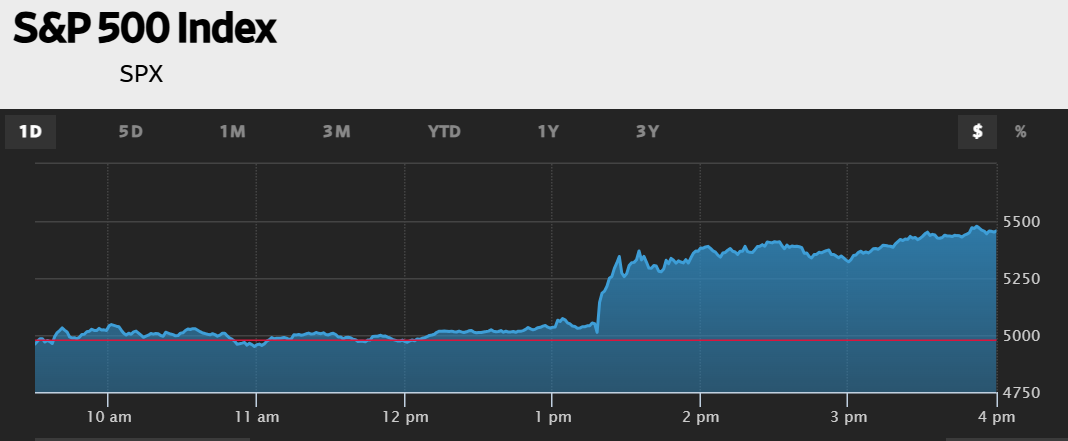

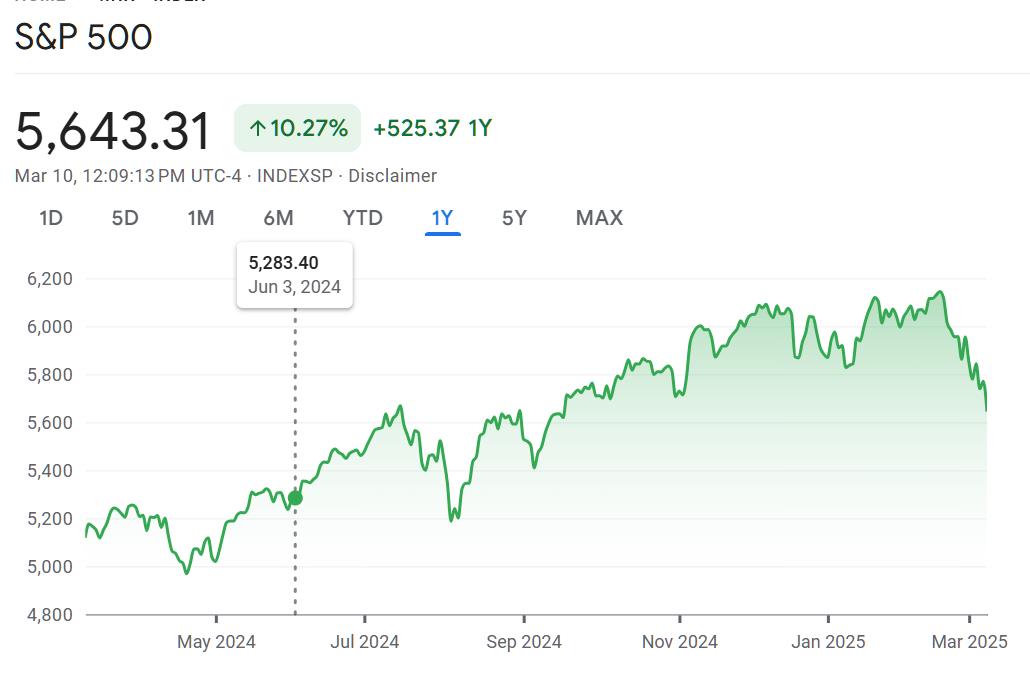

If attacking Iran is a disaster for the U.S., why is the stock market slightly up?

