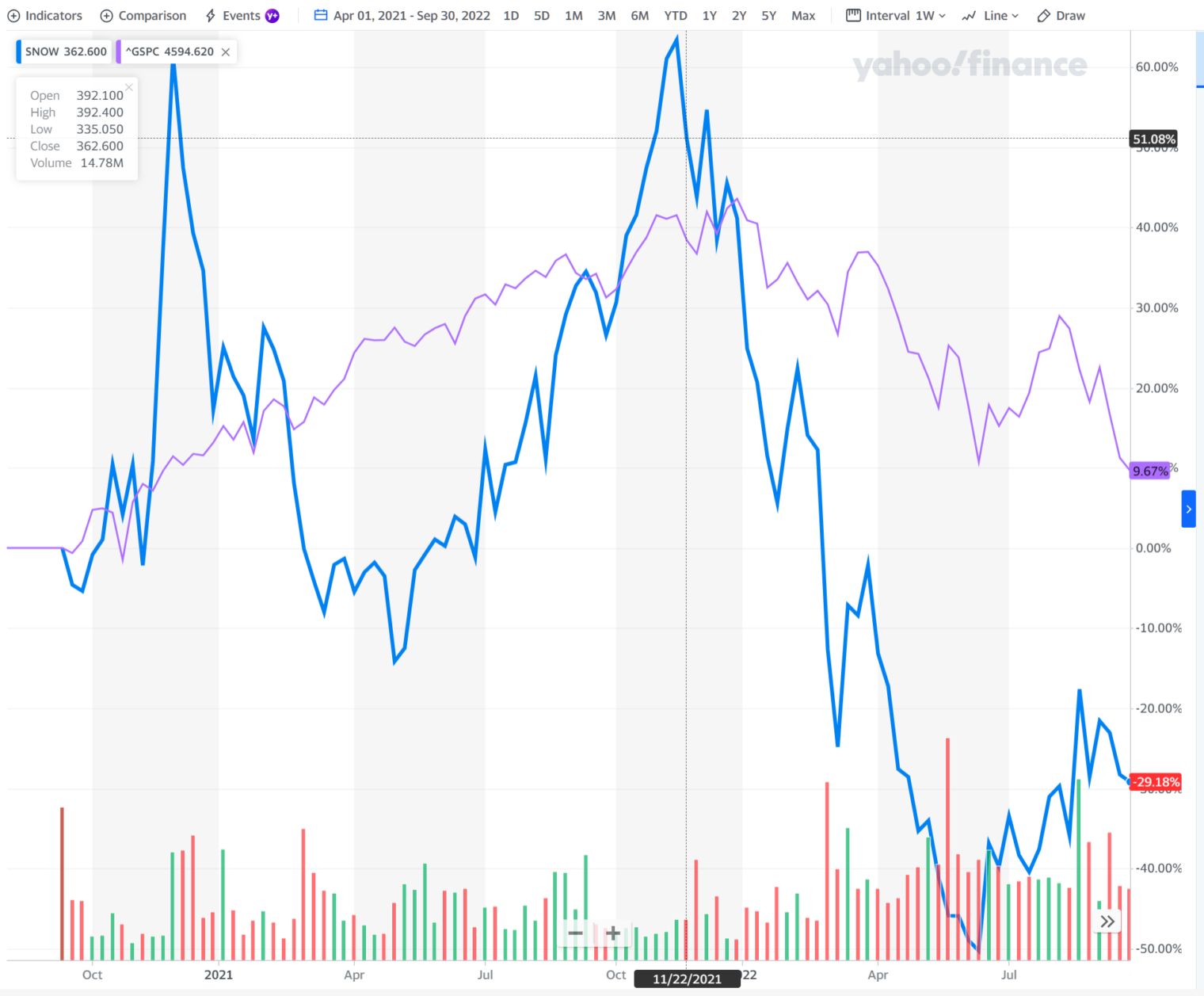

1.5 years ago: Short Snowflake? Looking at SNOW versus the S&P 500 over that period:

SNOW is down nearly 30 percent while the S&P 500, thanks to Joe Biden’s careful stewardship of the U.S. economy, is down 10 percent (but actually that 10 percent over 1.5 years is more like 25 percent once inflation is factored in, a stunning loss of wealth for Americans).

In April 2021, SNOW was valued at roughly 30 percent of the value of Oracle (ORCL), the backbone of business data processing. What is the company’s market cap today, as a percentage of Oracle’s market cap? SNOW is worth $54 billion. Oracle is worth $165 billion. So I think the philip.greenspun.com fact checking department must rate my April 2021 claim as #False. SNOW turned out to be a loser for an investor, but not because 30 percent of Oracle’s valuation was absurd.

Related:

- How did SNOW do versus the S&P 500? (April 1, 2022): “Despite SNOW having gone down a bit, I continue to be mystified by its market cap. … Why is a money-losing company, albeit one with growing revenue, worth $70+ billion?”

Why would you trend SNOW against S&P500 index ? I understand if snow compared against NSADAQ Composite (close to 30% down for the year), S&P North American Technology Software Index (-36.78% for the year) or some more closely matching segment index.

https://www.nasdaq.com/market-activity/index/comp

https://www.spglobal.com/spdji/en/indices/equity/sp-north-american-technology-software-index/#overview

Disclaimer: not a SNOW fan.