… because there will be only one realtor.

“Home Sellers Win $1.8 Billion After Jury Finds Conspiracy Among Realtors” (New York Times, October 2023):

The influential National Association of Realtors and several brokerages were ordered to pay damages to home sellers who said they were forced to pay excessive fees to real estate agents.

A federal jury ruled on Tuesday that the powerful National Association of Realtors and several large brokerages had conspired to artificially inflate the commissions paid to real estate agents, a decision that could radically alter the home-buying process in the United States.

… under the verdict, the sellers would no longer be required to pay their buyers’ agents, and agents would be free to set their own commission rates, which could be slashed in half or less. For example, a home seller with a $1 million home can now pay as much as $60,000 in agent commissions — $30,000 to their agent and $30,000 to the buyers’ agent.

It looks like the problem has been solved for the long run (not in the short run, though; “Why broker fees have barely changed since the big settlement” (Axios, May 1, 2025)). It won’t be possible for brokerages to conspire because there will be only one brokerage. “Brokerage Giant Compass Agrees to Acquire Rival Anywhere for $1.6 Billion” (WSJ, today):

Leading real-estate brokerage Compass said it has agreed to acquire rival Anywhere Real Estate for $1.6 billion, the clearest sign yet that a long stretch of lackluster home sales is sparking industry consolidation.

The all-stock transaction would create a new industry giant with an enterprise value of about $10 billion, including debt, in one of the largest deals ever in the residential brokerage industry.

Compass and Anywhere were already the first- and second-biggest brokerages by volume in 2024, respectively, according to RealTrends. Compass has about 40,000 agents, while Anywhere has about 51,000 agents at brokerages it owns and another 250,000 agents at its franchises.

I’m trying to figure out why the U.S. has antitrust laws if something like this is allowed to occur.

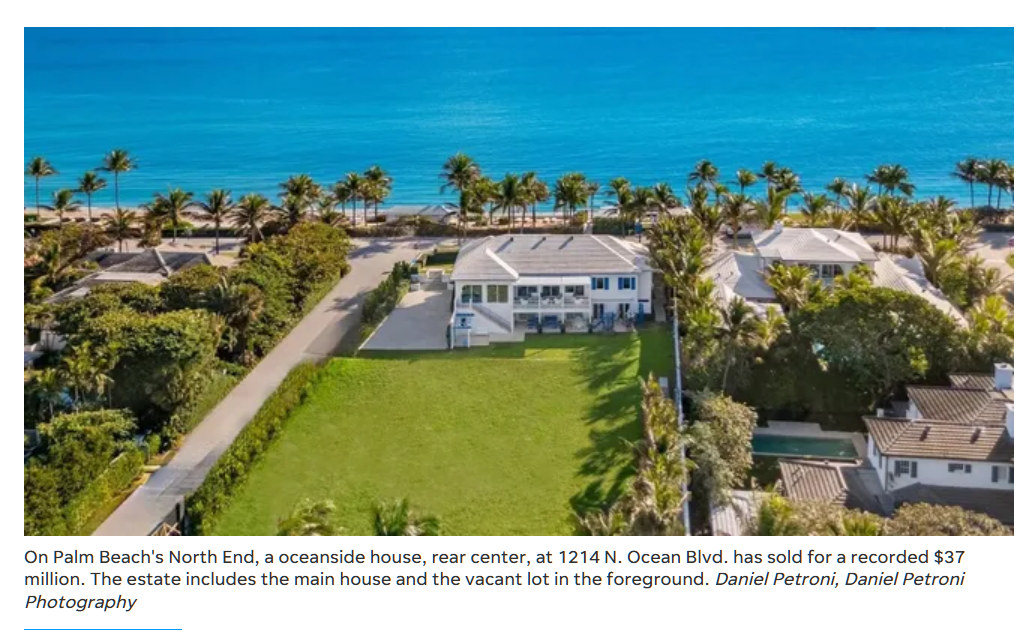

Separately, if you’re about to buy the new iPhone, here’s a photo of where some of the money you previously gave to Apple went, from “Ex-Apple CEO John Sculley sells Palm Beach mansion for $37 million” (USA Today, 9/10/2025):

Your post suggests the announced transaction will create an oligopolistic situation (resulting in market pricing power) and that antitrust laws are being ignored. You might calculate the Herfindahl-Hirschman Index (HHI) and see if in fact it suggests the proposed transaction substantially raises the concentration of the market. This is the metric most often used by antitrust reviews. Grok suggests the industry is highly fragmented and estimates an HHI of perhaps 2,500 level indicates high concentration).

Should read: “…estimates HHI of perhaps 200 (2,500 level indicates high concentration).

If you look at individual cities/markets, the HHI index is likely higher in many markets, but even then Grok estimates most markets below the 1,500 threshold.

HHI is interesting, but apparently these folks were concentrated enough circa 2023 to collude. Going forward they will be even more concentrated.

FYI, the 2023 trial and verdict did not address industry concentration in any respect. The entire legal argument was about rules by the NAR, which required agents to make blanket offers of compensation to buyers agents.