Having fizzled out, at least on a month-to-month basis (see Inflation of 0 percent reported as inflation of 8.5 percent), inflation got a big boost today when Joe Biden decreed that some members of the laptop class won’t ever have to pay back up to $20,000 of student loans (the debt will be transferred to Walmart cashiers and other working class chumps) and nobody needs to pay student loans until the end of 2022 (and no interest will accrue). From studentaid.gov:

“no one with a federally held loan has had to pay a single dollar in loan payments since President Biden took office.” I think that this is the more significant driver of near-term inflation. If no one has had to pay a single dollar in loan payments then no one needs to put down the Xbox controller, leave mom’s basement, and look for a job. An employer will have to keep bidding up wages in order to woo some of the limited number of Americans who’ve decided, perhaps out of habit, to stay in the labor force.

With Americans anxious about inflation, how could it make political sense for a politician to do something that will obviously stoke inflation? Nate Silver explains why this is not an irrational move for a federal government run by Democrats:

Note the “redistribute well-being” from the working class to the laptop class, just as low-skill immigration does according to a Harvard prof and just as the newly expanded $7,500 electric vehicle tax credit does. I’m beginning to wonder how much more the working class can be made to pay to the laptop class. In which year of the Biden administration does the Walmart cashier begin to have to subsidize the laptop class member’s purchase of a new fuel-efficient Cirrus airplane?

Economists are back to their multiple hands… “Nobody Knows How Interest Rates Affect Inflation” (WSJ, 8/24, John H. Cochrane):

Conventional wisdom says that as long as interest rates are below the rate of inflation, inflation will rise. Inflation in July was 8.5%, measured as the one-year change in the consumer price index. The Fed has raised the federal funds rate only from 0.08% in March to 2.33% in August. According to the conventional view, that isn’t nearly enough. Higher rates are needed, now.

This conventional view holds that the economy is inherently unstable. The Fed is like a seal, balancing a ball (inflation) on its nose (interest rates). To keep the ball from falling, the seal must quickly move its nose.

In a newer view, the economy is stable, like a pendulum. Even if the Fed does nothing, so long as there are no more shocks, inflation will eventually peter out. The Fed can reduce inflation by raising interest rates, but interest rates need not exceed inflation to prevent an inflationary spiral. This newer view is reflected in most economic models of recent decades. It accounts for the Fed’s projections and explains the Fed’s sluggish response. Stock and bond markets also foresee inflation fading away without large interest-rate rises.

The learned and credentialed author concludes with no conclusion about who is right. Even our most notable economists aren’t going to get rich via financial market trades, it seems, based on their superior predictive abilities for inflation rates.

Also from the WSJ, but written by a journalist rather than an economist, “Jerome Powell’s Dilemma: What if the Drivers of Inflation Are Here to Stay?”:

In an August 2020 book, “The Great Demographic Reversal,” former British central banker Charles Goodhart and economist Manoj Pradhan argued that the low inflation since the 1990s had less to do with central-bank policies and more with the addition of hundreds of millions of low-wage Asian and Eastern European workers, which held down labor costs and prices of manufactured goods exported to richer countries.

Mr. Goodhart wrote that global labor glut was giving way to an era of worker shortages, and hence higher inflation.

