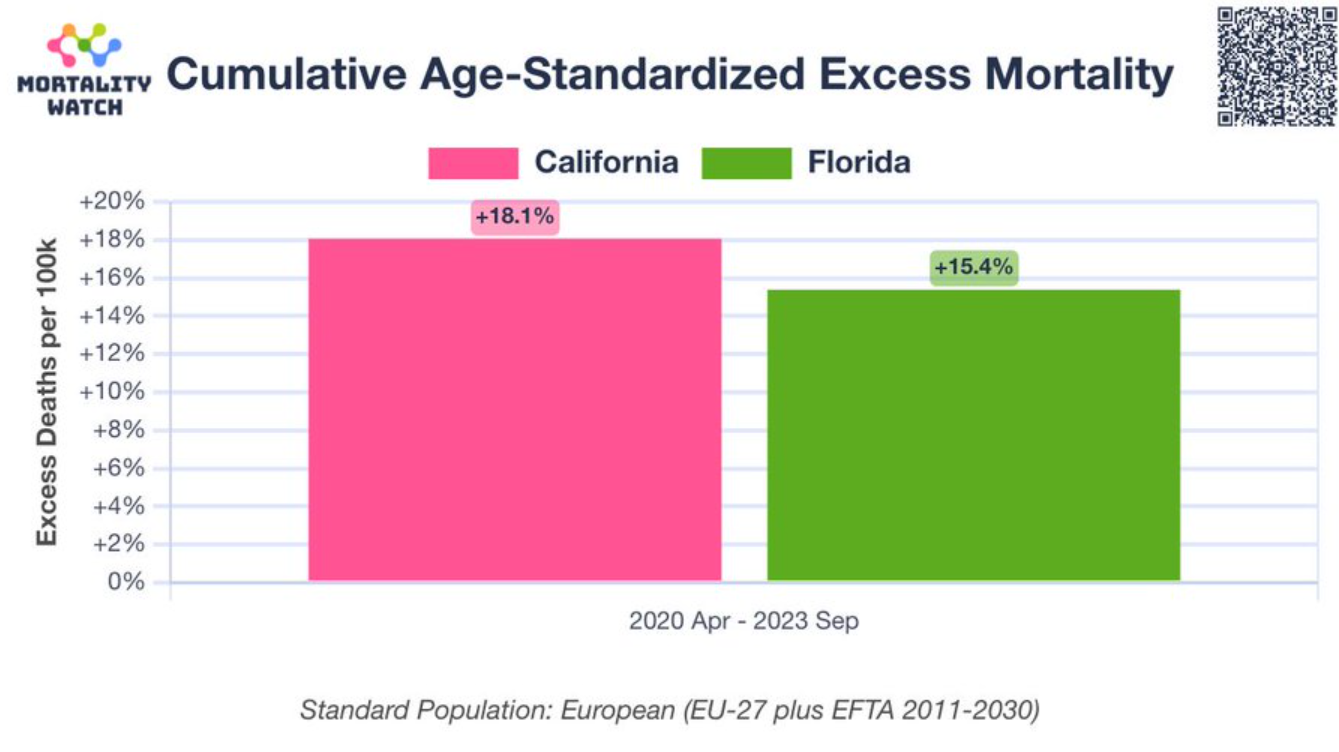

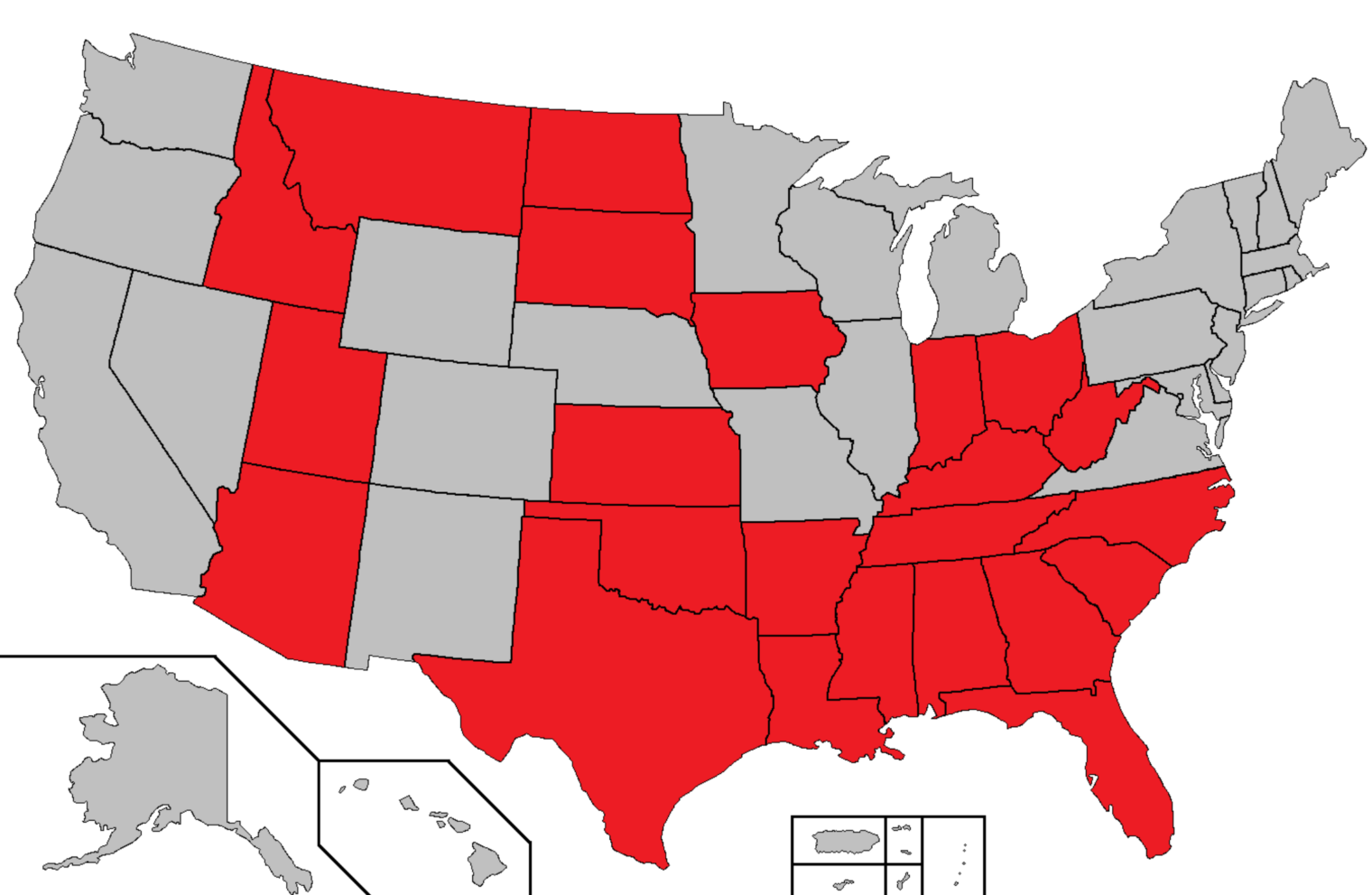

California continues to bleed high-income residents due to its deep dive into coronapanic

I was chatting with a software engineer who has been at Facebook (“Meta”) for about 10 years. His wife works an Excel-oriented analytics job for a company on the Peninsula. After their employers went 100-percent remote, they began spending more and more time in Hawaii. They grew to love it out there and now have purchased a family-sized house in Hawaii and are planning to move there full-time. Together they probably earn between $500,000 and $1 million/year. They’ll stop paying over $30,000 per year in property tax in California and start paying property tax on a multi-$million place in Hawaii. They’ll stop paying California income tax and begin paying income tax to Hawaii. What about schools? “The public schools in California are terrible,” said the Facebooker, “and the private schools are extremely expensive and in depressing facilities. The public schools in Hawaii might be even worse, but the private schools are cheap and they’re in beautiful natural settings between the beach and the mountains.”

This is plainly not a financially motivated move. Hawaii’s Department of Taxation proudly states that it is one of the highest tax places in the U.S.:

Hawaii has one of the highest income tax burdens of any state for all income levels

… The state ranks between first and the third place for highest income tax burden for every income level. Hawaii has the highest tax burden for very high-income taxpayers making over $500,000 filing single and $1,000,000 filing jointly, highlighting the progressivity of the state’s brackets.

In addition to paying high taxes, they’ll incur higher-even-than-California prices for many significant items.

This is a move that never could have happened, however, if California hadn’t developed a culture of maximum coronapanic, which necessarily spawned a culture of remote work.

Maybe Shohei Ohtani moving in to collect $700 million will help Gavin Newsom? ABC says he’ll likely pay California tax on only 3 percent of the headline number:

The Dodgers will pay Ohtani $20 million over the next decade, when the baseball star will be hitting and, health permitting, pitching for the National League powerhouse.