This is my last morning in Berkeley, California. Support for the Islamic Republic of Iran is almost universal here. Nearly everyone shares the New York Times perspective that Trump’s attack on the noble legitimate leaders of Iran was reckless and exposes the U.S. to risks almost as bad as climate change. Certainly there was no imminent threat from some guys chanting “Death to America” and working on nuclear bombs and ballistic missiles. At dinner last night I asked a local, “Have you checked the stock market? If we’re in serious trouble, the market should be down.” She replied that she hadn’t checked, but was sure that there had been a market crash.

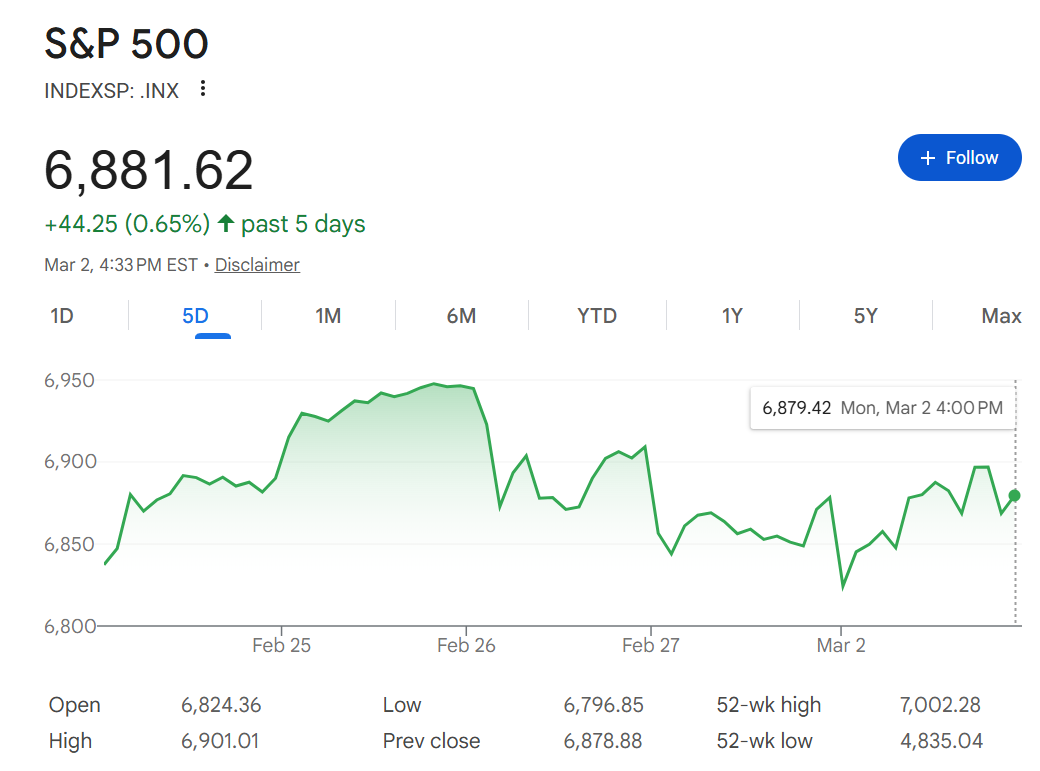

The Google shows that the market is about where it was a week ago.

How about oil?

Anyone who loaded up on oil on Friday is up 10 percent, but with standard leverage of 10:1, the lucky (or well-informed) trader has doubled his/her/zir/their money.

Loosely related, a favorite tweet regarding the fighting in and around Iran:

What else are Bay Area lifelong Democrats excited about? One friend wasn’t interested in the Iran war because he’s working to stop the construction of roughly 180 units of affordable housing that would be 2 miles from his house. (I’m also against this, of course, but likely for different reasons. A limited supply of taxpayer-subsidized housing results in a violation of the 14th Amendment’s Equal Protection Clause. 180 people will enjoy low rents for brand new units. Perhaps 5,000 nearby people with exactly the same income will be forced to pay high market rents for crummy older apartments. In what world can this be considered “equal” treatment by the government?)