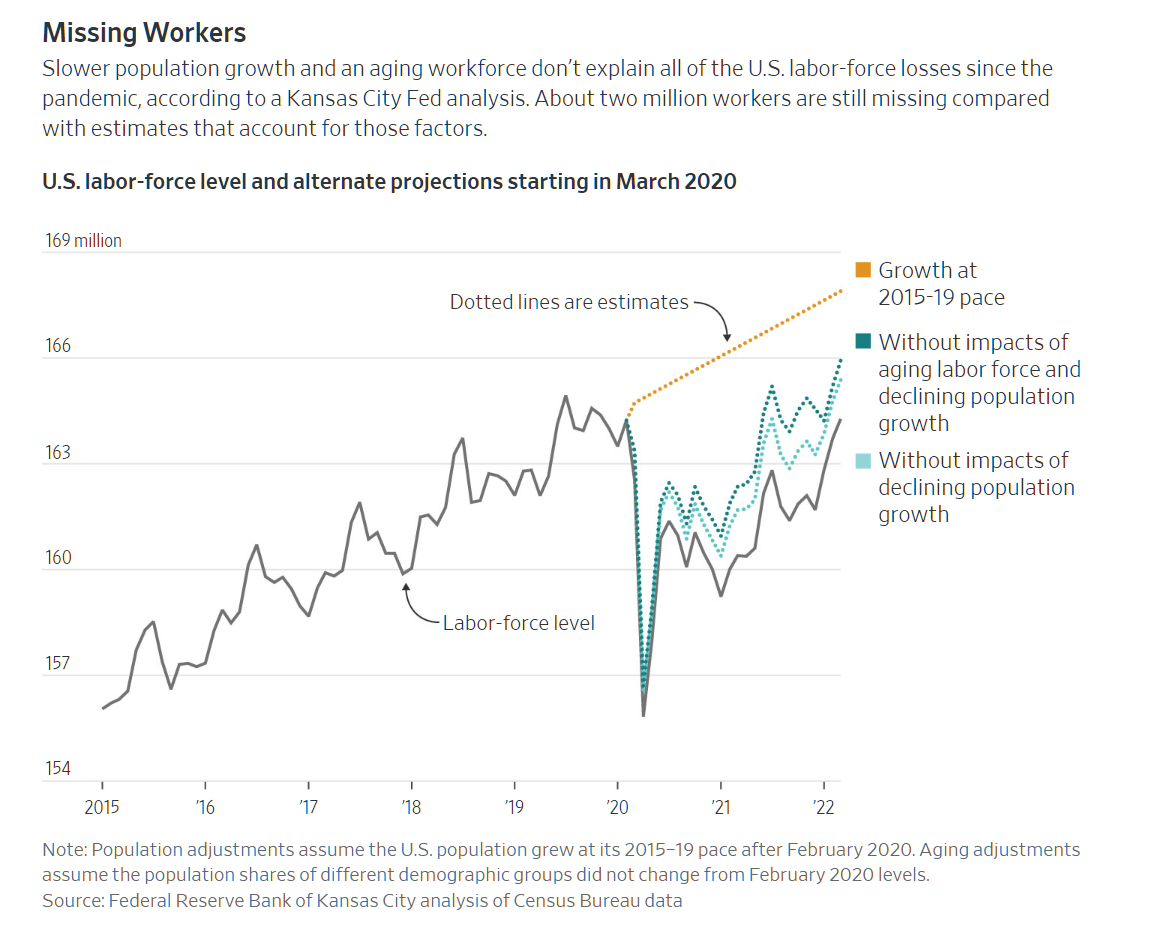

Meanwhile, the U.S. labor force has roughly 2.5 million fewer workers since the pandemic began, compared with what it would have if the prepandemic trend in workforce participation had continued and after accounting for the aging of the population, according to an analysis by Didem Tüzemen, an economist at the Kansas City Fed.

The low-inflation environment of the past 30 years caused consumers and businesses to not think much about price increases. Fed officials now worry that even if prices rise temporarily, consumers and businesses could come to expect higher inflation to persist. That could help fuel higher inflation as workers demand higher pay that employers would pass onto consumers through higher prices.

The expert witness world could serve as an example for the last paragraph. An expert witness engagement usually lasts no more than 3 years and, with inflation expectations low, it was conventional for a contract to call for a fixed rate for the entire engagement. Starting in 2022, however, it became conventional for contracts to allow for annual price increases.

[I should do a separate blog post at some point about how economists don’t seem to account for human nature in forecasting labor force participation. The assumption is that humans don’t get habituated to either working or not working. So an American will jump in and out of the labor force as soon as wages or conditions are adjusted. The American’s value of leisure time will be constant and won’t depend on whether the American has just spent the last two years not working, participating in a bunch of online games, in-person clubs and leagues, etc. Because of this flawed model of humans, economists are surprised on a daily basis that higher wages haven’t lured more Americans back into the labor force. There is nothing in the economics models that says if you play a lot of Xbox for a year you will get better at Xbox and enjoy playing Xbox more and, therefore, require a higher wage to tempt you out of the house.]

Related:

> “The learned and credentialed author concludes with no conclusion about who is right.”

Well, at least Larry Summers left himself an exit ramp. Which, I think – given the terrible history Larry Summers has had in the past couple decades with True Believer Progressive Comrades – is probably a good idea. Just like the “overflowing bathtub” of stimulus with the “taps left on” when he was basically cut off on National Public Radio in favor of people who wanted More Cowbell, he sounded a note of caution on Monday.

