Americans are obsessively following the Federal Reserve’s interest rate adjustments in hopes of figuring out if the future will be inflation, recession, or some combination (stagflation). “Fed likely to boost interest rates by three-quarters of a point this week” (CNBC) is an example.

What if nobody other than the government borrowed money for any reason and, therefore, the Fed’s interest rate became irrelevant to ordinary subjects. Could we still have inflation? Two economists say “yes” in “The Real Cause Of Inflation Is Insane Deficit Spending” (February 2022):

But proponents of MMT do get one thing correct — the Fed can create money to service the debt and avoid a default. But in real terms, meaning adjusting for inflation, this assertion is false. Creating money to service the debt devalues the currency. Investors then receive a lower real return on their holdings of federal debt.

(see also this 1983 paper from the Minneapolis Fed)

In the old days, inflation came down when the Fed raised rates. Therefore, unless our deficits are larger than in the old days, the interest rate hikes should work to tame inflation (maybe by damaging the economy). “U.S. deficit will shrink to $1T this year before soaring, federal forecasters say” (Politico):

While the nation’s shortfall has substantially declined following last year’s $2.8 trillion deficit, the Congressional Budget Office estimates the gap between spending and revenue will grow starting in 2024, reaching more than 6 percent of GDP a decade from now. The U.S. has only run greater deficits than that six times since 1946, CBO noted.

We’re actually in uncharted territory when it comes to deficit spending.

Another reason that inflation came down when the Fed raised rates is that people weren’t able to pay as much for houses, nearly always bought with borrowed money. But the current headline inflation rate has been cooked so that it doesn’t include the actual prices paid for houses or mortgages (those 1980s headlines were too alarming under the old formula!). The inflation rate won’t move until the fictitious “owners’ equivalent rent” changes.

Some prices that are part of the price index will obviously fall if the Fed causes a recession with high interest rates. Used cars, perhaps. But, given the huge deficits indulged in by Congress, will high rates and a recession be enough to push headline inflation down to the 2 percent level that the Fed claims to be targeting? Consider that if there is a recession, the welfare state will automatically kick in to increase spending on housing subsidies, taxpayer-funded health care (more people eligible for Medicaid), SNAP/EBT, Obamaphone, and free home broadband. Congress also likely won’t be able to resist massive new spending initiatives to combat the recession, just as they spent massively to combat the economic impact of the coronapanic shutdowns ordered by government.

Update, June 28: Economist answers my question about high interest rates and high deficits

Related:

- “President Biden orders 100-percent federal reimbursement for city’s Covid hotels” (January 22, 2021), in which taxpayers in Louisiana and Mississippi were forced to pay for San Francisco’s generosity in providing 2+ years of hotel rooms for the unhoused. If there is a housing “emergency” declared due to an interest rate rise, presumably the same executive order mechanism could be used to increase the federal deficit by spending on hotels.

