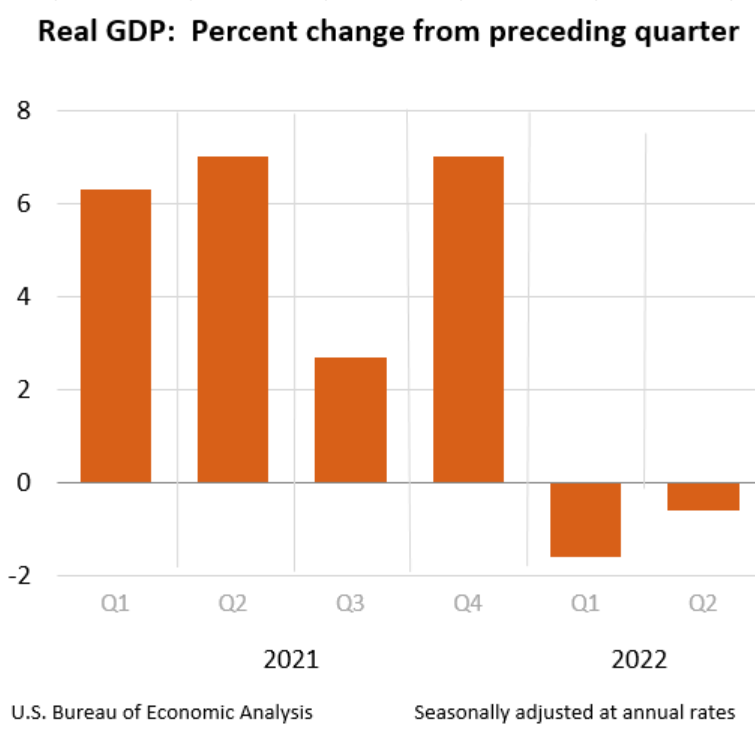

Today is the beginning of the big GDP statistics update from the BEA:

At the end of September, BEA will update five years of U.S. gross domestic product and related statistics, as well as GDP statistics for industries and for each state.

Maybe we’ll get some insight into how badly we fooled ourselves in imagining that people sitting at home scrolling Facebook and playing Xbox were as productive as if they’d continued to go to the office. The latest from the BEA:

Speaking of fooling ourselves, let me recommend The Lost Bank: The Story of Washington Mutual – The Biggest Bank Failure in American History by Kirsten Grind, a Wall Street Journal reporter. The Collapse of 2008 has been covered at a high level in a lot of books, but this one manages to touch on all of the big issues in the context of a single enterprise and group of people. As with “A single death is a tragedy; a million deaths is a statistic,” a narrative about one company is more compelling and easier to follow than a story about the entire U.S. economy.

The book explains how our modern world of a handful of enormous banks came to be. When there are no limits on how big a bank can get, small variations in bank health lead to enormous concentration. Due to being slightly larger, WaMu might have slightly lower costs per customer than a smaller bank, e.g., with information systems being spread across a larger base, thus making an acquisition sensible on both sides. WaMu would buy banks after the CEO got sued for divorce, leaving the target without effective leadership while the CEO was defending the lawsuit. WaMu would ultimately buy banks to feed its own executives’ egos, particularly Kerry Killinger’s, regarding its size rank among U.S. banks (when you’re #4, the desire to become #2 or #1 becomes tough to resist).

The book explains the roots of the Collapse of 2008. At a high level, the book identifies the following culprits:

- the federal government, starting with Bill Clinton, pressuring banks into lending big money to Americans with low income and bad credit history to serve a social justice goal of achieving a desire mix of skin colors among borrowers (regulators could simply shut down a bank that didn’t lend enough money to the groups of interest to the government)

- Fannie Mae, which abandoned its insistence on high quality mortgages and, partly due to pressure from the government, started buying low quality mortgages issued to home buyers/flippers who could not be expected to pay back loans if house prices flattened

- New York City, whose investment banks sold mortgage-backed bonds to investors worldwide and, also, those investors. The book describes people on the ground at subprime lenders, e.g., Long Beach Mortgage (acquired by WaMu in 1999), recognizing that the borrowers would never pay but assuming that if Wall Street kept buying the mortgages the investors must know something that they didn’t.

- California, where most of the fraudulent practices originated.

