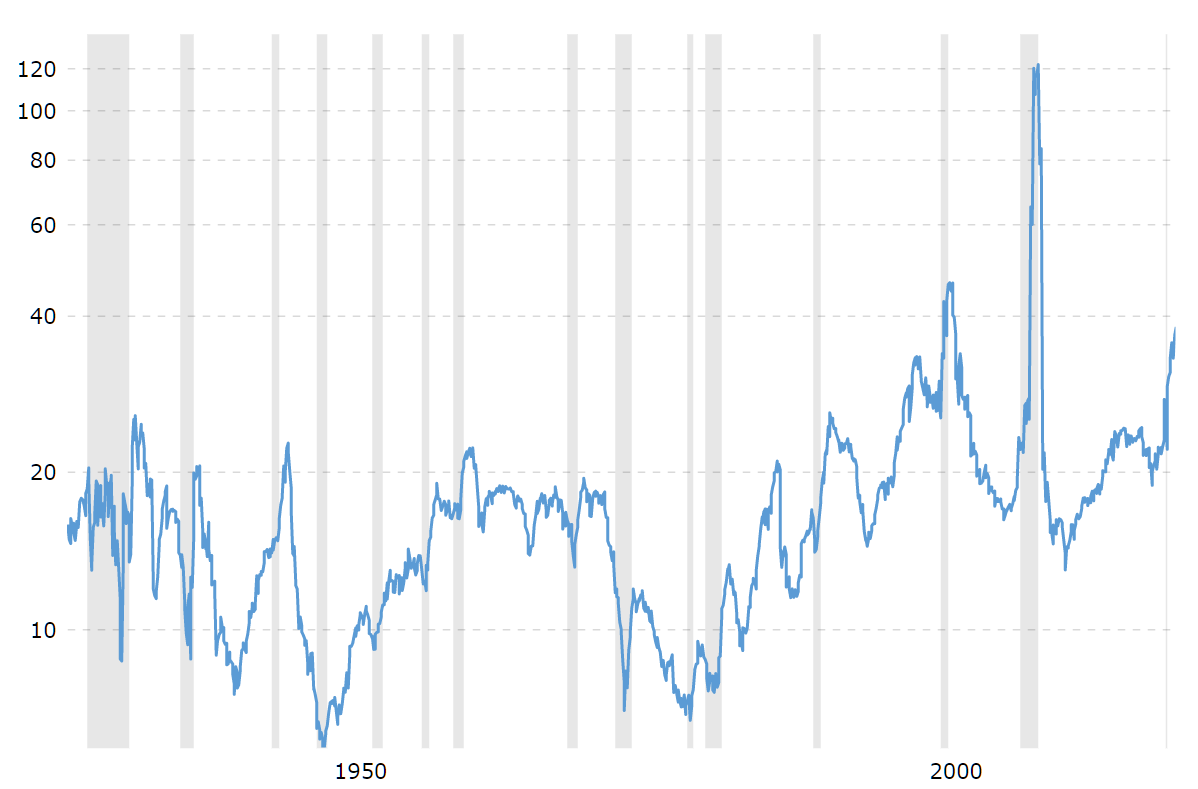

Happy April Fools’ Day! Today we can celebrate fools who buy stocks (or continue to hold, which amounts to the same thing) at near-historic-peak valuations:

(the insane spike to a P/E ratio of over 100 was in 2009 when corporate earnings went down even more dramatically than stock prices)

Let’s look at my foolish question from a year ago: Short Snowflake? I asked “How can a startup data warehousing company be worth a substantial fraction of Oracle’s $200 billion market cap?”

SNOW was worth $62 billion then. How would that idea have worked out? More importantly, how did SNOW do against the S&P 500? (since we assume that an investor would have taken the proceeds from shorting SNOW and put it into a default investment such as the S&P 500) The chart from yesterday:

Let’s remember that the S&P would have paid roughly 2 percent dividend yield during this time. If we assume that the inflation rate for anyone with enough money to buy stocks is 15 percent (includes the cost of a house in a decent neighborhood, for example), SNOW was down 11 percent in real terms while the S&P was up by 2 percent (the dividend yield). It would definitely have made sense to sell SNOW and buy the S&P. Shorting SNOW, on the other hand, might not have worked due to the various costs of borrowing the required shares.

Despite SNOW having gone down a bit, I continue to be mystified by its market cap. The company has revenue right now of $360 million per quarter or $1.4 billion per year. The accounting is tough to understand, but it looks as though they’re losing money. Why is a money-losing company, albeit one with growing revenue, worth $70+ billion? That’s 50X revenue and would correspond to a 200X P/E ratio if we created a fantasy world in which the company was as profitable as Oracle (25 percent, which very few companies achieve!). Presumably the answer is “growth” and the example of a company that loses money persistently and then finally becomes profitable is Amazon. But even Amazon, despite the U.S. government ordering its bricks and mortar competitors to shut down (#StopTheSpread), had an operating income of only about 5 percent of revenue in 2021.

