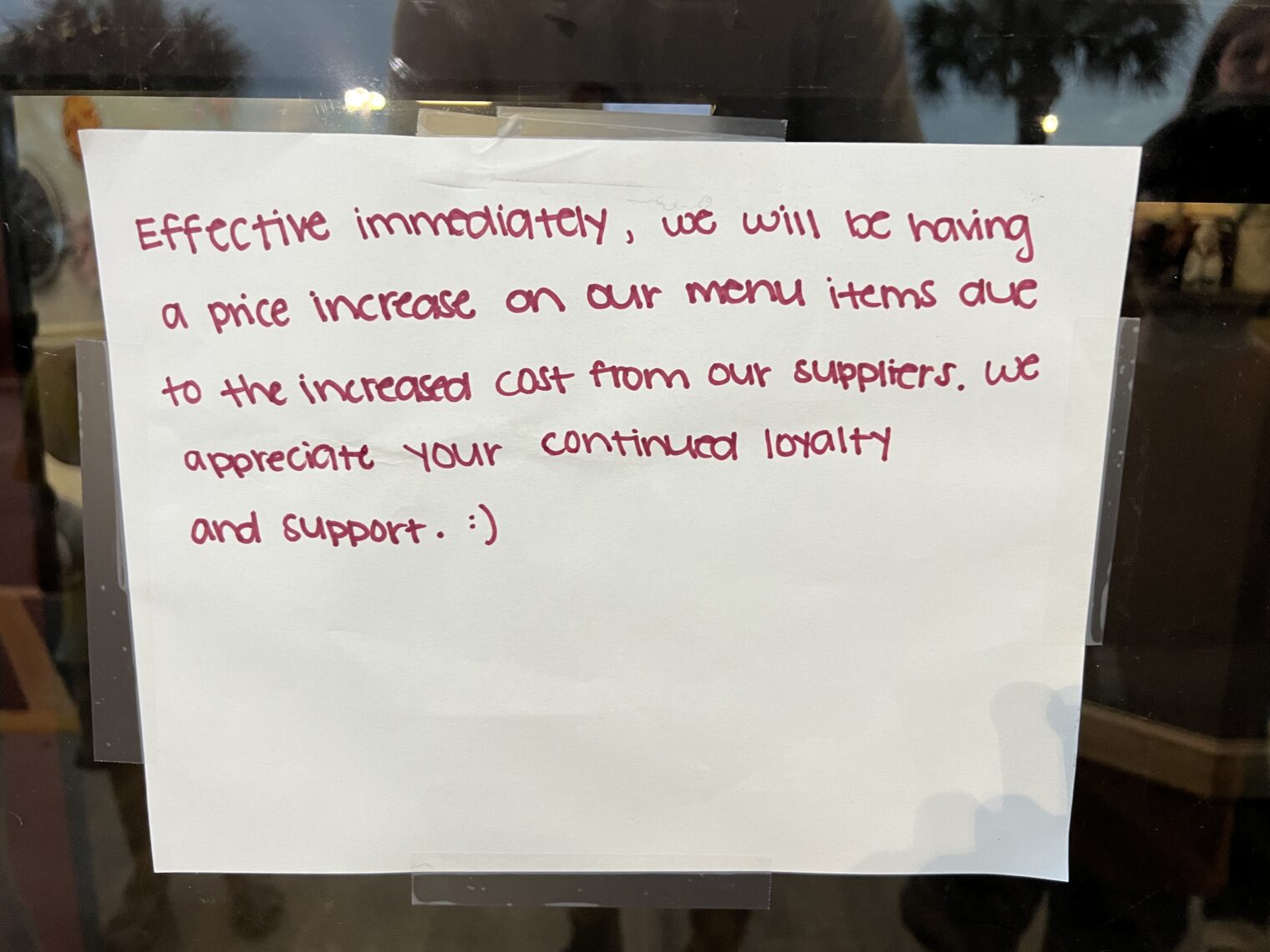

Raging inflation at the sushi and noodles place near Legoland (burned some $4.50/gallon dinosaur blood in the minivan):

Can we find someone to blame for our debased money? The Wall Street Journal can! “The Humbling of the Federal Reserve” (3/14/2022):

The central bank faces an inflation mess of its own making.

Government spending excesses in 2020 and 2021 played a role, but the Fed made all of that easier to pass by maintaining the policies it imposed at the height of the pandemic recession for two more years. Low interest rates make deficits seem more fiscally manageable than they really are. The Fed has continued to buy Treasurys and mortgage-backed securities even as inflation nears 8%—right up until this week’s meeting.

What went wrong? The Fed is supposed to have the world’s smartest economists and access to the best financial information. How could they make the greatest monetary policy mistake since the 1970s?

