“The Ultra Wealthy Are Riding Out the Market Chaos in Luxury Real Estate” (WSJ):

Despite a chill in the overall housing market, ultraluxury home sales in areas like New York, South Florida and Los Angeles are accelerating as the wealthy buyers bet on real estate’s long-term value. Since February, the number of homes sold for $10 million or more has surged in major markets nationwide, according to an exclusive analysis by The Wall Street Journal. Between Feb. 1 and May 1, sales at that price point in Palm Beach, Fla., surged 50% from the same period last year, while sales in Miami-Dade County jumped 48.5% year-over-year, according to public records and local multiple listing service data. In the luxury ski destination of Aspen, Colo., sales jumped 43.75% in that same period, followed by Los Angeles County at 29% and Manhattan at 21%.

When President Trump’s tariffs were first announced, some wealthy buyers tapped the brakes and backed out of deals. In recent weeks, however, real-estate observers have been surprised to see a wave of big-ticket sales across the country.

The largest was the $225 million sale of a residential compound in Naples, Fla., in late April, the country’s second-most expensive home sale ever recorded. The seller was tied to the DeGroote family of Canada, property records show. The same week, billionaire David Hoffmann paid $85 million for a waterfront property nearby.

Home buyers at lower price points, by contrast, are holding off on buying and selling amid the chaos, agents said. For Miami homes below $20 million, for example, listing prices have dropped 10% to 20% since the start of the trade war, said agent Danny Hertzberg of Coldwell Banker.

“The most bullish buyers seem to be the highest-net worth buyers,” said Hertzberg, who knows of at least three Miami homes in contract to sell for $40 million or more. “The rest of the market is soft—frozen in some aspects—whereas the top of the market is accelerating in the number of sales and prices.”

The estimates of construction costs don’t seem right:

Hoffmann, an activist investor, already owned a smaller home in Naples but was searching for a larger compound in the area for five years. “This wasn’t a spur of the moment thing,” he said. The $85 million house, which measures about 17,200 square feet with eight bedrooms, ticked all the boxes in terms of design, size, quality and location. He is also in contract to buy the adjacent property with a guesthouse, bringing the total purchase price to just over $100 million. The two properties had been listed for a combined $125 million.

Hoffmann said he has diverse investments, including a “significant” amount of money in the stock market, but isn’t worried about short-term fluctuations. Moreover, he felt he got a good deal on the Naples home, since it would cost about $110 million to build today.

Even at $1,000 per square foot, a 17,200-square-foot-house would cost only $17 million to build.

Especially in higher-end neighborhoods of South Florida, a physical house is seen as a depreciating asset that will require a bulldozing or a gut rehab after 20 years. In my brain, the only ways that it could make sense to consider such an asset an “investment” are (1) interest rates are near 0 percent and it is easy to get a 90-95 percent mortgage, (2) an expectation that the land underneath will become much more valuable. Interest rates are not close to 0 percent anymore. The only reason that land would rise dramatically in price is if rich Americans decide that they need to cluster together even more tightly.

(See the classic 1997 “A Long Run House Price Index: The Herengracht Index, 1628–1973” in which real estate doubled in value… over 345 years; “The Amsterdam rent index: The housing market and the economy, 1550–1850” (2012) is similarly discouraging regarding appreciation potential beyond whatever is happening in the larger economy; a 2002 paper by Gregory Clark (of The Son Also Rises fame) found that constant-quality rents actually did rise substantially in England between 1550 and 1909.)

Why should we care? Rich Americans control our political parties, especially the Democrats (The Nation). If the rich are concentrated in just a handful of neighborhoods they have less reason to care about what happens to the rest of us. It might be rational to support filling the U.S. with Tren de Aragua members if you are assured that you will never encounter one.

