This is one of my favorite New York Times headlines ever: “G.D.P. Report Shows the U.S. Economy Shrank, Masking a Broader Recovery”.

Our technocratically-managed economy is thriving, even if shrinking a bit (the per capita shrinkage would be more dramatic if you consider population growth, just as the headline “GDP growth” figures that we’re accustomed to seeing don’t represent an actual improvement for the average person because there are more people in the US every day). So we shouldn’t lose faith in the central planners.

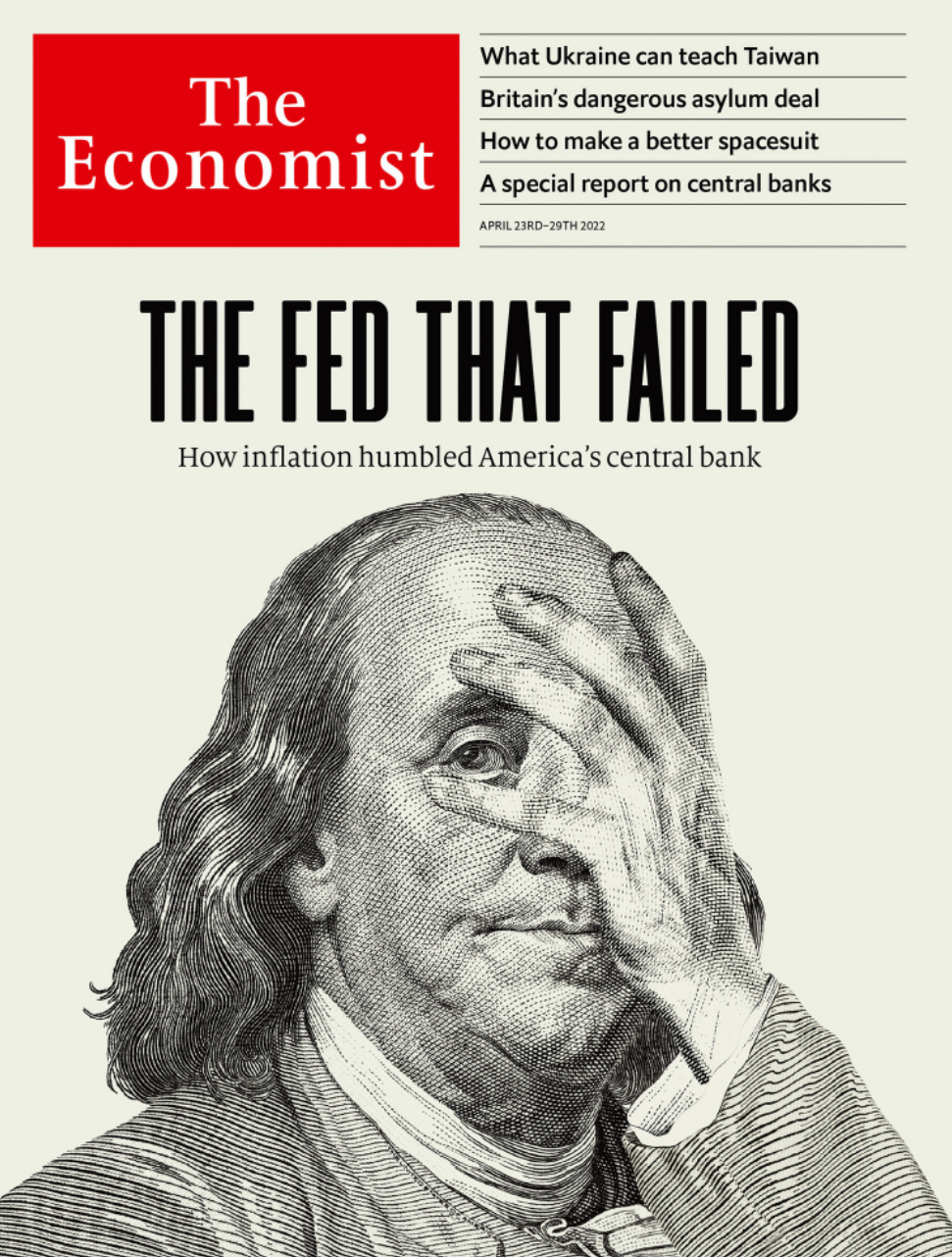

Speaking of central planners, I visited a friend in D.C. who works as an economist at the Federal Reserve. A few days earlier, she had received the Economist magazine in the mail. The cover story: “The Fed that failed; Why the Federal Reserve has made a historic mistake on inflation”.

One of the things that I like least about the Economist is their faith in technocracy. All of the world’s problems can be solved with enlightened leadership. Here’s how the article begins…

Central banks are supposed to inspire confidence in the economy by keeping inflation low and stable. America’s Federal Reserve has suffered a hair-raising loss of control. In March consumer prices were 8.5% higher than a year earlier, the fastest annual rise since 1981. In Washington inflation-watching is usually the preserve of wonks in shabby offices. Now nearly a fifth of Americans say inflation is the country’s most important problem; President Joe Biden has released oil from strategic reserves to try to curb petrol prices; and Democrats are searching for villains to blame, from greedy bosses to Vladimir Putin.

It is the Fed, however, that had the tools to stop inflation and failed to use them in time. The result is the worst overheating in a big and rich economy in the 30-year era of inflation-targeting central banks.

(I’m not a subscriber, so I don’t know how it ends. Maybe a reader can enlighten us all!)

Update: After disabling JavaScript for this site in Microsoft Edge, I can see the whole article. Some choice excerpts:

Strip out energy and food and the euro zone’s inflation is 3%—but America’s is 6.5%. Also, America’s labour market, unlike Europe’s, is clearly overheating, with wages growing at an average pace of nearly 6%.