It’s the decade after that when the Dodgers will really start to pay Ohtani — $68 million per year from 2034-43. Ohtani will turn 40 in 2034, an age when most Major League Baseball players have retired. By then, Ohtani could stop playing baseball and choose not to live in California, potentially avoiding for the bulk of his salary the state’s 13.3% income tax and 1.1% payroll tax for State Disability Insurance.

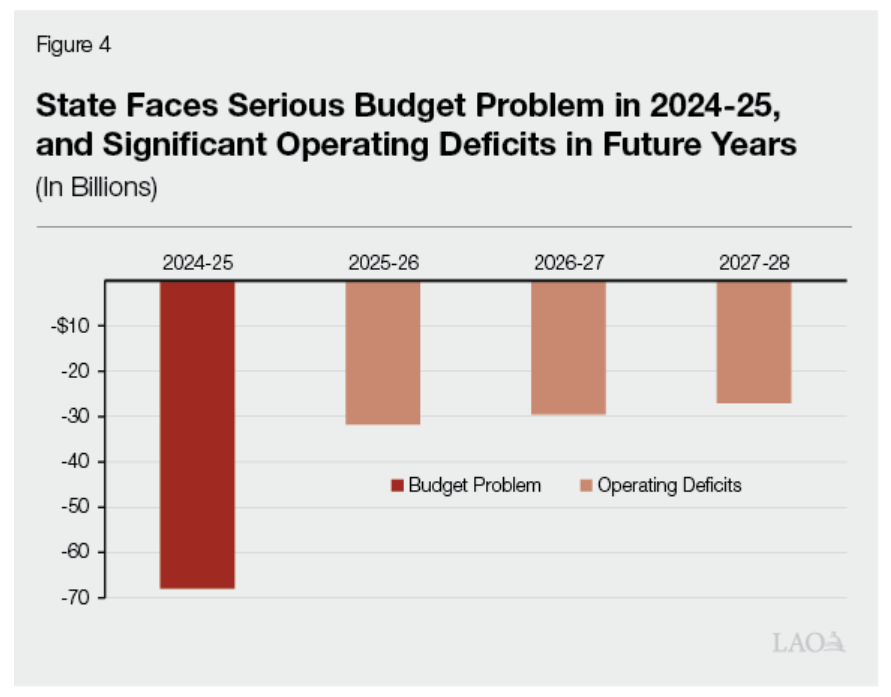

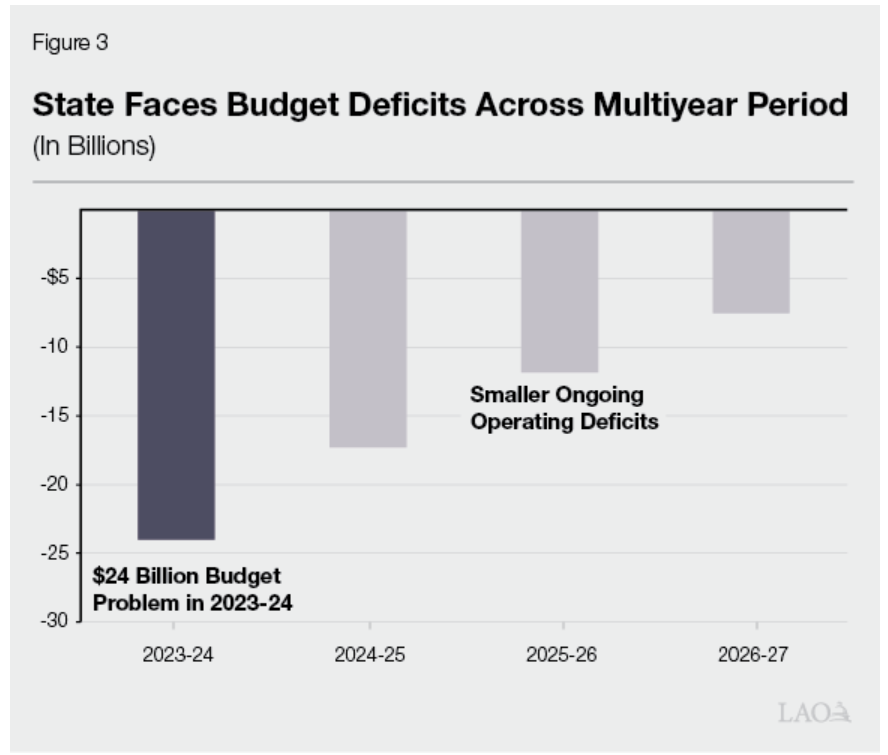

With 97% of Ohtani’s Dodgers income deferred, it means California — where there is an estimated $68 billion budget deficit this year — will have to wait at least a decade before it can collect taxes on the bulk of his salary, if it can collect at all. California could collect taxes from Ohtani’s significant endorsement deals, assuming Ohtani is a California resident.