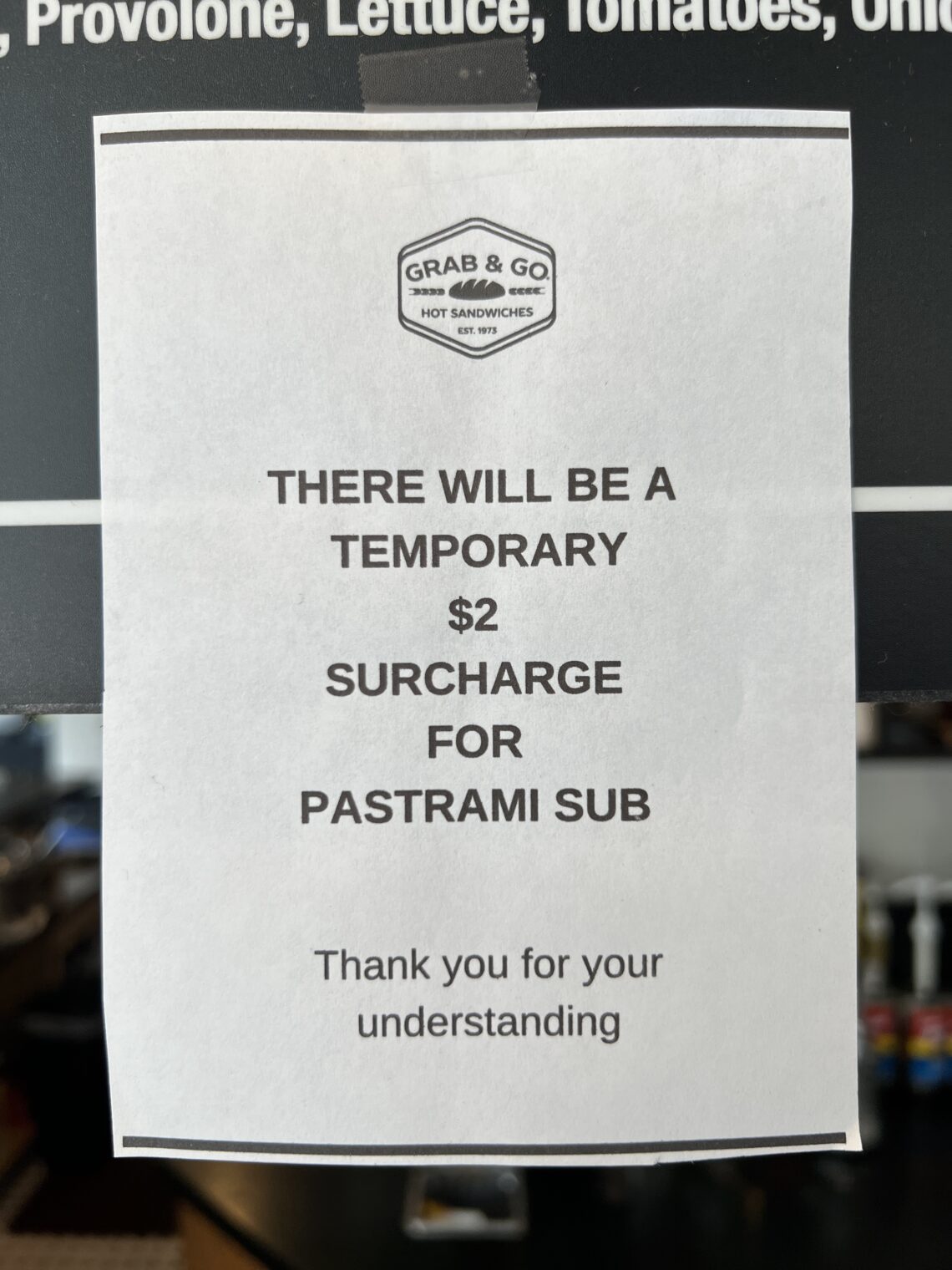

- The $12 sandwich here in San Diego is temporarily $14 (up 17%):

