“NASA Decides to Bring [$4.3 billion Boeing] Starliner Spacecraft Back to Earth Without Crew” (nasa.gov):

NASA will return Boeing’s Starliner to Earth without astronauts Butch Wilmore and Suni Williams aboard the spacecraft, the agency announced Saturday. The uncrewed return allows NASA and Boeing to continue gathering testing data on Starliner during its upcoming flight home, while also not accepting more risk than necessary for its crew.

This isn’t unconditionally great news for the astronauts. From The Sky Below (book by an astronaut):

my multiple spaceflights and spacewalks mean the likelihood of spinal trouble is almost as inevitable as an overloaded, rickety Jenga tower toppling over into a ragged heap. In space, the spine straightens and the intervertebral discs swell when not being compressed by gravity,

(the author spent about 8 weeks total in space)

Let’s check in with Boeing…

Each member of our global team brings something uniquely valuable to Boeing, and we grow stronger when everyone has an opportunity to contribute. Boeing remains committed to creating a culture of inclusion that attracts and retains the world’s top talent, and inspires every teammate to do their best work and grow their careers.

It turns out, though, that not all members of the global team are equally valuable. Black team members are apparently more valuable than non-Black ones. Boeing’s “Aspirations and Progress” section sets out “Increase the Black representation rate in the U.S. by 20%.” as the number one goal to achieve by 2025. Lower down on the page: “Fair360, a world leader in using data to assess companies’ commitment to inclusion, ranked Boeing 9th out of more than 160 companies reviewed.”

The “2024 Boeing Sustainability & Social Impact Report”:

We value diverse perspectives and continue to see more women and U.S. racial and ethnic minorities represented at nearly every level of the company compared with a year ago.

The company’s “Allies spreading awareness” page:

Their stories are part of a series celebrating the perspectives and accomplishments from LGBTQIA+ employees and allies across Boeing.

When her oldest child, Asher, recently came out as non-binary and embraced they/them/their pronouns, the family’s main priority was to be supportive and learn as much as they could about gender identity.

Elizabeth also looked into health insurance benefits and was able to connect Asher with Boeing’s Gender Affirmation Team, which provided information and resources to help Asher and family navigate through the transition process.

For Maggie Duckworth, advocacy for the transgender community is also a key component of her life. … The software engineer met her partner more than 20 years ago at an anime convention. The two bonded over the animated art where gender fluid characters were commonly a part of storylines. Later, Maggie’s partner, Ryn, came out as non-binary and now uses the pronouns they/them/theirs. “For a long time they were struggling with defining who they were,” Maggie said. “Then Ryn realized that they were (gender) neutral and we both felt relieved because we had found a definition.”

“I want to be an example for women in aerospace”:

One of [Chantel’s] main objectives in this role is to increase the representation of women in STEM (Science, Technology, Engineering and Mathematics) careers—a goal of personal significance.

If a person who identifies as a “woman” works at Boeing, one of the biggest tasks for which she is paid by Boeing shareholders is getting more “women” to go into STEM careers, regardless of whether those careers are at Boeing?

The most exciting part:

For the first time in her 8-year career, Chantel, a woman of color, reports to a director who is also a woman of color. Chantel believes she can support continued progress by ensuring other women in STEM see fulfilling career paths for themselves.

Her efforts help support our equity, diversity and inclusion commitment. In 2021, women’s representation at Boeing increased to 23.2% in the United States and 24.6% internationally. And representation for women of color at Boeing has increased at executive levels and throughout the company.

So the news isn’t all bad with Boeing. Diversity is up substantially year-over-year both right now and that was also true back in 2021.

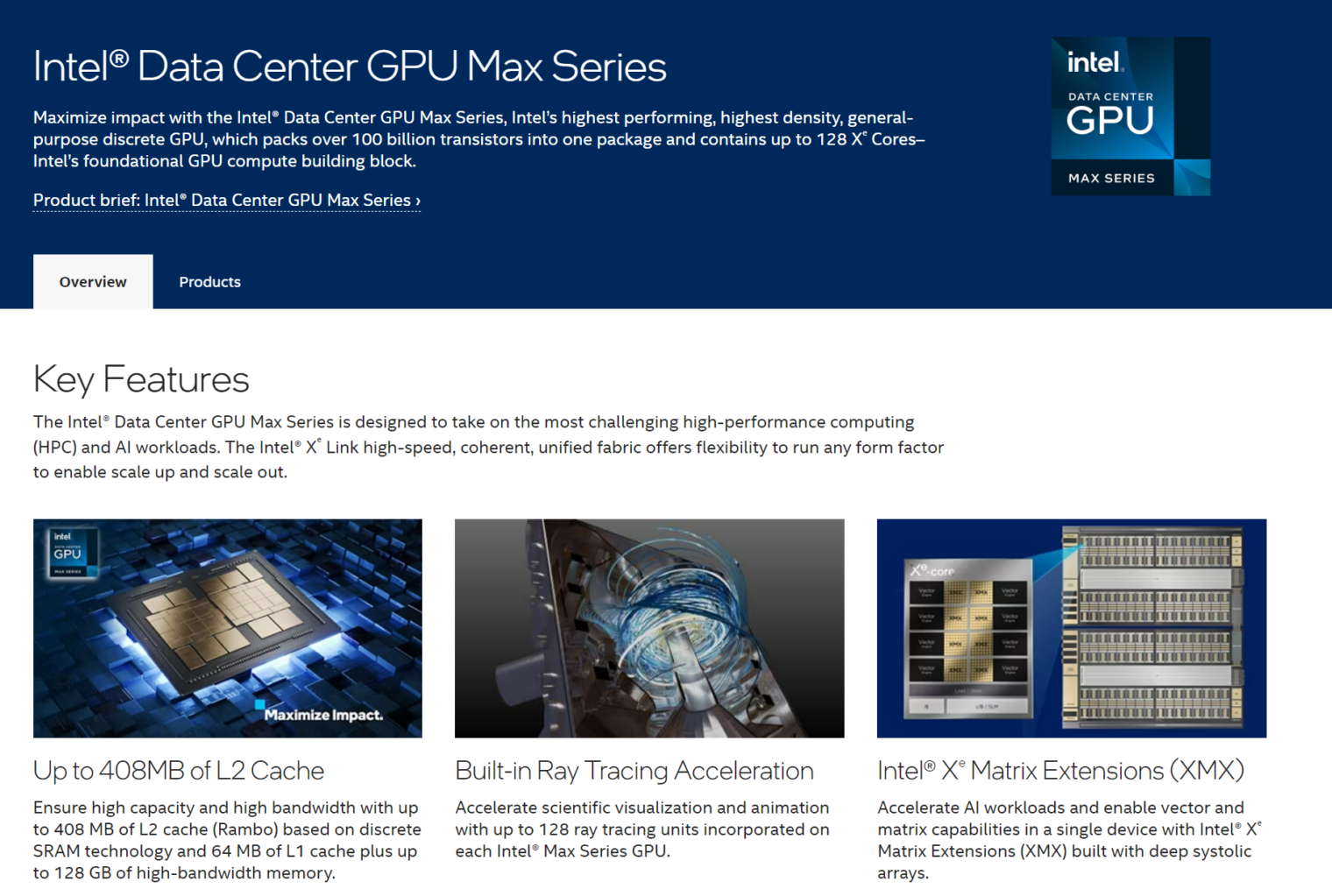

The company’s most recent “feature stories” about the product:

Related:

Full post, including comments