022 would only be up 5.4% per year or 1/36 the rate of housing inflation. This one feels like a man made decline, for the purpose of making someone rich.

Our leader is in the perfect position for insider trading Say you will put on tariffs or hint of a recession and the market goes down! Delay them and it’s back up! And he can do that without any effective scrutiny or penalties.

If only we had some insights into his (lack of) integrity.

At the moment, no one knows why the market does what it does because causation is not observable – i.e., the “cause” of the market’s downturn could be Trump’s tariffs or could be the market foresees a recession (bond yields are down which might suggest that) or something else. I don’t know that the market is mean reverting since the data series is not large enough to make that generalization. Re Phil’s claim that he is (now?) an efficient market aficionado, as a long time loyal reader I seem to recall some brilliant investment ideas that Phil has shared with his flock including investing in Portugal, don’t remember the reason, and investing in Sweden (something having to do with Covid). s Phil’s conversion purported or the result of a real epiphany like Paul on the road to Damascus? And while we are on religious topics, given the imminence of Passover, I hope he has finished his annual consultation with Professor Wikipedia so he can once again debunk the Book of Exodus.

jdc: investing is Portugal is to get an EU passport for myself and, more importantly, the kids (flexibility to work and study in Europe, though that seemed like a more realistic possibility a few years ago when I embarked on the quest); it was not an idea for beating the S&P 500

Sweden has been a basket case compared to the S&P 500. They are rich in migrants so they should be rich, but for some reason they aren’t.

In 2013, I revealed myself as a Church of Efficient Hypothesis believer. https://philip.greenspun.com/blog/2013/11/06/should-we-short-twitter/

I have also tried to apply this religion to ceramic paint coating. https://philip.greenspun.com/blog/2021/09/27/best-paint-treatments-for-cars-and-airplanes/

“I can’t get over my Efficient Market Hypothesis question: If ceramic coating makes sense, why isn’t it the final step at the car factory? The paint shouldn’t ever be smoother than when the car is brand new, right? Why not apply the magic elixir when the paint is new and doesn’t need the expensive “correction” step?”

Dr. Greenspun, instead of an EU passport, have you considered investing or even moving to New Zealand? It seems like a nice stable place to live as a refuge.

Can also recommend NZ for living. The whole country outside of Auckland and Wellington is full of southern hospitality. I worked there for 6 months back in 2007-8.

Cost of living is higher than FL, though. And I’m not familiar with school quality for the kids.

Anon: New Zealand is certainly a great place for Scientists (i.e., those who love lockdowns and vaccine passports). See https://en.wikipedia.org/wiki/New_Zealand_government_response_to_the_COVID-19_pandemic

With a population of just 5 million, however, the chance that a child would one day want to study or work in New Zealand is small compared to the chances that a business or school in the EU (450 million people and being enriched daily by fresh migrants) would have something uniquely appealing. Suppose that a child is passionate about Minecraft. He/she/ze/they would want to move to Stockholm and work for Mojang. If a child is passionate about tunnels, the choice would be to go to Germany and work for Herrenknecht. A child who wants to study Islamic culture and religion might go to Paris. A child who wants to learn to cook might go to Italy.

Finally, as far as I know New Zealand has no program that would enable a non-resident to get a passport.

“I can’t get over my Efficient Market Hypothesis question: If ceramic coating makes sense, why isn’t it the final step at the car factory? The paint shouldn’t ever be smoother than when the car is brand new, right? Why not apply the magic elixir when the paint is new and doesn’t need the expensive “correction” step?”

I suspect automakers aren’t trying all that hard to improve the durability of their coatings/paints. Mediocre paint assures obsolescence, at least in the northeast. Cars rust through their paint (if not the frame) well before mechanical failure and their owners, feeling rather self-conscious, replace them.

A. Jackson: I guess that’s the same reason that spec houses in Florida always concrete tile rather than clay tile. It saves about $10,000 and looks pretty good for a few years (long enough to sell the house). The maintenance on concrete tile is much more expensive (has to be treated against mold more frequently because it absorbs more water) and the color (dyed in or painted on rather than part of the material) fades from UV light. So an automaker needs paint that looks great when the car is new and holds up for at least a 3-year lease and anything beyond that is optional. Maybe the paint should hold up reasonably well for 5 years to support people who buy cars (not lease) and trade them in on the same brand. But it also shouldn’t look perfect at the 5-year mark because otherwise people have a reduced incentive to trade in.

A high barrier to entry insulates the auto oligopoly from competition. I doubt the strategy would pay off for very long otherwise. Pundits call this either “excessive regulation” or “saving the environment” depending on who you listen to, but they’re all full of shit. We’re told our vehicles have to meet the strictest emissions standards. What about the ship that brought them here on bunker fuel? Catalytic converters are all well and fine, but then if we all must have them why doesn’t the government nationalize palladium production, like the Stillwater mine? Congress would be more useful if they were sent to *work in a mine*, but I digress.

(Overcome by profound righteous indignation, I forgot to sign up for email notifications.)