New York-based journalists love to write about how New York taxpayers shouldn’t flee to Florida and skip paying 14.8 percent state/city income tax, 8.9 percent sales tax, and 16 percent estate tax (vs. 6-7 percent sales tax in FL and 0 percent income/estate). Here’s a recent example, “The Worst Housing Market in America Is Now Florida’s Cape Coral”:

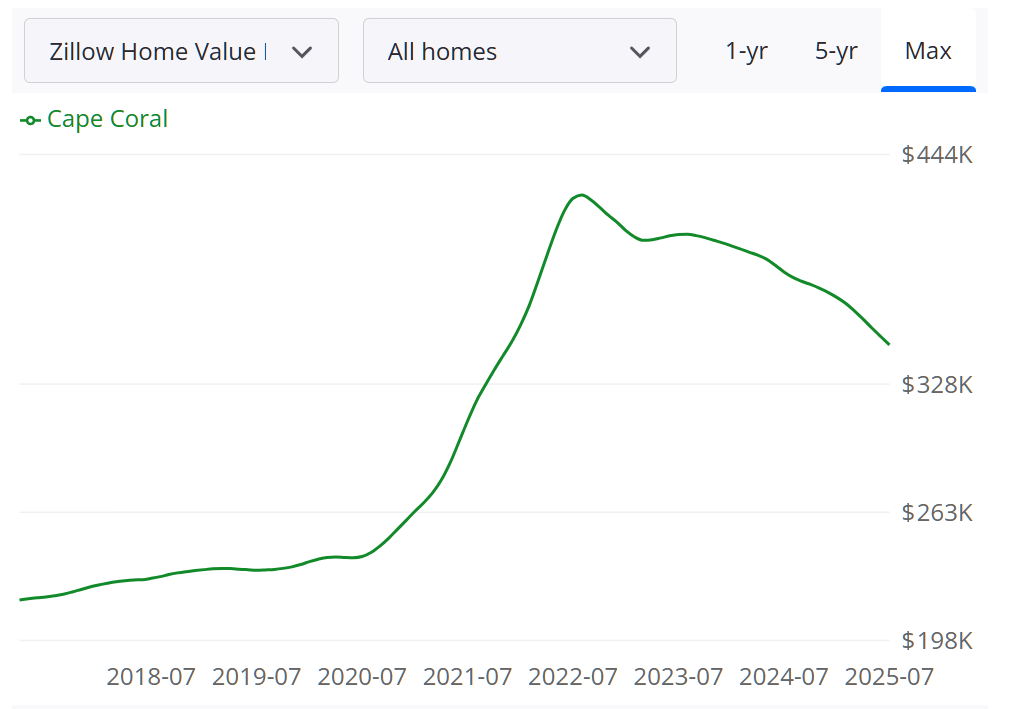

The median home price soared nearly 75% to $419,000 in three years, transforming the character of this middle-income community that for decades has catered to retirees and small investors. … Home prices for Cape Coral-Fort Myers have tumbled 11% in the two years through May

