How did the coronanxious come into power?

Still celebrating the start of Year 2 of “14 Days to Flatten the Curve”…

I closed out Commercial flights during Coronapanic: a mostly mask-free experience with

I wouldn’t recommended the experience for those who are anxious about COVID-19. While you’re constantly being reminded about how hazardous COVID-19 is, there isn’t enough room in the airport to be truly distant from those who are potentially infected. People sit glumly with their masks on, waiting to see how the Russian roulette game that they’ve chosen to play will turn out. Unless you believe in the effectiveness of crude non-N95 masks, it’s the same risk level as being in a crowded Miami club, but a lot less fun.

One of the great things about Internet, which even Facebook hasn’t managed to destroy, is that reader comments can be much more interesting than the original post. From RS:

Can we just say that about all other aspects of life? I would love if people who are anxious about COVID-19 would just stay home so the rest of us can get back to normal life. It feels like they’re holding society hostage so they can have the illusion of protecting themselves without having to do the one thing that actually protects them (staying home).

With a handful of exceptions (Florida, South Dakota, Sweden, Russia), it seems as though the coronanxious are in charge and able to force those who don’t mind coexistence with this virus and its myriad variants (the “covidiots”) into various forms of shutdown, mask theater, etc. The coronanxious have pretty much sat at home for a year anyway. It wouldn’t have cost them anything or increased their personal risk if they’d let the non-anxious carry on with their lives, education, and careers.

So that raises the question… why is it obvious that the coronanxious would prevail in setting government policy? (i.e., could we have predicted Mass Karenhood?) Is it because leaders tend to be old and therefore personally vulnerable? Is it because the restrictions imposed don’t hurt the elite and the elite are indifferent to the suffering imposed on the non-elite? (public school shutdowns aren’t a problem when your children and/or grandchildren are in private school…)