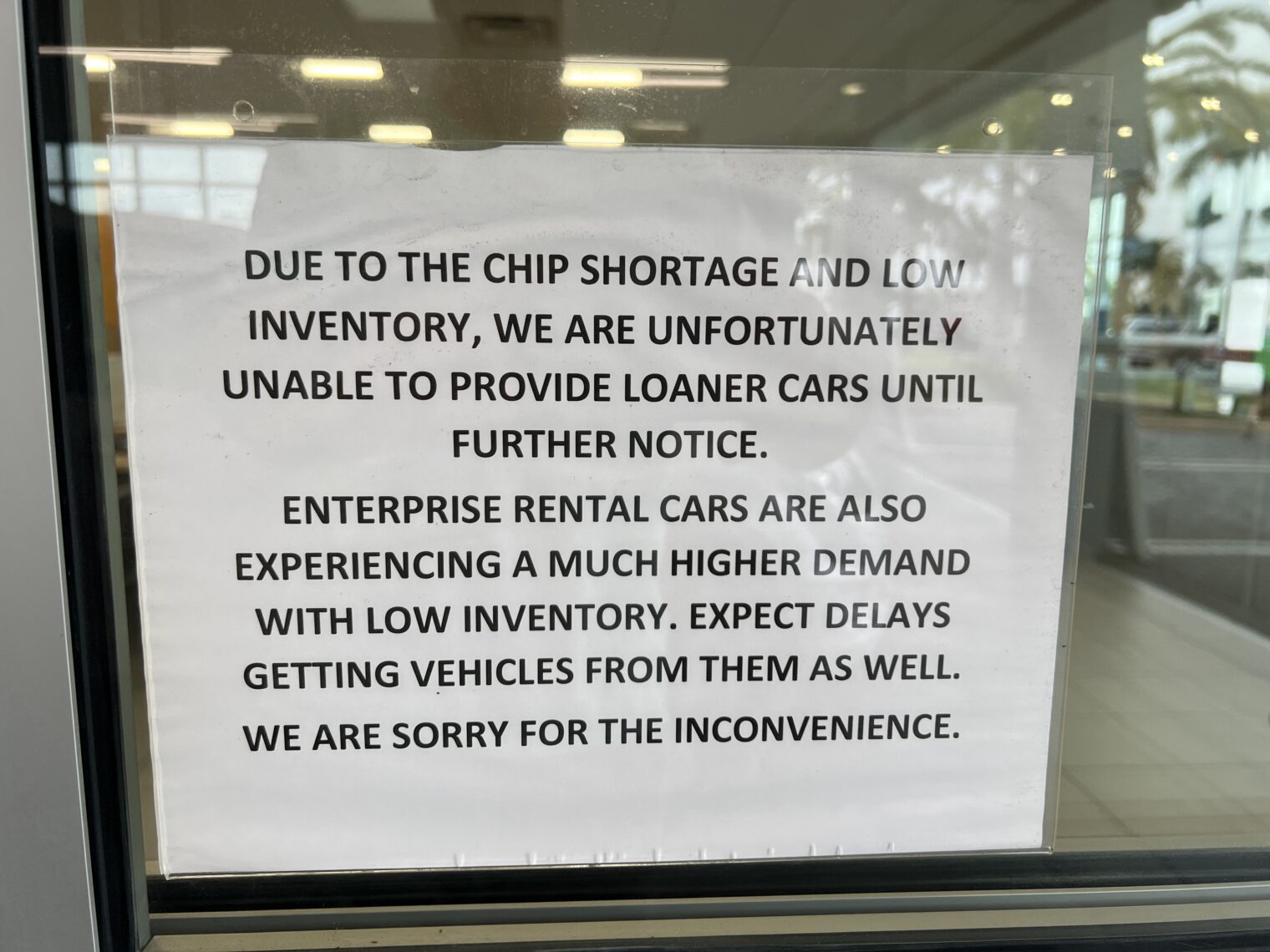

- Below, sign at a South Florida car dealer, June 9, 2022

The government still pays the federal funds rate on treasuries, so it would eventually run out of money. The lion kingdom suspects a much lower interest rate would be required to stop inflation today than 1980 because so much money is printed instead of fractional reserve banking. They can reduce the fed balance sheet instead of raising rates.

Here’s a banker/economist who studied empirical data, says interest rates have little to do with inflation (or reducing it). Rather, inflation comes from too much credit creation, compared to real production growth. So according to him, if the fed prints excess money to fund deficits, then yes prices will inflate regardless of interest rates.

In logical world raising interest rate elevates consumer borrowing rate and thus reduces credit and cause borrowers to scramble. But in a “woke” world of American left political handouts will not cease and credit for “green” schemes and “progressive” causes will be guaranteed and forced. Value producers will have harder time borrowing while having to compete with taxpayer-financed political handouts that raise labor and real estate costs. So Summers’ expectation of stagflation seems very reasonable, especially given regulatory unfriendliness to traditional working energy-producing businesses, extra manufacturing regulations and expected corporate tax hikes and de-facto middle class tax hike.

