It’s Veterans Day. Historically, one of the things that U.S. society tried to do was ensure that good jobs were available for those who left the military and returned to civilian life. This was a matter of great concern around the end of World War II. See for example “JOBS FOR VETERANS REPORTED FEWER; Full Impact of Discharges Is Yet to Come, Says Commerce Bureau” (New York Times, December 20, 1945):

Veterans are beginning to encounter difficulties in finding employment, with the full impact of discharges upon the labor market yet to be felt, the Department of Commerce said today in this month’s issue of its Survey of Current Business.

With Army surveys showing that at least 75 per cent of the returning veterans would be job-seekers, the article concluded that the country faced a “primary problem” of developing a labor demand sufficient to provide employment for the returning veterans,” along with the additional problem of “finding jobs satisfactory to the veteran with previous training, newly acquired skills and generally high expectations.”

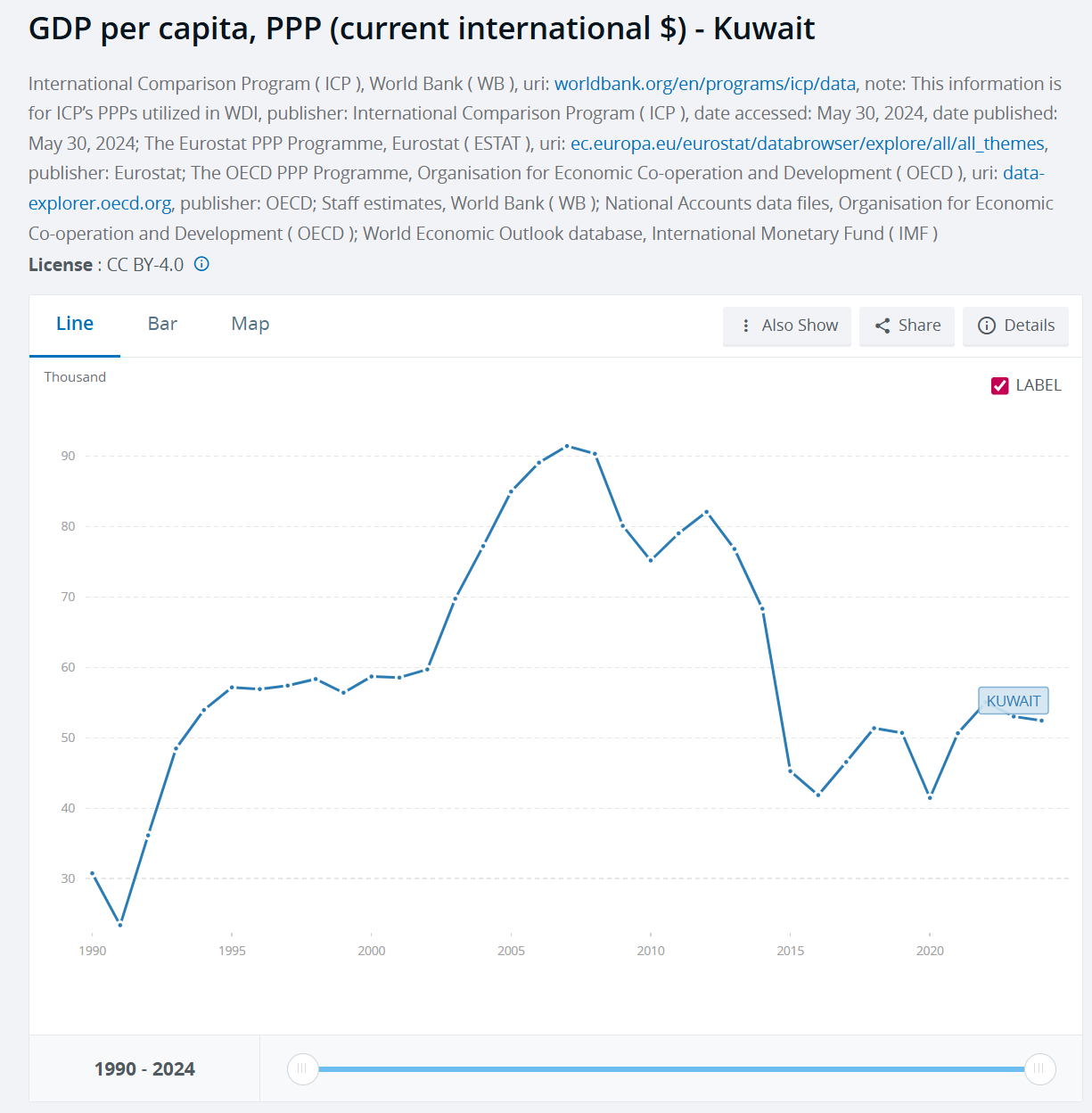

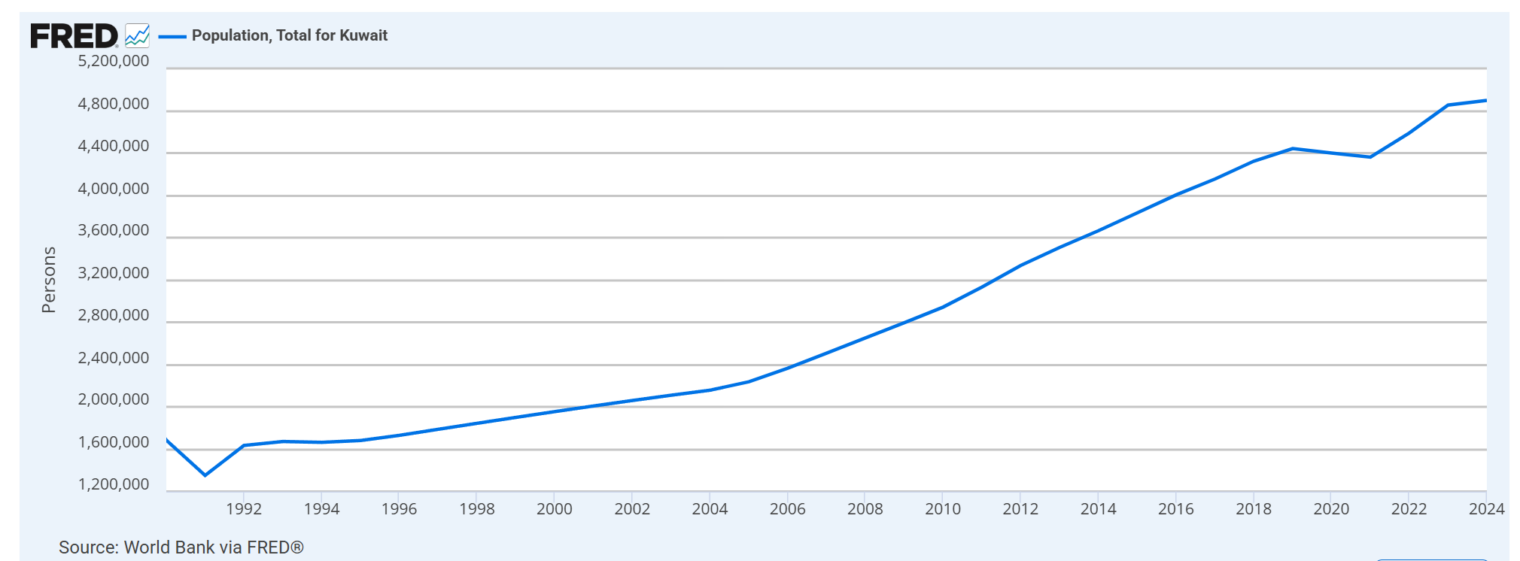

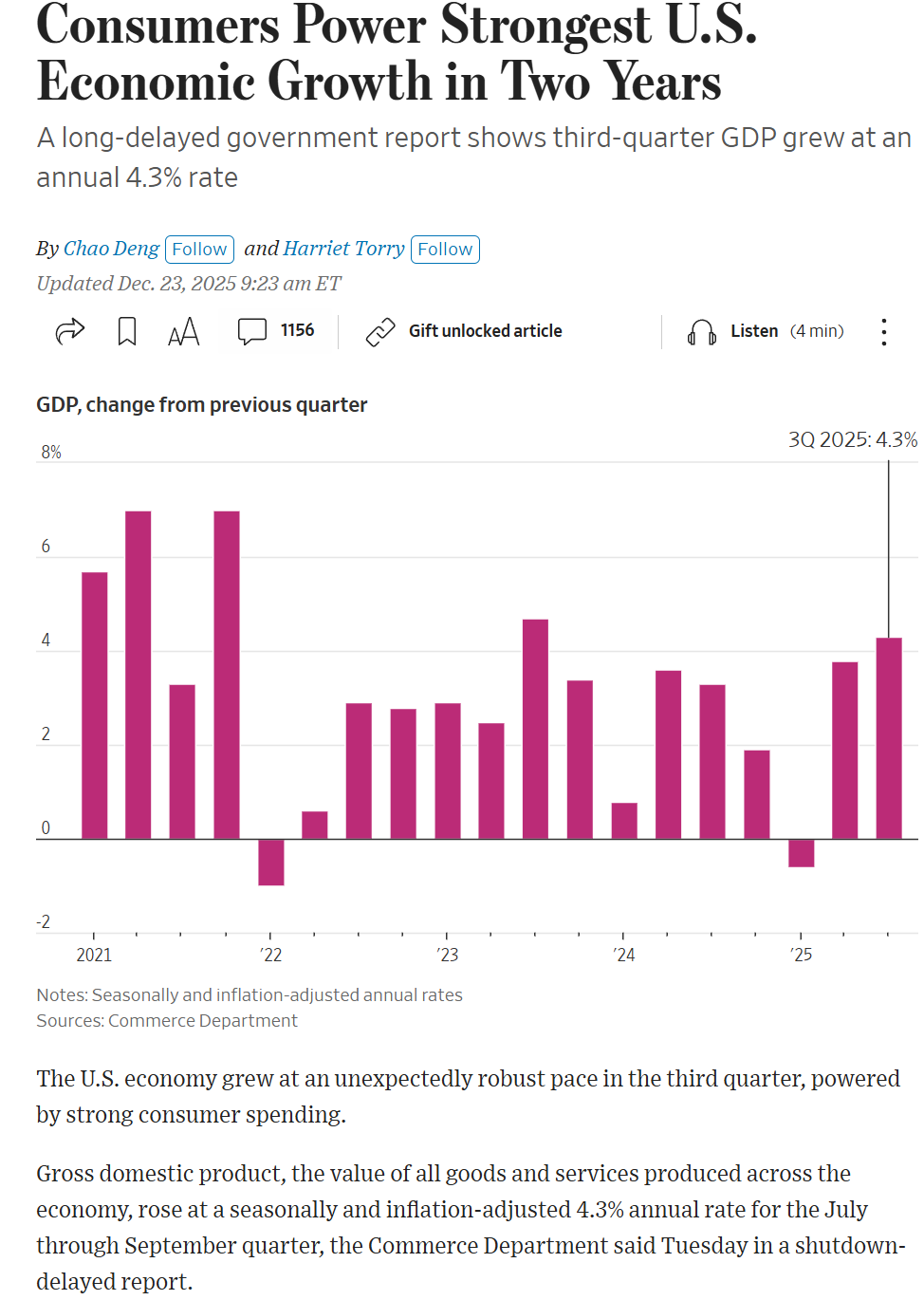

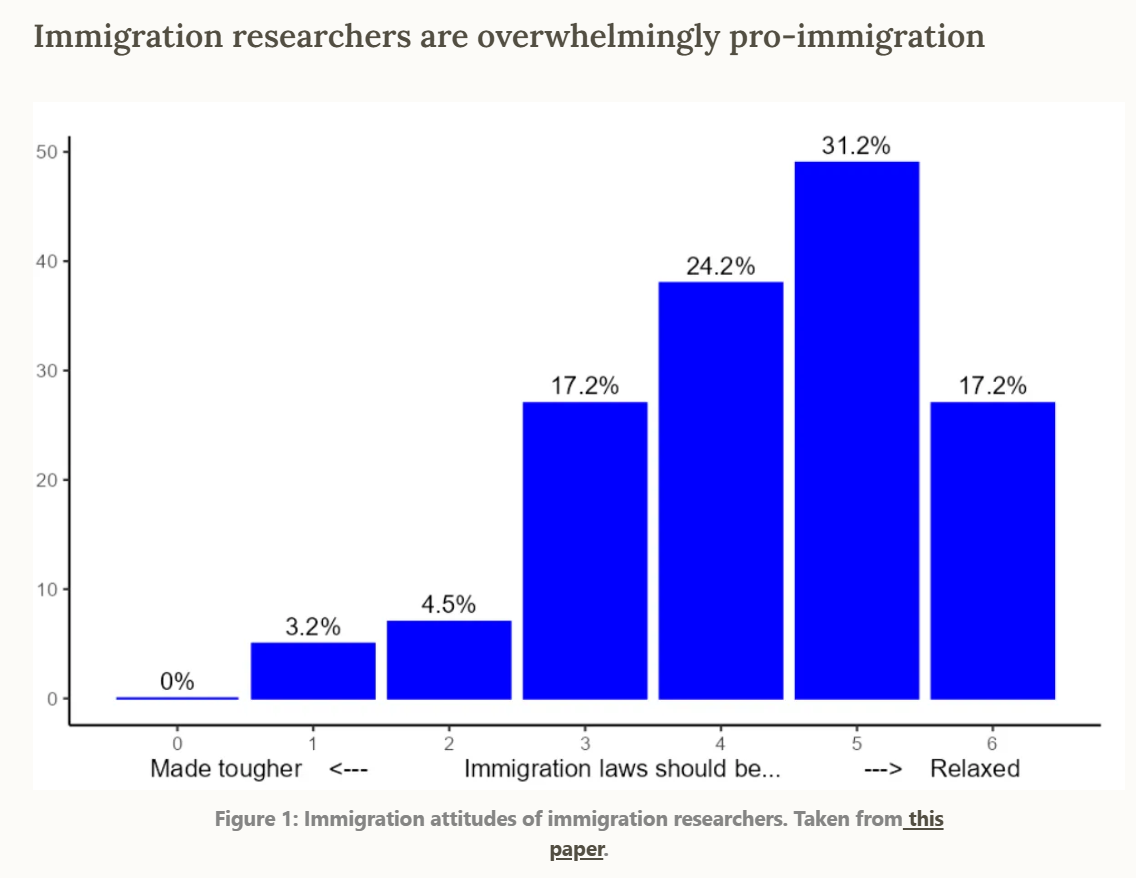

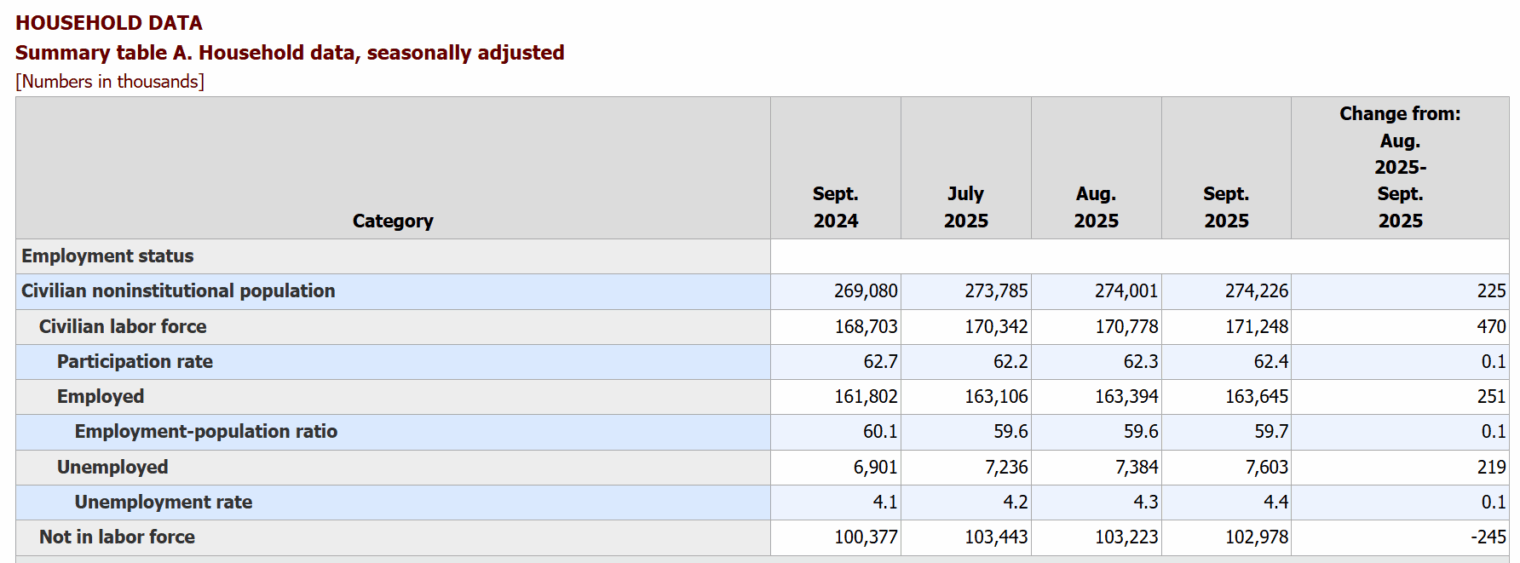

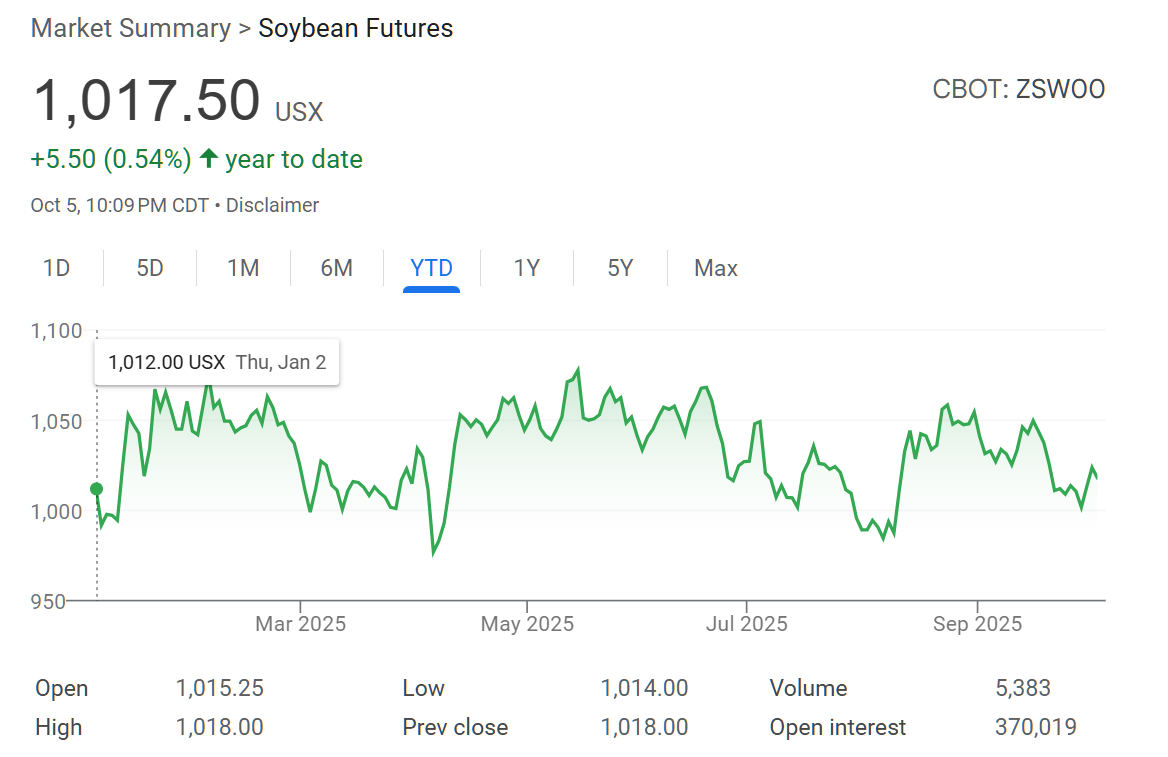

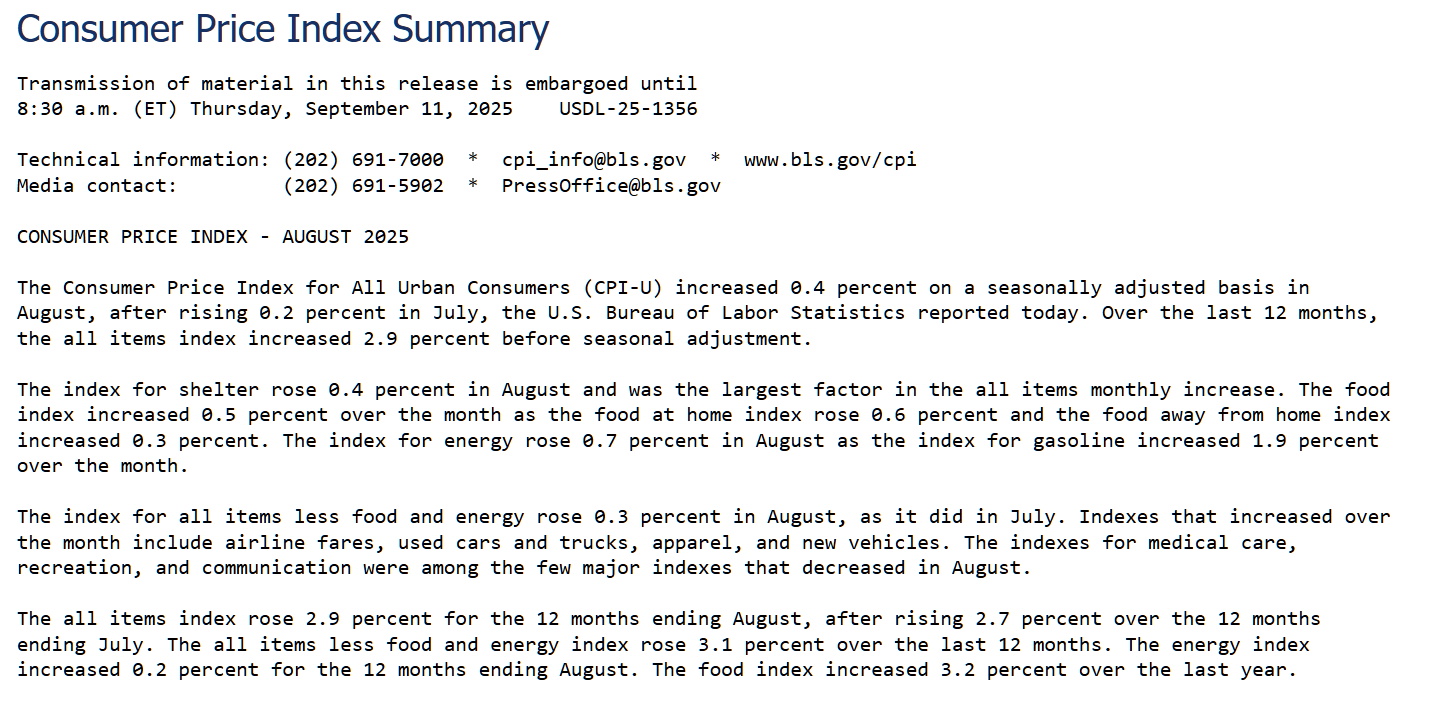

Ever since we opened our borders in 1965 we’ve forced veterans to compete with an ever-larger group of immigrant workers. We’re informed that it is a Scientific fact that an open border enriches every American, including veterans, because immigrant workers are critical to the U.S. economy and there are more than enough jobs to go around. For this post let’s ignore that our immigration policy doesn’t select for immigrants