But who even knows who Larry Summers is outside of Cambridge and a handful of other people (demographically speaking)? We are all supposed to remember that he’s a sick man, at least when it came to being President of Harvard. Every time I see poor Larry now, he’s got bigger and bigger bags under his eyes. What a terrible fate he chose for himself. Always ahead of the game, always behind the 8-ball.

https://nypost.com/2022/08/22/larry-summers-student-debt-forgiveness-will-make-inflation-worse/

As I read the Post’s artilcle, Biden did what Larry Summers thought was wise. Here we go again!

> Nate Silver explains why this is not an irrational move for a federal government run by Democrats: …

I remember living in Chicago before the subprime mortgage crisis when Penny Pritzker’s bank basically “wrote the book” on that kind of lending a few years prior – and we can all remember the results, some more bitterly than others. Many of the intellectuals I knew (all Democrats) were in favor of it (prior to the Crisis.) “Poor people need that money!” But the subsequent crash also had the desired side-effect of helping to elect Barack Obama! All Bush could say was that Wall Street ‘got drunk.’ They sure did!

I remember thinking afterward: “That was the most brilliant move I’ve ever seen the Democrats accomplish. You “write the book” on this stuff back in the early ’00s. Then you figure out a way to coerce and cajole ordinarily careful bankers and lenders into giving mortgages to people with no way to pay them off, based on the idea that home prices can never decline. Wall Street works their Smart Guys and finds a way to help them by selling all that terrible debt to hapless idiots everywhere. Then it crashes the economy, which the people blame on the incumbent, and it helps elect the Man of the Hour. They pay a little fine (in the scheme of things) and nobody ever mentions it again. She becomes his Campaign Finance Manager!”

It worked!

I know, I’m pretty cynical at this point. I think these folks really don’t know much – or rather, they know too much and don’t like to accept what they know – and keep trying to come up with new ways to shake the snow globe and redistribute some of the flakes, while making sure their friends know when they’re going to do it. In this case, there’s an election coming in two months, so everyone knows exactly why they did it.

And I think there’s going to be MORE. This is Act One.

Am I wrong?

Sorry, forgot the links. The financial crisis of 2008 could have been foreseen by anyone who had ever taken Econ. 101, but fortunately for the important people involved, they were much more advanced.

https://www.wsj.com/articles/SB121660089138069207

https://www.gao.gov/assets/a109091.html

A WSJ comment:

“Help for Quiet Quitters is on the way: Democratic Senators are considering introducing legislation that will provide new benefits for many more Americans. The Americans With No Abilities Act is being hailed as a major legislative goal by advocates of the millions of Americans who lack any real skills and ambition.

“Roughly 50 percent of Americans do not possess the competence and drive necessary to carve out a meaningful role for themselves in society,” said VP Kamala Harris. “We can no longer stand by and allow People of Inability (POI) to be ridiculed and passed over. With this legislation, employers will no longer be able to grant special favors to a small group of workers, simply because they have some idea of what they are doing.”

In a Capitol Hill press conference, Nancy Pelosi pointed to the success of the U.S. Postal Service, which has a long-standing policy of providing opportunity without regard to performance. At the state government level, the Department of Motor Vehicles also has an excellent record of hiring persons with No Ability (63 percent).

Said Sen. Dick Durbin II: “As a senator with no abilities, I believe the same privileges that elected officials enjoy ought to be extended to every American with no abilities. It is our duty as lawmakers to provide each and every American citizen, regardless of his or her inadequacy, with some sort of space to take up in this great nation and good salary for doing so.”

Gotta have a sense of levity about it at this point. Borrowed from a fellow WSJ commenter: “Great news! Now if you didn’t get a chance to go to college, you can experience paying for college!” I am also seeing yet another incidental consequence of this hare-brained scheme by what I have concluded is a quietly vicious, elitist leader. (South Carolina hostess of Bidens’ luxe beach vacay — Joe, Jill, Hunter & family, and perhaps other Biden family members — and her son who runs late father’s hedge fund stand to benefit by $millions in lower taxes because New Mexico Democrat blocked effort to close carried interest loophole for hedge fund managers.)

So current college students are eligible, but if they’re dependents, it’s their parents’ income which is used to determine eligibility. With $10K on the table, these kids will declare their independence??? Parents lose deduction, and may stop paying the term bill, but hopefully the family unit will figure out optimal way to go under the new rules. Few college students make $125K, even their first year out of college. From Fortune, published today: “Students currently in school with loans also qualify for forgiveness. If they are dependents, the Department of Education will use their parents’ income to judge eligibility. Loans must have been originated before July 1, 2022, to qualify.” Imagine how all of a sudden every borrower’s income will fall below $125K on paper. Encourages black market work even more — so naturally fewer taxable dollars available to fund this $300B+ program.