Part of the answer lies with the Fed’s economic models, which are rooted in Keynesian analysis in which demand trumps all. The Fed models give little thought to incentives for or barriers to the supply-side. As finance scholar Emre Kuvvet wrote recently on these pages, among economists in the Federal Reserve System, Democrats outnumbered Republicans by 10.4 to 1 in 2021. They prefer James Tobin over Milton Friedman.

This leads the Fed to overestimate the growth effect of federal spending but underestimate the growth benefits of regulatory and tax reform. For years after the 2008-2009 recession, the Fed’s governors and regional bank presidents predicted faster GDP growth than what happened. But they missed the faster growth after the 2017 tax reform.

What happens next? We’re told to expect an 0.25 percent increases in interest rates. How much of a difference can that make when interest rates remain lower than inflation (i.e., when you’d have to be a fool not to borrow)?

The news from Legoland isn’t all bad, incidentally. There are no problems too challenging for Presidents Biden and Harris to tackle from the White House:

History lesson: a stroller was often as important as a battle axe:

Related:

- “Disney C.E.O. Says Company Is ‘Opposed’ to Florida’s ‘Don’t Say Gay’ Bill” (NYT) (but Legoland’s CEO has not taken a position on 2SLGBTQQIA+ education for kindergarteners)

So what would you do to preserve the value of your savings? The real estate seems to be in the state of irrational exuberance, yet again. Some of the top financial advisors are afraid to advise on equities at this time. You borrow, and then what? Rental property? The eviction bans are all to recent to be forgotten. Buy and hold, if you’re able to keep making the payments in hope of price appreciation? Too speculative.

“So what would you do to preserve the value of your savings? The real estate seems to be in the state of irrational exuberance, yet again

S&P500 has a high PE ratio that could easily revert back to mean. Preserving savings probably means keep working. Or have a nice government pension.

In an inflationary time you need to own assets not cash. None of the choices are so terrific but they are all better than cash which has depreciated 7.9% over the last year.

Joseph: even someone without any savings can take action in the current situation. Borrow to the absolute limit and buy everything that he/she/ze/they think that he/she/ze/they might want over the next five years. And we see that a lot of Americans do just this. As soon as they have any home equity (due to inflation) it is time for a refinance that takes cash out. The cash is immediately spent on fun stuff.

inflation can be hedged by leveraging real-estate debt at 10x or 100x income and then let inflation slowly erode the debt. Just don’t lose the ability to service the debt or it’s back to apartment. Assuming a cheap run down rental that has plenty of pit bulls roaming around pooping on the grass doesn’t require a credit check.

“burned some $4.50/gallon dinosaur blood in the minivan” Sweet deal. Gas station closest to my house is 6.49

An ugly pre-fed tuesday is in store, followed by a bump when the fed turns out to be lighter than expected. They’re just going to keep talking up interest rate expectations without doing anything until the balance sheet hits $10 trillion next year.

Inflation has forced a lot of early retirees back into the workforce: on-site jobs in Greenspunchussets. A few other bloggers who bragged about their skilled stonk trades over the last 15 years have cut short their European getaways & gone back to at least part time.

We are still suffering from the equity-driven subprime mortgage lending that caused the 2008 crisis:

https://en.wikipedia.org/wiki/Subprime_mortgage_crisis

Apart from QE induced inflation, how did the equity program work out? Did it provide more housing?

https://www.pewresearch.org/fact-tank/2020/09/04/a-majority-of-young-adults-in-the-u-s-live-with-their-parents-for-the-first-time-since-the-great-depression/

“A majority of young adults in the U.S. live with their parents for the first time since the Great Depression.”

In 1960 the number was 29%, in 2000 38%, then a sharp rise starting around 2005-2008 up to 52% in 2020.

It is very reminiscent of the Arthur Burns years at the Fed when the Fed worked hand in glove with the government to help deficit finance the Vietnam War and Great Society social programs. This time around the fed helped finance people staying at home for 2 years and not working and whatever other programs Biden was able to get through Congress. The 25 bps will accomplish nothing — serious economists were calling 6-9 months for an initial 50 bp increase and that short term rates would need to go to at least 4%. Once inflation gets going it is hard to control — last time around 40 years ago it took close to a decade, a strong fed chairman and a nasty recession to bring inflation under control.

I blame Putin. Now join me, comrades, in the daily 2 minutes of hate against him! #1984

I guarantee you there will be no rate hikes in 2022.. there will always be another excuse of the day… covid, russia, etc…

It is up 0.25% as of today! Only 28 more of these increases and interest rates will be higher than inflation.

Darn it! I was wrong! I guess Powell has more cojones than I thought. But you’re right it’s just a drop in the bucket against inflation.