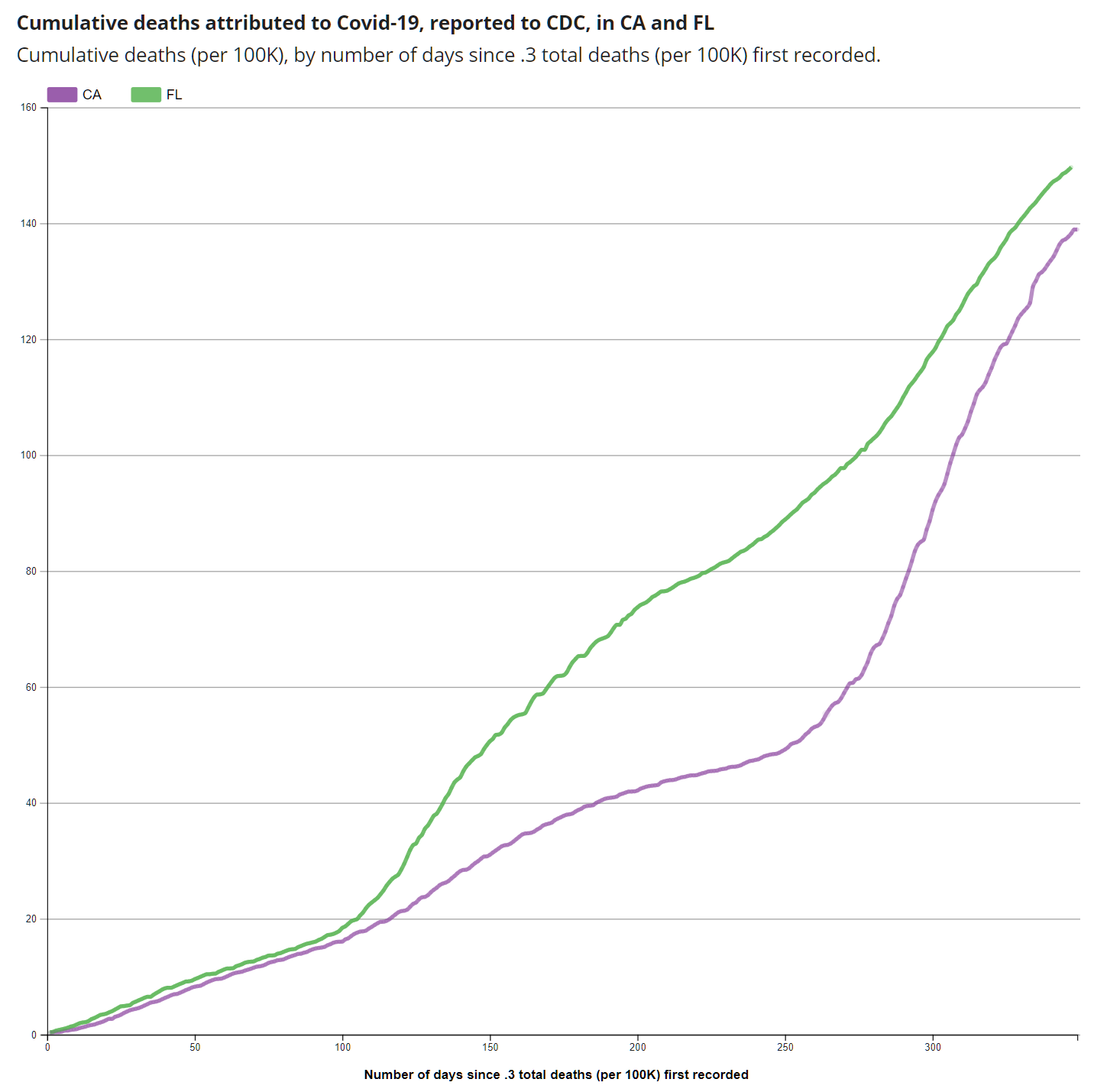

From the CDC, March 14, California and Florida, at opposite ends of the shutdown spectrum:

Note that more than 20 percent of Florida’s residents are over 65 (and therefore potentially vulnerable to COVID) while just 14 percent of Californians are over 65. So the COVID death rate among the elderly in Florida is almost surely much lower than in masked-and-shut California.

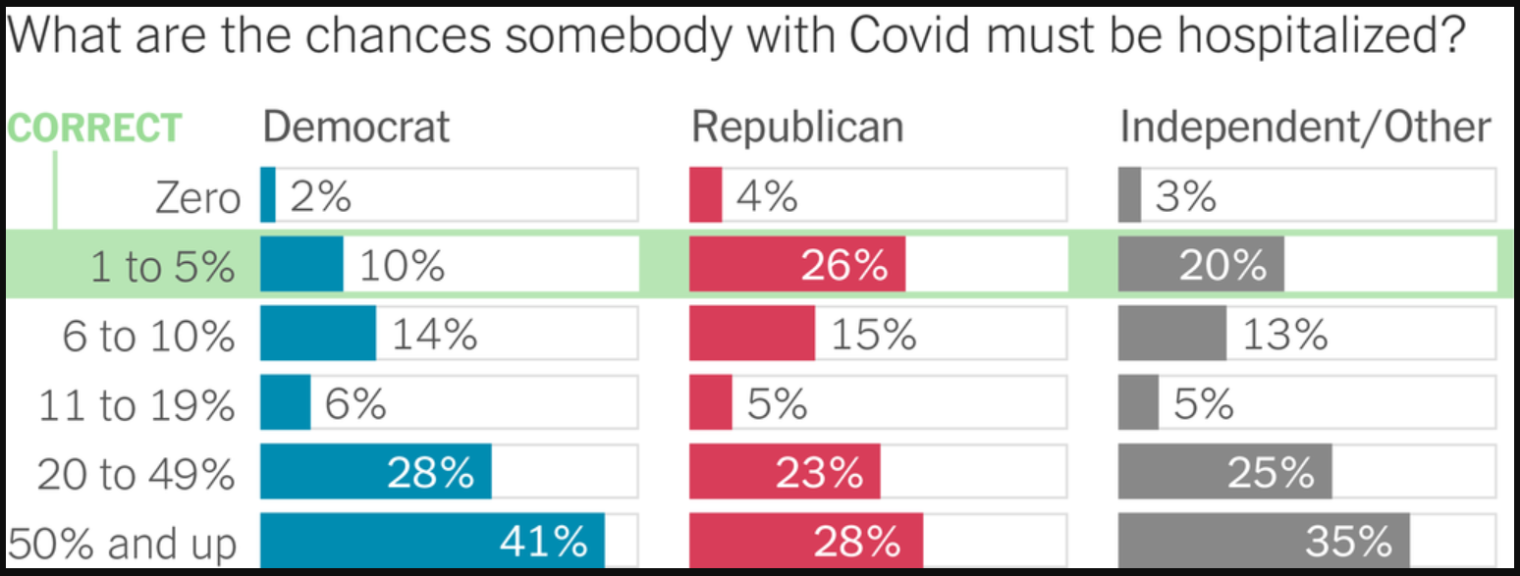

An objective measure of panic from one of America’s principal vendors of panic, the New York Times (March 18, 2021):

First of all, it is unclear whether the 1-5% hospitalized answer is actually “correct” if you consider “with Covid” to mean “could produce a positive PCR test”. With the CDC estimating that more than half of Americans have been infected with coronavirus, is it conceivable that COVID-19 means a 5 percent risk of hospitalization? We should have seen 2.5 percent of the folks we know carted off to the hospital (with a median personal network size of 472, the typical person should know 12 people who’ve been hospitalized with COVID). Leaving that aside. Casual inspection of this chart shows that 88 percent of Democrats overestimate the risk of hospitalization from COVID-19 while 70 percent of Republicans do. The journalists at the New York Times nonetheless report that “Republicans tend to underestimate Covid risks”. Based on the chart, it would be more accurate to say “Four percent of Republicans tend to underestimate Covid risks.”

Full post, including comments