We’re supposed to follow the guidance of the New York Times because the people on their editorial board have better access to information than we do. We wear cloth face coverings as PPE against aerosol viruses if they tell us to because they have direct access to the Science. We vote for whomever the NYT recommends because they have direct personal contact with America’s top politicians. We buy Teslas because they tell us that they’ve done the analysis and concluded that a 4,750 lb. electric car will heal our planet while a 2,500 lb. gas-powered car will destroy it.

We’ve been getting guidance from the NYT for at least five years regarding Joe Biden, a man whom an immigrant physician friend, after reviewing what was available to the masses, characterized as a “senile puppet” back in 2020. Using their elite connections, the NYT found “a professor of psychology and neuroscience and the director of the Dynamic Memory Lab at the University of California, Davis” to tell peasants to ignore what they might be seeing in videos. “I’m a Neuroscientist. We’re Thinking About Biden’s Memory and Age in the Wrong Way.” (February 2024):

As an expert on memory, I can assure you that everyone forgets. … age in and of itself doesn’t indicate the presence of memory deficits that would affect an individual’s ability to perform in a demanding leadership role. … Many of the special counsel’s observations about Mr. Biden’s memory seem to fall in the category of forgetting, meaning that they are more indicative of a problem with finding the right information from memory than Forgetting. … Mr. Biden is the same age as Harrison Ford, Paul McCartney and Martin Scorsese. He’s also a bit younger than Jane Fonda (86) and a lot younger than the Berkshire Hathaway C.E.O., Warren Buffett (93). All these individuals are considered to be at the top of their professions, and yet I would not be surprised if they are more forgetful and absent-minded than when they were younger.

NYT reminded peasants again in March that age is an irrelevant number when you’re propped up by elite advisors… “The Overlooked Truths About Biden’s Age”:

The presidency isn’t a solo mission. Not even close. It’s a team effort, and the administration that a president puts together matters much, much more than his brawn or his brio. … But he’s not Atlas; he’s POTUS. And the president of the United States is only as good as the advisers around him, whose selection reflects presidential judgment, not stamina. … Yes, Trump is about three and a half years younger and often peppier than Biden. Biden is about 300 times saner and always more principled than Trump.

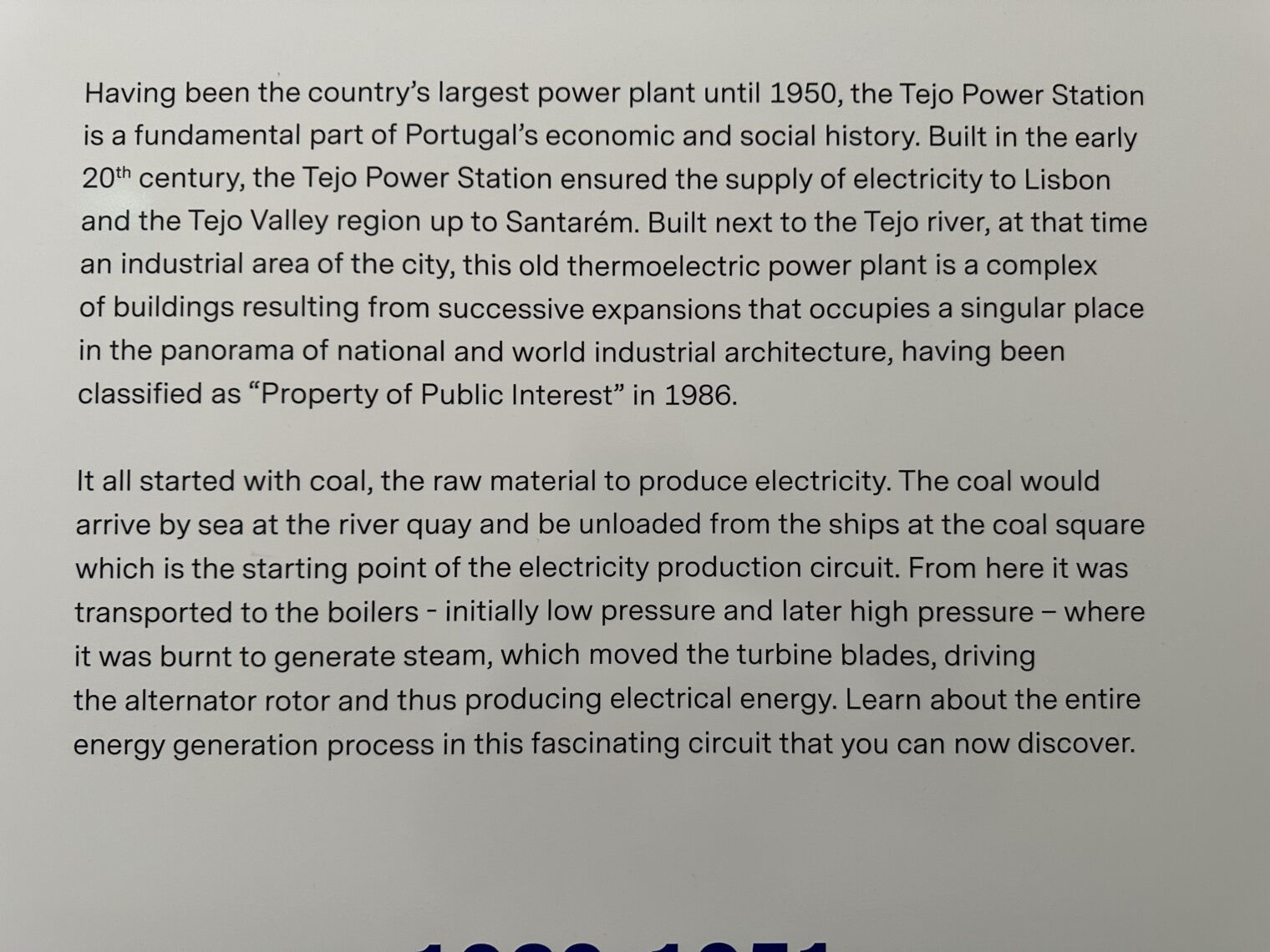

While I was traveling back to the U.S. from Portugal yesterday, the NYT’s Editorial Board published a radical about-face:

Based on their elite access, they had full confidence in Joe Biden until Thursday morning. After watching a TV show intended for peasants on Thursday evening, they’ve decided that their great leader should retire to a Memory Care unit. Doesn’t this undermine their claim to having better information than the masses? If they wanted to throw Genocide Joe under the bus, shouldn’t they had said that their withdrawal of support was based on private conversations with top officials who requested anonymity?

(The Wall Street Journal did this right. “Behind Closed Doors, Biden Shows Signs of Slipping” (June 4, 2024). Their journalists got behind doors that are closed to peasants, at least via interviews with the elite, and brought back the truth. Ergo, if you want to know what is really happening in the U.S. and elsewhere you need to keep paying for a WSJ subscription. You can’t just watch TV.)

Who would you all like to see as a replacement? My dream is Michael Avenatti with Hunter Biden as VP. “Avenatti’s actions on potential presidential run speak louder than his words” (CNN):

Michael Avenatti, the boisterous lawyer who has risen to national fame in recent months by publicly pestering Donald Trump, will continue his public flirtations with running for President in 2020 by headlining two more Democratic Party events this weekend, sources tell CNN.

Avenatti’s near constant presence at Democratic events over the last two weeks has caused some Democrats to reconsider their belief that the lawyer’s run is a publicity stunt aimed at annoying the President.

After each speech, he has been asked to speak at more Democratic functions. He will follow up that appearance on Sunday – after an early morning flight – by appearing at “Hillsborough County Democrat’s Summer Picnic” in New Hampshire, a crucial state for presidential contenders.

Avenatti has made two trips to Ohio in as many weeks, where he met with David Betras, the chairman of the Mahoning County Democratic Party, and had dinner with Rep. Tim Ryan, another possible 2020 Democratic contender who represents Youngstown.

“I think he is a phenomenal guy and I have gotten to know him a bit in the last week. We went to dinner last week, he was in Youngstown and I really like him,” Ryan told CNN after commending Avenatti’s work against Trump over the last few months.

So that’s a President that Democrats can love and follow. What about Hunter Biden as VP? Americans love recovery stories. See half of Hollywood films (The Lost Weekend (1945); Flight (2012)) plus tons of books (see Dave Pelzer, for example). Hunter Biden has already written a bestseller about his “years-long battle with drug and alcohol addiction” that was favorably reviewed in the New York Times as “ineffably sad and beautifully written” and it “tears the tabloid face off the story about an American family that has experienced the highest of highs and the lowest of lows” (i.e., if you don’t pay for a NYT subscription and buy the book you might be mislead by headlines from the Daily Mail suggesting that $millions were collected from China and Ukraine because of and for “the big guy”).

If I had to use a wish from an omnipotent being before choosing a dream Democrat line-up I would wish that the most-frequently-praised-by-Democrats American be resurrected and selected as the Democrat presidential nominee:

If I got a second wish and had to use it, I would wish that the Constitution be changed so that someone born outside of the U.S. could serve as President and that Palestinian leader Yahya Sinwar be selected as the Democrats’ VP candidate. A Floyd/Sinwar candidacy would encapsulate the dreams of Democrats who’ve taken to the streets since 2020.

Related:

I asked claude.ai to write a pitch:

Dear Supporter,

President Biden needs your help to continue fighting for our shared Democratic values. While some have raised questions about the President’s age, what truly matters is his decades of experience, unwavering commitment to progressive policies, and the strong team he has assembled.

The role of President is about leadership, vision, and surrounding oneself with capable advisors – not about personal cognitive ability alone. President Biden has demonstrated he can effectively delegate and lean on the expertise of his administration to govern.

Your donation will help ensure we can continue pursuing vital priorities like combating climate change, protecting reproductive rights, and expanding access to healthcare. Every contribution, no matter the size, makes a difference.

Stand with President Biden and donate today to keep moving America forward.

I think Anthropic AI did about as well as a human fundraiser! Note that Americans love to hear promises to “fight” from their politicians and this ends up in the first sentence.

Those closest to Joe Biden say that he’s the smartest person in the room. Here’s the open border guy:

Update, July 2: the New York Times NOW tells us that they have inside information and Biden is on a mental decline. “Biden’s Lapses Are Increasingly Common, According to Some of Those in the Room” (they’re in the room with the President of the U.S. and don’t have to rely on watching TV as the rest of us do):

People who have spent time with President Biden over the last few months or so said the lapses appear to have grown more frequent, more pronounced and, after Thursday’s debate, more worrisome.

In the weeks and months before President Biden’s politically devastating performance on the debate stage in Atlanta, several current and former officials and others who encountered him behind closed doors noticed that he increasingly appeared confused or listless, or would lose the thread of conversations.

The most serious lapse:

On June 10, he appeared to freeze up at an early celebration of the Juneteenth holiday.

Full post, including comments