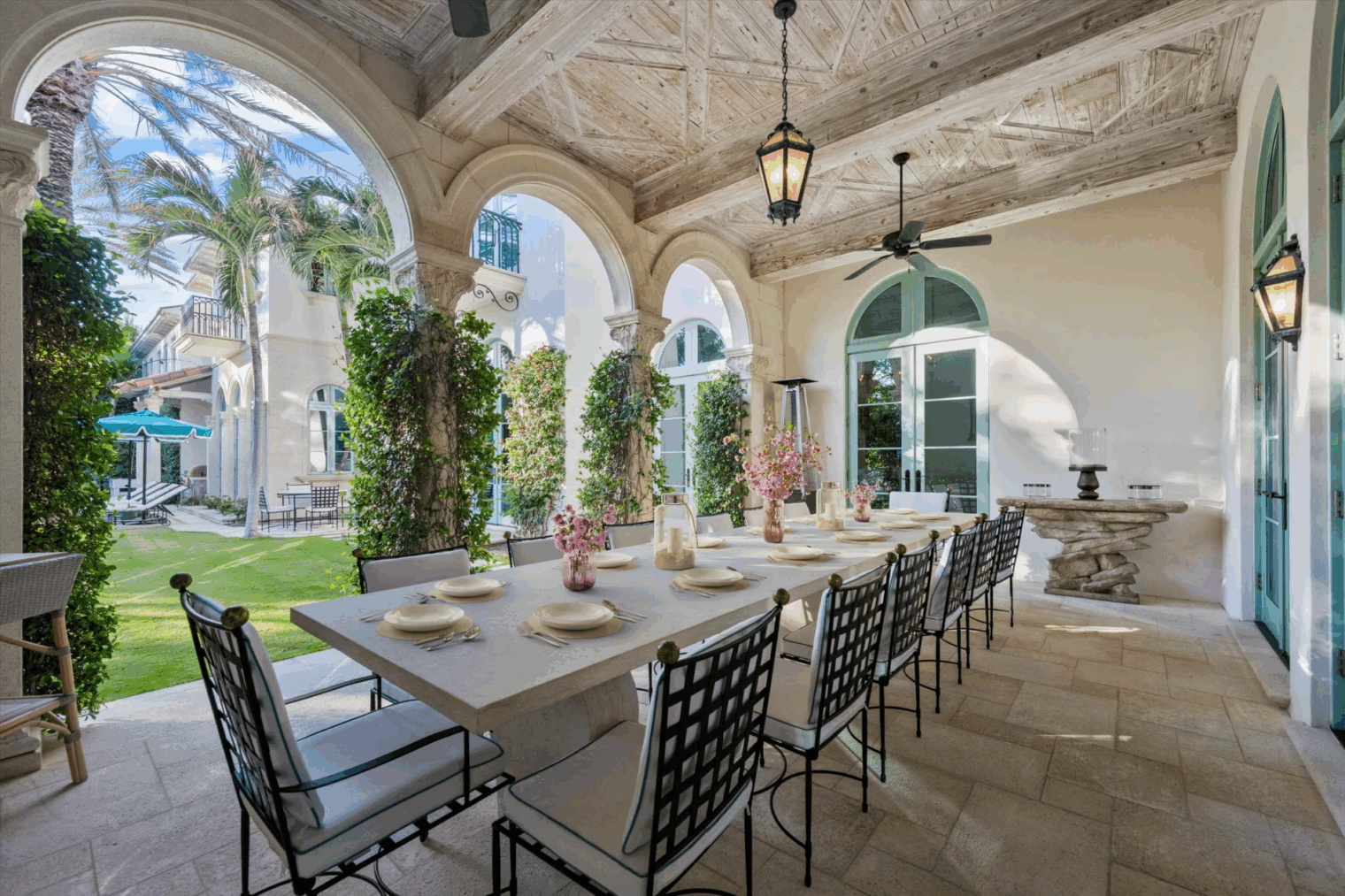

Some porn from the WSJ (the $51 million Palm Beach, Florida house that Bren Simon, widow of the real estate tycoon Mel Simon, recently bought):

“Are America’s rich people betting on the rich becoming more concentrated and isolated?”

Probably. But, thank God for them! Their property taxes are funding the local municipalities’ growing personnel expenses!

EtR: are you sure that increased concentration is good? If all of the rich people move to five towns those five towns get fat on property taxes and every other town starves! (I guess I can’t complain because our own tax rate in Palm Beach County has been going down as more rich people move into Palm Beach per se and build palaces.)

I disagree that super-rich buying real estate is an indicator of anything except of them being super rich and of real estate and so – called “property taxes” becoming major expense item even for moderately rich. Is continuing commercial success of Amazon, Costco and Walmart is an indicator of any middle class conspiracy?

The bar is definitely higher than 5 years ago. $2 mil used to be the division between the winners & losers. In today’s money, $20 mil is what’s going out of style.