When will we feel safe enough to remove our coronapanic signs?

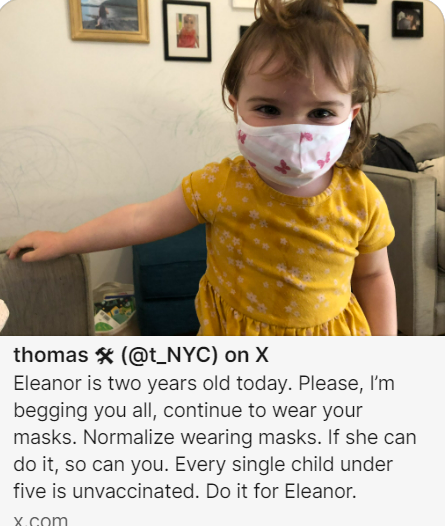

For those who are logically consistent, coronapanic hasn’t ended. This follower of Science in New York begged people to protect his 2-year-old from a disease that kills 82-year-olds (tweet deleted, sadly):

and then he repeated his plea just a few weeks ago in a now-deleted tweet. I admire people like this hero because SARS-CoV-2 is still with us, still mutating, and still killing humans. Anders Tegnell pointed out in February 2020 that the rational approach to COVID-19 was change your life in ways that you’d be willing to continue forever because, as with influenza, that’s how long SARS-CoV-2 would be with us. If a New York progressive masked his/her/zir/their 2-year-old in 2020, therefore, he/she/ze/they should still be masking 2-year-olds here in Year 5 of coronapanic.

Another New Yorker who has spent more than four years terrified of a respiratory virus but hasn’t taken the seemingly obvious self-help step of moving out of one of the world’s most crowded environments:

If he/she/ze/they doesn’t want to get sick, why isn’t he/she/ze/they living in a suburb, having groceries delivered by the Latinx essential workers, and Zooming into work? (note also the two people in the background who are afraid enough of SARS-CoV-2 to wear a 30-cent mask, but not afraid enough to refrain from riding the NYC subway system)

Here’s another example of critical thinking, this time from San Francisco:

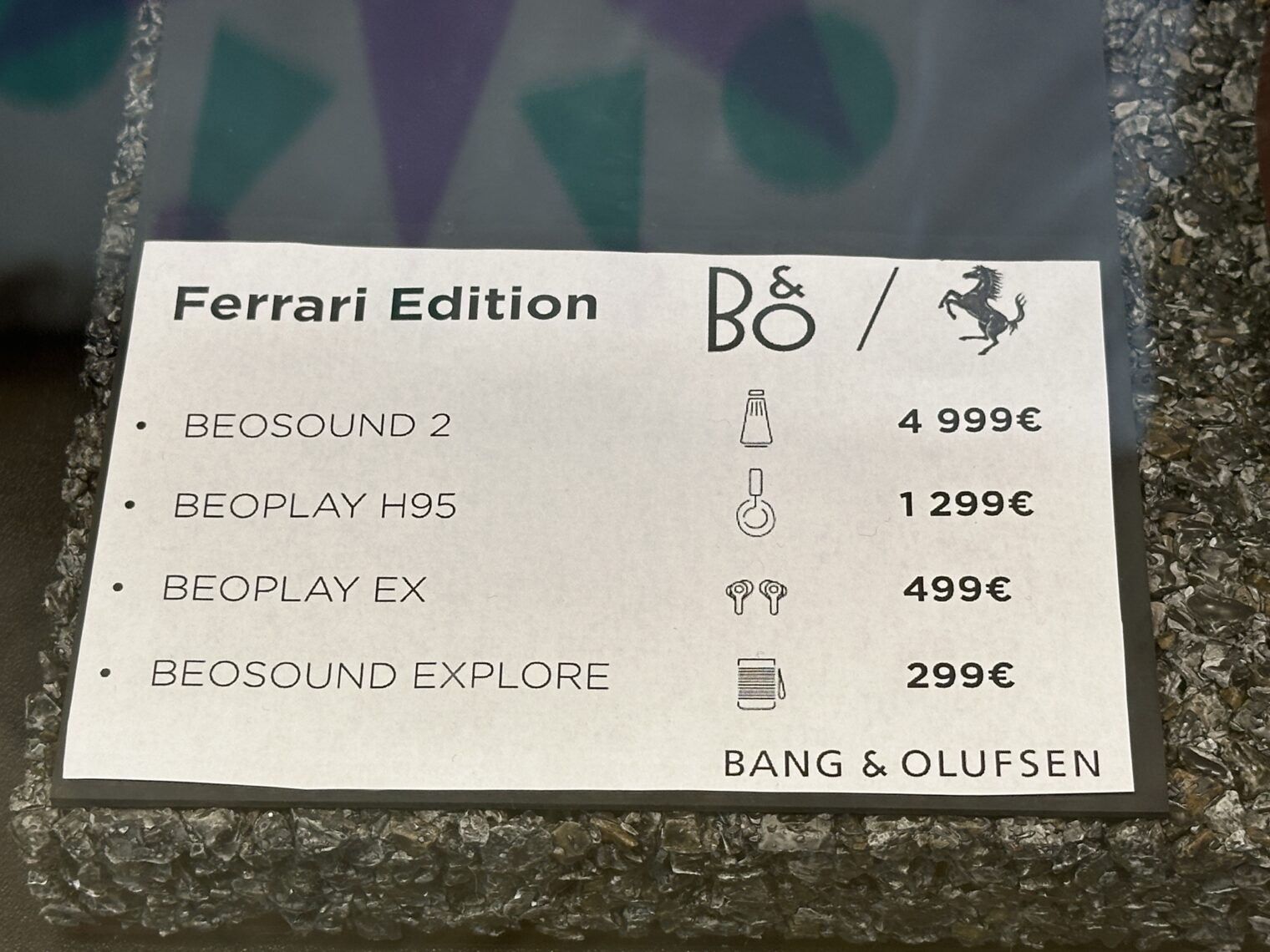

Most people, however, aren’t rational. Those who disinfected the grocery bags that Latinx essential workers dropped off at their suburban mansions switched to hosting sleepovers for their tweenagers just as soon as everyone had been stuck with what turned out to be a not-very-effective vaccine. Now that hardly anyone is continuing with the behaviors that Fauci promised would preserve them from COVID-19, when do the Faucism signs come down?

From my hotel in Fort Worth, Texas, May 2024, and an adjacent shop:

(The only rational approach to fighting a virus that kills the obese is to be careful in elevators while on the way to a donuts-and-alcohol breakfast.)

