“China’s Snub of U.S. Soybeans Is a Crisis for American Farmers” (New York Times, September 15):

On a windy September morning, Josh and Jordan Gackle huddled to discuss the looming crisis facing their North Dakota soybean farm.

For the first time in the history of their 76-year-old operation, their biggest customer — China — had stopped buying soybeans. Their 2,300-acre soybean farm is projected to lose $400,000 in 2025. Soybeans that would normally be harvested and exported to Asia are now set to pile up in large steel bins.

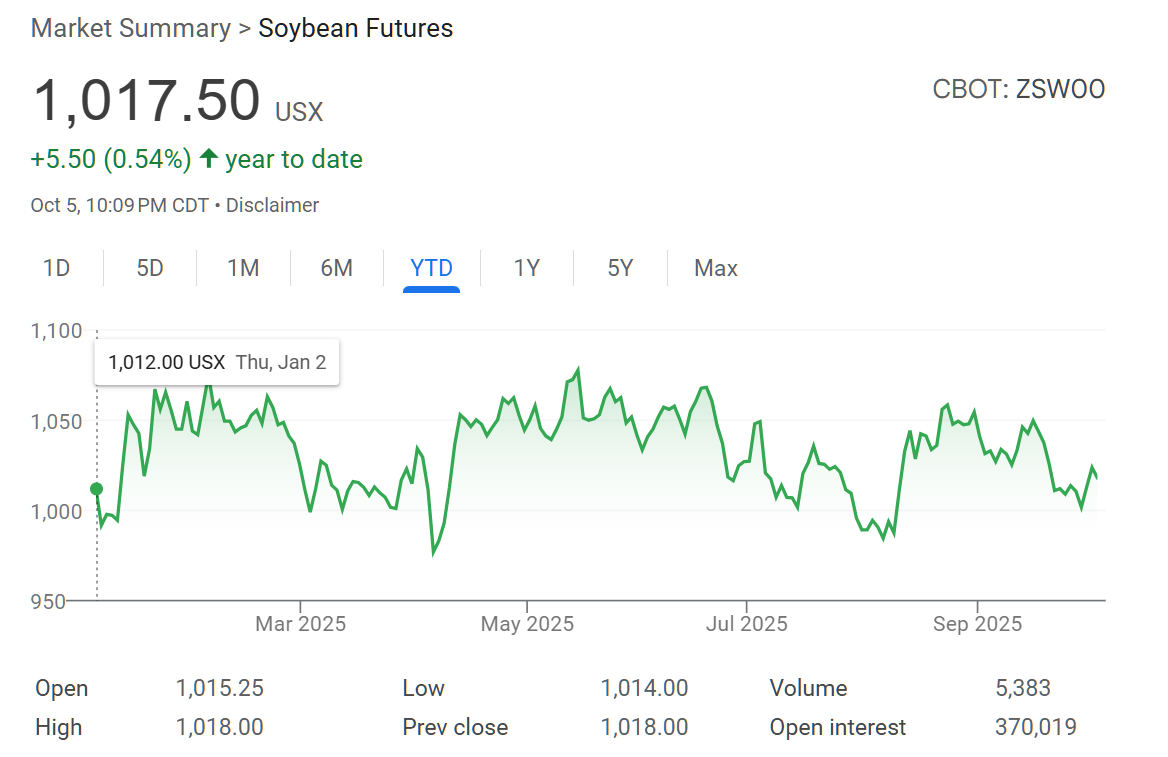

If we ask the Google for a quick summary of “soybean futures” we get the following chart that shows prices almost exactly where they were on January 1, 2025:

How can there be a “crisis” and at the same time an unchanged price? Is there some other soybean price index that should be considered?

A couple things:

1) Look at a longer-term price series and you will see that the price has collapsed from as much as $1,600/ton in 2021-2023 period, so farmers are indeed suffering given that their input costs inflated dramatically in recent years due to Bidenflation (fuel, seeds, equipment etc.) and haven’t retreated as have bean prices. For reference, current bean prices are the same as during the 2016-2017 period.

2) Beans are a fungible global commodity, so just because China buys elsewhere doesn’t result in a collapse in of itself as other buyers will just step in. The 2025 global crop is expected to be a record, following very large crops in both 2023 & 2024. This is S/D in action…

Thus, news stories have been incorrectly been placing the blame on China for currently depressed price.

The $400,000 loss for 2,300 acres is $173.90 per acre. A soybean yield of 60 bushels per acre would mean the loss is $2.90 per bushel. The chart at https://www.macrotrends.net/2531/soybean-prices-historical-chart-data of soybean price per bushel since 1968 shows that the price went from $8.44 in April 2020 to $15.57 in May 2021 and from $12.18 in May 2024 to $9.87 in August 2024, and were generally pretty high from May 2011 to August 2014 and April 2020 to December 2023 and pretty dismal from September 2014 to May 2020. Is which person who is President of the United States a causative factor? Is future likelihood of who will be POTUS a causative factor? Is Russia claiming Crimea a factor? I think the 1973 oil price shock was definitely a factor. But I also understand that a soybean farmer would appreciate an extra $3 per bushel to get to, or a little above, breakeven.

I don’t recall farmers paying attention to prices per ton, they see prices per bushel.

Related to this.

In 2018-2019 there was a $19 Billion farmer bailed and they are talking about around $10 Billion now. But all the fiscal conservatives never oppose this but they oppose any other kind of bailout to anybody else. I oppose all bailouts.