In What edge does Rivian have in the truck or EV market? (November 2021) I wondered how Rivian could be worth $127 billion, given that Ford will soon be selling electric pickups. As of today, the company is worth $78 billion and GM has promised to start delivering electric pickups in volume within two years (engadget). Like the Ford, the Chevy starts at around half of what Rivian wants for its electric pickup. If everything goes perfect, Rivian will produce a handful of trucks before Chevy pushes the Silverado EV out the door in late 2023, but why does that translate to $78 billion in long-term value? If there is $5,000 in profit to be had from each truck and we use a discount rate of 0%, Rivian needs to sell more than 15 million trucks before $78 billion in profit is generated.

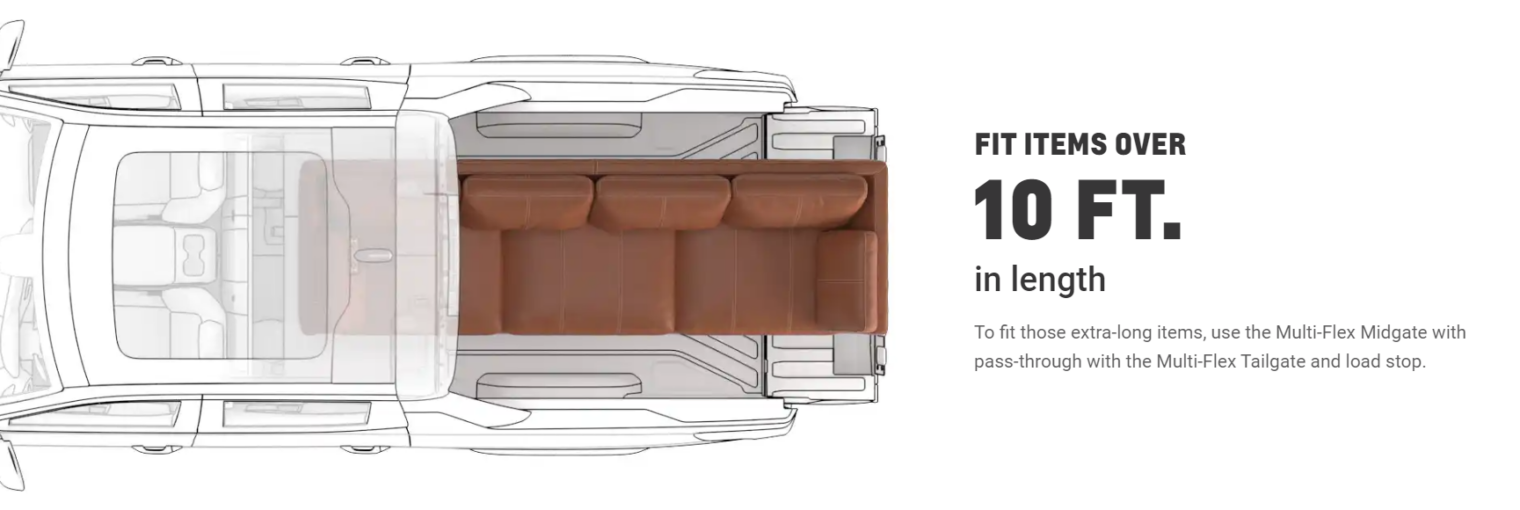

The GM truck does seem better than what Rivian is offering due to the capability of extending the bed via folding back seats. And with a massive frunk it would be a pretty good family vehicle (put the stuff that is valuable and/or can’t get wet in the frunk). Why would anyone pay $67,500 for the Rivian when the “work” version of the GM can be had for $40,000?

In my opinion, the Silverado interior and dashboard seem to be better-designed than what Rivian offers. If we wanted a pickup truck we certainly wouldn’t pay extra to get a Rivian rather than a Chevy or Ford and it doesn’t seem likely that Rivian can profitably produce trucks at the Chevy or Ford price.

Can someone again please explain to me why Rivian is worth anything?

[Also, what about my faith in the Efficient Market Hypothesis? How did Rivian go down in value by 40 percent over two months? There haven’t been any surprises from the legacy car manufacturers.]

Related:

I don’t think it can be justified. I think most of it comes from code switching from car company to tech stock, and therefore getting evaluated relative to say the fifteenth entrant to the food delivery gig thing

Rivian was hyped because it was building vehicles for Amazon:

https://www.theverge.com/2020/10/8/21507495/amazon-electric-delivery-van-rivian-date-specs

Now that Amazon also buys from Chrysler, Rivian’s stock price drops:

https://www.ft.com/content/7775cdec-f2a3-4681-91a4-60cd285c9895

Bezos giveth, Bezos taketh away (alternate version: Bezos giveth, MacKenzie taketh away).

The idea that Bezos would just leave 120bn or whatever on the table which he could easily just take is deranged. That guy eats alone

Andrea: All Deplorables who identify as “guys” eat alone. They are pining for the unanswered love of AOC:

https://www.dailymail.co.uk/news/article-10366793/Candace-Owens-lashes-AOC-tweet-branding-Republicans-sexually-frustrated.html

Yes of course. I had forgotten to mention AOC, which is clearly the lynchpin of the Rivian valuation debate. Sorry for initially omitting this crucial piece of the puzzle.

I think we should put AOC in a Rivian with Doug DeMuro and send them deep into the woods with a cooler full of Absolut Berry Vodkarita, a bed tent and some sleeping bags so he can learn all her “Quirks and Features” and vice-versa. The two of them might become high-tech progressive Homesteaders! Just get some solar panels out there to charge the Rivian, they’re made for each other!

The federal funds rate only needs to go to a fraction of a percent to bring this whole shindig down. Today’s investors have never known a non zero interest rate & have only known getting stars for everything they ever did.

The government could get away with high inflation when it was all in Calif* but if there really is a mass migration of Goog salaries to Wichita, the valuations of the last 15 years are going to end in tears.

@lion2 Please do say more – are envisioning the ex-tech investors jumping onto bonds wagon? One could say the prediction has been around for quite some time …

The “big winners” after the IPO according to this online rag were: 1) Amazon 2) T. Rowe Price, 3) Abdul Lateef Jameel and 4) Ford. The four of them are holding this ridiculously-overvalued paper wealth asset but in the meantime the likes of Doug DeMuro are pulling out all the stops among the Dweeb-Lords to make Rivian the Next Cool Toy for Rich Nerds.

https://markets.businessinsider.com/news/stocks/rivian-ipo-77-billion-rivn-big-winners-electric-trucks-amazon-2021-11

I don’t understand how it all works. It’s all financial/marketing/glitz/buzz horseshit to me, but this is what America is all about now, unicorns and hocus pocus.

Sorry, I spelled “Latif” incorrectly. Abdul Latif Jameel is one of those Saudi “Communities” that receives effusive praise from everybody – from Prince Charles to Bono to Prince Albert II of Monaco to the co-founder of the Carlyle Group, and a President Emeritus of MIT. So they must know something we don’t about why Rivian is such an attractive investment.

One thing I think we can all agree on: it’s really important that rich people who visit each other on their yachts in Monaco stay rich! And Rivian is heling them do that! So don’t question this whole thing too much, you might wind up in a suitcase somewhere.