who are able to work; someone who is 2 years old or 85 years old or disabled or completely unskilled has the same entitlement to lifetime residence/citizenship under our asylum-based system or under our family relation-based system as someone who is of working age. Let’s assume that, in fact, immigration does bring in mostly people who are capable of working and who want to work (an irrational desire in a cradle-to-grave welfare state!). Does the assumption that there are ample jobs both for new veterans and new immigrants still make sense?

“More Big Companies Bet They Can Still Grow Without Hiring” (Wall Street Journal, October 26, 2025):

American employers are increasingly making the calculation that they can keep the size of their teams flat—or shrink them through layoffs—without harming their businesses. Part of that thinking is the belief that artificial intelligence will be used to pick up some of the slack and automate more processes. … “If people are getting more productive, you don’t need to hire more people,” Brian Chesky, Airbnb’s chief executive, said in an interview. “I see a lot of companies pre-emptively holding the line, forecasting and hoping that they can have smaller workforces.”

Many companies seem intent on embracing a new, ultralean model of staffing, one where more roles are kept unfilled and hiring is treated as a last resort. At Intuit, every time a job comes open, managers are pushed to justify why they need to backfill it, said Sandeep Aujla, the company’s chief financial officer. The new rigor around hiring helps combat corporate bloat.

“Amazon Plans to Replace More Than Half a Million Jobs With Robots” (New York Times, October 21, 2025):