- the issuance of complex variable rate mortgages, such as Option ARM, to consumers who lacked the sophisticated or, in many cases the English language skills, to understand them (it didn’t help that these folks had the financial capacity only to pay the initial teaser monthly payments and were guaranteed to default if a house price didn’t go up enough to enable a refinance; Federal regulators at the Office of Thrift Supervision approved the practice of issuing a $4000/month mortgage to a consumer who could afford only the $1000/month teaser rate)

As in Bubble in the Sun book: even those with the best information can’t predict a crash, those on the inside did not always see crash coming. In early 2007, for example, as investors were fleeing from high-risk mortgages and as some of his junior executives warned of impending doom, Kerry Killinger tried to buy a huge California-based subprime lender, Ameriquest, which went bankrupt shortly afterwards. Questioned regarding why he would want to pay for Ameriquest while the crash appeared to be underway, Killinger responded “They don’t ring a bell at the bottom.”

Kirsten Grind references Are You Missing the Real Estate Boom?: The Boom Will Not Bust and Why Property Values Will Continue to Climb Through the End of the Decade, by David Lereah, Ph.D., the chief economist for the National Association of Realtors. The 2005 book was rereleased in February 2006 just as the market for subprime mortgage-backed securities began to collapse (but Fannie Mae kept buying!).

The book is a great lesson in what we might call “success disease.” Executives who take risks when everything is going up imagine that they have some special talents. Like individual investors in high-beta stocks, they don’t risk-adjust their high historical returns for the fact that they took a lot of risk and that it could easily have gone in the other direction.

The book answers the question Why did banks work so hard to lend money to people who obviously weren’t going to pay? Due to the higher interest rates on subprime, and the assumption that almost all of the low-income folks who took out subprime loans would actually pay, it was 5-10X more profitable to lend money to someone with no job than it was to lend money to a person with a job and a history of paying his/her/zir/their bills. The book doesn’t say so explicitly, but this also explains why banks couldn’t easily abandon their subprime practices in 2005 when the problems were already obvious. If they had done so, they would have needed to fire half of their employees (since the revenue from being a mortgage lender to those who could actually afford houses was such a small fraction of the subprime revenue stream).

Those passionate about social justice will be pleased to learn that the one voice of praise from a shareholder at the April 2008 meeting was from a Ph.D. economist who was also and employee. She expressed confidence in the Board and executive team, thanking them for their focus on diversity in hiring and lending to minorities (“community”). WaMu had recently rejected an $8/share buyout offer from J.P. Morgan Chase and also recently obtained $7 billion in smart money from the private equity geniuses (WSJ, Sept 2008 describes all $7 billion being lost). The private equity investors got half the company and let the Board and executives keep their jobs.

The book is also a cautionary reminder that it can take a while for bad decisions to work their way through the system. The California-style lending practices first reached the rest of the U.S. perhaps in 2003. It wasn’t until four years later that the subprime lenders began to go bankrupt, in mid-2007. And it was more than a year later before the broader U.S. markets and economy collapsed. If you think that U.S. economic policy has been misguided since March 2020 (as I do, because the rewards have been tilted in favor of those who don’t work or who engage in counterproductive activities), it could be a few years before the consequences of this policy become apparent.

Don’t forget that a disaster for ordinary folks, investors, etc. may be only a minor problem for the executives who caused the disaster. Kerry Killinger took so much money out of WaMu on the way up that he could pay off Wife #1 while also building and enjoying a dream lifestyle with Wife #2 that apparently persists to this day. The Latinx subprime borrowers lost everything, but Killinger still had his collection of $6 million houses (worth $20 million each today?). Killinger’s epic risk-taking would have been rational, even with full advance knowledge that it would render the bank’s shares worthless. If he had managed the bank conservatively, nothing dramatic would have happened either to the shares or to his own net worth.

I’ve actually been listening to The Lost Bank: The Story of Washington Mutual – The Biggest Bank Failure in American History via Audible, but don’t love the narrator so perhaps the Kindle or print versions would be better.

Related:

- Is LGBTQIA the most popular social justice cause because it does not require giving money? (includes photos from Seattle)

Worst outcome was bank executives were too big to jail.

@Donald, they were not too big to jail. They enabled lefty real estate investment policy that was fostered at banks by government and their executives and traders overlapped and interconnected with government. Due to their policy home home ownership in the USA peaked over 70% with many not financially qualified under regular actuarial criteria people became home owners. Outright fraud where individual owners who took 100% of profits were prosecuted.

Nobody indicts government employees, why would their financial counterparts often connected by family and other ties would be indicted?

Housing prices did continue climbing through the end of the decade, the 2020 decade. Houses are the collateral for the national debt, in asset backed currency. They can’t count as inflation & they can’t decline. If they ever declined long term, the government would run out of money.