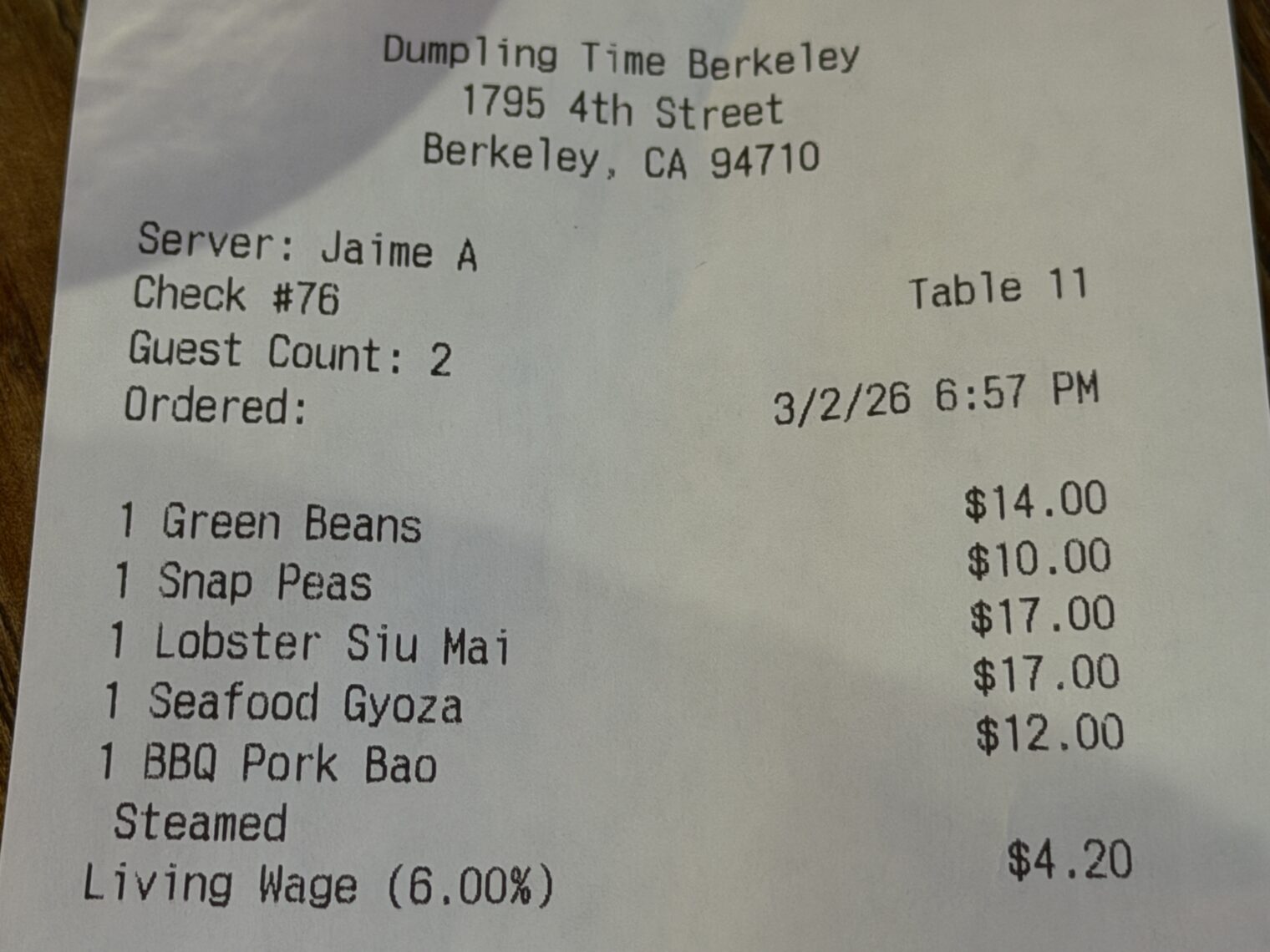

Another friend was passionate about not straying too far from the 4th Street restaurant where we’d dined. She believed that we would become victims of crime if we walked away from the brightly lit main blocks. I pointed out that it wasn’t a great advertisement for 70 years of lavishly funded progressive government if Berkeley, in fact, had dangerous neighborhoods. (My local friend says that she often sees broken glass in parking spaces, evidence of prior break-ins.)

Separately, check out the “Living Wage” bump of 6 percent over the menu prices for this kosher meal.

Full post, including comments