How are Brazilians doing now that they’ve eliminated the biggest threat to their democracy?

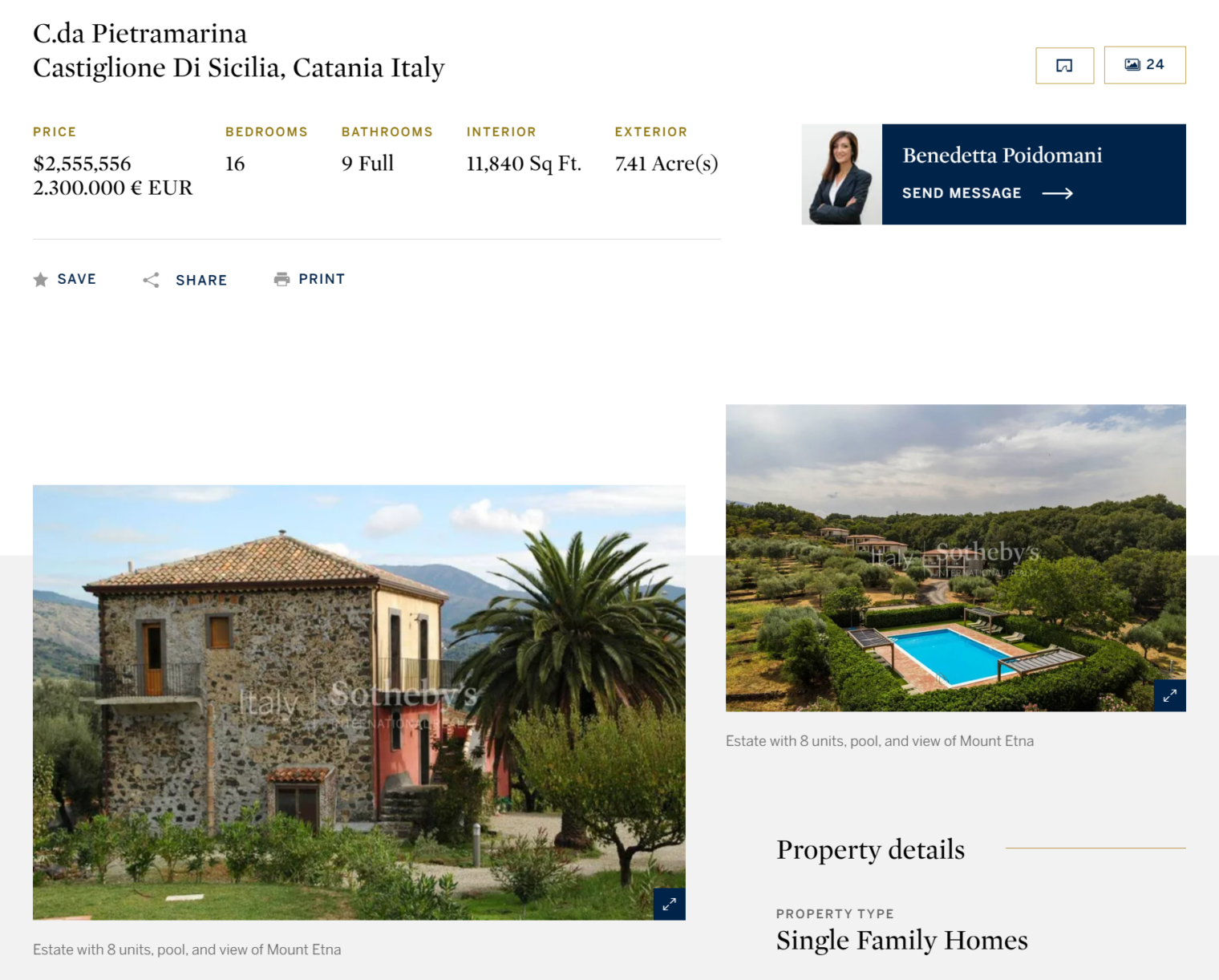

Here’s Jair Bolsonaro, characterized by media elites as “far right”, “authoritarian”, and “a threat to democracy”, in 2023 (from “Exiled Bolsonaro lives it up in Florida as legal woes grow back home” (Guardian)):

The Brazilian masses responded to elite advice and voted to preserve their democracy (50.9:49.1), but the threat wasn’t completely extinguished. “The Big Lie Is Going Global. We Saw It in Brazil.” (New York Times, November 14, 2022), for example:

Donald Trump’s playbook of poisoning the polity with misinformation … is being exported and deployed beyond the United States and becoming a transnational threat to democracy.

Mr. Trump’s methods were energetically adopted in Brazil by his authoritarian, right-wing friend Jair Bolsonaro, who pushed misinformation during his presidency, seeded distrust in the electoral system for years and, eventually, tried to discredit the electoral process in Brazil after losing the presidential election to Luiz Inácio Lula da Silva last month.

It’s bad enough when a threat to democracy speaks and even worse when he/she/ze/they doesn’t speak:

For more than 44 hours after his electoral defeat, Mr. Bolsonaro maintained a dangerous silence

So long as the government does not control all media and social media, democracy is unsafe:

The attempts of Mr. Bolsonaro and his supporters to create uncertainty about Brazil’s future could be the new global norm as would-be autocrats are embracing the Big Lie as a legitimate political strategy.

NYT, today, “How Brazil’s Experiment Fighting Fake News Led to a Ban on X”:

To combat disinformation, Brazil gave one judge broad power to police the internet.

That justice, Alexandre de Moraes, has since carried out an aggressive campaign to clean up his country’s internet, forcing social networks to pull down thousands of posts, often giving them a deadline of just hours to comply.

It has been one of the most comprehensive — and, in some ways, most effective — efforts to combat the scourge of internet falsehoods.

When his online crackdown helped stifle far-right efforts to overturn Brazil’s election, academics and commentators wondered whether the nation had found a possible solution to one of the most vexing problems of modern democracy.

Then, on Friday, Justice Moraes blocked the social network X across Brazil because its owner, Elon Musk, had ignored his court orders to remove accounts. As part of the blackout order, the judge said internet users who tried to circumvent his measure in order to keep using X could be fined nearly $9,000 a day, or more than what the average Brazilian makes a year.

Justice Moraes has continued to use the threat to democracy as a justification for his actions. In his order on Friday, he said Mr. Musk’s refusal to comply with orders to suspend accounts “represents an extremely serious risk to the municipal elections in October” in Brazil.

How else are Brazilians being protected from threats to their democracy? The current government has the opposition leader more or less under house arrest: “Brazil’s Bolsonaro must hand in his passport for coup investigation” (state-sponsored NPR, February 2024). Brazil is on the right side of history, according to the best minds of Harvard, Columbia, and Berkeley: “Brazil president withdraws his ambassador to Israel after criticizing the war in Gaza” (state-sponsored PBS, May 2024; “Lula has been a frequent critic of Israel’s offensive in Gaza, which he compared to the Holocaust earlier this year.”). [Note that the “Holocaust” is being exacerbated by a population explosion.]

Some additional warnings that Brazilian voters heeded:

- “Brazil: Bolsonaro Threatens Democratic Rule” (Human Rights Watch, 2021): “Harasses Supreme Court, Signals He May Cancel Elections, Violates Free Speech“

- “International warnings grow over threat to democracy in Brazil” (Al-Jazeera)

- “Jair Bolsonaro lost in Brazil, but his threat to democracy remains” (University College London)