2021 United States federal budget – $6.8 trillion (submitted 2020 by President Trump)

2020 United States federal budget – $6.5 trillion (submitted 2019 by President Trump)

2019 United States federal budget – $4.4 trillion (submitted 2018 by President Trump)

2018 United States federal budget – $4.1 trillion (submitted 2017 by President Trump)

2017 United States federal budget – $4.2 trillion (submitted 2016 by President Obama)

2016 United States federal budget – $4.0 trillion (submitted 2015 by President Obama)

2015 United States federal budget – $3.9 trillion (submitted 2014 by President Obama)

2014 United States federal budget – $3.5 trillion (submitted 2013 by President Obama)

2013 United States federal budget – $3.8 trillion (submitted 2012 by President Obama)

2012 United States federal budget – $3.7 trillion (submitted 2011 by President Obama)

2011 United States federal budget – $3.8 trillion (submitted 2010 by President Obama)

2010 United States federal budget – $3.6 trillion (submitted 2009 by President Obama)

wow that woke leftist Trump really racked up a large bar tab!

I wonder what happened in 2019 to cause this increase. No, really cannot think of anything.

What happened in 2015? Much higher increase as fraction of previous budget then in 2019, in more expensive dollars. I think that Tea Party died by electing the crier speaker of US congress that enabled Obama to destroy America military capacity by default cuts previous year.

In 2019 Trump was rebuilding military capacity and also supported US farmers who were cut-off by China. Looks like a bargain in relative terms, as a fraction of previous year budget.

> Trump was rebuilding military capacity and also supported US farmers who were cut-off by China

Didn’t Trump campaign on increasing isolation and reducing American involvement in overseas conflicts? Why would he need to increase the (already insanely bloated) Defense Budget to accomplish that?

US Farmers weren’t “cut-off” by China, Trump engaged in a foolish trade war that he lost, and had to funnel even more Blue State cash to shore up his base.

Wasn’t it Cheney (or Reagan) that said deficits don’t matter ?

If there is inflation, it is clearly Putin’s fault with the Putin Price Hike. Home owners who see the value of their home increase 15% annually for the next 50 years will appreciate the Putin Price Hike. Now if Section 8 moves in next door and that decreases the value of the home then that will be deflationary and deflation is good too as less money buys more house.

Not to worry- if inflation won’t go down, they’ll just redefine the calculations (housing costs vs. “owner equivalent rents” was one way) until it does.

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose….” – John Maynard Keynes

Printing too much money causes inflation. This has been proven over and over in history. The Confederate greenback, for example.

Fortunately, we know how to counteract inflation. The secret is to increase the defense budget (https://www.politico.com/news/2022/06/16/senators-tack-45b-onto-bidens-defense-budget-00040154)!

“This week’s boost brings the bill’s topline budget figure to $847 billion, according to Armed Services Chair Jack Reed (D-R.I.). The goal, he said, is to counteract runaway inflation, aid Ukraine, replenish weapons sent into the fight against Russia, and fund military priorities left out of the Pentagon budget request.”

Dollars are not money, they are currency. Notion of money relates to value and I do not see rate of value production catching up with rate of population growth.

Dollars printed to service debt got to large debtors, countries and funds, who could cause large inflation if they wanted to or could do without hurting themselves more. So debt servicing becomes the issue when value production falls relative to debt, which I think is a far description to current US economy, caused by left radicals in charge.

I kind of figured they want inflation to reduce the overall debt. I think at current rates it is equivalent to a 1.7 Trillion hidden tax. (6.85% of GDP)?

Also is this not partially a tax on foreign holders of short term treasuries? If inflation is 8.6% rates 1.75% then China and Japan are paying America 6.85% for the right to hold treasuries.