Happy Labor Day to those not smart enough to refrain from working!

Soon all of our dreary poetry writing, creative image and video production, etc. will be accomplished by LLMs. Freed from this labor we will be able to spend all of our time cleaning the kitchen, unclogging drains, fixing roofs in 90-degree Florida heat/humidity, etc.

Let’s check in with the machines that will be doing all of our laboring going forward.

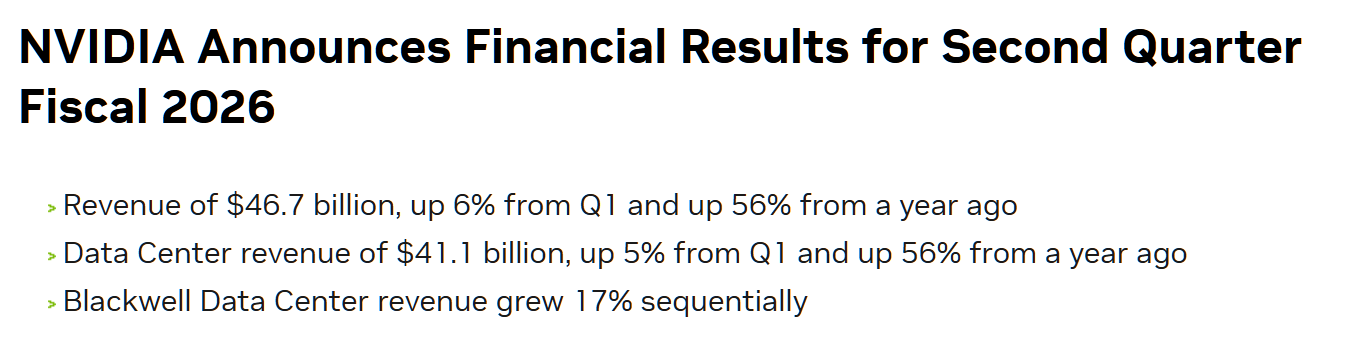

NVIDIA recently released some financials:

My question for NVIDIA chips, via ChatGPT:

Extrapolating from revenue trends of the last five years, how long will it be before Nvidia’s annual revenue exceeds the United States GDP?

The answer:

Short answer: about 2036—but only under a wildly unrealistic straight-line extrapolation.

Here’s the quick math I used:

- Nvidia’s last five fiscal-year revenues (billions): 2021 $16.7, 2022 $26.9, 2023 $27.0, 2024 $60.9, 2025 $130.5. That implies a ~67% CAGR from FY2021→FY2025. Macrotrends

- U.S. nominal GDP: about $29.2T for calendar year 2024 (BEA Table 1.1.5); latest quarterly SAAR (Q2 2025) is $30.35T. FRED+1

Assuming Nvidia keeps compounding revenue at ~65–70% annually and U.S. GDP grows ~4% nominal per year, Nvidia’s annual revenue would mathematically catch U.S. GDP in roughly 11.4 years—i.e., mid-2036. With GDP held flat at today’s level, the crossing is ~10.5 years. (This requires ~224× growth from FY2025 revenue.)

Sensitivity (still using simple exponential curves):

- If Nvidia grows 40%/yr → cross in ~18 years (≈2043).

- 30%/yr → ~24 years (≈2049).

- 20%/yr → ~38 years (≈2063).

⚠️ Reality check: this comparison is apples-to-oranges (company revenue vs a country’s value-added), and no firm can sustain ~60–70% annual growth for a decade+ in a competitive, capacity-constrained industry. Treat the dates above as a fun extrapolation, not a forecast.

How did Grok do on this question? Terrible. Its initial interpretation of the question was that it was about this year’s U.S. GDP, i.e., that it should hold GDP constant. When corrected, it chose an absurd 8.5 annual growth rate for U.S. GDP (would make sense only if there is 6 percent inflation; we’re lucky if we can eek out 2 percent real GDP growth even after flooding the U.S. with migrants; per-capita real annual GDP growth in the U.S. has been about 1.3 percent per year during the past 25 years (FRED)).

Loosely related:

- Our AI overlords will need more power than the Sun generates within 43 years

- “The Work versus Welfare Trade-Off: 2013” (sadly, the most recent year available, but a good guide to the states where lifetime of playing Xbox and watching Netflix yields higher spending power than working at the median wage)

> Extrapolating from revenue trends of the last five years, how long will it be before Nvidia’s annual revenue exceeds the United States GDP?

…

>How did Grok do on this question? Terrible.

So, better than expected.

Grok (a word invented by American science fiction author Robert A. Heinlein in his 1961 “Stranger in a Strange Land” novel, my words not Grok’s) totally ignored the Yellowstone Caldera economic super-bubble waiting for the right pin to burst it. Welcome back corporate welfare (Nvidia will be first in line with the porridge bowl: “We power ‘Grok’–we are too big to fail!”).

Labor Day Link:

> Freed from this labor we will be able to spend all of our time cleaning the kitchen, unclogging drains, fixing roofs in 90-degree Florida heat/humidity, etc.

SouthPark is ahead of Dr. Greenspun this time (something tells me you have already seen this though, haha):

https://youtu.be/RcoGzT9QrTI

https://m.imdb.com/title/tt29474455/

Nvidia might also become GammaDia just like AlphaBet.

Kind of like the 80’s again, with us hitting an upper limit on what can be done with neural networks, with reasonable amounts of money. Except for some stackoverflow searches getting copied & pasted, the output is still garbage no-one reads.