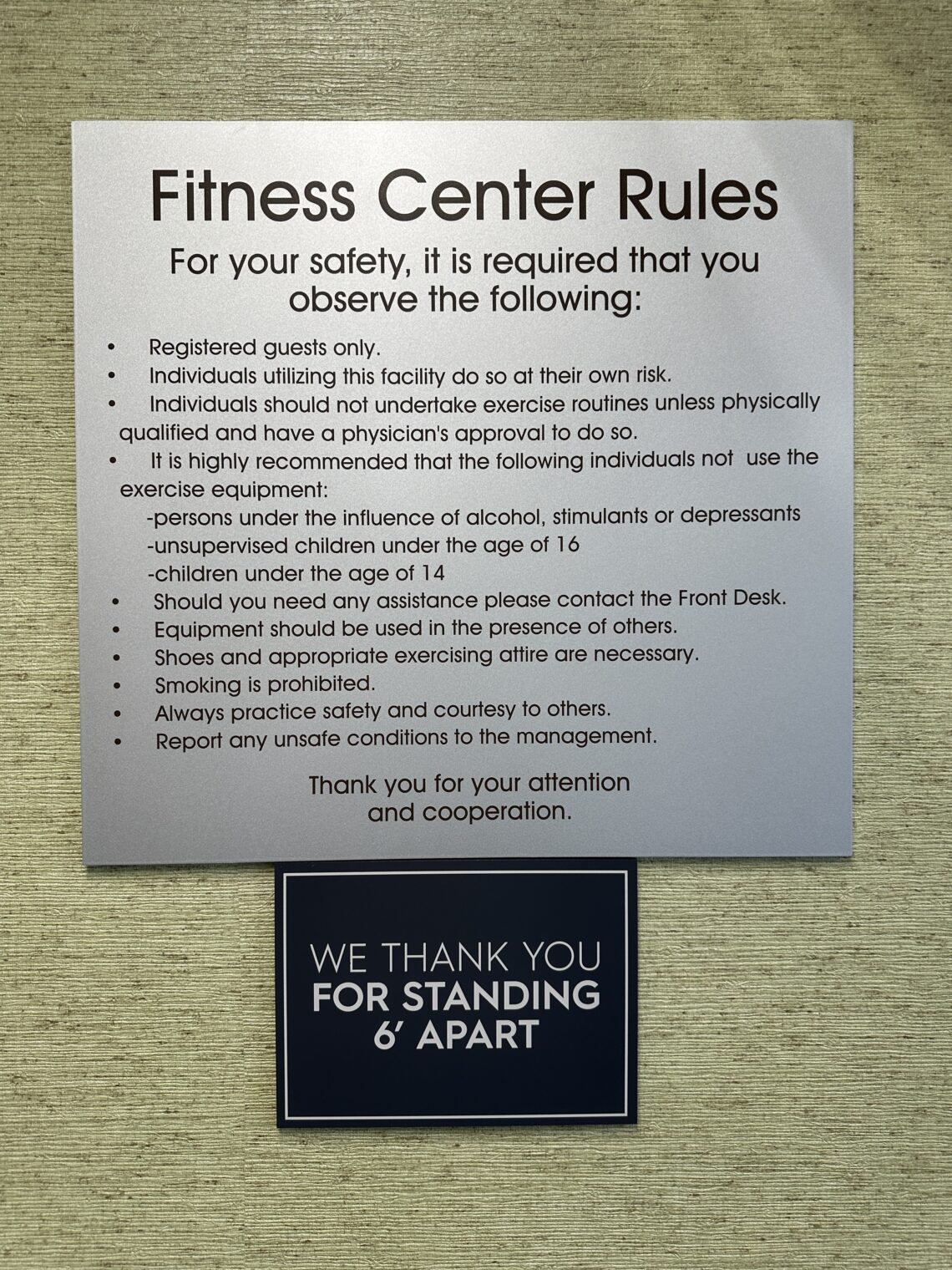

From a Marriott in El Paso, Texas, April 2024:

This seems to be an international phenomenon. Portugal went all-in on Faucism (mask orders, 100% vaccine coverage (NYT), etc.) and was rewarded with a 7 percent excess death rate (compare to 6 percent in do-almost-nothing Sweden).