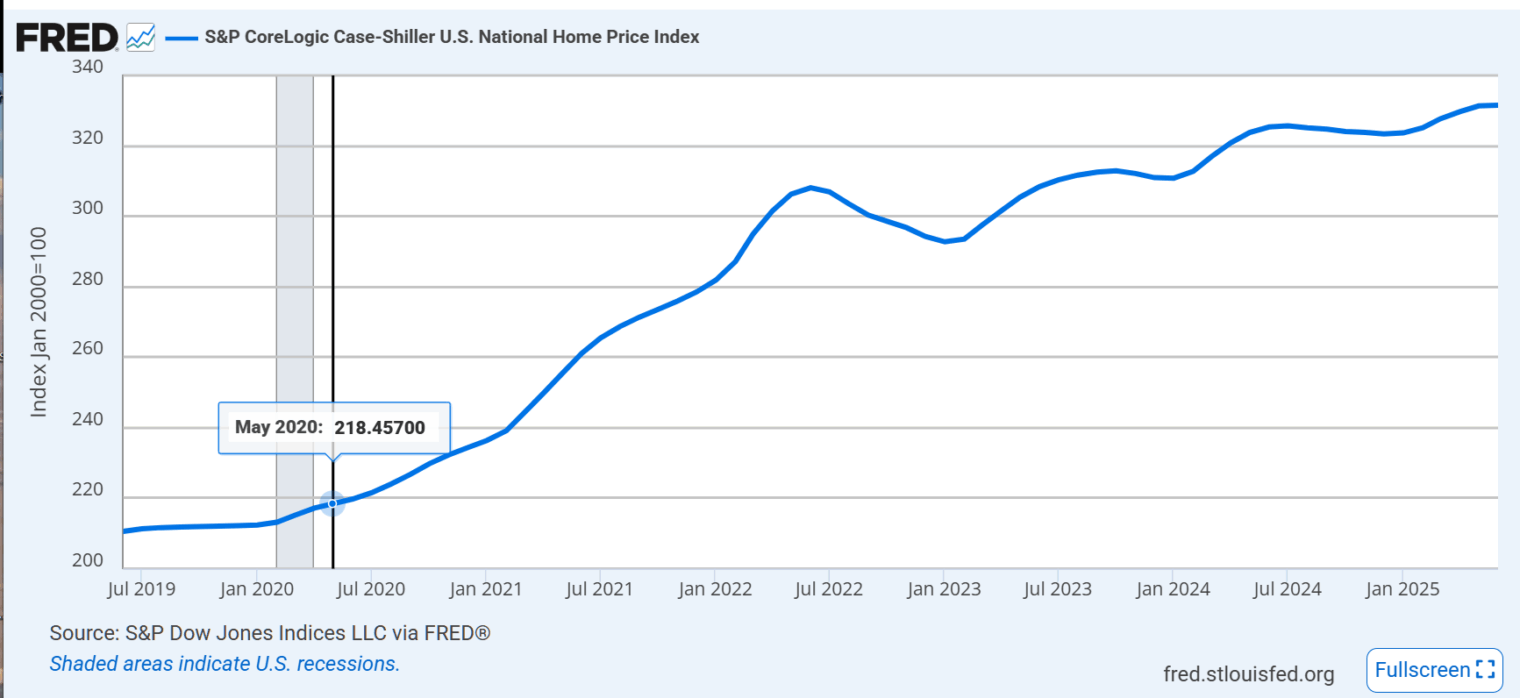

So the prices went up about 56 percent, over a five-year period. That’s before adjusting for Bidenflation. What happened in the U.S. overall? Prices went from 218 to 331 (source), a rise in nominal dollars of 52 percent:

In other words, for people who bought a house five years ago (the average tenure in a house for an American is about 12 years), what the WSJ calls “the worst housing market in America” outperformed the U.S. residential real estate market overall.

What Zillow shows is that the Cape Coral market was more volatile than the national average:

