I was chatting this morning with a friend who is a retired professional investor, having been previously involved in the management of $billions (not as the ultimate fund manager, but in a pretty senior role). A staunch Democrat and an active trader of his own portfolio (using exotic techniques such as “selling premium”, shorting a leveraged ETF while being long the unleveraged index, etc.), he was predicting doom and gloom for the U.S. economy due to Republican incompetence and stupidity. The stock market would continue to go down and we would suffer a depression. He cited the example of George W. Bush ladling out $700 billion to Wall Street in 2008 because “it was the right thing for the American People” and contrasted to Donald Trump, who wasn’t even trying to do anything right for Americans. I disputed that “Americans” was a meaningful term because the owner of an apartment building has different interests than the renter of an apartment. More substantially, I took the position that someone, maybe us, would blink first and mostly everything would return to the previous status quo. Therefore, I argued there was no need to do anything other than perhaps invest any available cash into the S&P 500.

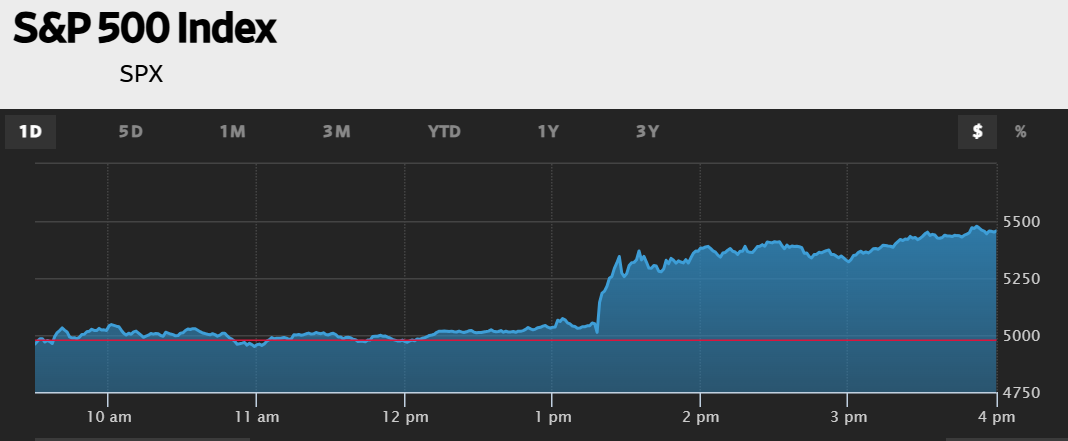

The call in which my friend implicitly advised me to sell everything began at 10:12 am. What happened later in the day? NBC:

President Donald Trump said Wednesday he was pausing higher targeted tariffs for 90 days for most countries, a stunning reversal in his trade war that has sent markets reeling.

Trump wrote on social media just before 1:30 p.m. that he came to the decision because more than 75 trading partners didn’t retaliate and have reached out to the United States to “discuss” some of the issues he had raised.

(The S&P 500 was up 9.52 percent today.)

When someone does something stupid, it’s not a matter of “who blinks first.” A lot of damage has already been done, and it’s likely to be long-lasting. There’s no quick return to the status quo. (It reminds me of that line from Monty Python and the Holy Grail: “Let’s not bicker and argue about who killed who.”) Let’s see what the coming days and months bring. Scary times.

And here I thought that quote came from american news reporting. You learn something new every day.

What quote? I don’t understand. The “Holy Grail?”

An example of lasting damage: the P/E ratio of American stocks is much higher than that of European or Japanese stocks (not to mention Chinese ones). The reason is the faith that both foreign and domestic investors have in America—they’re willing to pay a premium. Rivers of capital flow from abroad into American companies every year. But the actions of recent weeks have convinced many that this premium is no longer justified. That’s why so much money has moved overseas. This administration is killing the goose that lays the golden eggs.

I’m not convinced the “goose” or the “golden egg” is dead — at least, not yet.

Let’s assume you are right and that investors or entrepreneurs are turning away from the U.S. Let’s take a look at their alternatives:

China? Good luck to any foreigner trying to start or expand a business there without giving up control, handing over trade secrets, or getting copied out of existence. The Chinese government’s primary concern is keeping 1.4 billion people in check — they’re not eager for another Tiananmen Square moment.

Europe? Try navigating their overwhelming bureaucracy and heavy-handed regulations. Remove Germany from Europe and what’s left is a struggling economic zone. Europe champions global warming initiatives and human rights, but can’t to stand up to Putin — despite Russia’s weak economy and dismal military. And since Europe is a big advocated of human rights and illegal migrant, soon enough, they will adopt Sharia Law.

Mexico and South America? Best of luck dealing with corruptions — corrupt government agencies and even courtrooms.

Canada? I will let our Comrade Pavel weigh in on what’s happening up north.

