One of my faith-based beliefs is that productive assets, such as a company that makes widgets, are more valuable than rocks or metal bars. This, of course, hasn’t been true lately. Here’s the price of gold over the period of Bidenflation (we’re still in the “Bidenflation” period even without Biden, since inflation is tough to tame once it gets going, e.g., because government is nearly half the economy and many government payments are automatically indexed to inflation):

On the other hand, the S&P 500 is also way up, especially the Big Tech/AI companies.

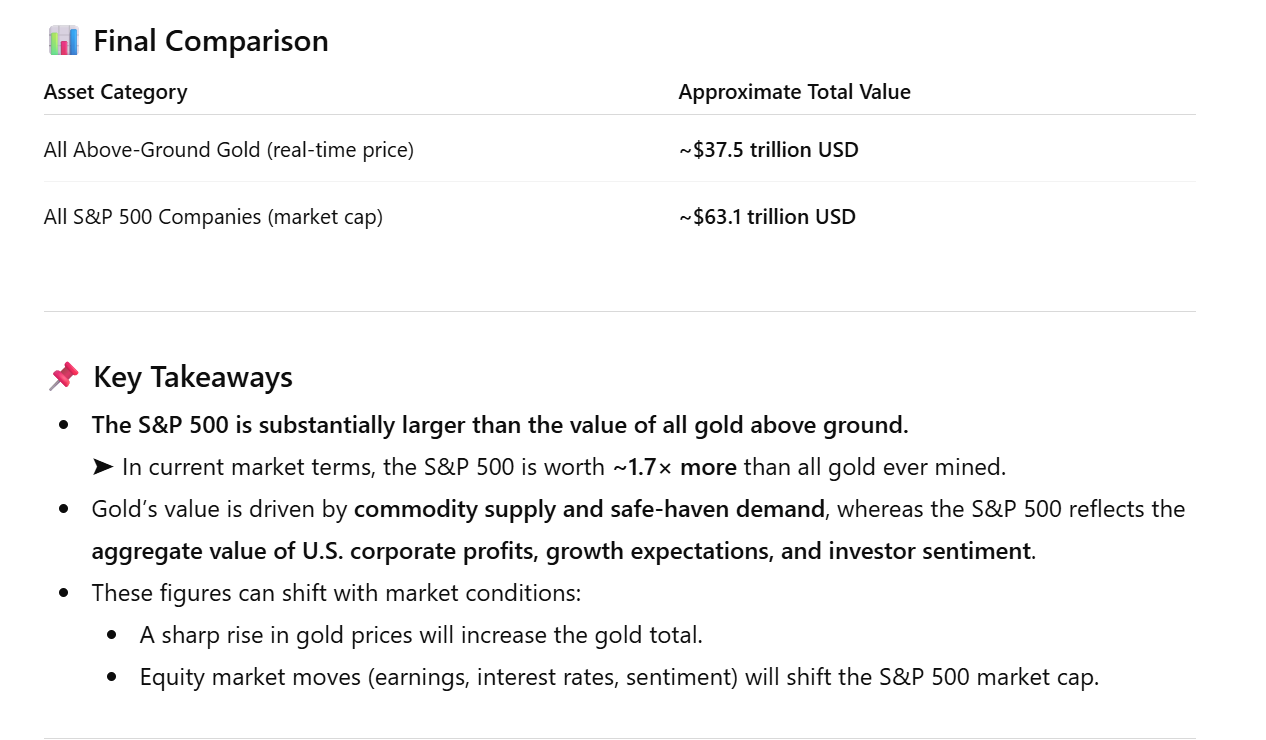

What does ChatGPT have to say? The S&P is worth 1.7X all of the above-ground gold:

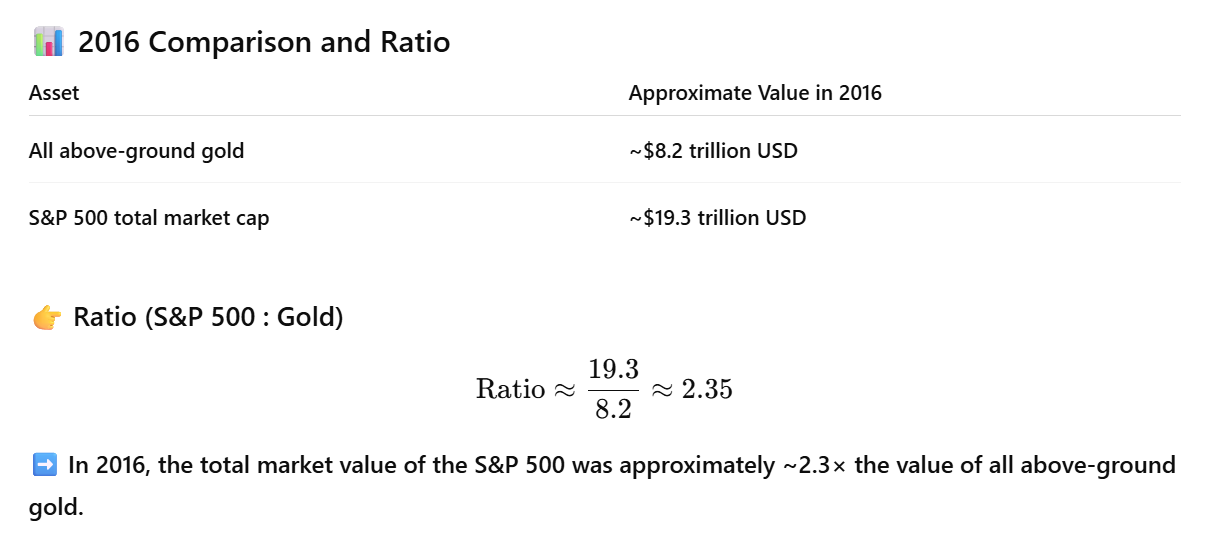

How about 10 years ago when AI wasn’t functional and productivity gains from AI weren’t baked into investor expectations? The ratio was higher: 2.35X.

So the value of productive assets, which should be enhanced by AI, have actually fallen relative to an unproductive asset, whose value shouldn’t be directly affected by AI.

Does this mean that markets don’t think that AI is useful? Or perhaps they think that AI will make some companies more productive, but it will render so many humans useless that taxes on the productive to fund idle lifestyles for the useless will wipe out any economic gains? Or maybe there is a simpler explanation, e.g., people love gold.

The media is doing a good job drumming up fear. The sub $200 AI plans are dog turds, but the gootubers spending $1000+ on claude opus plans & codex CLI plans are saying AI is undervalued if anything. The demos are convincing enough, but developing effective prompts, creating a harness for the agents to run in, & mastering the AI tools is like learning another programming language.

So much drumming by all involved — fear, shock, and awe — it’s like everybody has four sticks [1].

I see gold heavily advertised to us senior citizens on OTA television. “I like an investment I can visit in person at the bank.” Not sure what that indicates. Conjugal visits by chrysophiles?

[1]

> The media is doing a good job drumming up fear.

Trying to balance out the “irrational exuberance”?

> Alphabet sells rare 100-year bond to fund AI expansion as spending surges

https://www.reuters.com/business/alphabet-sells-bonds-worth-20-billion-fund-ai-spending-2026-02-10/

The price of gold reflects the perceived or real level of risk. There is a war in Eastern Europe, the United States is no longer an ally of Western Europe (and may even be an adversary), there is instability in Asia and the Middle East, and China is becoming increasingly powerful. There are many things that could go wrong. In due time AI will transform the world, but that promise does not reduce the levels of global risk. Even simpler: things are worth what people think they are worth.

> Even simpler: things are worth what people think they are worth.

Modulo advertising, gaming, and hype. (See above.)

Gold is valued as a collectable, like an Andy Warhol painting it has no real intrinsic value and unlike commodities such as coal or steel or molybdenum that have real uses. In the olden days it was thought to be a good hedge against inflation, though today there are TIPS and all sorts of derivative products if that is what you are worried about. Also, the data seem inconclusive about gold as an inflation hedge over time – for some periods of time it works and for some it doesn’t. Some people like gold for end of the world scenarios, though it is far from clear how would work. A contractual right to gold would suffer the same drawbacks as any contractual product – how will the right be enforced and by whom?–and physical gold you would need to protect and conceal and concealing gold bars is not that easy as Bob Menendez learned.

> Gold is valued as a collectable…unlike commodities such as coal or steel or molybdenum that have real uses.

Other than electronics, edible foil for topping desserts of the ultra wealthy, jet engines, radar, Trump’s toilets, and many other industrial uses.

Because Wall St is based on speculative notional wealth, not real physical wealth? Imagine AI robots built cars for a 10x lower price. Many more real people would buy many more cars, and their real lives would be “wealthier”. Meanwhile, the speculators on Wall St would see lower car prices => lower corporate earnings => lower stock prices, then go on Bloomberg tv bemoaning it as negatively affecting “the economy” (total gdp).

> One of my faith-based beliefs is that productive assets, such as a company that makes widgets, are more valuable than rocks or metal bars.

LOL! This matches with how Nature deems value to human beings, I guess.