Cambridge City Council and “Israel’s current genocide in Gaza”

Harvard students were urged via mailing lists to vote (today) for three candidates with a link to a letter that they wrote:

We are heartbroken by the ongoing conflict in Palestine and Israel. We send our deepest condolences to everyone affected by this tragic situation.

We condemn all forms of violence unequivocally. That includes the recent attacks from Hamas and Israel, and the ongoing Israeli occupation and apartheid of Palestinians for the past 75 years. What we are witnessing in Gaza is an evolving humanitarian atrocity, and we remind all that collective punishment is a war crime. We do not support U.S. funding of Israel’s current genocide in Gaza.

We must come together as a community in Cambridge to protect and hold each other as the situation continues to escalate. We denounce all doxxing, intimidation, hate speech and silencing of individuals in our city. We specifically call on Harvard University to protect its students from racist attacks and threats.

We urge everyone in our community to spread love, not hate, to treat each other with empathy and support, to acknowledge all the suffering that is happening overseas and locally and to lean on our shared humanity and desire for peace. We must all do what we can to alter the course of history toward peace, justice and freedom for Palestine.

Quinton Zondervan, Ayah Al-Zubi, Vernon K. Walker and Dan Totten

(Hamas did some bad stuff on one day; Israel has been doing bad stuff for 75 years.)

As I noted in Why won’t the people who say that Israel is committing genocide go to Gaza and fight?, it remains a mystery to me why people who have identified an ongoing “genocide” advocate doing almost nothing about it. Do these progressives propose sending in the lavishly funded U.S. military to stop the genocide? Do they say that they’re going to leave their comfortable Cambridge homes ($1,000/square foot or, if one refrains from working and gets through the waiting list, $0/sf in public housing) and go to Gaza to help the Islamic Resistance Movement (“Hamas”) and Palestinian Islamic Jihad stop the genocide? Do they demand war crime trials at the Hague for Israelis? Do they demand the expulsion of Israelis, the perpetrators of this genocide, from the U.S.? No, no, no, and no. The Righteous of Cambridge (TM) suggest a slight reduction in Israel’s financial resources.

