In recent conversations with Democrats in California, New York, D.C., and Maskachusetts they’ve volunteered their feelings regarding the High IQ Party’s recent loss of power. I’ve also checked out their Facebook and X feeds.

Typical and eloquent: “What’s WRONG with Americans?” The poster owns a $2.1 million home in Berkeley, California, holds a taxpayer-funded job that requires a master’s degree, has a husband who earns money at a technical job, has a nonbinary child (1 out of 2, I think, so only a 50 percent rate of identification with the 2SLGBTQQIA+ community), and is passionate about cats and foster kittens. She will never compete with a low-skill migrant for a job nor an apartment for rent. I responded by pointing out that low-skill immigration is economically harmful to the working class, citing a Harvard study that is consistent with Econ 101 (albeit inconsistent with the Democrat Religion in which Our Lady of Open Borders performs miracles of raising wages and lowering rent every time a migrant walks across), and therefore another explanation was that some American voters are differently situated than she is. She and her friends doubled down on how the only reasonable explanation for a Republican vote was stupidity and/or immorality. I cited the example of my mother’s Haitian aide who voted for Trump. Did the white Berkeley Righteous want to say that there was something wrong with this Black immigrant? Answer: defriending. (Just like when my friend’s daughter asked the “male feminist” (button) social studies teacher in Lincoln, Maskachusetts why companies didn’t hire only women in order to earn higher profits after the teacher asserted that women do the same jobs as men for 80 percent of the salary. Answer: Detention!)

