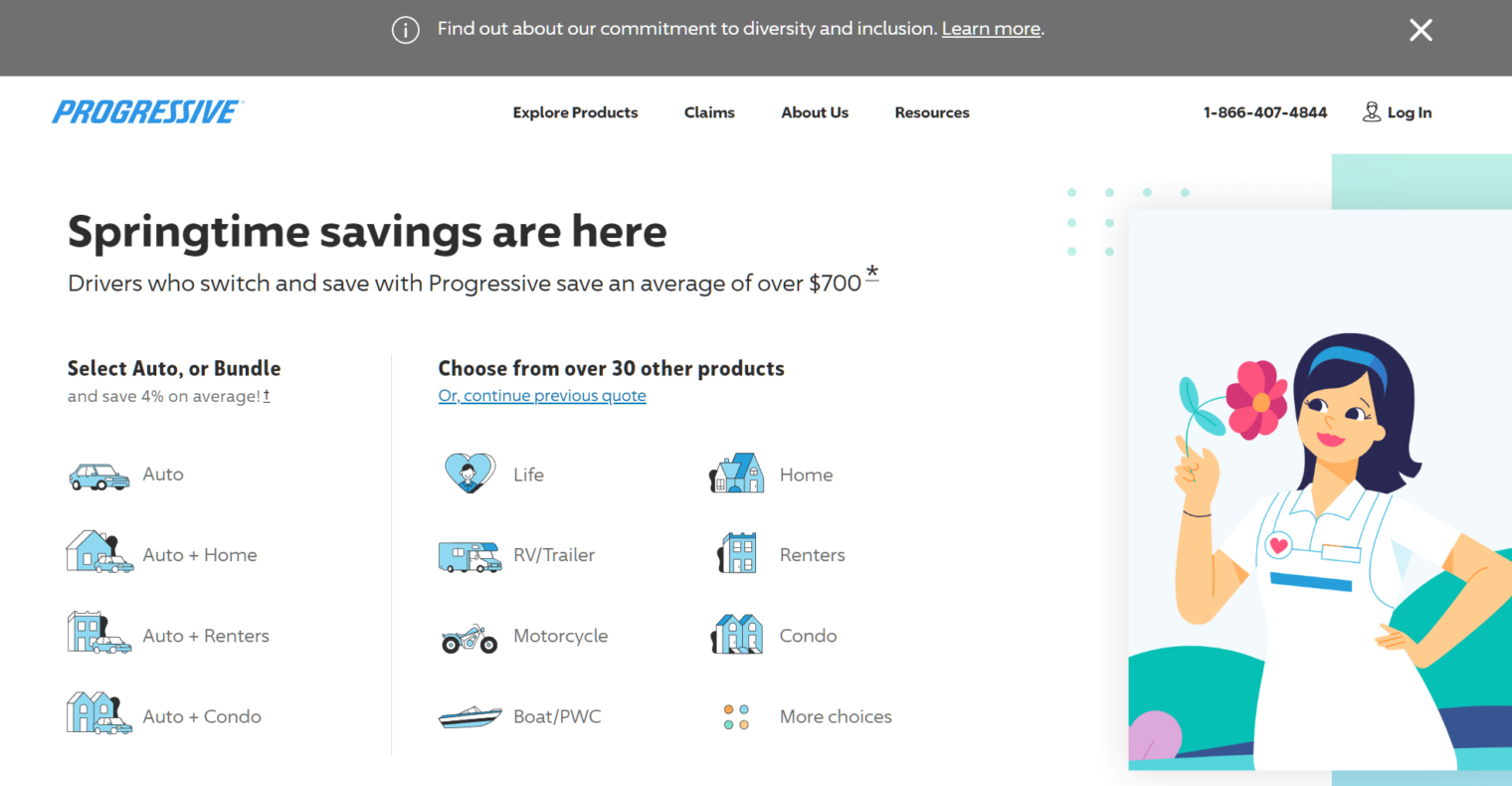

From June 2022, Progressive Insurance is Progressive, the company put a diversity and inclusion banner across its home page, dwarfing the “claims” button:

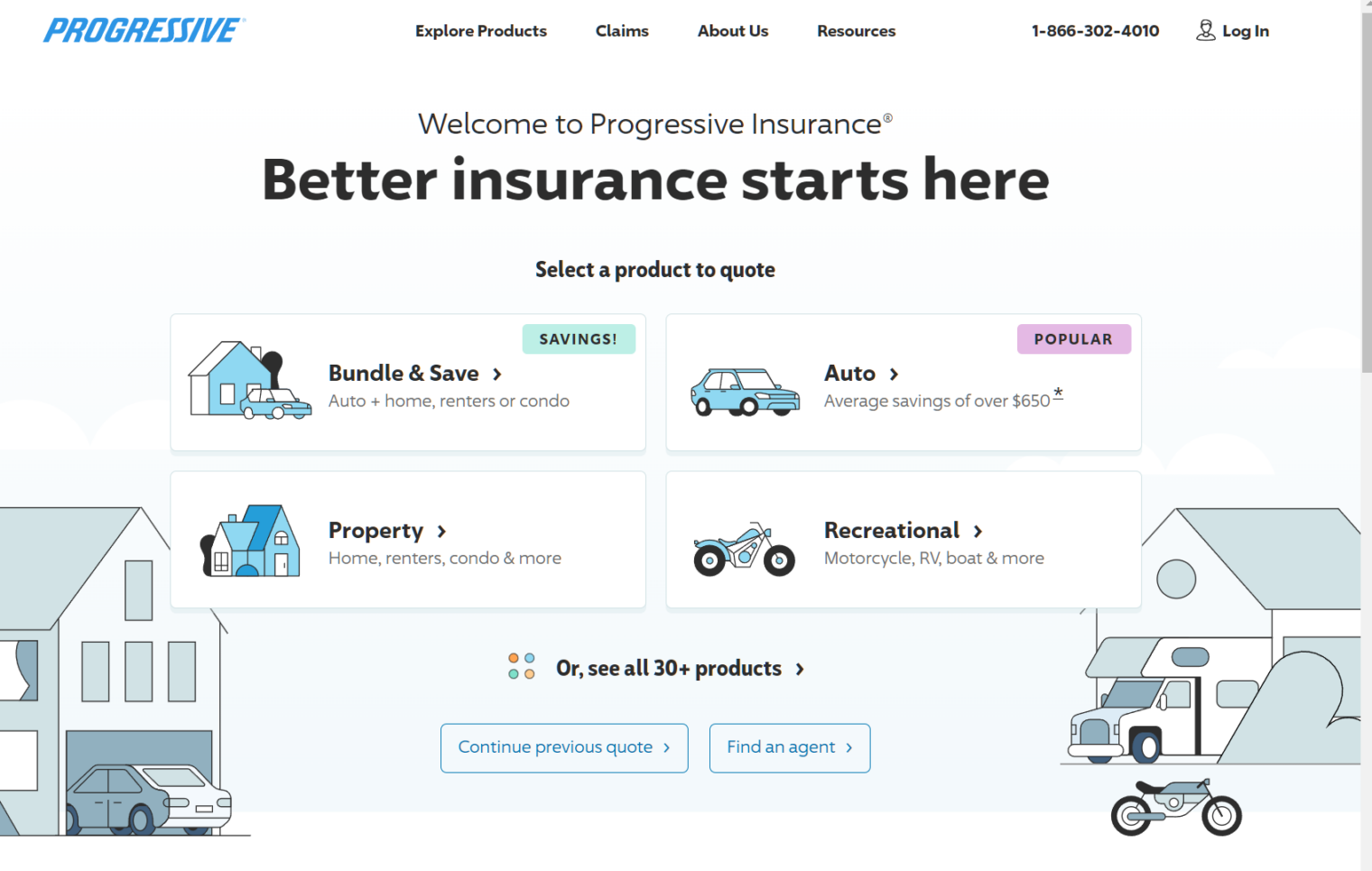

How about today?

They still have a Diversity & Inclusion link, but you need to scroll down two pages to find it. Unlike in 2022, the linked-to page makes no mention of 2SLGBTQQIA+ or any subset thereof. But this might be just an HTML coding mistake. The linked-to page is a generic “about” page and itself contains a Diversity & Inclusion link. That page does mention “LGBTQ” and “LGBT+”. The company has expert knowledge of what a miserable place the United States is for anyone but a white cisgender heterosexual non-immigrant person:

With so many acts of racism, homophobia, transphobia, and xenophobia in our communities, this is more important than ever. We stand in solidarity with communities of color, the LGBTQ community, and other marginalized groups, and we encourage our people to discuss these all-too-prevalent issues with our leadership team, one another, and our Employee Resource Groups.

(employees tasked with handling claims are supposed to spend at least part of their day discussing “racism, homophobia, transphobia, and xenophobia” with each other? What percentage of customers’ premium payments are to be spent on this activity?)

