Happy Tax Day for those who celebrate (i.e., Americans who aren’t smart enough to have joined Mitt Romney’s Club 47).

David Brennan and Jackie Mustian, attorneys at Moffa, Sutton, & Donnini, gave a talk at Sun ‘n Fun about how people avoid owing a 6 percent sales tax when buying an aircraft that will ultimately be based in Florida. (Imagine the potential liability for an elite buying a $100 million Gulfstream!)

First, it seems unlikely that Florida is getting any real benefit from imposing this tax. The true beneficiaries are attorneys and accountants who set up schemes to avoid it. Perhaps because of that, there is no urgency among legislators to eliminate the tax, as Maskachusetts did back in 2001. Under the assumption that the tax, and the army of professionals whose job it is to avoid it, are with us forever, here’s what we learned…

A nonresident who owns a new-to-him/her/zir/them aircraft has to be careful about visiting Florida for reasons other than maintenance or flight training. If the aircraft is here for 21 days within the first six months of ownership, Florida sales tax is owed. A flight that lands at 11:55 pm and departs 10 minutes later at 12:05 am is considered to have spent two days in Florida out of the allowable 20.

A Florida resident cannot take advantage of the above exemption. If the Florida resident is the sole owner of a Maskachusetts, Delaware, or Montana LLC that owns the aircraft, the 20-day exemption might apply, but an auditor might also try to look through the LLC shell to the real owner. The Floridian ideally would keep the aircraft out of state entirely for six months and also not display an obvious intent to bring it into the state on Day 183 (maybe the Floridian is a super douche and also is looking at buying a house in Nantucket and has written to the airport there about getting on the hangar waitlist).

Where the tax advisors seem to make money is in setting up an LLC that is in the business of owning an aircraft and reselling it or its use to others. Prior to the aircraft purchase, the LLC is registered with the State of Florida to collect sales and use tax. The “real owner” then dry leases time with the aircraft from the LLC and the LLC collects and remits sales tax on the dry lease payments, e.g., $75/hour, but only for those hours flown within the State of Florida. In the speakers’ opinion, the State of Florida doesn’t have a legal basis for challenging the reasonableness of the lease rate. The state is entitled to collect tax only on the money that is actually changing hands. That said, a $10/hour dry lease rate for a $1 million aircraft could seem ridiculous. (Other states where this kind of scheme is employed have some rules about the minimum cost for the dry lease based on prevailing interest rates.)

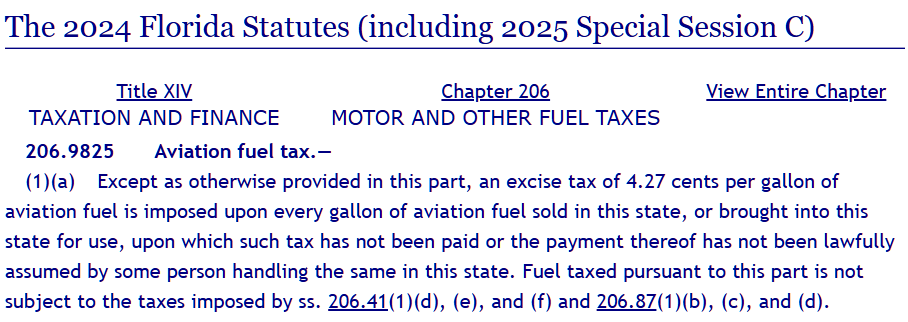

It’s too bad that DeSantis and the Legislature haven’t cleaned this up. In my opinion, the efficient way to tax aviation is a fuel tax and if the state wants more money from aircraft owners it should simply raise the existing aviation fuel tax (FL 206.9825):

Tourism/hospitality is the #3 sector in terms of employees in FL with more than 1m workers. Source – https://www.floridajobs.org/economic-data/quarterly-census-of-employment-and-wages-(qcew)/top-industries-by-employment-wages

Am guessing an avgas tax would not be popular with those businesses.

Could they do an annual registration fee with carve outs for airliner sized plans?

Disclaimer to my last comment: importance of tourism hasn’t stopped Florida from soaking people with exorbitant car rental and hotel taxes and probably airport fees so maybe I’m wrong. I just suspect the airlines may be better organized to lobby against their taxes than tourists from out of state.

Ryan: The federal fuel tax isn’t paid by airlines since they’re already paying a tax on ticket sales. I assumed that the situation would be similar for Florida, but our Google AI overlord says “A reduced rate of 2.85 cents per gallon applies to aviation fuel used by air carriers operating scheduled or all-cargo flights.” Supposedly this was done in 2018, which means that the tax was substantially cut via Bidenflation.

Oh it never occurred to me they could charge different rates to different customers for avgas! Us proles who buy automobile gas all pay the same for a given type.