Obtaining some public records in Brookline, Maskachusetts

“I tried to pry public records from Brookline schools. They stiff-armed me for months.” (Boston Globe, 9/21/2025):

The rub: Because of flaws in our state’s law, theory differs from practice. It takes just minutes to file a public records request, but as I painfully learned, to actually get a request fulfilled may require months upon months of follow-up; a nontrivial sum of money; a lawyer or two; and persistence verging on a pathological inability to let go.

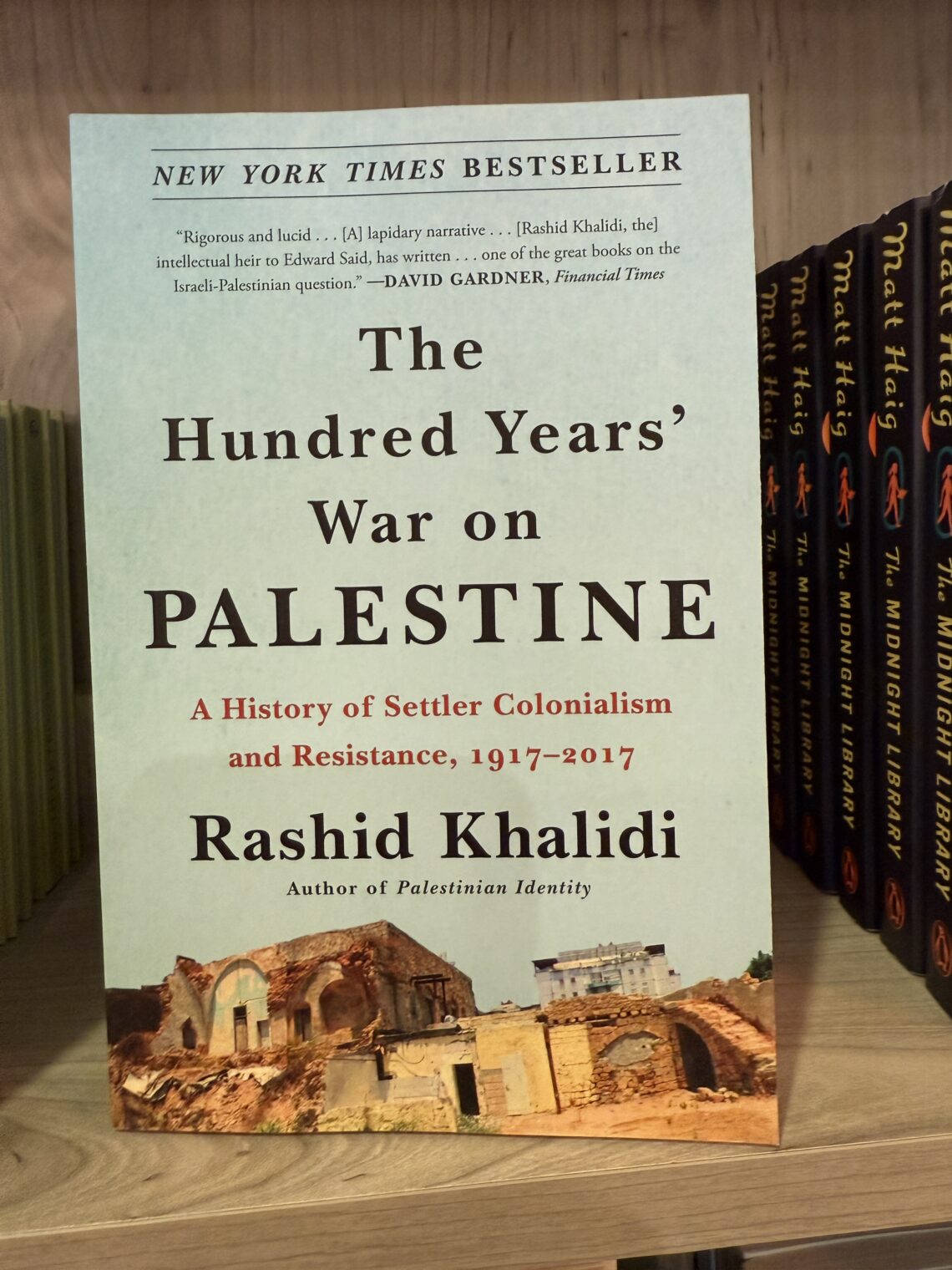

Just after the Hamas attacks of Oct. 7, 2023, the schools superintendent sent out two messages that sparked instant backlash. “As you are likely already aware, violence is escalating rapidly in Israel and Palestine,” began one note, sent to the entire school district community. Though the town includes large Jewish and Israeli populations, the note neither decried the Hamas atrocities nor expressed sympathy to the many affected local families. A separate note to staff recommended an undeniably slanted set of teaching resources. It included links to pro-Palestinian sources like Visualizing Palestine and Decolonize Palestine but no similarly pro-Israel sources to balance them, and nothing on Hamas.