Let’s meet the candidates for election…

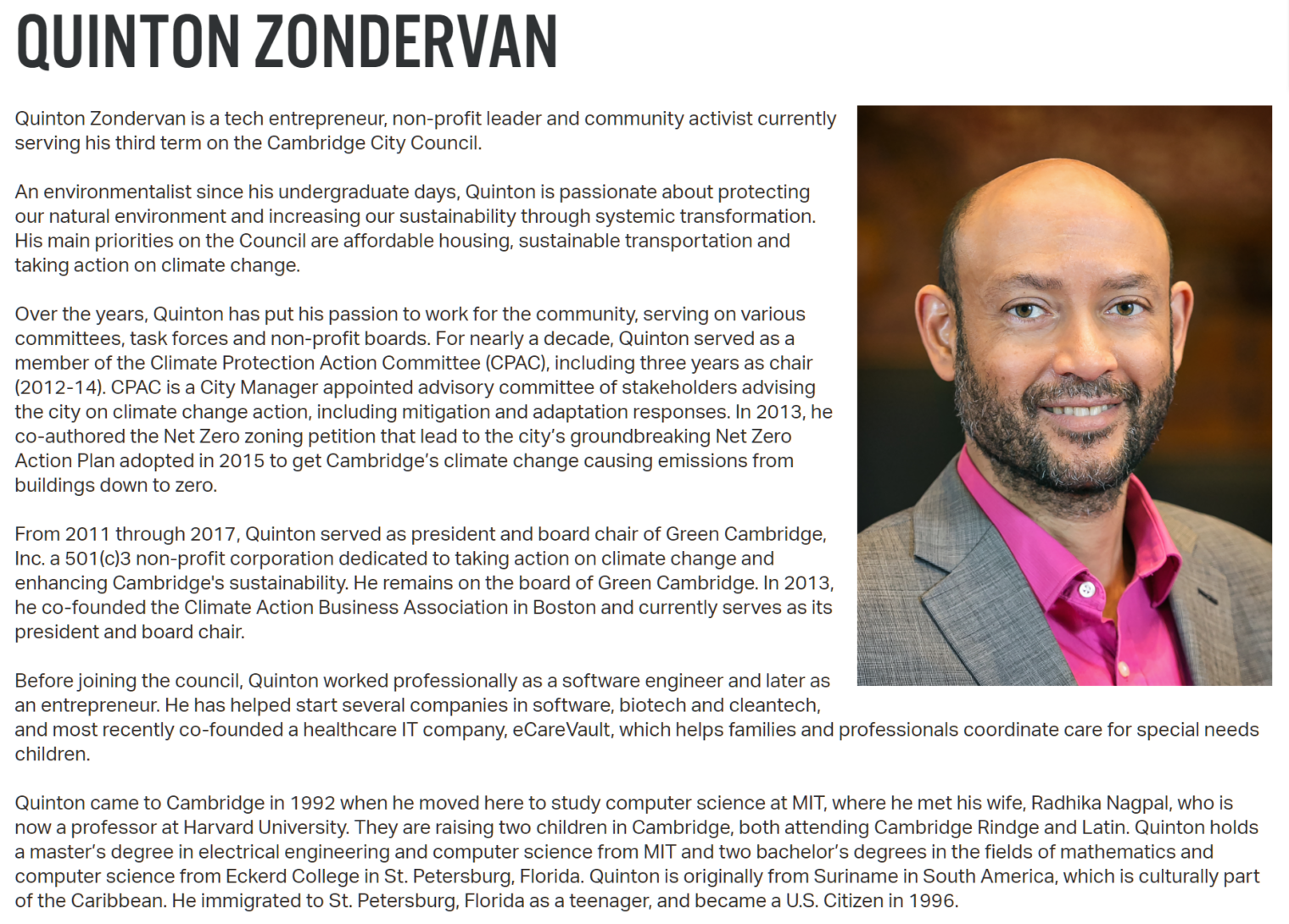

Mr. Zondervan is an incumbent who isn’t running for reelection, but is hoping to pass the torch to these three new candidates. Quinton is an MIT graduate (he and his now-wife were on our floor in the old CS lab) and immigrant from Suriname:

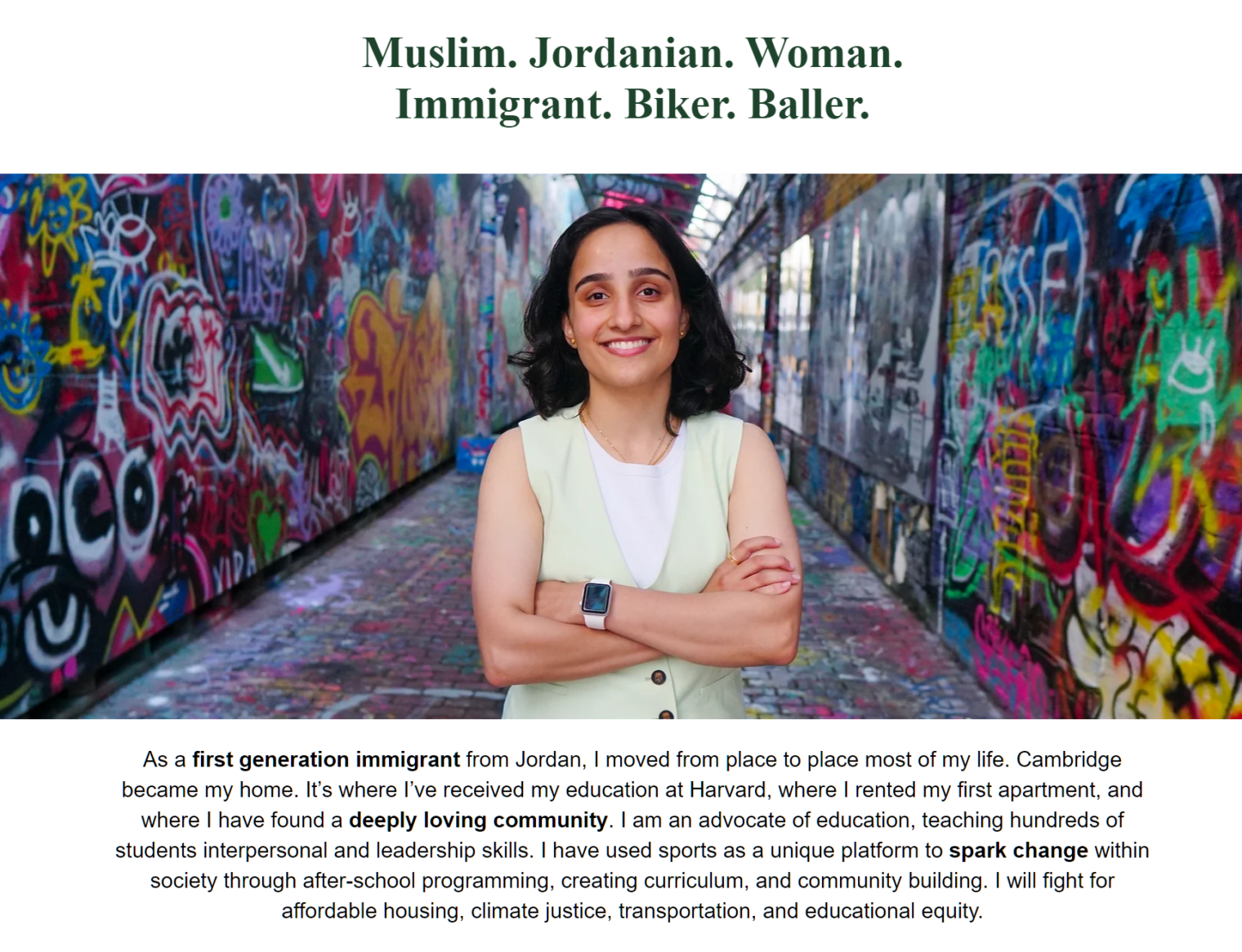

Ayah Al-Zubi is a Harvard graduate in sociology and psychology who immigrated from Jordan:

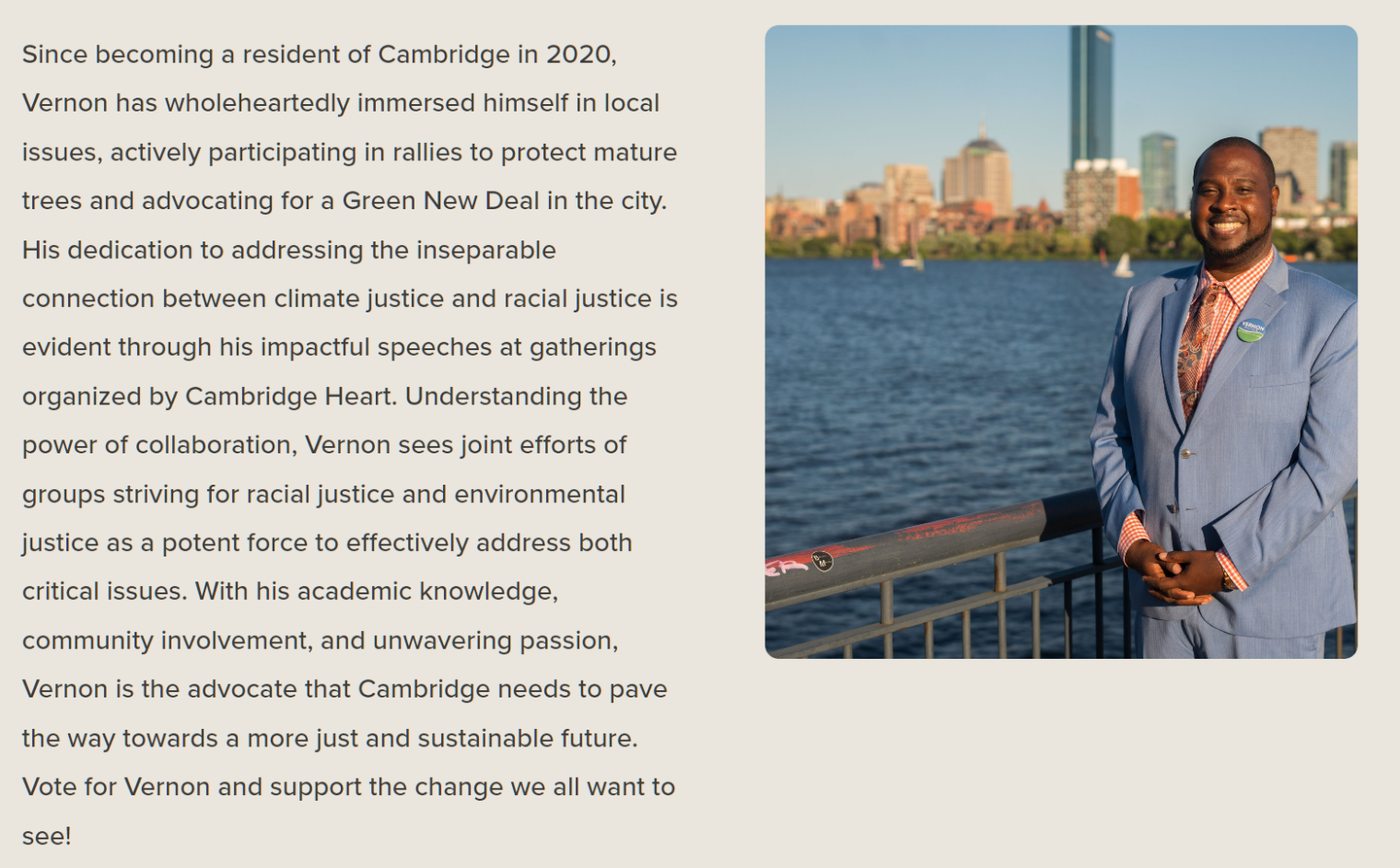

Vernon Walker works on “the inseparable connection between climate justice and racial justice”:

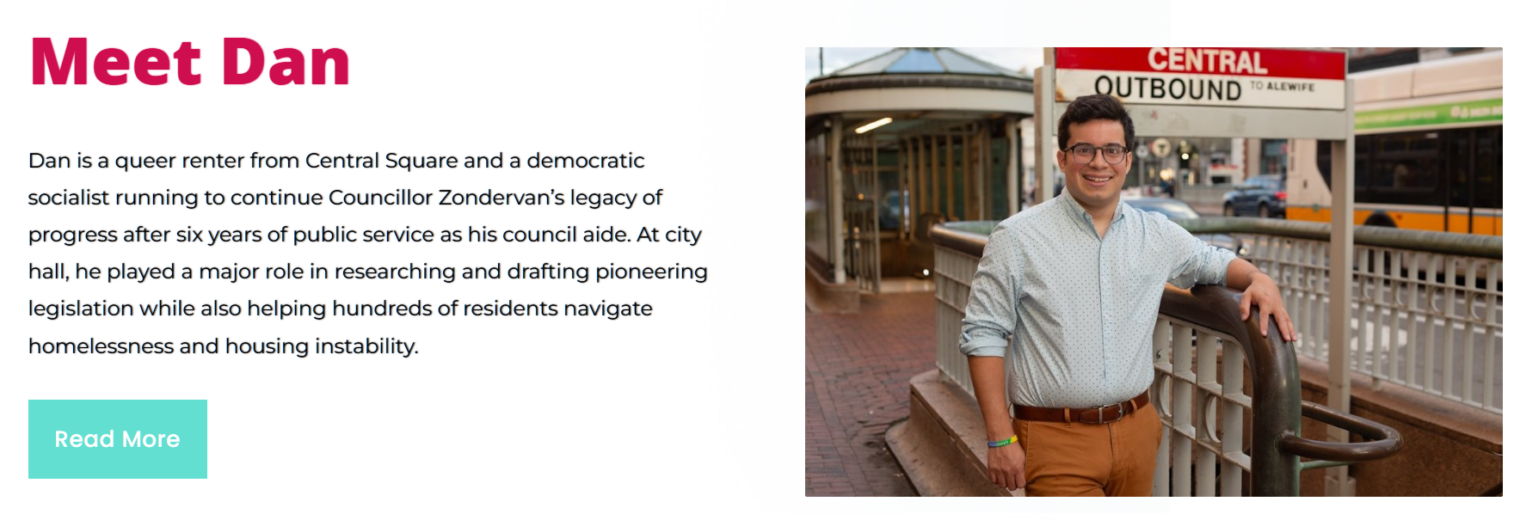

Dan Totten is “a queer renter from Central Square and a democratic socialist”:

They’re all apparently content to be idle bystanders to an ongoing genocide so long as they think they aren’t directly funding it. Let’s see how these milquetoasts do in today’s election, which might be decided by people who can’t read English. Here are the language options from the city :

Update: The people have spoken (in at least 8 languages). None of the above candidates were successful (which means they’re all free to go to Gaza and help Hamas and Palestinian Islamic Jihad stop occupation, apartheid, and genocide). All of the incumbents were reelected, including Mayor Sumbul Siddiqui (“the first Muslim mayor in Massachusetts”). Two insiders were elected, one a former councilor and one a school committee member. One outsider won, a bike lane advocate (of course, Cambridge does it in a mostly unsafe manner compared to Denmark).

Full post, including comments