Who else has seen a less equitable large-scale program? Solyndra-type boondoggles which benefited the wealthy come to mind, but I am truly gobsmacked by this one. I live in an an area with a lot of kids who join ROTC because they can’t afford college, or who live at home (not experiencing dorm life with its defacto welfare in terms of room & board) to work their way through community college. They often work a minimum wage job to defray expenses like a car to commute to avoid taking on debt. We are rewarding fiscal irresponsibility, but then again use Hunter Biden for reference. Here’s the Minnesota father who scrimped & saved, to whom Elizabeth Warren said, “You’re out of luck, chump!” Those who repaid the loans, and lived within their means, are outta luck, too. https://www.youtube.com/watch?v=62i2feu9fxk

Little if any tax revenue will flow from writing off $10K or $20K for borrowers. Mostly non-borrowers will pay the $300B+ tab in the form of higher taxes. From Fortune Magazine: “Thanks to a provision of the American Rescue Plan (ARP), the economic stimulus bill passed in 2021, any student debt forgiven this year (and any forgiven through 2026) will not be taxed.

Typically, canceled debt is treated as income, meaning recipients of student loan forgiveness would pay income tax on it. That can lead to surprise tax bills for many who weren’t expecting it. While those borrowers are still likely better off in the long run, that can put a damper on cancellation in the short term.

That said, it is possible borrowers might owe state income tax, depending on where they live. They should be on the lookout for state governments to make an announcement of how the taxes would work.”

We wouldn’t want to put a damper on this windfall, would we?

Bread and circuses. Our industrial base is badly eroded, our technological base is greatly dimished (see Intel), we overspend on military every year and on pointless land wars on the other side of the world, but hey, let’s throw some (borrowed) money at the voters.

I could actually live with this proposal if the $10K or $20K forgiveness were contingent on 1-2 years of military service (and the borrower would be eligible for military salary/benefits, including signing bonuses). But I agree with you that military spending and intervention in foreign wars are out of control. re: Ukraine apart from Poland, which has been generous, the rest of Europe has been miserly relative to their GDPs. State Dept never even addresses this.

I truly wonder why the economists Biden has in the Exec Office of the President weren’t willing to point out the glaring inequities, in order to stop this $300B+ train wreck. Of course, they’re enjoying their $180K+ positions. Similar to Jen Psaki, whose inflation numbers and endless distortions of the CPI and everything else were surreal.

The inflation report is fabricated. Modern interest rates are artificially lowered by quantitative easing & aversion to risk. The difference between interest & inflation is the amount CNN says you should pay for security.

The forgiveness of mortgages of 2009 though caused greater aversion to debt rather than making millennials borrow more. Most millennials bought with cash even as interest rates went negative. Government bailouts increase the supply of money more than they reduce the amount of debt because they monetize debt.

My righteous friends on Facebook and Twitter are already talking about how proud they are to pay the debts of the next generation of laptoppers. Here’s one exchange on Twitter (https://twitter.com/BostechLegal/status/1562812204004413443?s=20&t=W19HsY5l2BsBDp0HIJXCmw )

Righteous: My Mom went to college on the VA bill, this here debt forgiveness is just a down-payment. Let’s go back to the support there for colleges after WWII. [i.e., the Greatest Generation would have loved to borrow money and not pay it back!]

Me: Transferring college costs to Walmart cashiers is a great idea. I hope that it doesn’t interfere with them paying $7,500 toward every new electric car that a Laptop Class member buys. What else can Joe Biden force Walmart cashiers to buy for the work-from-home Laptop Heroes?

Righteous: What are you talking about? No changes are being made to the taxation of the average Walmart cashier. Have you really come to mindlessly repeating moronic right wing themes?

Me: Let’s accept your assumption that the Walmart cashier pays exactly the same amount in tax. Government receives less (because the laptop class doesn’t repay student loans) and thus has less to spend on services. Cashier gets reduced services in exchange for paying the same taxes.

Me (after Righteous had said this was like federal hurricane relief): Before you said that a laptop class member’s child going to get a gender studies degree was the best thing that ever happened to the working class. Now you’re comparing the acquisition of gender studies degrees to an economically damaging hurricane.