(I’m not sure that it is reasonable to call the October 7, 2023 event “Hamas attacks” given that there were fighters from UNRWA and Palestinian Islamic Jihad involved, as well as “civilian” Gazans. By saying that it is only “Hamas” that wants to destroy the Zionist entity and achieve river-to-the-sea liberation the implication is that if the 6 or 7 remaining Hamas-affiliated Gazans were removed the Gazans would cheerfully accept the existence of Israel.)

On Oct. 16, 2023, when I filed my request, I figured I was just asking for a couple of days’ worth of one official’s emails on a specific topic. Type a few terms into a search bar and done, right?

Wrong. It took more than 18 months to get that modest request fulfilled, and I still don’t have one central document (but I’ve given up). It took enlisting pro bono lawyers; appeals to the supervisor of records, the state team that handles public records requests; countless nagging emails; two speeches and a half-dozen emails to the School Committee. … I refiled the request in May 2024. This time, when it was once again met with silence, I knew enough to appeal after 10 days to the supervisor of records. That office promptly ordered the town to respond.In July 2024, the Brookline town counsel did send over a document. Only one, but still — a document!

Sadly, it was nothing but an email saying a draft of a Google Doc for the Oct. 7 messaging had been created. All names were blacked out, without the justifications for those redactions that are required by law. Also, I knew the superintendent had received many emails responding to his messages; our local Brookline News had even covered them. Where were they?Stymied, I finally sought legal help through the Anti-Defamation League’s project on antisemitism in K-12 schools, and it provided two top-notch pro bono attorneys. In mid-December, I wrote to the town counsel conveying, for the first time in my life, the ultimate attention-grabber: “You’ll be hearing next from my lawyers.”

Soon came the count — the town counsel’s office had identified 368 potentially relevant emails — and the price tag: they estimated that at least 39 hours of staff time would be needed to process the emails, at a cost of $926.25.

In April and May of this year, the town counsel sent over four batches of repetitive, sometimes irrelevant emails, sprinkled with a few gems. Several indicated that two senior district staffers had led the drafting of the messages: a senior director of teaching and learning, and the director of the Office of Educational Equity.

Any Massachusetts taxpayer who wants to fund “education” instead of “educational equity” can move to Florida, I guess.