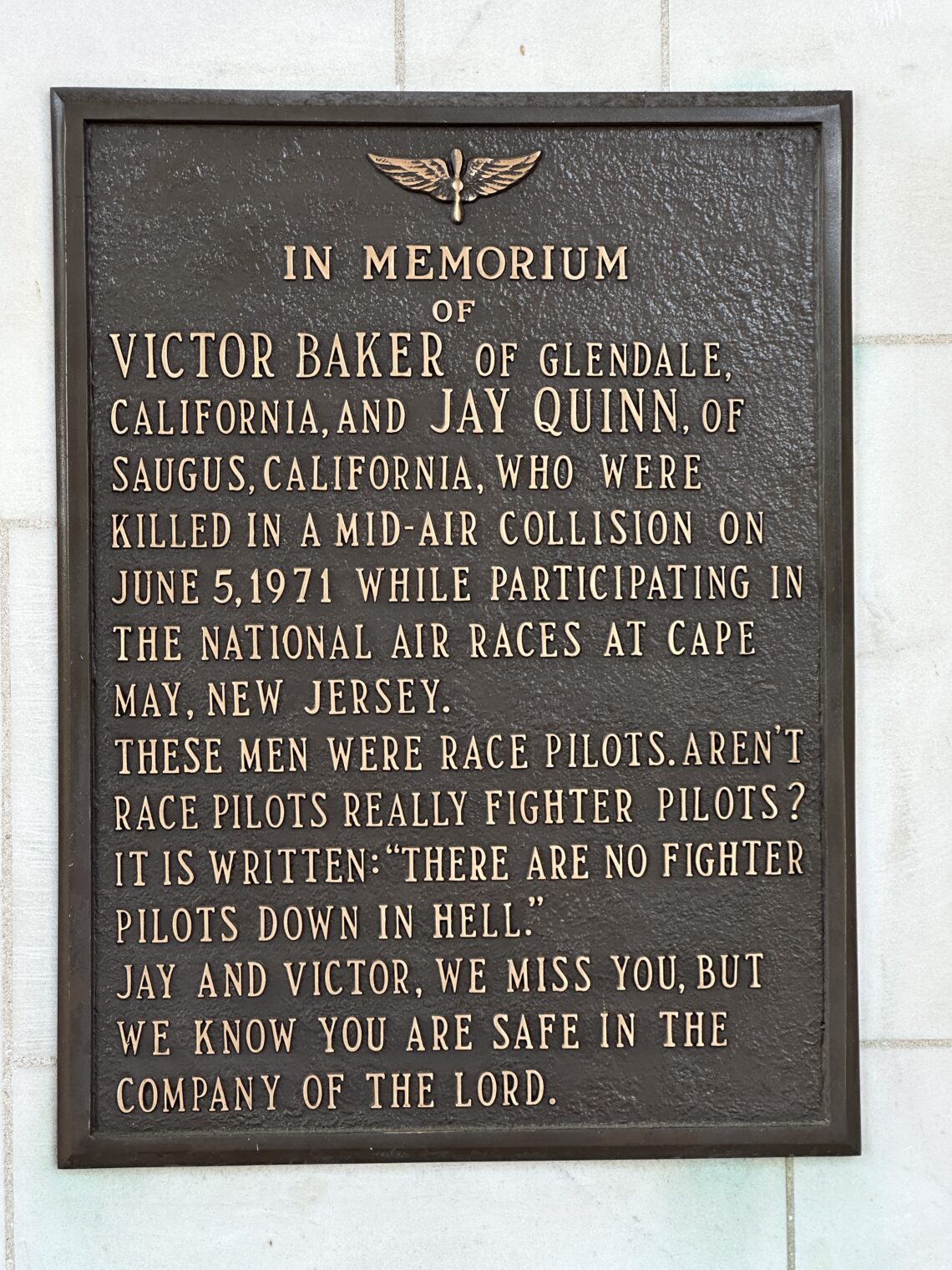

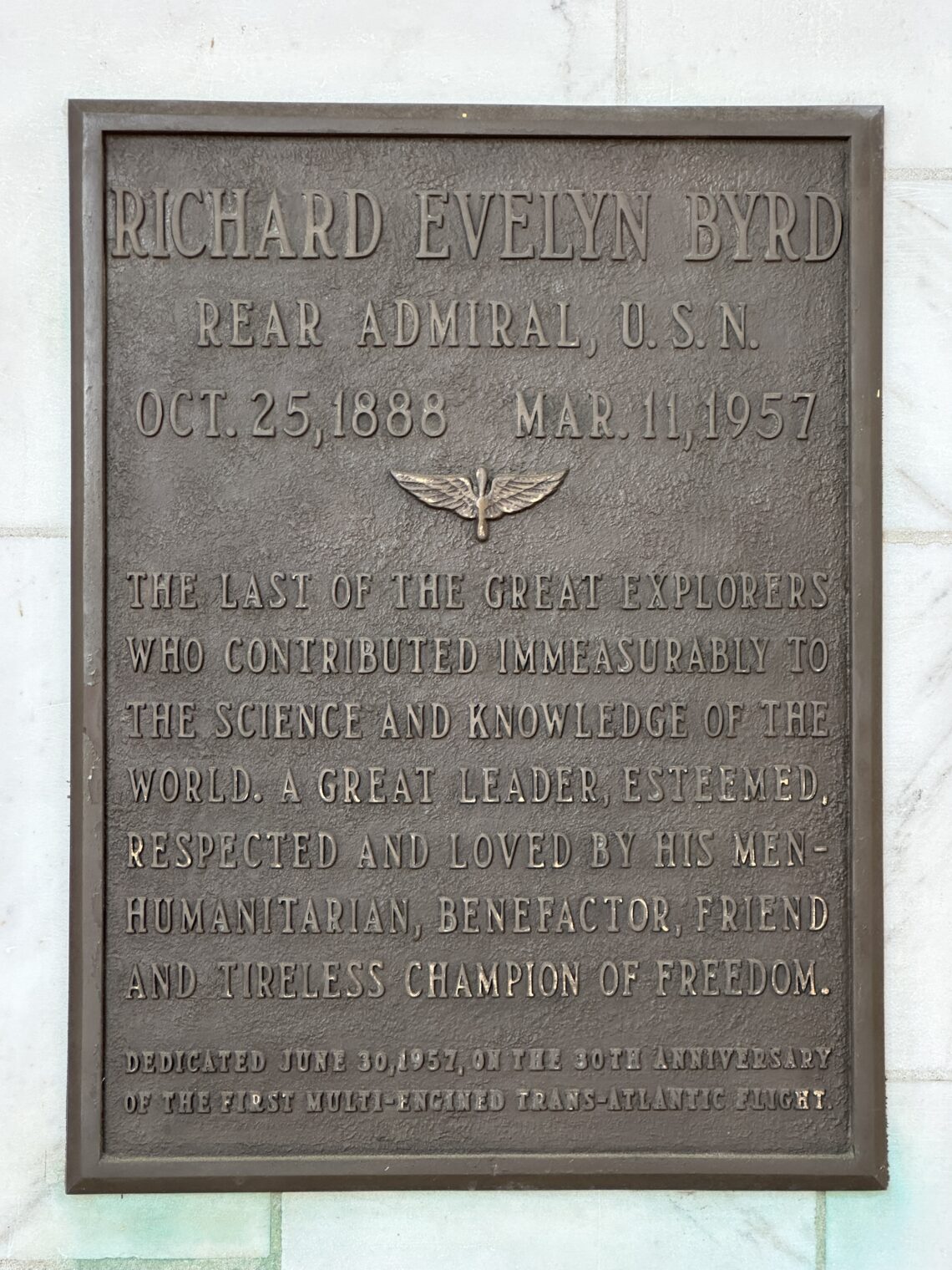

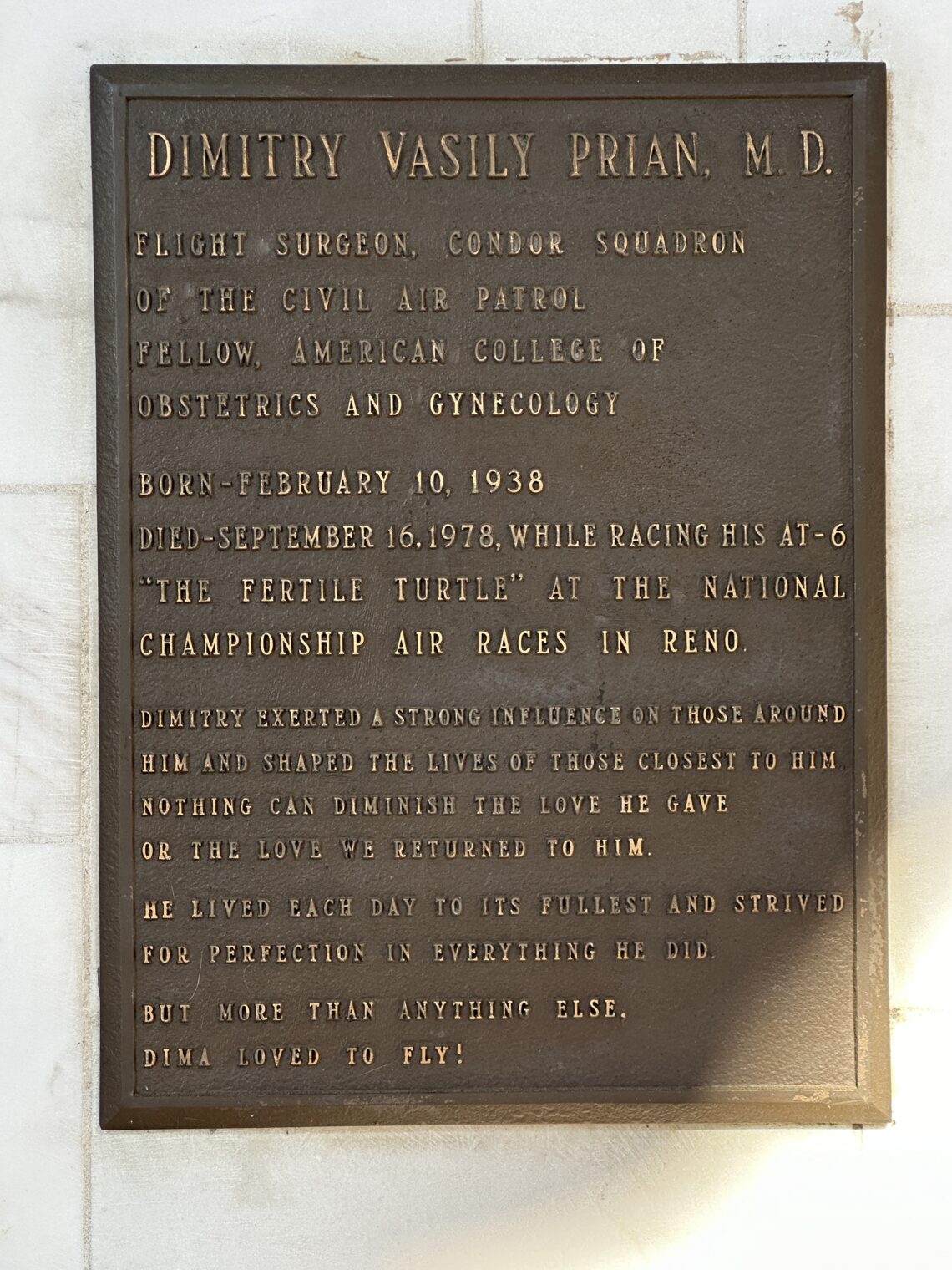

Loosely related, one of my favorite Hawaii snapshots, captured on 6×6 cm film with a Rollei.

(I personally wouldn’t want to live in Hawaii. The topography makes it mostly impossible to build standard walkable/bikeable towns and cities with a grid of roads. The typical Hawaiian island is a strip of development on a ring road and that ring road has become extremely congested. For those who love Asia, Hawaii seems like it might be a reasonable choice, but it is a 9-hour flight to Tokyo and 11 hours to Korea. You’re not going to go to Asia for a long weekend.)

Related:

- “The wealthiest Californians are fleeing the state. Why that’s very bad news for the economy” (LA Times, December 2023): “… in the years 2015-16, an individual or couple who had moved from California to Texas reported an average income of $78,000, about the same as Texans who relocated to California. But by 2020-21, California transplants in Texas reported an average income of about $137,000, while tax returns from former Texans who moved to California showed an average income of $75,000. The income gap between those coming into California and those going out is even bigger when it comes to Florida, which, as far away as it is, has become a top five destination for emigrating Californians.”