Peter Schiff gave an excellent speech to a crowd of Mortgage Bankers who couldn’t believe what this guy was telling them. Just listen to it like podcast – it’s better than any book:

https://www.youtube.com/watch?v=jj8rMwdQf6k&t=2717s

“My Mortgage Bankers Speech from Nov 13th 2006 is now in one video clip. I gave this presentation at the the Western Regional Mortgage Bankers Conference in Las Vegas. There were over 2,000 mortgage bankers in attendance. I also made similar comments when I addressed this conference a year earlier in 2005 at the height of the real estate bubble. For those people who said no one saw it coming, this presentation is a real eye opener.”

Interesting book, I’ll check it out. Having lived in Chicago at the PEAK of the housing boom there, I can remember the general atmosphere of Carnival in the real-estate market there. You’d see brand spanking new, beautiful “gut rehabbed” buildings built with a lot of illegal labor, with expensive upscale condos in the $400,000 and up range. They would go on the market and be snapped up like a bleeding cow crossing the Amazon filled with piranha. Then you’d see the people moving in, driving up in their dilapidated old Toyotas and Geo Metros. You knew they could never afford the places they were mortgaging unless all of the miracles came true.

I don’t know how to describe the “vibe” – it was like an orgy of money and lending and real estate. People would sit on their computers during the day and watch the value of the condos they were going to flip – they bought them and hung a bicycle from a hook on the ceiling to establish “residence” – go up, and up, and up. The air was abuzz with greed. You’d go to a Title company and meet the lawyers and notice that even the janitorial staff had fake boobs.

Of course, this book doesn’t seem to mention the Pritzker-family bank, but since it focuses on WaMu that can be excused. In any case, I was there on the ground in Chicagoland near the peak and I just had an overwhelming feeling of vertigo. The smell of financial coitus was in the air.

Even if you knew nothing about how it all worked behind the scenes, anyone who couldn’t sense that just as a PERSON must have been willfully negligent, or just didn’t care – because even if it all fell apart they would be OK. Ethics, morals, prudence, and all the rest? Out the WINDOW!

I remember the booming business being done in Dog & Ponyland, with the house-showing parties and the loan-closing parties with all the booze and drugs and music and the catered food and the women (and men! lots of them!) wearing cheap vanilla perfume and Paco Rabanne It was decadent.

I timed the break right, a few months before it all started to go to hell. I was too suffused with white-knuckle fear to hold on much longer. Anyone who couldn’t see it coming, who couldn’t sense “This is crazy!” is lying, IMHO.

For anyone unfamiliar – here you can find a relatively light-touch article by the Chicago Sun-Times inre: Superior Bank.

https://chicago.suntimes.com/news/2008/4/28/18576987/obama-s-billionaire-finance-chair-penny-pritzker-s-failed-bank-lost-money-for-1-400-customers

“Pritzker’s attorney Kevin Poorman [!!] and Obama’s campaign spokesman emphasized that not all “subprime lending” is the “predatory” kind that Obama and White House rival Hillary Clinton rail against. The kind of subprime lending Superior was doing in 2001 was not predatory, Poorman [ https://ptfound.org/who/team/kevin-poorman/ ] said.

But at least some of the 1,400 victims who are still owed money seven years after the bank failed say Pritzker is the wrong person for Obama to put in charge of the campaign’s finances when part of his campaign is about reforming the banking industry.

“They still owe me $113,000,” said Fran Sweet, 63, of Downers Grove, who deposited her $480,000 retirement account at Superior a month before it collapsed. “To the Pritzkers, this is nothing. They probably think, ‘Why pay her back?’ That’s nothing. But we’re all upset that someone who made these decisions could be in that position.”

Judging from the record-breaking job Pritzker has done raising money for Obama’s campaign, her fund-raising skills do not appear to be in question, but Sweet said it sends the wrong message.”

Captain Capitalism wrote a book about it. It is an expose written by Aaron Clarey, a credit analyst who worked at various banks in the Twin Cities and saw first hand the unethical, if not, illegal dealings that led up to the housing bubble and subsequent crash. Stories of commission-addicted bankers, bribed appraisers, FBI investigations, IRS raids, offshore bank accounts and more regale the reader with a blood-boiling story of corruption, incompetence and limitless greed.

https://www.amazon.ca/Behind-Housing-Crash-Confessions-Insider/dp/1439204063/ref=sr_1_1?crid=2QDKFF9DBFHU3&keywords=behind+the+housing+crash&qid=1664647980&s=books&sprefix=behind+the+housing+crash%2Cstripbooks%2C137&sr=1-1