Me: As a thought experiment, imagine if Joe Biden ordered that everyone who currently owns an airplane gets $100,000 from the Feds for avionics modernization. Nobody’s taxes are changed by this executive order. Working class folks who don’t own airplanes are harmed. The diversion of $205 billion (about 205,000 registered aircraft) means that the government will ultimately have $205 billion less to spend on stuff that the working class might be able to use and enjoy. Ask a carpenter if he/she/ze/they can use someone else’s college degree.

Me, after Righteous talked about how the working class benefits from laptop class kids attending college, referencing St. Krugman: If you and the Nobel laureate Professor Krugman are correct and the working class benefits any time that a laptop class child spends money on college, why is Biden’s loan forgiveness limited? Instead of $10,000 or $20,000, why not $100,000? And, going forward, why do college students have to pay anything? If a non-binary 18-year-old wants to get a gender studies degree at a liberal arts college, shouldn’t the federal government pay their tuition directly on behalf of the working class, who will ultimately benefit?

Righteous, after blocking me: Why are you frothing at the mouth about gender studies in a converation where it is irrelevant? I don’t know what you are doing, but it is not good for you in any way I am going to block you for your own good.

(Righteous had the last word because Twitter says “You can no longer send messages to this person” after I viewed his block message.)

Philip, why did not you mention obvious points: fairness (why not forgive mortgages, providing roof over someone’s head for families and children is more noble endeavor that paying for someones food testing college level classes) and the most likely result of the contested theft scheme: increasing price of common goods for everyone that hits especially hard Walmart cashiers?

Also you could point with long lines for affordable housing, which is a human right according to socialists in power. “Services” is too general. In my school district universal free school lunches are cancelled and everyone needy needs to apply individually with a lot of paperwork

perplexed: That’s a great point on the public housing. A laptop class member’s kid will enjoy a European vacation instead of suffering the indignity of repaying the loan. This will cost the Treasury about $300 billion, supposedly. But if we assume it costs $300,000 to build an apartment, that would be enough to build 1 million apartments. That’s enough to house 100 percent of the unhoused in the United States (roughly 500,000, with 160,000+ in California) and also provide affordable housing (i.e., free) for another 500,000 single parents and their offspring.

Walmart cashiers are just spectators in all this, except for the impact of inflation. The cash transfers are electronic bookkeeping whose only effect is adding to the inflating debt bubble. Nobody will pay until it collapses, whereupon the Larrys will bail out the banks (again). Nothing here, move on – get in your Cirrusses and fly away.

Walmart long-term employees and managers/asst managers, all of whom make salaries high enough to pay quite a bit in federal, state & local taxes, who by-and-large went out into the workforce without attending college, are all gonna now pay higher taxes for this latest Biden boondoggle. Cashiers will be affected mostly by inflation – true enough.

Scrooge, inflation is an abstract term that is now subverted with specially engineered criteria to reduce visible impact of common goods price increases. Commodity or common goods price increase with more money printed and no new value created is the most obvious result of stealing public money and re-allocating them to Party line voters. Now, with near record gas prices, even some esteemed long term readers of this blog believe that gas price went down because they were even higher at record levels one month ago, never mind that the prices remain at least 70% higher then 2 years ago. And since only milk, meat, fish and museum tickets are up in the last month but gas is down a little for the month we have official 0% 🙂 “inflation”. And general public seems to buy this.

General public I’m seeing is not accepting this 0% inflation figure put out by White House social media. They continue to experience sticker shock, for basic grocery list items like milk, eggs and deli meats, at least where I live which includes a high percentage of working class families. (Over 32% of the students in my school district qualify for free or reduced lunches under federal guidelines, and farther from the coast where I am, over 50% qualify. https://elementaryschools.org/directory/de/cities/bridgeville/woodbridge-middle-school/100185000073/#section-5)

I am just comparing identical items year-over-year, summer 2021 to summer 2022, e.g., Fage 33 oz yogurt $4.99 in 2021; $6.65 in 2022. That’s a 31% annual rate. I could cite at least 50 items which I buy moderately regularly which have gone up 20-35% on an annual basis. Includes dishwashing liquid and dishwasher detergent — for the latter, they’ve reduced the package size so the comparison is a good algebra problem for a middle schooler. (I happen to remember exact prices, mostly because grocery shopping is basically the only type of shopping I enjoy.)

Back in the spring, the WSJ had a profile of a USDA shopper who gathers data for the CPI. Her shopping list was a joke — basically all the foods which lead to the rise in obesity in this country. Among them: Hot Pockets, Swanson frozen dinners, Oscar Mayer lunch items, processed American cheese (Velveeta or perhaps the Kraft slices), . . . some fresh produce and cereals and grains, granted, but at any rate, I am not sure the market basket reflects what Americans who value their health should buy. Just back-of-the-envelope calculation, a market basket with more natural foods would have gone up far more than what the USDA price checker reported to the BLS folks who keep track of CPI/PPI.