Possibly contrary to the recent Supreme Court interpretation of the U.S. Constitution, the company says that it is passionate about “increasing the representation of women and people of color in management.” They’re proud of their new quota system:

To focus our efforts in 2020, we introduced an ambitious goal to double the representation of people of color in senior leadership from 10% to 20% by the end of 2025. As of December 2022, people of color account for 17% of our senior leadership ranks.

They’re also proud of their ability to cook the numbers:

We’re proud to report that for Progressive employees with similar performance, experience, and job responsibilities, women earn one dollar for every dollar earned by men, and people of color earn one dollar for every dollar earned by their white co-workers.*

This last one is confusing. If equal pay regardless of gender ID and skin color, once adjusted for “performance, experience, and job responsibilities”, isn’t already part of the job market as a whole, is Progressive overpaying some groups while underpaying others in order to achieve the precise pay equity that it claims? If so, why don’t those paid below-market quit and why don’t the shareholders complain about company management paying a selected group above-market wages?

This concludes my research into Progressive’s progressivism. As of this month, I have switched to State Farm for auto/umbrella (State Farm currently writes new homeowners policies in Florida, but not in our neighborhood. Our house is just barely new enough (2003), but maybe it is slightly too close to the ocean or too vulnerable to a storm surge or maybe they already have too many other houses nearby that they cover).

Even back when almost everyone pretended to be a Christian, or pretended to be Patriotic, or pretended whatever, they didn’t go on and on like this about their ideologies and mythologies. I don’t know how long it’s been since you’ve worked at a BigCorp, but the kind of rubbish on their homepages is lifted from the same source as the weekly HR emails about diversity.

The weekly Covid emails actually got them off this diversity kick for a while, and was kind of a relief. At least Covid was less dangerous.

My first BigCorp job out of college was with HP. Let’s check in to see what they’re communicating to customers…

https://www.hp.com/us-en/hp-information/about-hp/diversity.html

HP says that “women, minorities, veterans, people with disabilities” are 67% of their new hires. They don’t explain why “veterans” are lumped in with these three victimhood groups. They claim that they have “46% minorities” on their Board and “46% women”. For the dreary technical jobs, as opposed to the high-paid fun Board jobs, only 24% are women but also invite visitors to “See how women in technology grow and thrive in HP’s culture of innovation and collaboration.” They’re claiming that “Asians” are “minorities”. They’re proud of their “Perfect score of 100 on the Disability Equality Index® (DEI)” and “A 2020 Diversity Best Practices Inclusion Index Company” badge and “A Best Place to Work for LGBTQ equality by Human Rights Campaign” banner.

Flo is now 53 & has gotten her screen time cut, so about as progressive as silicon valley. Lion parents are being required to pay for a new roof, which sounds like a deal compared to State Farm. What’s the point of insurance if you have to replace the house anyway?

I can’t comment about Progressive’s woke policies, but I can comment that it has been one of the most profitable companies in the US over several decades. Over the last 24 years it has gone up about 20X plus dividends. I think it was Buffet who said that Progressive has the best data analytics in the auto insurance industry, better than Buffet’s Geico. The woke stuff is nothing new. I think it was Peter B. Lewis, no longer alive, who really created the modern Progressive and his big cause was marijuana legalization along with modern art. Their annual reports used to showcase up and coming artists.

I’ve had Progressive for my auto insurance in FL for over 30 years. They’re always $200 – $600 less costly than all the others, and customer service and roadside assistance is excellent and 24/7!

Wondering why you don’t self-insure? Seems like it would be sensible for someone with your financial circumstances…what’s the premium on the home as % of home value?

Anon: Good question. I don’t think it is legal to register and drive a car around without insurance. I couldn’t resist getting a 3% mortgage (rate locked in Feb 2022; closed on the house in April 2022). It seemed like it was going to be free money given the massive deficit spending in which Congress was indulging. I must have insurance, which is about 0.7 percent of the house value (the house per se, not the house+land), as a condition of the mortgage.

Got it, had assumed no mortgage. With a super low mortgage rate (you appear to have nearly bottom ticked mortgage rates), makes sense to leverage up and invest the proceeds in bidenflation (home and/or the many other wonderful opportunities).

I could have paid cash, but I would have had to sell some stocks that had appreciated in nominal dollars and paid capital gains tax both on the small real gain and also on the big fake gain (due to inflation). It continues to amaze me that no matter how much inflation rages in the U.S. the subjects don’t demand inflation-indexed capital gains taxation.

Yes, the subjects on average appear to like socialism and all its “benefits.” Hoping there were others like yourself who took advantage of some aspect of the bidenflation carry trade (e.g. 3% debt invested in nasdaq +26% ytd).