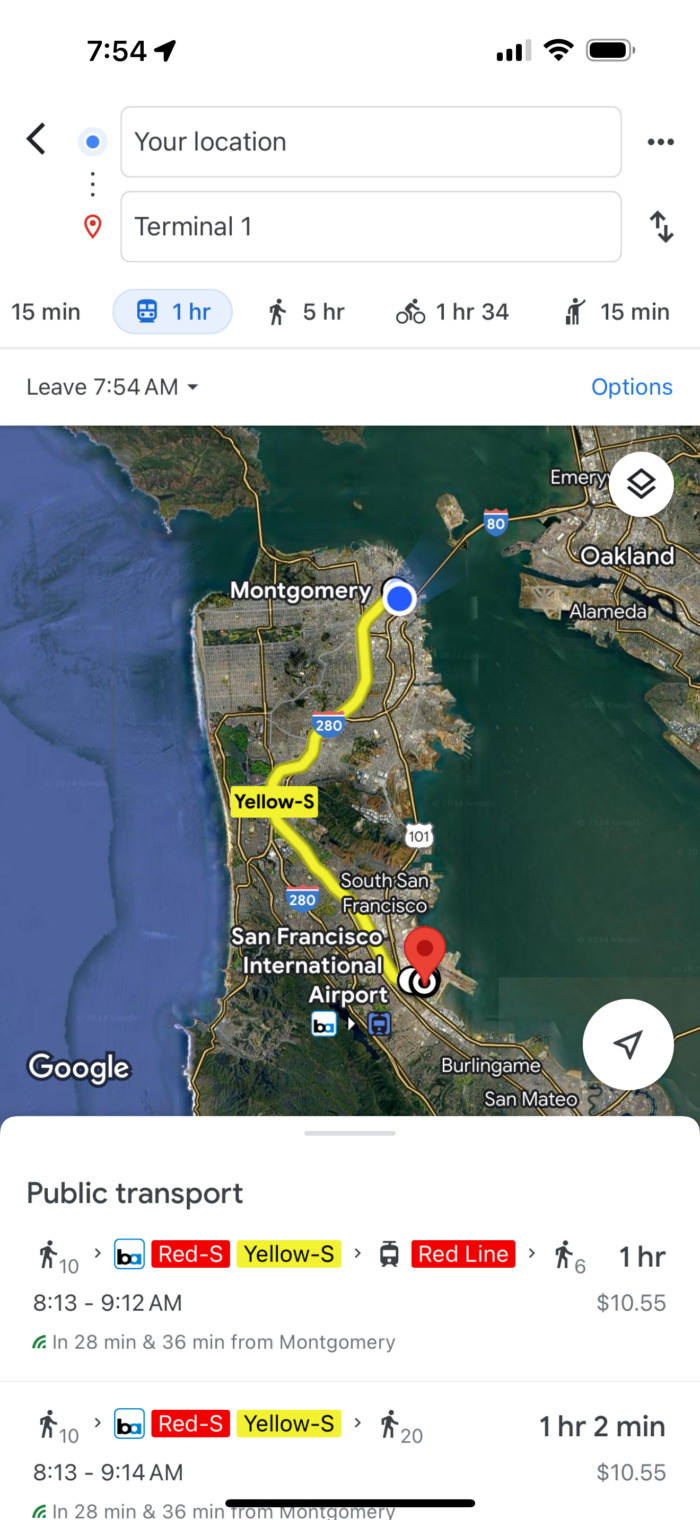

Part of a subsequent text-message exchange with a friend who was part of the Facebook conversation:

I think this is an example of how Democrats failed to understand that peasant Americans might be turning against them. Democrats live in bubbles where they almost never interact with anyone who disagrees with them or where disagreeing with the Democrat dogma is punished so severely that dissenters stay quiet.

If California ever finishes counting its ballots (slower pace than Ron DeSantis restoring power after Hurricane Milton!) we will likely find that there are some Trump voters even in Berkeley. But they are never going to put out a lawn sign or mention their Love that Dare Not Speak its Name in casual conversation.

The result is an asymmetry. The working class understands [let’s call her Nina] and her point of view as a homeowner and holder of a job that requires an advanced degree that undocumented migrants and their descendants are unlikely to ever earn. But Nina will never understand the working class.

(This reminds me of what a wise gringa in Corcovado, Costa Rica said about parrots: “They understand our language, but we don’t understand theirs.”)

Here’s a typical Democrat on X highlighting “Why Does No One Understand the Real Reason Trump Won?” (Democrat-run The New Republic), which points out that a majority of Americans were apparently fooled by lies in “right-wing media”. As Democrats were not fooled, that makes non-Democrats… stupid.

My mom recently had lunch with a Radcliffe ’55 classmate. The 90-year-olds, both in poor health, talked about their fears of an impending Trump dictatorship. My mom’s friend heaped derision on the Americans who had voted “against their interests” for Trump. She expressed sorrow that would-be-Assassin #1 hadn’t killed Trump. I successfully refrained from pointing out that a change of government in D.C. isn’t the biggest risk faced by a typical 90-year-old.

It’s interesting that that Democrats claim to be the Party of Empathy, a quality in which all Republicans are sorely lacking, and can’t put themselves in the shoes of a working class American for even a few seconds. On a recent Uber ride from Stuart, Florida back home the driver was an immigrant from Colombia who had voted for Trump in hopes that further low-skill immigration would be curtailed. Having never tried to make a living as an Uber driver, I don’t think any of my friends could fathom the man’s desire to not see the labor market flooded with new arrivals. Nor would they understand why he doesn’t want to pay higher taxes and/or receive fewer government services so that college graduates can fly to Europe instead of paying back their student loans.

Here’s a beautiful one. An election prophet says that his/her/zir/their prophecy of a Kamala-Tampon Tim victory did not come true because the electorate was irrational (i.e., stupid) and misled by misinformation/disinformation spread by Elon Musk.

Surveying X, we find the old reliable explanation for why not everyone supports Democrats:

(If a Trump dictatorship is all about misogyny that raises the question of why there wasn’t/isn’t more solidarity among the sisterhood. As in 2016, the Trump 2024 campaign manager identified as a woman (she’ll now be his Chief of Staff). A Representative who identifies as a woman just agreed to be Trump’s UN Ambassador. Why are people who identify as “women” helping Donald Trump against the interests of those who share their gender ID?)

Readers: What are you hearing from your Democrat friends? As noted above, mine are saying that they knew tens of millions Americans were stupid and easily fooled by Fox News and similar, but they made a mistake in underestimating the number of stupid Americans.

Full post, including comments