The Greenspun blog needs a SPAC. It would have a $100 trillion valuation. Blog comment warehousing is going to be a big part of the next economic stimulus infrastructure package.

lion: A blog SPAC can’t be a riskier investment than an electric aircraft SPAC!

Earnings, what earnings? Price-to-revenue is the new price-to-earnings ratio. The median price-to-revenue ratio for public companies in the software-as-a-service (SaaS) sector is now 12.2x, with some SaaS companies in hot niches trading at 40-60x (ZScaler, CloudFlare, DataDog).

https://finerva.com/report/b2b-saas-2021-valuation-multiples/

Then again, you also predicted Apple’s decline after Jobs… https://philip.greenspun.com/blog/2011/08/27/apple-will-decline-after-steve-jobs/

All of my predictions are wrong, but that one wasn’t the worst.

https://philip.greenspun.com/blog/2015/01/15/still-wrong-my-2003-prediction-about-chinese-made-cars-on-u-s-roads/

covers my 2003 prediction regarding inexpensive cars disrupting the U.S. auto industry. Instead, $50,000 is the new $15,000! Apple has outperformed the S&P 500 by only 4X since the 2011 prediction. My car prediction was off by about 10X (the first Chinese cars people are driving in the U.S. are Teslas?).

Let’s see how bad my Apple prediction was… I don’t think it is reasonable to count 2020 and 2021 because the government made a lot of offline activities illegal. That gave all the “sit inside and stare at a screen” companies prosper in a way that nobody could have expected.

https://www.statista.com/statistics/265125/total-net-sales-of-apple-since-2004/

goes back only to 2004. So maybe let’s look at 2004-2011 growth compared to 2011 to 2018. 2011 revenue was 13.5X the 2004 revenue. The same 7-year period starting in 2011 saw revenue rise by 2.4X.

So actually, the exponential growth did stop until the government made it illegal for people to leave their houses.

SNOW solves a problem nobody else does: sharing live, up-to-date, and easy to query data between different departments, organizations, and companies. And no need for DBAs.

It is becomung social network of enterprise data. Huge network effects. Hence, valuation. And the growth is impressive.

A propos… the December crash in valuation was all about whale insiders diversifying their portfolios.

averros: How common is it for an enterprise to want to share its data? (I guess you’re including the case of two departments in the same company that want to share, which seems like it would be much more common but also easier to do with other tools.) Also, why can’t competitors, especially those who are also cloud-based, also facilitate sharing from one customer to another?

And is there actually a network effect? Suppose that someone is using Google BigQuery. What stops him/her/zir/them from grabbing data stored in Amazon RedShift, Snowflake, and Databricks? Why is it so much easier Snowflake Customer B to use Snowflake Customer A’s data than for an Amazon RedShift customer? If Snowflake is using AWS under the hood then in both cases data must be transferred from one AWS server to another, right?

(In most of the comparisons that I can find right now, Snowflake comes up as cheaper than competitors. If they’re cheaper because they’re reselling AWS services at a loss (subsidized by investors), isn’t there a risk that when the subsidies stop the users will migrate the next project to BigQuery or RedShift?)

Apologies for being lazy. You answered the above in a comment on the year-ago post….

Philg – organizations absolutely want and need to share data. Without Snowflake this is real pain, since doing reliable and secure data pipeline and synchronization with reponsibility split between different companies is a very hard. There are even new business models startup companies are trying to do based solely on this new capability for easy cross-org data sharing.

This is real disruptor in government IT, supply chain management, and such. It also makes it easy for centerprise SaaS companies to cut corners on data access features (i.e. instead of writing code to provide this or that API for data access to their customers they can simply expose their internal tables with Snoflake providing access control and needed data access restrictions or mangling for PII and such).

Massive data sharing was already a thing when Simon Garfinkel wrote Database Nation. It’s 100x these days and will become even more prevalent in the future as companies will find new ways to exploit this easy to use capability.

Nobody seems to care whether the company is profitable. There are a lot of articles that talk about Snowflake’s revenue growth and they don’t mention profit or loss.

https://www.bloomberg.com/news/articles/2022-03-02/snowflake-plunges-on-slowing-sales-growth-acquisition

does mention that the company lost $132 million on quarterly sales of $384 million.

https://investors.snowflake.com/news/news-details/2022/Snowflake-Reports-Financial-Results-for-the-Fourth-Quarter-and-Full-Year-of-Fiscal-2022/default.aspx

suggests that the losses come mostly from lavish spending on sales and marketing ($203 million in the quarter). So if the company gets dramatic revenue growth from existing customers this could result in eventual profitability (shouldn’t have to spend too much to sell an existing customer on more services).