Over the past two decades, no company has done more to shape the American workplace than Amazon. In its ascent to become the nation’s second-largest employer, it has hired hundreds of thousands of warehouse workers, built an army of contract drivers and pioneered using technology to hire, monitor and manage employees.

Now, interviews and a cache of internal strategy documents viewed by The New York Times reveal that Amazon executives believe the company is on the cusp of its next big workplace shift: replacing more than half a million jobs with robots.

Amazon’s U.S. work force has more than tripled since 2018 to almost 1.2 million. But Amazon’s automation team expects the company can avoid hiring more than 160,000 people in the United States it would otherwise need by 2027. That would save about 30 cents on each item that Amazon picks, packs and delivers to customers.

Executives told Amazon’s board last year that they hoped robotic automation would allow the company to continue to avoid adding to its U.S. work force in the coming years, even though they expect to sell twice as many products by 2033. That would translate to more than 600,000 people whom Amazon didn’t need to hire.

“Amazon to Lay Off Tens of Thousands of Corporate Workers” (WSJ, October 27, 2025):

The latest round of job cuts would be the largest since 2022, when Amazon eliminated around 27,000 roles. That layoff occurred in waves.

The company views the cuts in part as an effort to correct an aggressive hiring period during the pandemic, the people said. During that period, a boom in online shopping led Amazon to double its warehouse network over a two-year period.

Amazon CEO Jassy has sought to find ways for the company to do more with less. In June Jassy sent a note to employees that said increasing use of artificial intelligence will eliminate the need for certain jobs. He called generative AI a once-in-a-lifetime technological change that is already altering how Amazon deals with consumers and other businesses and how it conducts its own operations, including job cuts.

“As we roll out more Generative AI and agents, it should change the way our work is done,” he said at the time. “It’s hard to know exactly where this nets out over time, but in the next few years, we expect that this will reduce our total corporate workforce.”

Veterans are above-average in health, intelligence, and education and they come from richer-than-average families. Nonetheless, I wonder if the combination of AI and a continued inrush of legal immigrants (somewhere between 1.2 and 2.6 million annually, according to ChatGPT) will make it almost impossible for tomorrow’s veterans to get decent jobs.

Related: The Bobs.

Full post, including comments