Uncle Sam has been on a unique path because of Mr Biden’s excessive $1.9trn fiscal stimulus, which passed in March 2021. It added extra oomph to an economy that was already recovering fast after multiple rounds of spending, and brought the total pandemic stimulus to 25% of gdp—the highest in the rich world. As the White House hit the accelerator, the Fed should have applied the brakes.

Is it fair to blame the Fed? When the government is spending like an alimony plaintiff, what could the Fed possibly have done to stop inflation?

The good news is that we can continue cheating hard-working foreigners, even as Americans continue to relax at home:

Inflation that is stable and modestly above 2% might be tolerable for the real economy, but there is no guarantee the Fed’s stance today can deliver even that. And breaking promises has consequences. It hurts long-term bondholders, including foreign central banks and governments which own $4trn-worth of Treasury bonds. (A decade of 4% inflation instead of 2% would cut the purchasing power of money repaid at the end of that period by 18%.)

When the Japanese (holders of $1.3 trillion of our debt) come over to redeem the 30-year Treasury Bonds that they purchased in good faith reliance on our integrity, they’ll be able to use that money to buy a one-week visit to Disney World for a family of three?

The only people surprised by inflation are the highly-paid experts whose jobs are to not be surprised by inflation.

I love how the NYT draws the conclusions and tells me What I Need to Know. Like:

“U.S. economic growth is stellar, until inflation is factored in.”

STELLAR!

I apologize in advance, but I couldn’t help myself: The infamous “Shrinkage” scene from Seinfeld.

The Economist article continues with concern that the Fed must choose between credibility and real world outcomes. If it raises too much in defense of “credibility” then it will cause a recession. If it does not raise and inflation is really hot then it will lose the confident of long-term bondholders (central banks), which in turn would add an inflation risk premium to America’s cost of borrowing. At root, I believe the concern is that the Fed is at risk of no longer being perceived as the God of Economics and as such American centrality (dollar) in the world will be diminished.

BD: The Economist is famous for proposing simple solutions. I think of them as a printed version of a TED talk. Do they say what the Fed should do? Or just provide a lot of options?

The Economist suggests the Fed should focus on inflation.