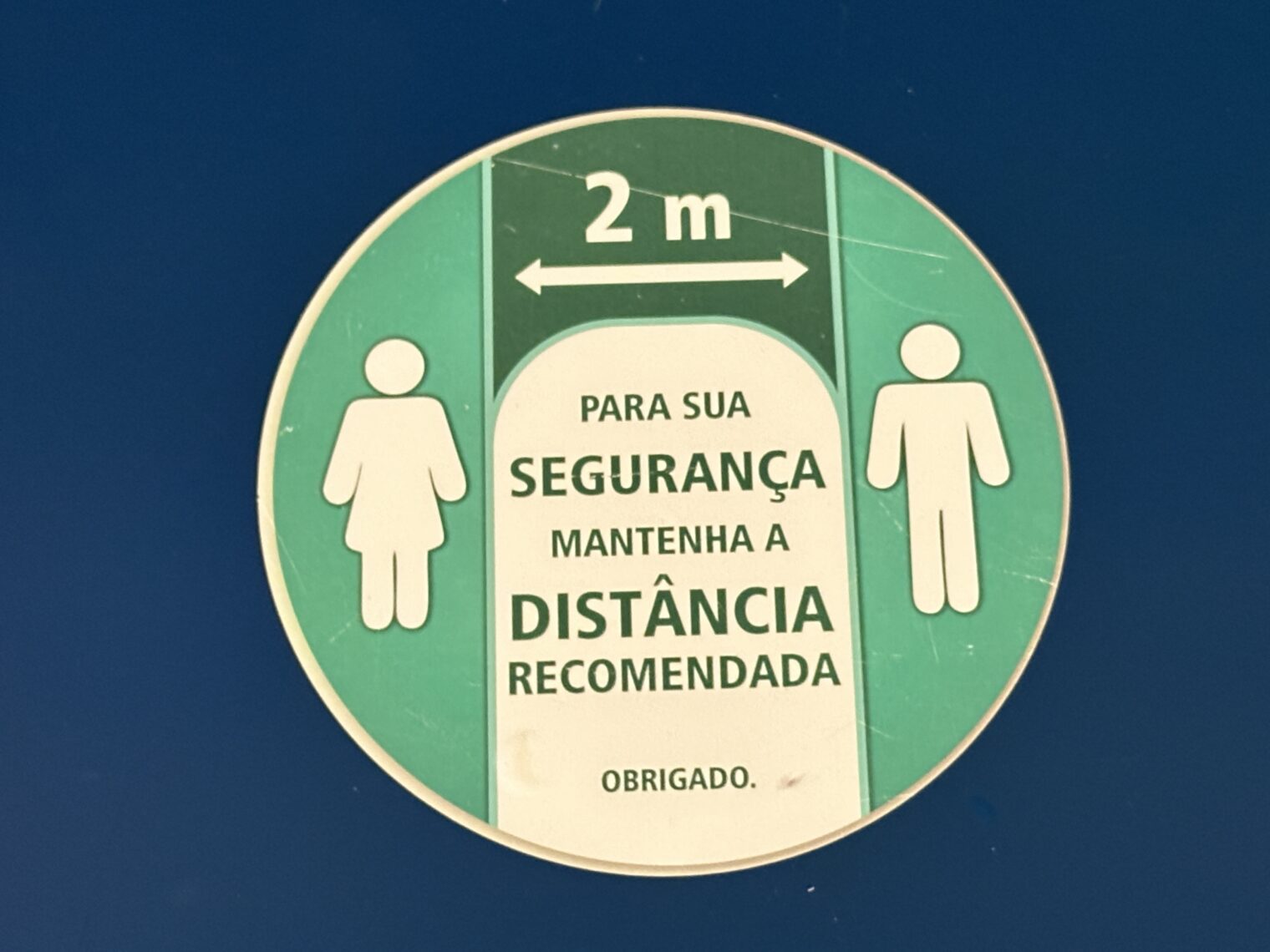

Heading into the rental car center at LIS to pick up the 2024 Mercedes plug-in hybrid diesel that would fail completely after 48 hours:

It was “mandatory” to wear a mask, but the customers crammed together in 45-minute lines (Line 1 to get paperwork and Line 2 to pick up the car; allow 1.5 hours total in the summer regardless of rental company) weren’t wearing masks and neither were any of the employees.

Here’s a hotel in Campo do Gerês, a small town in the mountains where I never saw anyone wear a mask:

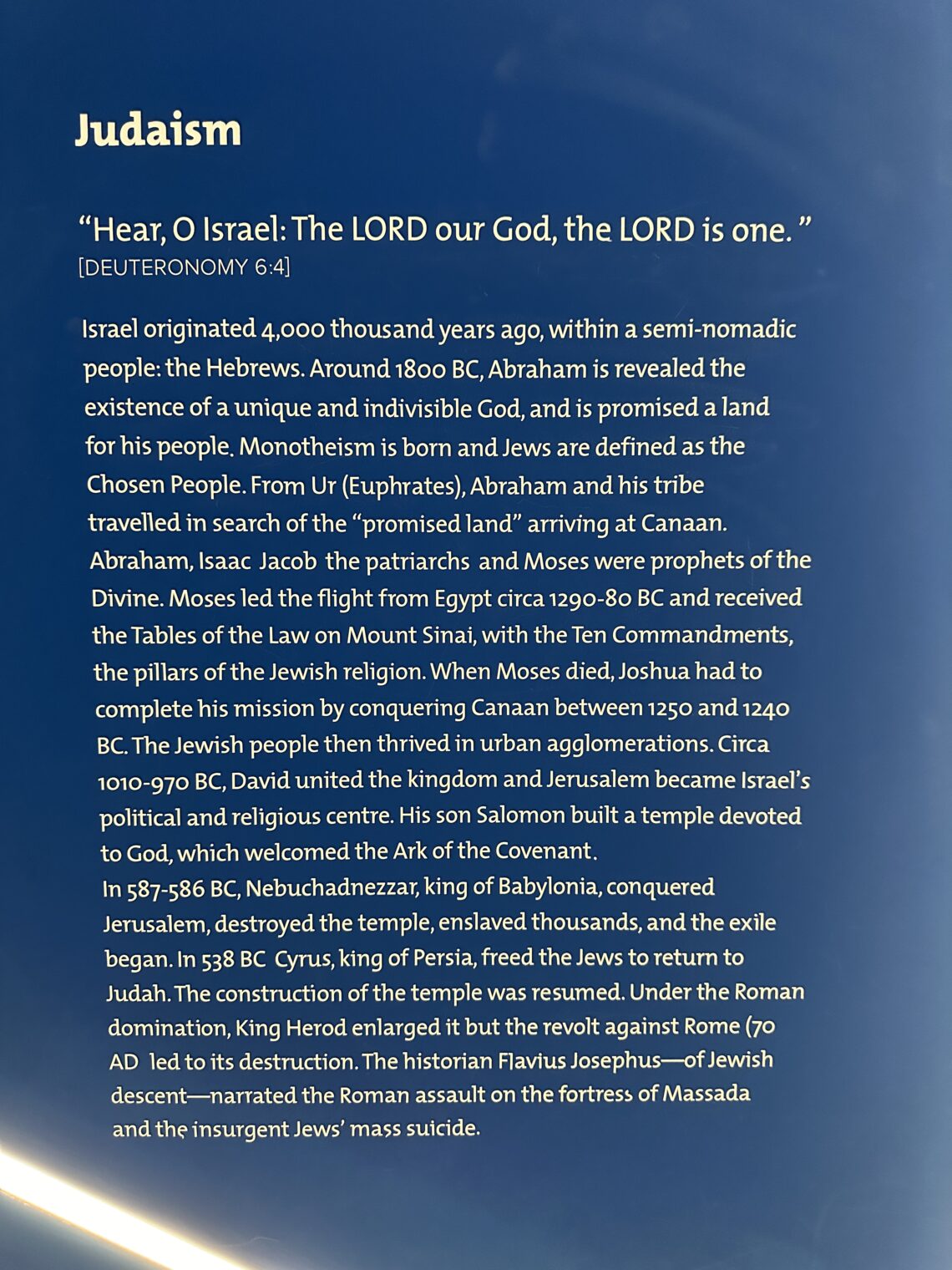

Here’s the Jewish Museum in Belmonte (wall and floor signs plus a remarkably succinct history of the Jews):

At a rich guy’s house-turned-museum in Lisbon, a sign celebrating “compliance”:

In Santiago de Compostela, Spain, cathedral museum:

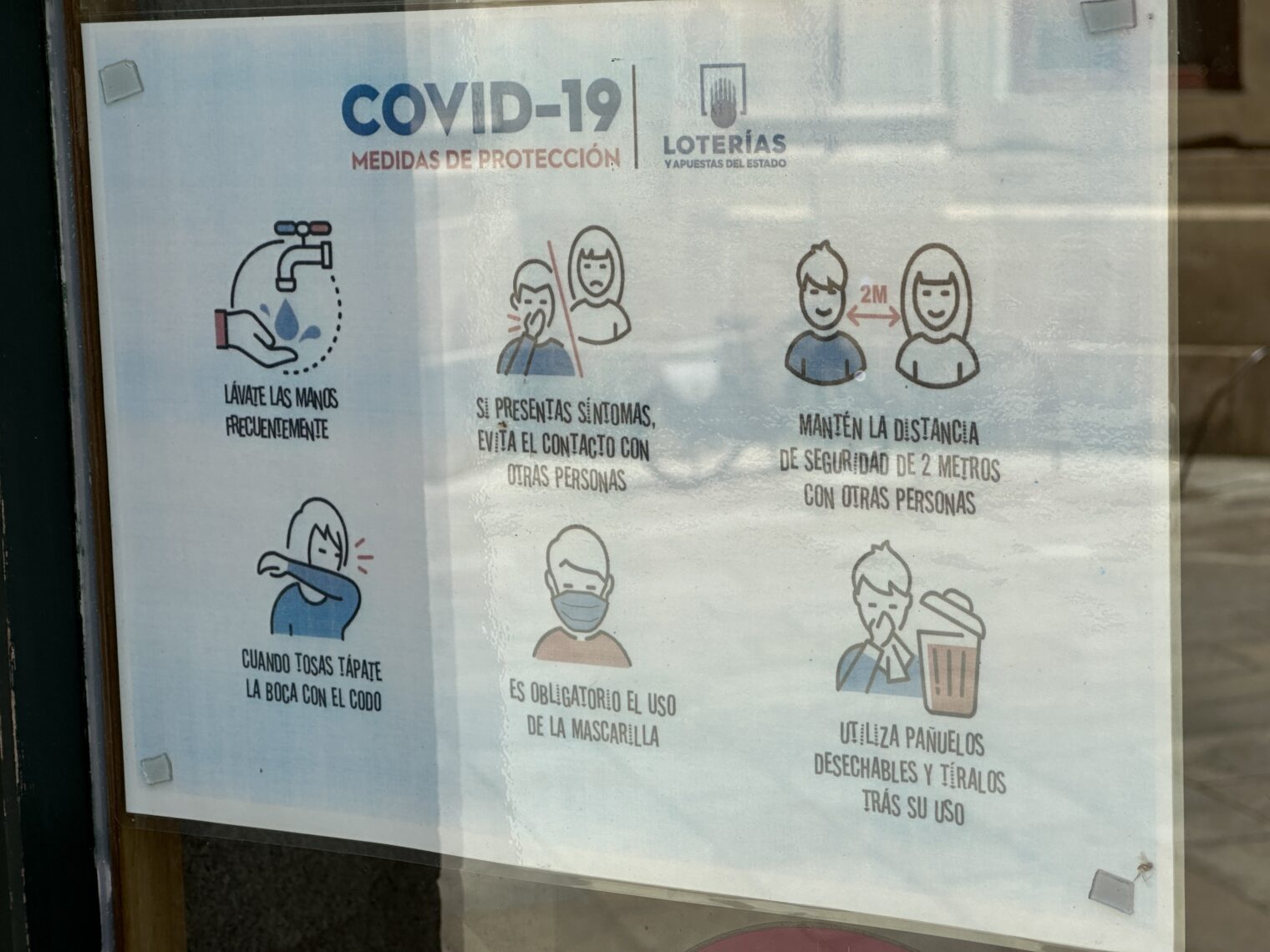

Also in Santiago de Compostela, Spain, a store selling lottery tickets posts on the front window what seems to be an official sign from the state lottery:

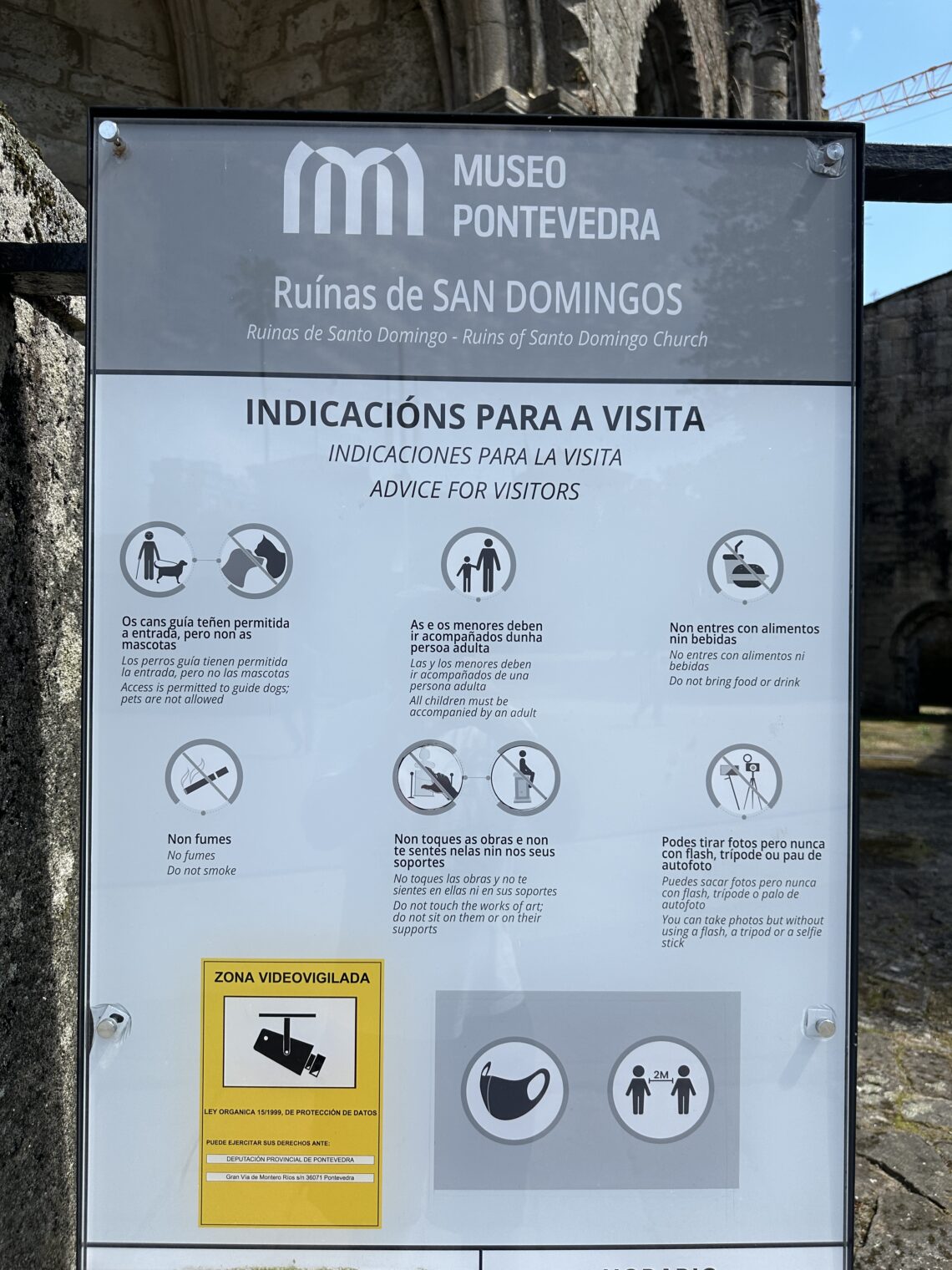

In Pontevedra, Spain, the famous church ruins tell visitors to wear a mask and stay 2 meters apart (note also that the church is ruined and has been replaced by what I think translates to “Galicia with Palestine”):