South Asia? There’s potential, if you’re in the right country, know the right people, and are okay with inconsistent infrastructure and quality of life.

The Middle East? Best of luck finding skilled labors or committed workforce, and you will often find yourself dealing with tribal politics or regimes that change every couple decades.

Japan? Highly developed, but its rigid work culture and closed-loop business networks make integration difficult for outsiders.

Israel? In my opinion, if you can handle the occasional rocket fire from Palestinian “freedom fighters,” it’s a solid choice. After the U.S., in my opinion, Israel ranks among the top in tech innovation and startup success.

So, are you convinced yet that, at least for the next few decades, the U.S. is still the best place to live, invest, and build a business? If not, maybe investors should look into Heard or McDonald Islands as an option.

For me, my bet is still on the U.S. However, if we don’t fix the open-border policies and unsustainable welfare system, we are doomed.

Anon, a P/E ratio is a rough valuation metric that over time reflects the future earnings/cash flow stream that a company will generate. Most U.S. companies are squarely focused on operating to maximize the value for their shareholders (e.g. future growth in cash flow etc.) as they should be. European companies not so much generally, due to socialist policies in the countries where they operate, unions that often have representatives on boards of directors etc. If you look at the cash flow growth of companies comprising European equity indices and compare those to, say the S&P 500, you will see the European companies lag badly. Same goes for most other regions of the world. Consequently, European companies have lower valuations (P/E). And, there is little indication this will change any time soon, so I would gladly take the other side of your argument that U.S. valuations will converge with those in Europe (or elsewhere).

Mr. Market, I think your view that European companies are somehow hindered by “social policies” is not accurate. In fact, one could argue that American companies bear a disproportionately high cost for healthcare compared to their European counterparts.

Additionally, I don’t believe that large European banks or energy companies invest as much effort into maintaining diversity as American companies, for example. The EU is a $20 trillion economy—it didn’t reach that size by being a bad place to do business.

In my opinion, it’s the perception of the U.S. as a hub for innovation and legal security, in other words, reputation, that drives higher valuations for American companies. It that is not the case, why should you pay more for a company that has a higher P/E ratio?

Anon, you are partially correct about European companies’ P/E discount to the U.S., but your argument actually supports the discount: you say that “the U.S. is “a hub for innovation.” Innovative companies/industries typically grow much faster than companies overall, hence the much faster cash flow/earnings growth in the U.S. (e.g. S&P 500). The fact that there is much less “innovation” going in in Europe (and many other regions) is a significant factor. We can disagree why this is true, but most market participants and other rational observers attribute a large portion of this to socialist and other policies that inhibit businesses generally and risk-taking in particular. It should be a wake up call to Europeans that that there are almost no Elon Musks starting innovative, fast-growing companies there (or in many other regions).

Anon, US market is driven by successful entrepreneurs, ie new large companies.

Microsoft is 50 now but it seems that every decade a new market leader emerges in the USA. Now in China too, and in India, but mostly in either established industries or pioneered earlier in the US. How many new companies Europe produces? ASML and ARM come to mind, and they were created in 1980th – early 1990th, the rest of European industry was created by gran-grand father generation or even earlier, few centuries old. It makes sense that companies whose reach expands to every corner of Earth via internet have higher valuations.

I bought a little on Friday and my accounts are back to normal today. I was never too worried because I trust that Trump knows what he is doing, even though I am not sure what he is doing. On the other hand, people who hate Trump and are convinced he is stupid probably sold and lost money. If I had seen Trump’s message this morning that it was a good time to buy I would have bought still more. I can see how this situation would anger the left though, it is unprecedented and could be used for insider trading.

I also do not understand today’s big rally, there is still a trade war going on. I plan to become less aggressive going forward, it is clear that economic warfare is ahead and I am retired. If I were young I’d ignore everything and concentrate on my work and life.

I don’t think Trump is stupid; what he is, is old and dogmatic. Having elderly rulers causes many problems. One of them is that older people have a very outdated concept of economic reality. A few decades ago, it was common to find people over seventy who thought agriculture was economically very important because it had been when they were young. People the age of our president have a conception of the economy in which industry is much more important than it actually is.

Many economic concepts are both simple and not so easy to understand. When foreigners sell us products and services, we pay them in dollars. Those dollars necessarily have to be used to buy something here. If what foreigners buy are our bonds, then they are financing us. Another issue is that we may use that money so our healthcare providers can buy McMansions. America does not have a foreign trade problem. Now it seems to have a big governance problem. We need younger leaders.

A good lesson not to listen to those with TDS and EDS. This person’s former clients are surely thankful he is “retired.” Sounds a lot like Jim Cramer, who is now widely “revered” for his “inverse Cramer” calls…and true to form was *again* a perfect inverse predictor two days ago on Monday (see his crazy video online)!!

