Some news from the Mamdani Caliphate… “Ricky Gervais has just sold a NYC apartment for $1.4M — a slight loss from its 2008 purchase price” (NY Post):

The English comedian and actor Ricky Gervais has just sold an apartment on East 63rd Street for $1.4 million, according to city property records filed on Monday.

Gervais, whose many credits include the across-the-pond version of “The Office,” and his longtime partner Jane Fallon, both appear on the deed in the property transfer to a limited liability company — whose identity could not immediately be identified.

The pair still own a larger unit on the 12th floor, which they bought in 2011 for $3.74 million, records show. They purchased this ninth-floor residence — with one bedroom and 799 square feet — for $1.66 million in 2008, property records also show. This means a slight loss for the couple.

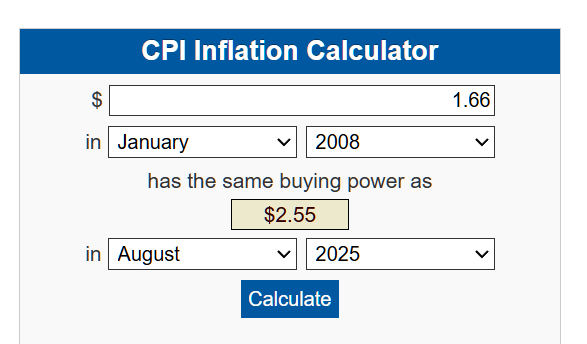

A “slight loss”? If we adjust for inflation at official CPI, the purchase price is equivalent to $2.55 million in today’s mini-dollars:

Gervais took a 45% hit on the value of this apartment in real terms, in other words, but via Money Illusion it is only “a slight loss”.

(My hedge fund manager friend, if anyone talks up real estate as a surefire investment: “Prices can only go up because they’re not making any more condos.”)

What if we consider the loss in terms of gold? My question to ChatGPT:

In terms of ounces of gold, what percentage loss was it to buy something for $1.66 million in June 2008 and sell it for $1.4 million in June 2025?

Answer (not in quote style):

Here’s one way to think about it:

- In June 2008, the price of gold was about $925.10 per ounce (on June 30, 2008). StatMuse

- In June 2025, gold was around $3,264.03 per ounce (on June 30, 2025). Gold Price

Step 1: Convert the transaction amounts into ounces of gold (at those dates)

- $1.66 million in June 2008 in terms of gold ounces = 1,660,000925.10≈1,794.8 ounces\frac{1,660,000}{925.10} \approx 1,794.8 \text{ ounces}925.101,660,000≈1,794.8 ounces

- $1.4 million in June 2025 in terms of gold ounces = 1,400,0003,264.03≈429.1 ounces\frac{1,400,000}{3,264.03} \approx 429.1 \text{ ounces}3,264.031,400,000≈429.1 ounces

Step 2: Compute the percentage loss in gold ounces

- Loss in ounces = 1,794.8 − 429.1 = 1,365.7 ounces

- Percentage loss relative to original (in ounces) = 1,365.71,794.8×100%≈76.1%\frac{1,365.7}{1,794.8} \times 100\% \approx 76.1\%1,794.81,365.7×100%≈76.1%

So, in terms of ounces of gold, the transaction represents about a 76 % loss.

Who are the two journalists and at least one editor who failed to notice the massive loss? “Zachary Kussin is the real estate editor at the New York Post. … He holds degrees from Bard College and the CUNY Graduate School of Journalism. … Mary K. Jacob is a reporter at the New York Post. … A graduate of New York University with a degree in politics and journalism…”

In other words, the two reporters who worked on this story are among the American elite when it comes to educational credentials.

Did you reach out to the reporters?

Dave:

More fun would be to reach out to the NY Post commenters, where SouthTownSkins asks:

> The real question is who would willingly pay to live in a far left Regressive cesspool?

I think the Post’s commenters won by a nose (that’s horse racing terminology for those of you who didn’t lose their first fortune on the ponies) on obnoxiousness with the “Marry Lisa” story. Even worse than YouTubers. Phil’s commenters were, as always, gentle men/women/non-binaries.

And if instead of buying a 1-bedroom condo, he had put the money into an S&P 500 index fund he would have $10.8M. He should have rented the apartment and invested the capital.

Lions only try to view losses relative to hard drive deflation. That 1st paycheck 25 years ago, making 2% in conservative investments, buys many times more storage than it did.

What’s crazy to me is that this, by coastal standards, a “regular person” property value. I mean I have friends with houses that are worth that much. His neighbors were probably accountants and lower-level tech bros and shit.

Oh, I missed the part about the second unit. I wonder if it was an office or for a nanny or servant or something?

Wait…Mamdani Caliphate? Why don’t you just let us ‘Murcans bury our head in our suburban lawns and wait for everything to get better Phil? Do you mean to tell me that Mohamed Atta and Osama bin Laden failed to destroy the resolve of NYC and America, so their spiritual successors want to just take it over through Attila the Hun tactics? I thought we spent $X trillion to fix this problem.

I do admit that I get easily distracted by minor things like affordable apartments in NYC ($1.4M doesn’t even buy you much in Ann Arbor, MI anymore, TBH–please don’t tell me lovely Ann Arbor has Muslim militant activity) which don’t even have the maintenance-intensive English gardens Atta and I hate so much about America.

I’m confused.

assuming the llc purchaser includes Mr. Gervais in some way, why would he create a taxable gain for this transfer?