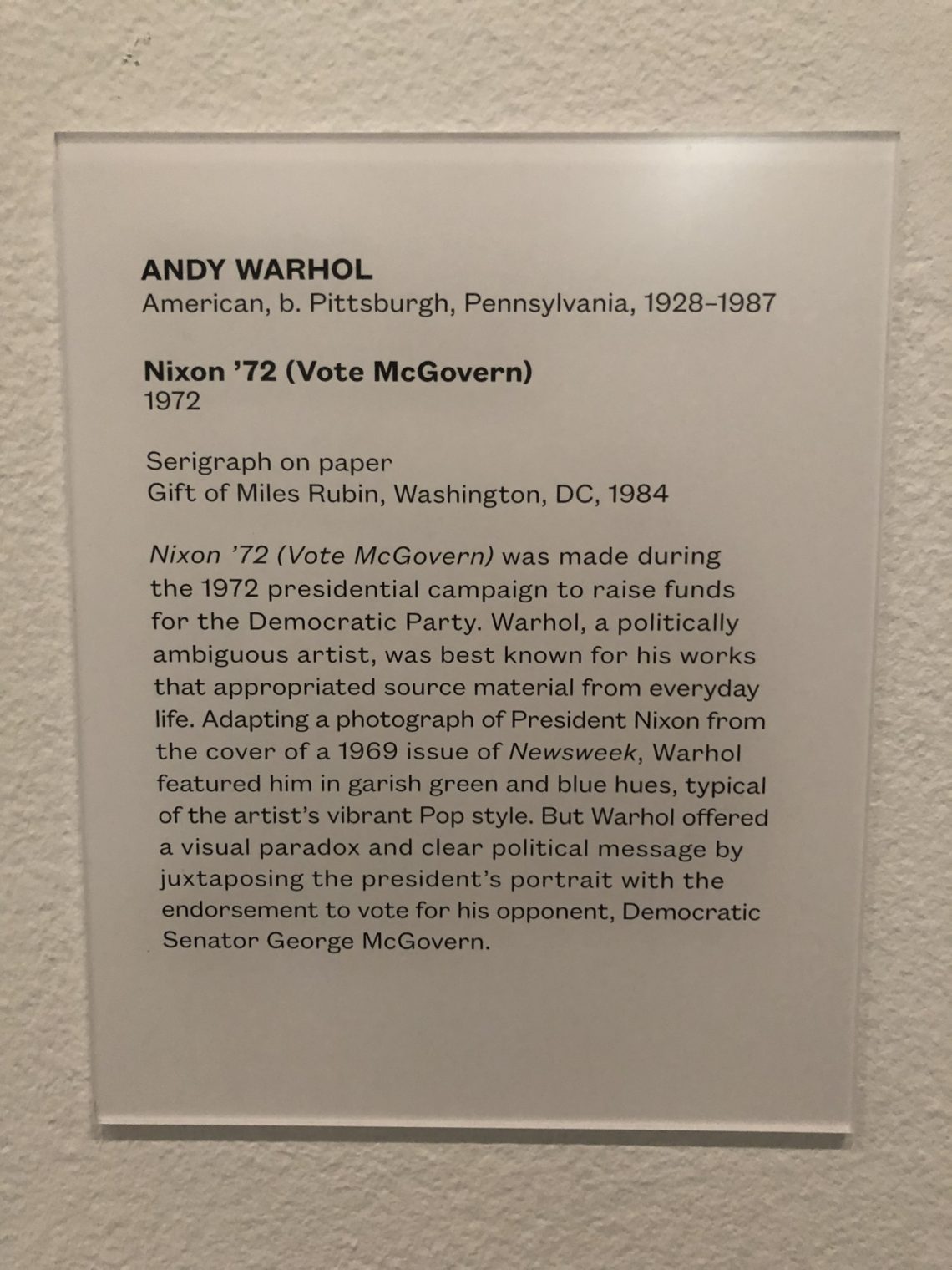

Complete glass cockpit in one retrofit instrument

Here’s something that one would have thought would have been built about 15 years ago: a complete glass cockpit that fits into a legacy instrument panel 3″ hole. The uAvionix AV-30: it can be an attitude indicator, an HSI, a G meter, angle-of-attack indicator (“AoA is calculated by comparing the aircraft’s pitch, flight path, and G-loading”), etc. It even has a built-in battery that will run for 2 hours after the aircraft’s electrical system fails. All for about $2,000 for a certified aircraft.

Thought: if the Boeing 737 MAX had used this device, which tries to determine AOA via inference, instead of the (failure-prone) mechanical AOA sensors that it did use, nobody would have been killed by the airplane.

Related:

- the same company has a retrofit wingtip-mounted ADS-B OUT transponder and a new one that will work on the 1090 MHz frequency required for Canada