TSA employees working without pay

The Government Employee Fair Treatment Act of 2019 guarantees 100 percent pay for federal workers who either (1) show up to work during a “shutdown”, (2) relax at home during a “shutdown” as blessed non-essentials, or (3) vacation in Europe during a “shutdown” without using any vacation days (again, limited to those who can get classified as non-essential).

How does the New York Times characterize the potentially-slightly-delayed paychecks of TSA employees (funding ran out a week ago)? “T.S.A. Workers Brace for Another Shutdown They Didn’t Cause”:

Lawmakers left town this week without a deal to fund the department over a disagreement about reining in the Trump administration’s hard-line immigration enforcement tactics. Most of the hardships faced by employees — who are working without pay — will go unnoticed by the public with a few possible exceptions, including the people who check IDs, scan baggage and complete other security tasks at U.S. airports.

Officers are frustrated that they have to pay the price for a political fight that has nothing to do with them. It’s even worse this time, because they have to work without pay while immigration officers will continue to be paid through a separate fund.

Nowhere do the journalists mention that TSA employees are guaranteed to receive 100-percent pay so long as the U.S. government is able to print money.

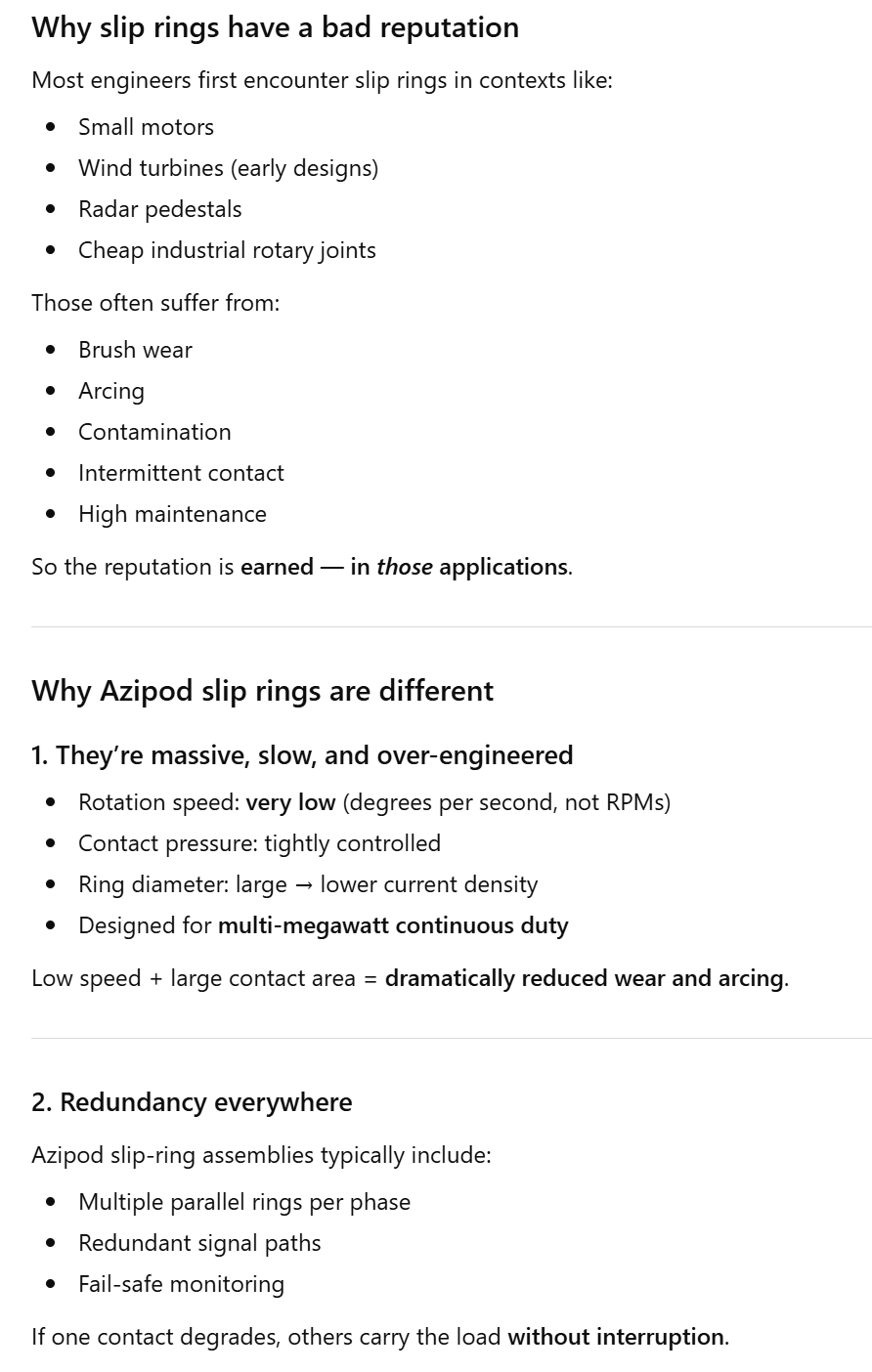

Here’s another fun one… “With Latest Rollback, the U.S. Essentially Has No Clean-Car Rules” NYT, February 16, 2026):

The momentous end to the federal government’s legal authority to fight climate change makes it official.

The United States will essentially have no laws on the books that enforce how efficient America’s passenger cars and trucks should be.

That’s the practical result of the Trump administration’s yearlong parade of regulatory rollbacks, capped on Thursday by its killing of the “endangerment finding,” the scientific determination that required the Environmental Protection Agency to regulate greenhouse gases because of the threat to human health.

“The U.S. no longer has emission standards of any meaning,” said Margo T. Oge, who served as the E.P.A.’s top vehicle emissions regulator under three presidents and has since advised both automakers and environmental groups.