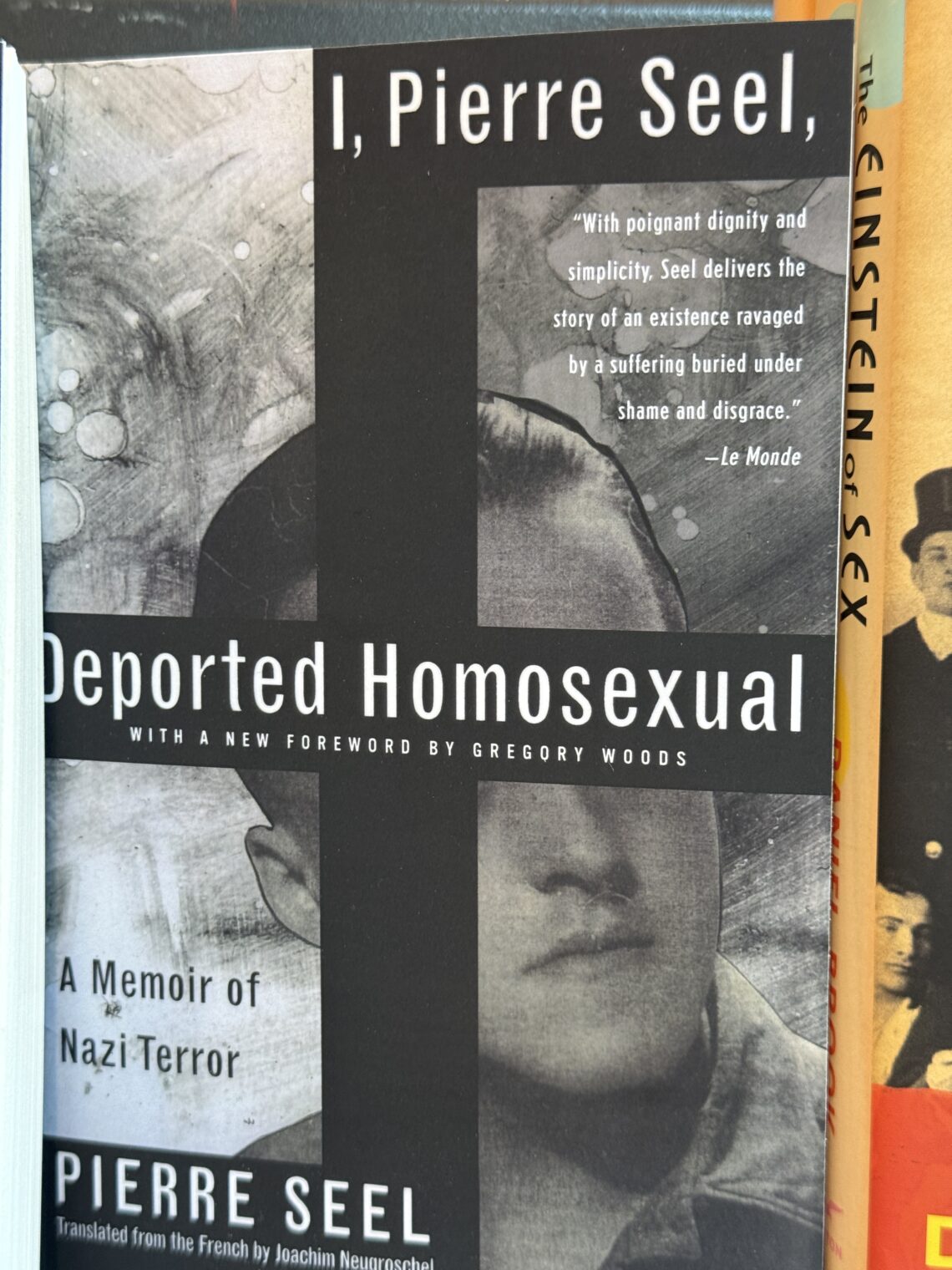

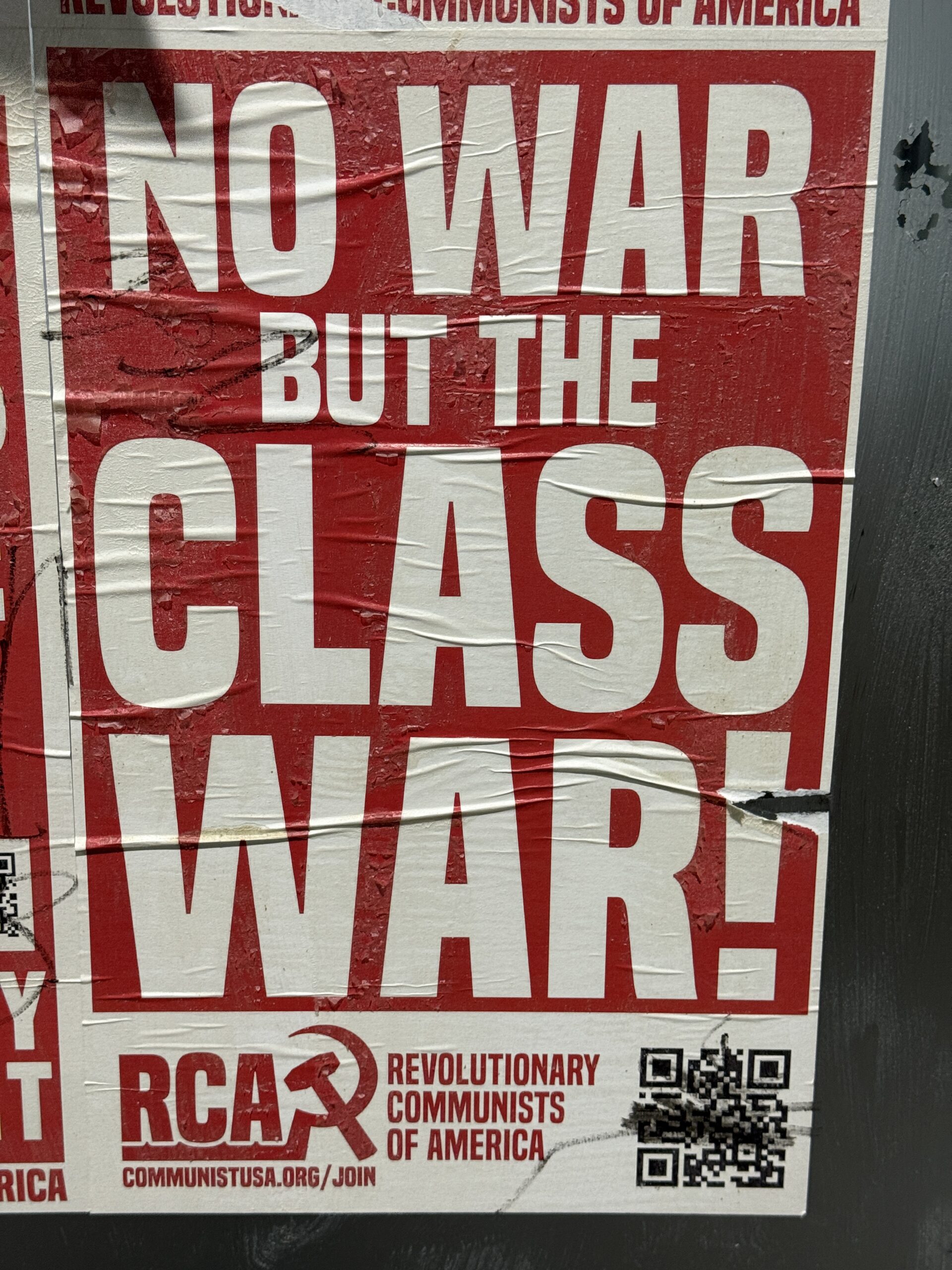

Here’s a page from the Decolonize Palestine site that the school bureaucrats wanted students to read:

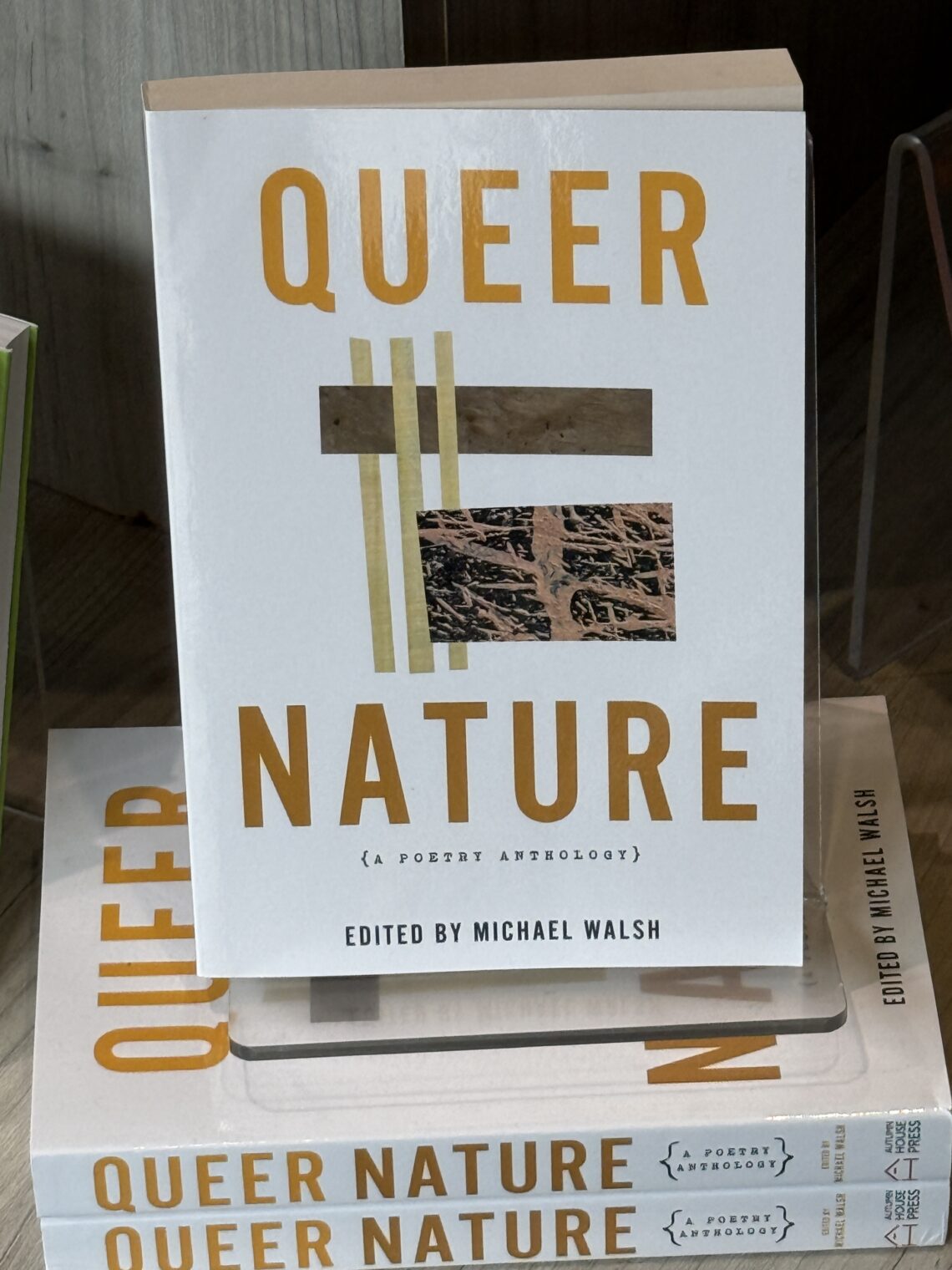

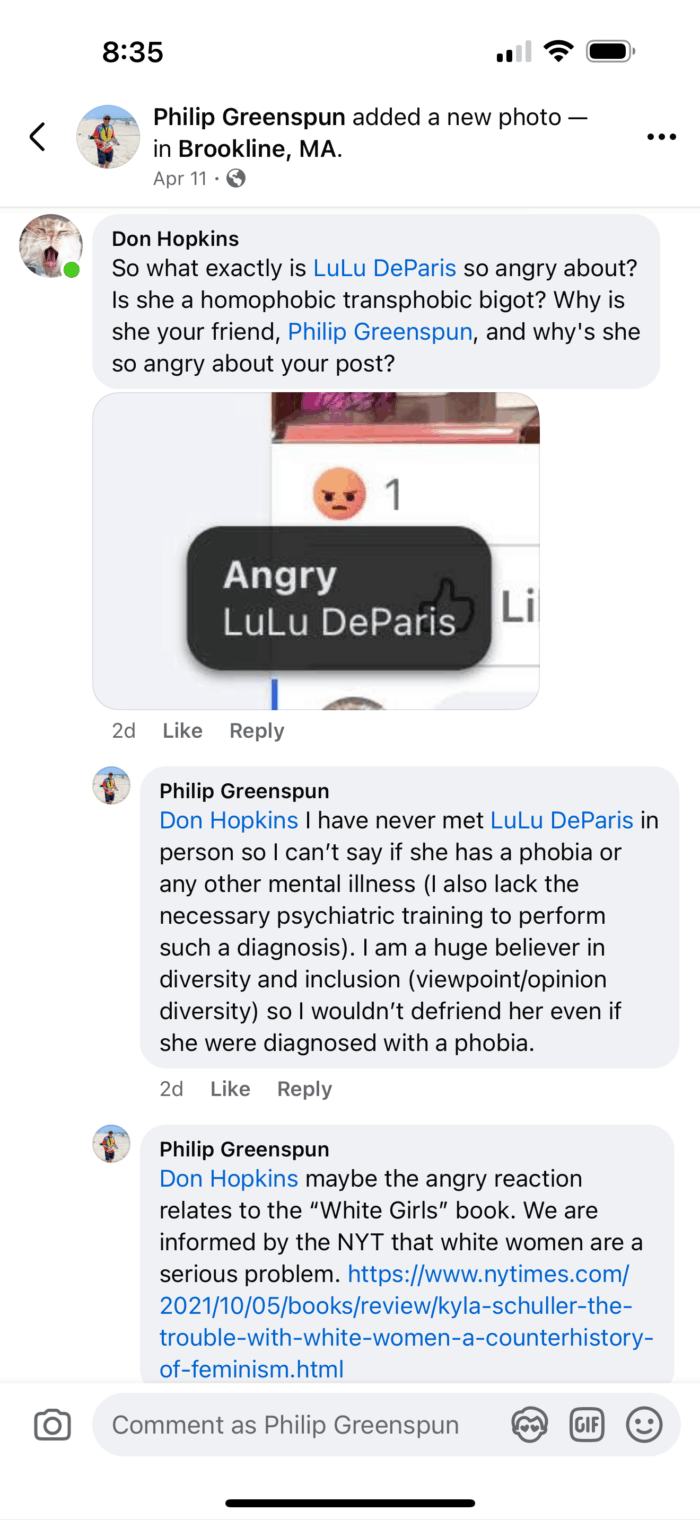

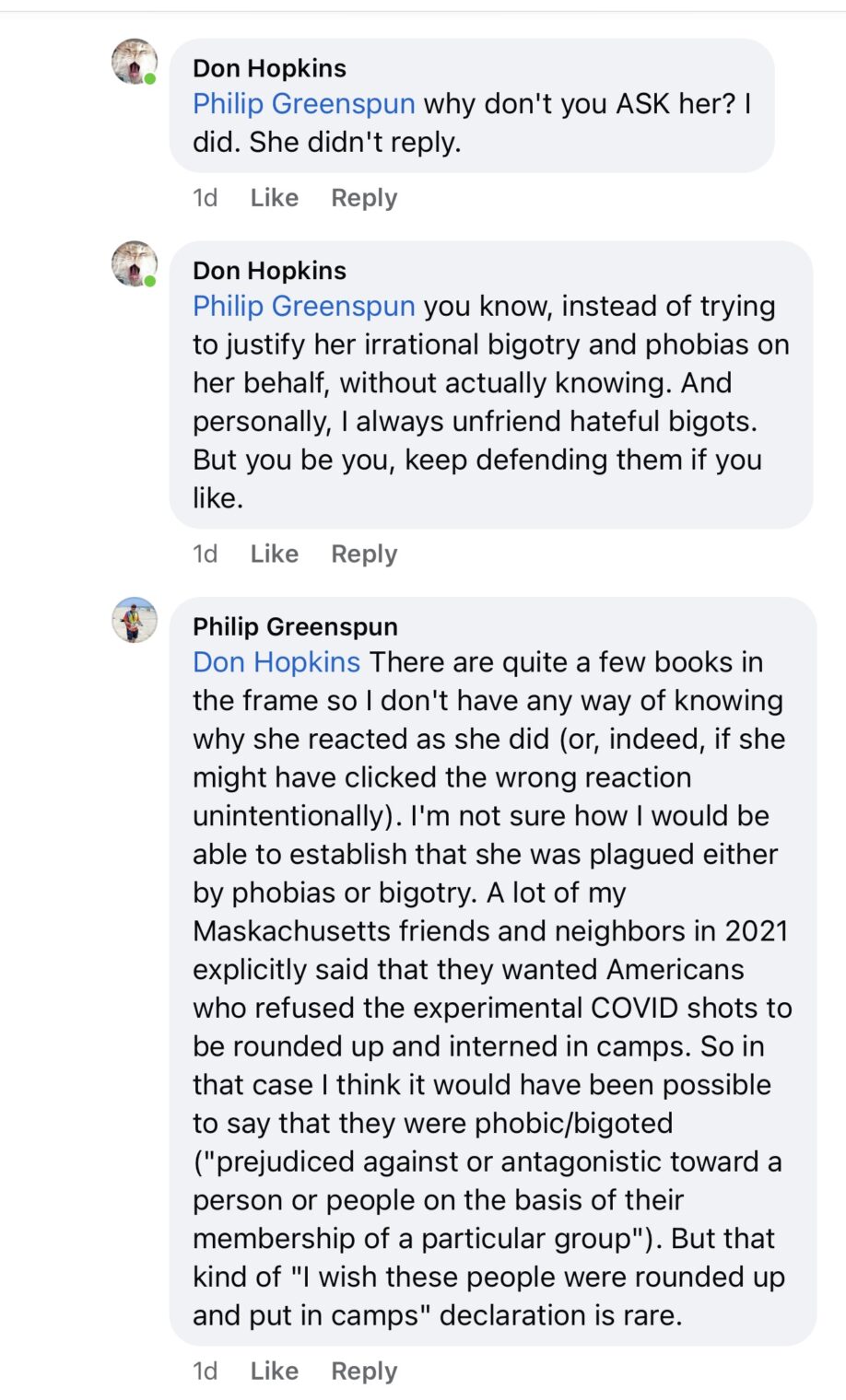

In other words, we always must circle back to Queers for Palestine.

Full post, including comments