“Inflation that is stable and modestly above 2% might be tolerable for the real economy, but there is no guarantee the Fed’s stance today can deliver even that. And breaking promises has consequences. It hurts long-term bondholders, including foreign central banks and governments which own $4trn-worth of Treasury bonds. (A decade of 4% inflation instead of 2% would cut the purchasing power of money repaid at the end of that period by 18%.) It might add an inflation risk premium to America’s cost of borrowing. And if even America broke its inflation promises in tough times, investors might worry that other central banks—many of which are looking over their shoulders at indebted governments—would do the same. In the 1980s the recessions brought about by Paul Volcker’s Fed laid the foundations for inflation-targeting regimes worldwide. Every month inflation runs too hot, part of that hard-won credibility ebbs away.”

What Amerikans call a broad recovery is usually the government growing & a falling GDP is usually the private sector shrinking.

Maybe Biden will resurrect Ford’s “Whip Inflation Now!” buttons before he gets to 14.8% like Carter did. CNN opined back in January that “we learned our lessons” then, so Biden has nothing to worry about. The buttons couldn’t hurt, though.

https://ktvz.com/money/cnn-business-consumer/2022/01/11/this-is-the-worst-inflation-in-nearly-40-years-but-it-was-so-much-worse-back-then/

https://commons.wikimedia.org/wiki/File:Plastic_%22WIN%22_sign.jpg#/media/File:Plastic_%22WIN%22_sign.jpg

Wasn’t it James Carville who once quipped that if he could be reincarnated as anything, it would be the bond market?

“Clinton political adviser James Carville said at the time, “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a . 400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.”

“President Joe Biden has released oil from strategic reserves to try to curb petrol prices; and Democrats are searching for villains to blame, from greedy bosses to Vladimir Putin.

They can at least add the corona virus to the list, before greedy bosses.

Philip, the technocrats at the Economist guard against article price deflation by sending the full text of the article to your browser, then hiding most of it with JavaScript. You can restore liquidity by toggling off JavaScript for the site (on magical Apple phones, the Brave browser comes with a handy switch to do this easily per domain).

Thanks, Ryan! It is a little cumbersome to do this in Microsoft Edge, but it works! I have to say that this is a security technique that would never have occurred to me.

@philg Often you can see the entire article simply by turning on the “reading mode” in Edge (F9). The effect is similar to disabling JavaScript with additional bonus of having clear text contents.

The way it ends, Phil, is according to Larry Summers, Ken Rogoff and others we have a nasty recession that bankrupts companies and throws lots of people out of work — since it is highly unlikely that the Fed will be able to raise interest rates sufficiently to stem inflation without this consequence. So all of the free stuff that was given out during the pandemic, people collecting checks while they sat in front of Netflix enjoying the intoxicant of their choice, will have to be returned & we can see that already happening with Netflix. And that is the way a just God would order the world, no?

As for the Economist, I think it deteriorated a lot over the last decade when a new, more enlightened editor was appointed. Its perspective for over a century was free market but the publication nonetheless supported Obama over both Romney & McCain & then like most of the rest of legacy media spent the next four years warning of imminent end of the world because of the orange man. Probably like all legacy media, there isn’t much of a point to it anymore since why pay to hear their point of view when you can get your economic analysis directly & for free from people like Larry Summers, John Cochrane and Ken Rogoff?

The Economist has taken freedom from bylines to its natural conclusion, and eliminated almost all the expensive domain experts from its staff years ago.

These days it is largely written by 21-24 year old fresh graduates, who are trained to follow the house writing style to avoid sounding as naive as their policy prescriptions.

@John: That’s the same way the Democratic Party in America sources its consultants and wonks to make policy, and I heard that from the most bonafide source – National Public Radio, because it was an internal “talking point” – too much policy being made by kids fresh out of Georgetown. They’re just doing what they learned in College.

And they drink the Good Stuff and smoke the Better Stuff, which is why they find themselves in the state they are currently in.