Wartime reading: The Last Days of Budapest

I recently finished listening to The Last Days of Budapest: The Destruction of Europe’s Most Cosmopolitan Capital in World War II by Adam LeBor. It covers the history of Hungary starting after World War I. From Wikipedia:

The Communist Party of Hungary, led by Béla Kun was a newly formed party aligned with the Bolsheviks of Soviet Russia. The Social Democrats were split in their relation to them, but on 21 March [1919], the radical faction won out, and the two parties officially merged. They declared the Hungarian Soviet Republic, and the dictatorship of the proletariat.

In terms of domestic policy, the communist government nationalized industrial and commercial enterprises, socialized housing, transport, banking, medicine, cultural institutions, and all large landholdings. Land was collectivized, which alienated most of the peasantry who still demanded redistribution. The Communists also introduced prohibition of alcohol, which was very unpopular.

That last sentence saddens me because, of course, I think that if COVID-19 justified lockdowns and school closures then alcohol prohibition is trivial to justify under the banner of public health. (See Use testing and tracing infrastructure to enforce alcohol Prohibition? and The CDC supports my neo-prohibitionist philosophy)

Eventually a right-wing government takes over and unifies Hungarian under the ideas of (1) regaining territory lost after a post-WWI Treaty of Trianon, (2) restricting the influence of Jewish Hungarians (about 5 percent of the population), e.g., with race-based university admissions programs. Hungary ended up as an ally of Germany in WWII primarily because it wanted to regain territories lost in WWI. The majority of the population supported various anti-Jewish laws, but not necessarily the killing of all their Jewish neighbors. A minority of Hungarians did work with the Germans to kill Jews while the majority, including the police and the army, much more powerful than the militias, stood by watching (in most other European countries, the Jews were first moved out of public sight and killed in more private settings).

Zionists, with the assistance of foreign diplomats such as Raoul Wallenberg, worked to create papers that would ultimately protect about half of Budapest’s Jews, many of whom ultimately made it to the British mandatory Palestine and fought against the invading Arab armies in 1948 to establish the modern State of Israel that is currently in the news for her role in attacking entirely peaceful Iranians who enjoy building nuclear weapons and ballistic missiles while chanting “Death to America”. (The New York Times says that Trump and Netanyahu had no reason to attack because it would be “it would be a decade before Iran could get past the technological and production hurdles to produce a significant arsenal [of nuclear bombs mounted on ballistic missiles capable of reaching the U.S.]” (maybe a good reason to move from NYC to West Palm Beach, Florida? If they have only a dozen nuclear bombs to deploy, the Iranians might not bother targeting Florida!).)

The tenacity of the Germans and Hungarians was impressive. They knew that they couldn’t hold out against a Russian siege, but fought almost to the last man (killing about 80,000 Russians in the process, but the Russians weren’t discouraged by casualties). Unfortunately for the Jews, the Hungarians, notably members of the Arrow Cross, were equally tenacious when it came to killing Jews. Even as they knew that their city and country were falling to the Red Army, Hungarians spent a lot of time, energy, and ammunition killing their Jewish neighbors. Perhaps there is a modern analogy. Europe is currently experiencing economic stagnation and irrelevance to the modern world economy (ChatGPT: “EU imports would generally be easier to replace than Taiwan imports … Taiwan imports are strategically critical; Substitution is slow and difficult; Some products currently have no near-term substitute”). Legacy Europeans are being replaced by new and improved migrants. What do a lot of legacy Europeans do with their time and energy? Protest against whatever the State of Israel is doing.

An email from New Yorker just now says that there is no upside, but only risk, in attacking Iran. I don’t subscribe so I can’t read their paywalled content, but presumably the Iranians who were previously chanting “Death to America” could start chanting “Double Secret Death to America”.

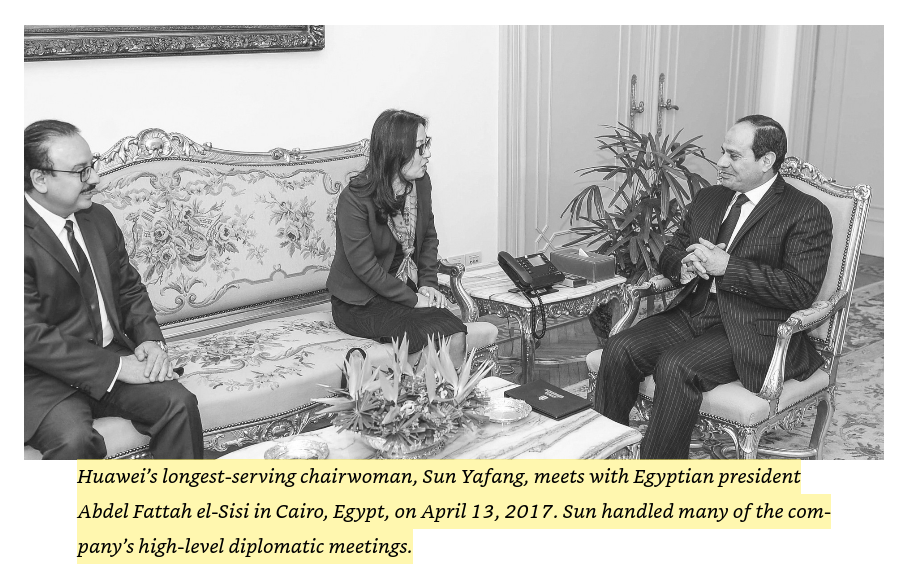

Let’s close with my favorite headline about the attack on Iran, from the Wall Street Journal. Breaking new ground in the Department of Projecting Strength, the Commander in Chief of the U.S. military is relaxing in Palm Beach rather than nervously drinking coffee in an underground war room in D.C.:

(The Israeli and U.S. militaries also projected strength by sleeping late and attacking Iran at 10 a.m. local time. The bombing of Tehran was scheduled for the same time of day as a student pilot lesson.)

Full post, including comments