Inflation is like a tax on the working class, and they are definitely feeling it. They rarely drive EVs either (and won’t be in the market for this $7500 EV subsidy in the “Inflation Reduction Act” ha!), as they’re lucky to be able to afford a reliable used car in most cases. Price at the pump, even after recent deflation, is draining their disposable income rapidly. They aren’t WFM like the “laptoppers” Philip references, so they fill their tank regularly. In fact, many have long commutes, close to 2 hrs R/T since the job sites where they mostly work are in areas where they couldn’t afford to live with their dependent spouses & children (many have children by their early twenties, unlike the often childless or childless until later in life college-educated crowd about to receive $10-$20K off their debt).

I believe Pelosi, Biden et al are waging war on the working class because they can, and because they don’t care — or at any rate, care more about getting re-elected than they do about the welfare of other humans. Look at the lifestyle of Pelosi and Biden — tells me everything I need to know.

This is a great “‘teachable moment” for young Americans and next generation of Americans: go out and enjoy live like a drunken sailors. When you are broke, we will find honest Americans to pay for your irresponsibilities. Of course, as this “free money” catches on and becomes “an entitlement” we will run out of honest Americans (or foreigners buying US debt) to pay for the next generation of drunken sailors. That’s when we will become a 3rd world country.

I love it when our politician see that the fix for every problem we have is pouring more money on the problem. After all “green” is king.

While the up-to-$20K “forgiveness” plan is getting all the headlines, the more insidious part of Biden’s plan is the change in income-based-repayment plans he proposes. Part of his order will allow for debtors to pay only 5% of their “discretionary income” (which I believe is household income minus the federal poverty level for one’s household size) and have the balance forgiven after 20 years.

So, as an example – let’s assume that Pat, an aspiring filmmaker who is currently a high school student that just really likes watching movies – attends 4 years at Columbia. He/she/ze/they (or his/her/zir/their “parents”) will need to pony up 4 x $70K = $280K for the privilege of partying – er, I mean, studying – in New York for four years.

In the olden days – back in, say, 2010 – Pat’s “parents” would have needed to somehow save up that $280K. But why spend your own money when you can find someone else to pay?

Rather than saving up that money, let’s assume Pat’s “parents” instead borrow 100% of the cost each year with a parent PLUS loan, for which the ability to pay is not a predecessor requirement. If Pat’s “parents” make the median household income in the US ($75K), they would end up paying $75K x 0.05 x 20 = $75K (total!) over 20 years, or about $3750 per year. At the end of the 20th year, they would have the balance forgiven – thereby sticking Uncle Sam with $280K – $75K =$205K of the bill, not including interest.

Of course, there are also the obvious second order effects of this. I mean, one has to assume the colleges are going to further increase the rate at which the sticker prices go up each year, right? Families shouldn’t mind borrowing whatever amount of money they college asks for, since they would never actually have to pay any of it back.

Strange times!!

Railroad Runner Harris and Conductor Schumer Have Spoken!

https://i.ibb.co/g6SGKk4/KAMALA-LOCOMOTIVE.png

https://www.dailymail.co.uk/news/article-11151469/Biden-told-NOT-cancel-student-loan-debt-Janet-Yellen-Jill-Kamala-pushed-him.html

Keith– you have pointed out possibly the most inequitable part of this. Many of the Parent PLUS loans were taken out specifically by parents who were spending more of their disposable income on themselves, since there were no income requirements on the FAFSA to qualify for those loans. Sorta the antithesis of the Minnesota father who worked a double shift to fund his daughter’s college education, and asked Elizabeth Warren about his refund (“Of course not!” Lizzie quipped). In any event, Parent Plus loan holders and their progeny combined get double the bail-out if this Executive Order holds up in court.

Loco Motive — was not shocked to learn that Kamala was the brilliant mind behind this. Her quantitative skills are sorely lacking, based on one of the VP debates. Kamala thought that Americans couldn’t grasp what “debt” means, what the principal of a loan means, etc.. It was clear that she herself struggles with basic math. So Kamala, like a good socialist, saw only the benefits to a select few, and none of the costs, including opportunity cost. The only thing which makes me resign myself to Biden is that Kamala would be far more socialist & incompetent.