With no emissions standards, then, it would be legal for Toyota, GM, and Ford to stop including catalytic converters ($300-$1,500?) with their new vehicles? Here’s part of what ChatGPT said regarding the greenhouse gas limits that are potentially gone and the “no emission standards of any meaning” world described in the New York Times…

——————-

If greenhouse-gas (GHG) limits on cars were removed in the U.S., a substantial set of non-GHG emissions regulations would still remain. These target pollutants that directly harm human health and local air quality rather than global climate.

Below is a structured breakdown of what would still be regulated.

1) Criteria Air Pollutants (Clean Air Act “criteria pollutants”)

Under the Clean Air Act, the EPA regulates tailpipe emissions that contribute to smog, soot, and toxic exposure.

Key regulated pollutants from light-duty vehicles

- Nitrogen oxides (NOₓ)

- Major driver of ground-level ozone (smog)

- Causes respiratory illness, asthma exacerbation

- Non-methane hydrocarbons (NMHC) / Volatile organic compounds (VOCs)

- React with NOₓ to form ozone

- Includes unburned fuel vapors

- Carbon monoxide (CO)

- Interferes with oxygen transport in blood

- Acute toxicity risk in urban corridors

- Particulate matter (PM / PM₂.₅ / PM₁₀)

- Soot from combustion (especially gasoline direct injection and diesels)

- Linked to cardiovascular and lung disease

These limits are embedded in EPA Tier 3 standards (phased in from model years 2017–2025).

2) Air Toxics (Hazardous Air Pollutants)

Vehicles are also regulated for toxic compounds under the Clean Air Act’s Mobile Source Air Toxics (MSAT) program.

Key examples:

- Benzene – carcinogenic fuel component

- Formaldehyde – respiratory irritant, carcinogen

- Acetaldehyde

- 1,3-Butadiene

- Polycyclic aromatic hydrocarbons (PAHs)

Regulation occurs via:

- Tailpipe limits

- Fuel composition controls

- Evaporative emissions standards

3) Evaporative Emissions

Even when parked, cars emit fuel vapors. These rules would remain:

Regulated sources

- Fuel tank permeation

- Hose and seal leakage

- Refueling vapor loss

Controls required

- Charcoal canisters (evaporative capture)

- Onboard Refueling Vapor Recovery (ORVR)

- Low-permeation fuel systems

These standards are especially important in hot climates (e.g., Florida, Arizona).

Full post, including comments