New York City is back, according to the media. Example… “The return-to-office trend is real — and it’s spectacular for NYC” (New York Post, August 17, 2025):

More employees now work in New York City offices than in July of 2019, according to the Placer.ai Office Index.

That’s right: The research platform, which uses cellphone data to track comings and goings at commercial buildings nationwide, found 1.3% more staffers at Manhattan desks last month than were there before the pandemic.

Similar article in the WSJ: “NYC Offices Are Back. Nothing Proves It More Than JPMorgan’s $3 Billion Tower.”

What does the lying stock market say? Here’s a 20-year chart for Vornado, a well-managed REIT whose portfolio is primarily office buildings and retail in New York City:

It’s gone from about $100 (sixty 2005 dollars adjusted for Bidenflation) to $37 today.

What about what one can see with one’s lying eyes? I visited a reader who lives near Wall Street and we surveyed some impressive towers from his 45th floor windows. We looked into the former Chase Manhattan building, fronted by an impressive Dubuffet sculpture, and found just a handful of workers at their desks at 2 pm. A nearby former Deutsche Bank tower remains vacant years after a renovation project started. In between is what used to be a name-brand hotel, now home to migrants for whom taxpayers foot the bill (their bicycles are chained up across the street):

The apparent lack of office workers means that there is more room for tourists, e.g., Fearless Tourist backs up Fearless Girl (“commissioned by State Street Global Advisors (SSGA), a large asset management company, to promote gender diversity initiatives and an index fund focused on gender-diverse companies with a relatively high percentage of women in senior leadership”):

The National Parks Service is there with 100 percent of exhibits in the “National Memorial” devoted to Americans who identify as “women”:

These exhibits that focus on a single gender ID (out of 74 recognized by Science) have apparently been up since 2021 (“Women’s Work, Never Praised, Never Done by Deb Willis, retrieving the stories of Black women in the struggle for the vote.”).

Consistent with the lack of observed office workers we found quite a few vacant storefronts, e.g.,

Maybe the retail space can be turned into mosques (masjids)? Here’s one a short walk north:

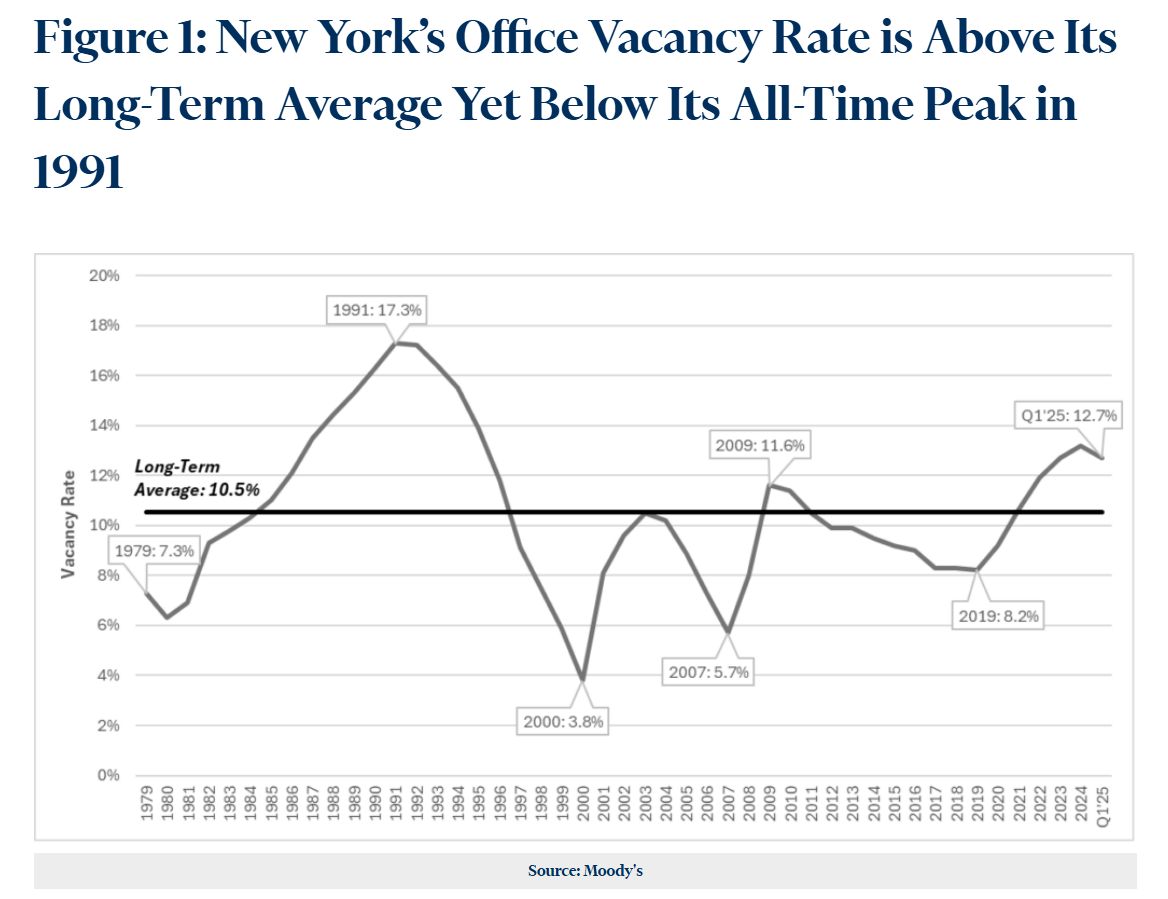

What about vacancy rates? From Moody’s, May 2025:

The current vacancy rate is a little high, but it doesn’t seem high enough to account for the observed emptiness of the Wall St. area or the terrible performance of Vornado. Covidcrats forced all Americans to learn how to work and collaborate remotely. It seems difficult to believe that a big enterprise would need to pay its support staff to work and live in Manhattan. Perhaps the Masters of the Universe still need to be in a Manhattan office building, but the trend toward moving support functions out to other boroughs, New Jersey, and other states must have been accelerated by everyone becoming proficient with videoconferencing. One would think that a typical company could get by with only half the Manhattan square footage per employee that it had in 2019 because so many people in 2025 would be either working from home or working from an office in Parsippany, NJ.

They used to have an expression in NYC:

The fastest way to get rid of something in New York is to chain it to a lamp post.

Looks like they have their “fridges” chained up too.

My memories of Wall Street in the ’80s were all the guys in Brooks Brothers puffing on reefers (marijuana cigarettes), and the women in business clothes but wearing Reeboks on the subway, with their dress shoes in their purse, which they strapped across their chest as a security measure. I still keep my wallet in my front pocket to this day.

I guess I have to be the one to say it, but that girl statue bears a striking resemblance to future Nobel Prize winner, and King of Sweden, Greta T. My wife didn’t think it was very funny to name the next Cat 5 hurricane, Hurricane Greta. In the ’80s if you would have looked up at a building or taken a picture of a statue, crooks would have instantly marked you for a tourist and robbed you. Looks almost like Wally World now.

> women in business clothes but wearing Reeboks

“Yuppies” was the word I was looking for, and a large reason for how we got into the mess we’re in. They flipped 180 on the “Peace and Love” thing to “Look out for No. 1” when they turned 30 something… They kept the sanctimonious (yet ostensible) do-gooderism B.S. and the weed, but somehow worked as a team to concentrate generational wealth and power, which is going to be transferred into the hands of the…[shudder]

I really should stop reading Phil’s blog, it makes me remember where I am. Pass the reefer, man.

All job leads now say on-site, but it makes lions wonder how strictly that’s being enforced, outside the top tier, post DOGE. As Louis Rossmann used to say before he became a gootube zillionaire, New York real estate is a scam. It was always just a small number of wealthy guys squatting on everything. The fair market price was always much lower.

I was going to get to that, lion. I stopped briefly in my happy place, back to 1987 when Japanese Becky and I were skating hand in hand, both with rosy cheeks, in the skating rink only The Donald was able to renovate:

https://en.wikipedia.org/wiki/Wollman_Rink

and her asking me to take her to a Bon Jovi concert in Madison Square Garden.

With all due respect to Paul Dunbar (hopefully his image has been removed from stone via bead-blaster under executive order–maybe use epoxy resin bas-relief printed in the image of the French guy that really did the first powered flight to replace him) I think the real modern poet/thinkers are here on Phil’s site–me excluded.

Maybe someday Phil will be credited with sparking a new Web Renaissance.

VNO is not an outlier since the other two NYC REITs – SL Green and Empire State Realty have about the same charts. VNO is office, mixed use and some residential. SL Green is mostly office. ESRT is office, retail, mixed use and residential. So it seems as if the fall in NYC property prices is across the board. The Moody’s report is written by three guys, none of whom has particularly impressive credentials. It is about vacancies while the market’s valuations of the three REITs are the market’s estimate of the future cash flows of those companies till eternity discounted to PV. The relationship of vacancies to valuations is unclear – e.g. cutting prices will reduce vacancies. The Moody’s report was published three months ago so that information has already been incorporated into the prices of the three REITs. The prices of the REITs don’t seem to have reacted to the Moody’s report which seems to indicate that what is contained in that report was generally known in the market prior to publication & the market did not think justified higher valuations. My guess is that as far as the valuation of NYC real estate goes, what the REITs reflect is accurate, that at least since Covid, NYC real estate has lost an awful lot of value. This would also be in accord with what anyone would notice who walked through lower Manhattan or Lexington Avenue midtown – e.g. many street level vacancies, storefronts empty since covid, the kinds of storefronts that previously would have only been vacant for a couple of weeks, and above seemingly, shall we say, “underutilized” office space.