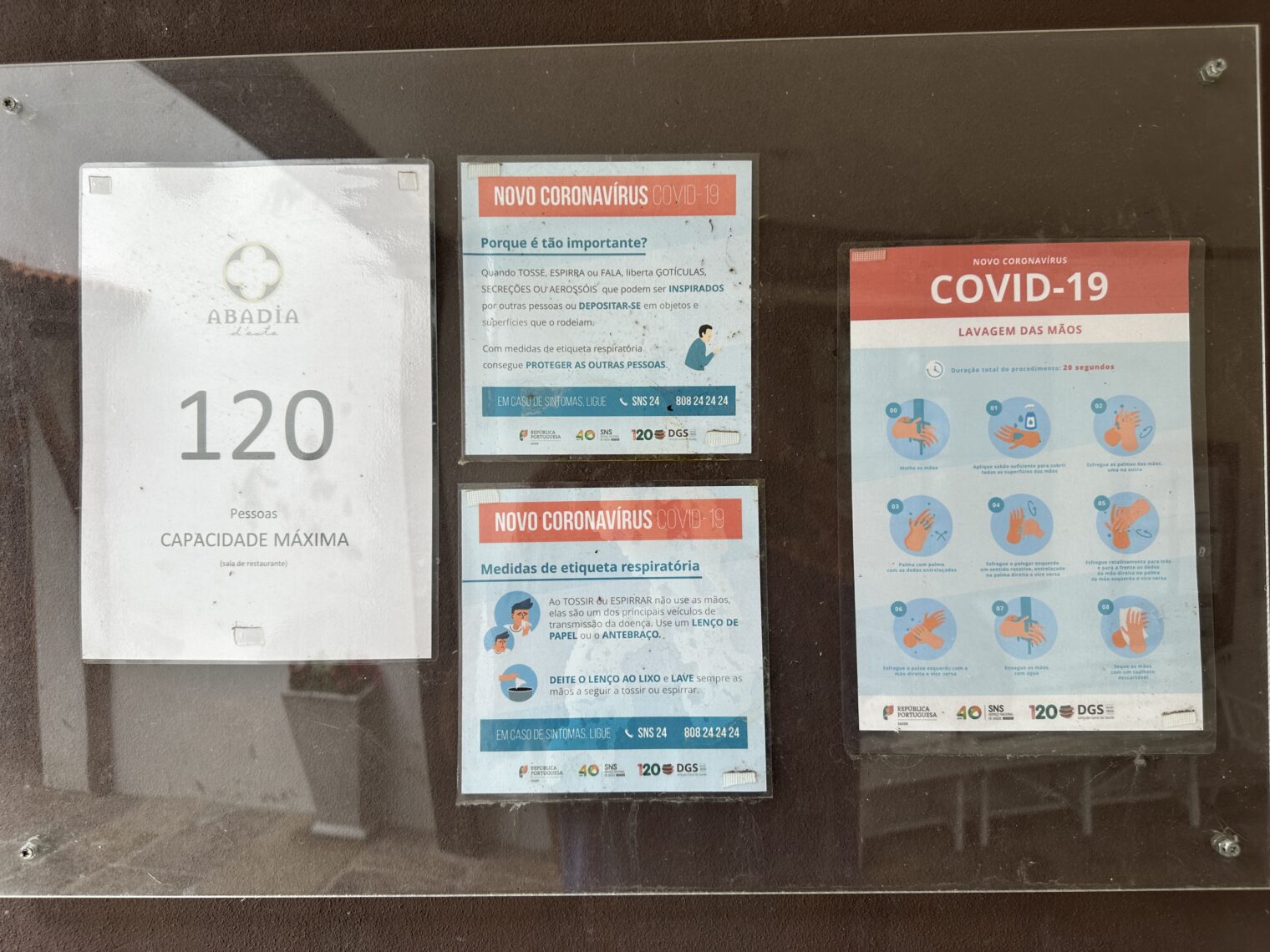

Back in Braga, Portugal, a hotel/restaurant warns customers about the “new” coronavirus:

On landing in Newark, New Jersey:

Are the signs being left up in case mask orders return? People will add Post-Its to the old signs reading “now we actually mean it”?

Related:

Full post, including comments