We’ll play again in 90 days. There’s no way for US to replace China’s manufacturing. The system is based on China exporting physical products & US exporting bullshit. It’s a balanced exchange of different needs.

Are you sure it’s not rubber dog shit? That would explain why the Navy flies cargo planes full of it to Hong Kong?

1940 book on investing, still relevant today:

“Where Are the Customers’ Yachts? or A Good Hard Look at Wall Street” by Fred Schwed Jr.

After the dotcom bubble, 9/11, 2008, and COVID, I only got richer by staying the course on my investments. So, I’m more than happy to be patient this time around, too.

Y’all are going to need to make that money to pay those college advisors to get your kids into a good school so that they won’t have to make their money by adding useful value through labour or entrepreneurship, but by arbitrage backed by easy credit. Then they can get a good job with lots of health benefits so they can continue to burn out their brains with time-release metamphetamines and afford a nice retirement home when the brain finally alzheimers from the stres and performance-enhancing drugs and the stress and the stresss.

If the markets tanked the masses would cheer. You geniuses wood half two due sumding yuiceful two surf ive.

WWJD?

Luke 16:1-14

And he said also unto his disciples, There was a certain rich man, which had a steward; and the same was accused unto him that he had wasted his goods.

2 And he called him, and said unto him, How is it that I hear this of thee? give an account of thy stewardship; for thou mayest be no longer steward.

3 Then the steward said within himself, What shall I do? for my lord taketh away from me the stewardship: I cannot dig; to beg I am ashamed.

4 I am resolved what to do, that, when I am put out of the stewardship, they may receive me into their houses.

5 So he called every one of his lord’s debtors unto him, and said unto the first, How much owest thou unto my lord?

6 And he said, An hundred measures of oil. And he said unto him, Take thy bill, and sit down quickly, and write fifty.

7 Then said he to another, And how much owest thou? And he said, An hundred measures of wheat. And he said unto him, Take thy bill, and write fourscore.

8 And the lord commended the unjust steward, because he had done wisely: for the children of this world are in their generation wiser than the children of light.

9 And I say unto you, Make to yourselves friends of the mammon of unrighteousness; that, when ye fail, they may receive you into everlasting habitations.

10 He that is faithful in that which is least is faithful also in much: and he that is unjust in the least is unjust also in much.

11 If therefore ye have not been faithful in the unrighteous mammon, who will commit to your trust the true riches?

12 And if ye have not been faithful in that which is another man’s, who shall give you that which is your own?

13 No servant can serve two masters: for either he will hate the one, and love the other; or else he will hold to the one, and despise the other. Ye cannot serve God and mammon.

14 And the Pharisees also, who were covetous, heard all these things: and they derided him.

@philg most of us on the this blog know dollar cost average investment in an index is the best way to invest in equities. The question is as a deffender/supporter/follower of Trump did you loaded up in the Dip.

Anon: I was already fully invested in equities so the only way I could have “loaded up” would have been to use leverage. I didn’t sell when all of the smart people were panicking so in that sense I was a buyer (i.e., a decision to hold is functionally the same as a decision to buy).

(I don’t know if I qualify as a “defender/supporter/follower” of the Great Trump! I do appreciate that he wishes “Shalom” to all of the pro-Hamas visa and green card holders whom he is deporting! His fondness for Hebrew is ironic because all of my Jewish Democrat friends say that Trump is going to put American Jews into extermination camps, just as the previous Hitler did. (At the same time, they aren’t taking any steps to protect themselves, e.g., follow Barbra Streisand in moving to Canada.) And I suppose it is worth noting that, as Elon Musk pointed out, it was German government employees who put the Jews into death camps, not Hitler himself.)

In hindsight, which is always the best way to be a successful investor, I wish that I had been a Truth Social user and had seen Donald Trump’s “great time to buy” post and then had broken my rule against leverage.

Philip, you did not see it (“great time to buy”), but I think quite a few people did particularly well yesterday (it was a good day for all of us, and a lot better for the lucky few). America has started to look much like the rest of the Americas.

There is a dip going on now if anyone interested.

As Warren Buffett might have put it, Mr Market is having a sale on stocks right now. I don’t know if he’s buying though.

Yes, some pull back after extreme recovery is anticipated. This is how bear markets usually work. They are not free falls.

Whatever there is to be known that affects equity prices is already incorporated into the stock prices. Your shrewd friend who makes these shrewd investments most likely made his money as some sort of “helper” and collected substantial fees for doing so. Almost no one on Wall St really made his money investing – a big exception is WB – and most who did never repeated so it was likely luck. The products your friend is buying most likely have very high fees that are almost impossible to figure out and someone else, most likely a very large financial institution with lots of PhD physicists doing the modeling, is taking the other side of the bet – any bet needs someone else on the other side. So before you bet, try to imagine who is on other side – more likely someone with a PhD in math from MIT than some doofus in Iowa playing video games in his parents’ basement.