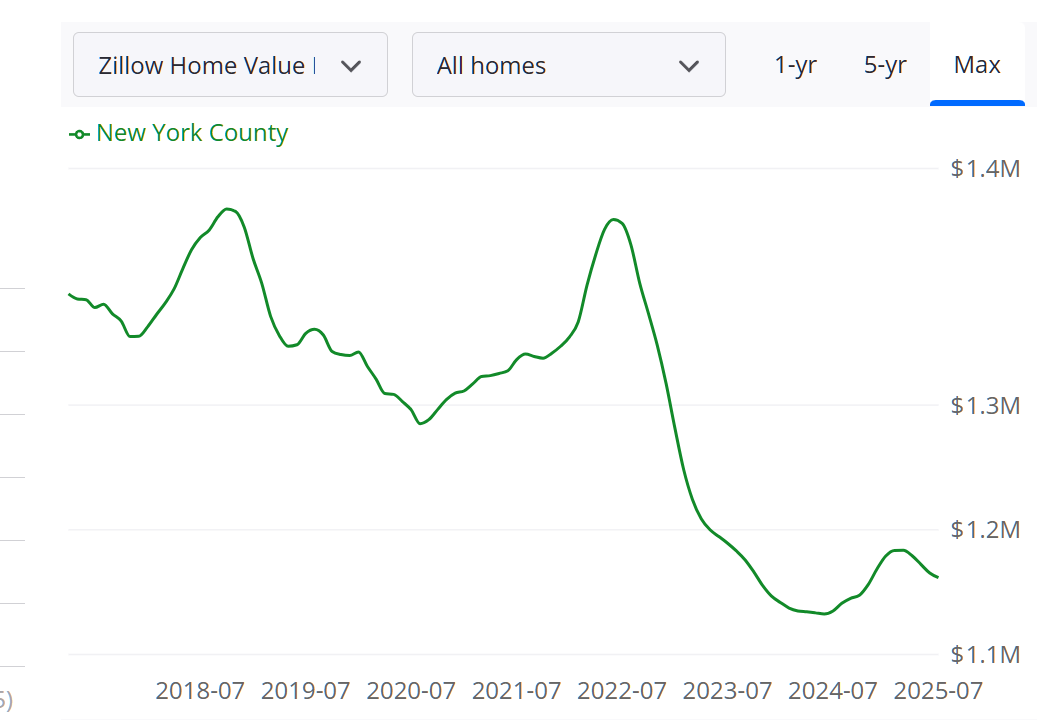

So Cape Coral actually has been a bad market for home-flippers who had the misfortune to buy in at the peak, but for the typical Cape Coral homeowner it has been a better market (albeit, not by much) than the average U.S. real estate market. What about for the elites who put the Wall Street Journal together? How has their Manhattan real estate done by comparison? Zillow:

(“New York County”=Manhattan)

So Cape Coral is objectively speaking the worst housing market in the U.S. (reported as fact/news by the Wall Street Journal rather than as opinion). At the same time, people who owned property in Manhattan fared far worse over the past 6 years or almost any time window within those 6 years.

Related:

- “The Flight of New York City’s Wealthy Was a Once-in-a-Century Shock” (New York Times, 2022): “The Manhattan residents who moved to Palm Beach County had an average income of $728,351, IRS data showed.”

- “Naples Estate Sells for $225 Million in One of the Country’s Priciest Home Sales” (Wall Street Journal, April 25, 2025): A waterfront estate in Naples, Fla., has sold for $225 million, the second-highest home-sale price in U.S. history and a record for the state of Florida. … The DeGroote sale comes amid a rapid-fire spate of major transactions for Florida, where real-estate values have skyrocketed.

Presumably they have to get these articles out now before the data show the results of the Zohranpocalypse.

I’m still optimistic about Mayor Mamdani keeping things comfy for Manhattan’s richest. What better way to preserve elite privilege than to distract the peasants with promises of lower rent and Jew-hatred (while not actually delivering lower rent and not doing anything concrete to slow down the IDF)?

If the non-rich New Yorkers can gather for a Two Minutes Hate every day against Israel they won’t notice the trash all over the streets, the migrant hotels, their cramped apartments, etc.

Careful what you wish for.

> transforming the character

The price isn’t the only thing transforming the character. For example, they call Cary, NC “containment area for relocated Yankees”. I guess you want their tax dollars. I really don’t want my semi-permanent home massively inflated–property tax, insurance, etc. “Slow and steady,” is my hope. Unsocialized Millennials with children, adulting for the first time, really change the character of a former retirement neighborhood, ask me how I know.

I was going to point out that Florida has high insurance rates, and carriers leaving. Then I did some digging and found that New York has had similar issues. At least in Cape Coral, one could self-insure, especially from the proceeds of an NYC residence. Living in a resort community would make me fear for AirBNB operations. Just what I need is some influencer having parties at 3 AM. I think Hilary wrote a book, “It Takes a Strong HOA: And Other Lessons Children Teach Us”

Jobs are another issue. If you aren’t retired, or WFH, what do you do in Cape Coral? Maybe handyman or plumber? How many of those are going to migrate from New York, and help maintain the Southern charm?

AT: if you read New York-based media you’ll certainly believe that home insurance rates are going up and carriers are leaving. The story from Florida, though, is that rates are decreasing and carriers are entering (admittedly mostly smaller carriers that are backed up by reinsurance rather than the biggest national companies). Example: https://www.flgov.com/eog/news/press/2025/governor-ron-desantis-announces-rate-reductions-miami-dade-county-auto-insurance

(the big insurers such as State Farm are still in Florida, but they don’t seem to be writing new properties that they consider “coastal” (Orlando good; Miami bad); they’re also trying to have a portfolio of houses that are as new as possible or at least with roofs that are as new as possible)

What kind of job pays well in Cape Coral, Florida? Same answer as for the rest of the U.S., minus New York and San Francisco: health care!

@philg

I think I’d need recreational weed for healthcare work, especially during the next pandemic. Most of the jobs I saw on Indeed were assistants–$20/hour. Maybe if I found 7 friends, we could afford living there, like in San Jose. Didn’t see any listings for the more lucrative medical care middleman.