@philg

would you want to live or work in lower manhattan? Was anything particularly unique or interesting in the area?

M: Would I want to live there? The public housing projects seemed pretty nice. Lots of green space compared to the typical Manhattan neighborhood (instead of 100% of the land being built on, only about 50% was used as footprints for mid-rise apartment houses). I’m old and boring so the parts of NYC that appeal to me most are the museums, Central Park, etc. Lower Manhattan seems filthier and more socially fragmented than uptown. There are white people walking their pit bulls to the marijuana stores. There are fully covered Muslim women for whom dogs are haram. There are Chinese people who apparently don’t consume marijuana (I didn’t see any cannabis retail in Chinatown). I guess we have the same situation nationwide (the U.S. having become a random assemblage of humans who don’t like where they used to live), but you don’t usually see these incompatible societies being physically adjacent.

Phil, I am in total agreement with you regarding rents. However, the supply of “free market” rental units is much higher today (1.12 million, according to ChatGPT) than it was in 1990 (same source). So, it’s safe to say that rents are rising because people want to live in NYC (or lack better options).

I Love NY!

New York City has its problems (many problems) but it is still a fantastic place to live. Lots of people agree with me; that’s why the rents are so high. Mocking the ‘horrible conditions’ of NYC is just part of a long tradition, going back to peasants complaining about imperial Rome.

“Hardly a night passes without robbery, and if no violent crime occurs, still sleep is broken by the howling of drunkards and the rattle of falling tiles. Think, too, of all the filth dripping from windows, the slops and broken pots flung down upon your head.”

Juvenal (not a peasant)

Anon: Aren’t the rents high because about half of New Yorkers don’t pay rent? You’ve got migrant housing (no rent), public housing (177,000+ units; no rent), rent-controlled apartments (1950 rent?), and rent-stabilized apartments (1970 rent?). If there were a free market in NYC real estate I think about 40 percent of current inhabitants would leave and the famously high rents on current market-rate units would fall dramatically.

I can’t remember, was Juvenal the president of the Rome Chamber of Commerce? Xhe makes it sound so inviting.

I was quite complementary to NYC in my comment here. It seems to be like a theme park compared to the ’80s. Having been a former happy resident, my mother-in-law smacked my head when I called it a “filthy sewer”, which I have now retracted. At least the pitbulls are on leashes (right?), Phil, try living in Boulder, CO and environs. Does the MJ smell now cover the odeur d’urine in the subway?

I thought half of NYC migrated to Montana during the pandemic (you can’t spell pandemic without “panic”) world changing Millennials who formerly thirsted for urban living. I was hoping to retire there, hah. The real estate market in MT has been stubbornly inflated (I guess that’s part of the NYC tradition), and they refuse to move back. You think that would put a downward pressure on the rent. I don’t have all the market forces completely figured out like that other guy here, but I also don’t care. Please call your friends in MT and invite them back!

Real estate in US is in “extend and pretend” mode, lots of owners are 20% underwater but can’t refinance or sell due to high interest rates. The loan note holders are also not in a hurry to reposess the properties as they would be in the same situation.

The following based on observations in Toronto’s financial district – more interesting than vacant space and current property valuation is space actually being used (vs leased and sitting empty/unused).

A Toronto-based analytics company found April 2025 foot traffic in the core is down 40% from January 2020, based on cell phone tracking (paywalled source: https://www.theglobeandmail.com/business/article-canada-downtown-foot-traffic-slow-post-pandemic/ ).

“Over all, the availability rate for downtown Toronto offices was 14.9 per cent, which is about three times higher than prior to the start of the pandemic.” July 2025, https://www.theglobeandmail.com/business/article-banks-return-to-office-mandate-space-real-estate-covid-pandemic/

Anecdotally, I feel that often “back to office” mandates often stop at the mandate eg: “Talk to your manager about your needs”.

Looking at the reporting following a July back-to-office press release for one of our larger banks:

“The bank said that many of its locations will be prepared to accommodate the new rule by November, but it will need to take some time to ensure others are ready. As a result, the new requirement may take effect at a later date for certain teams. ”

“If from time to time you need additional flexibility to work from home, please check with your people manager and we will work with you to support your needs,” Ms. Burns said. “