I was talking to an elderly Bay Area tech industry worker at a wedding in New York City recently (see Abortion care as a wedding gift?). He said that he has switched to thicker-soled shoes for commuting via BART due to the high density of used hypodermic needles and bodily fluids on the floor. Why doesn’t he move? “OpenAI is in San Francisco and that makes the city the center of the AI industry,” he responded. “Also, for a guy like me in his 20s I have a lot more credibility here as a startup founder than I would anywhere else.” (He’s in his late 20s, which is why I characterized him as “elderly” by Silicon Valley standards.)

I wonder if this will be what saves San Francisco from suffering a “doom loop” and becoming like Baltimore and Detroit. Yes, the folks who currently live in tents and those who live at taxpayer expense in public housing will never leave (why should they?). But the opportunity to get rich quick in the AI world could keep enough workers, and the taxes that they pay, in the city.

Where else is there a competitive concentration of AI startups?

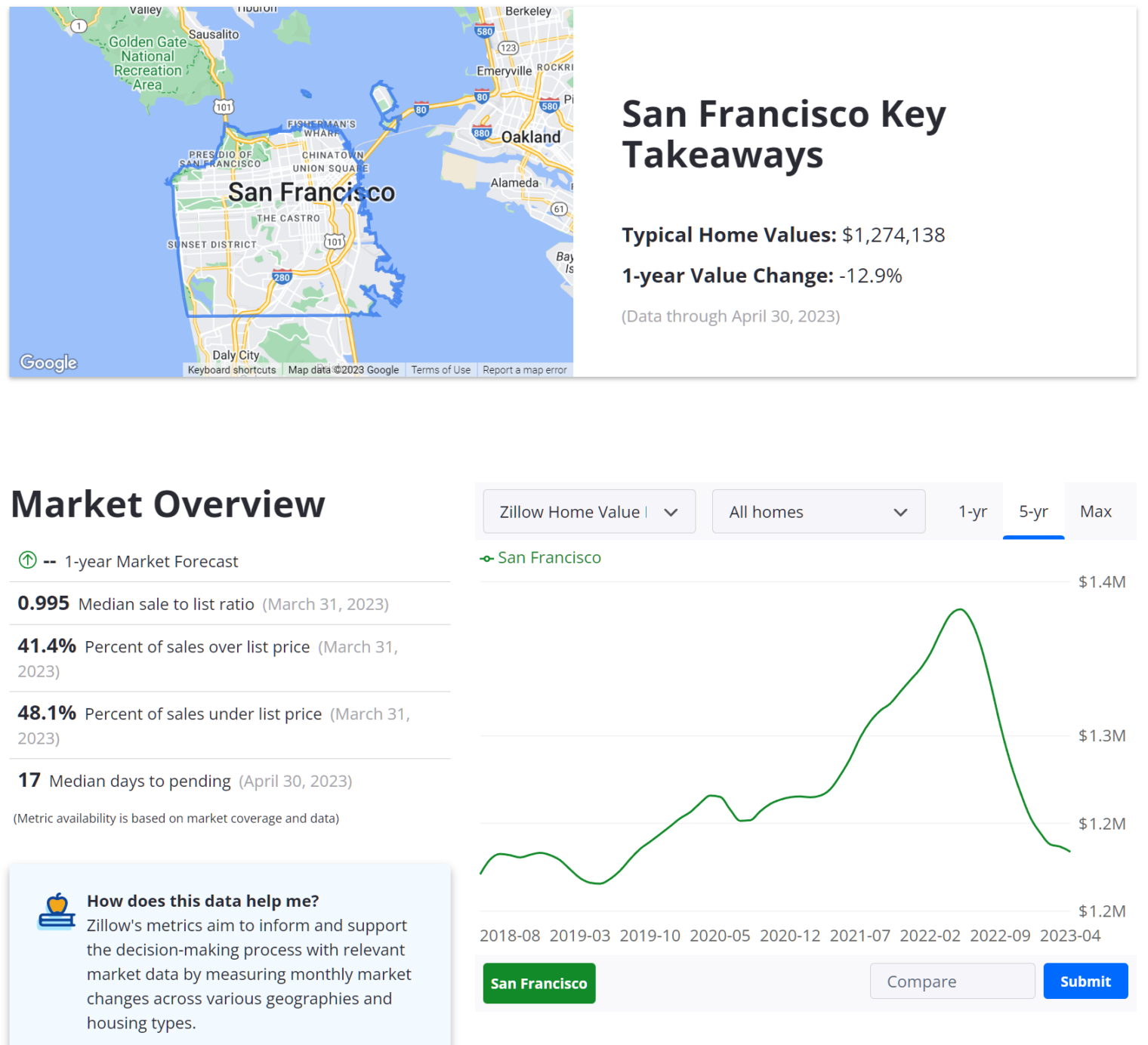

As a market enthusiast, I think we can get an estimate of the probability of San Francisco coming back, as NYC did from the 1970s nadir, by looking at residential real estate prices. Zillow says they’re down roughly 13 percent from a year ago. Adjusted for Bidenflation, therefore, they’re down 20 percent. But that only brings them back to something like pre-coronapanic values.

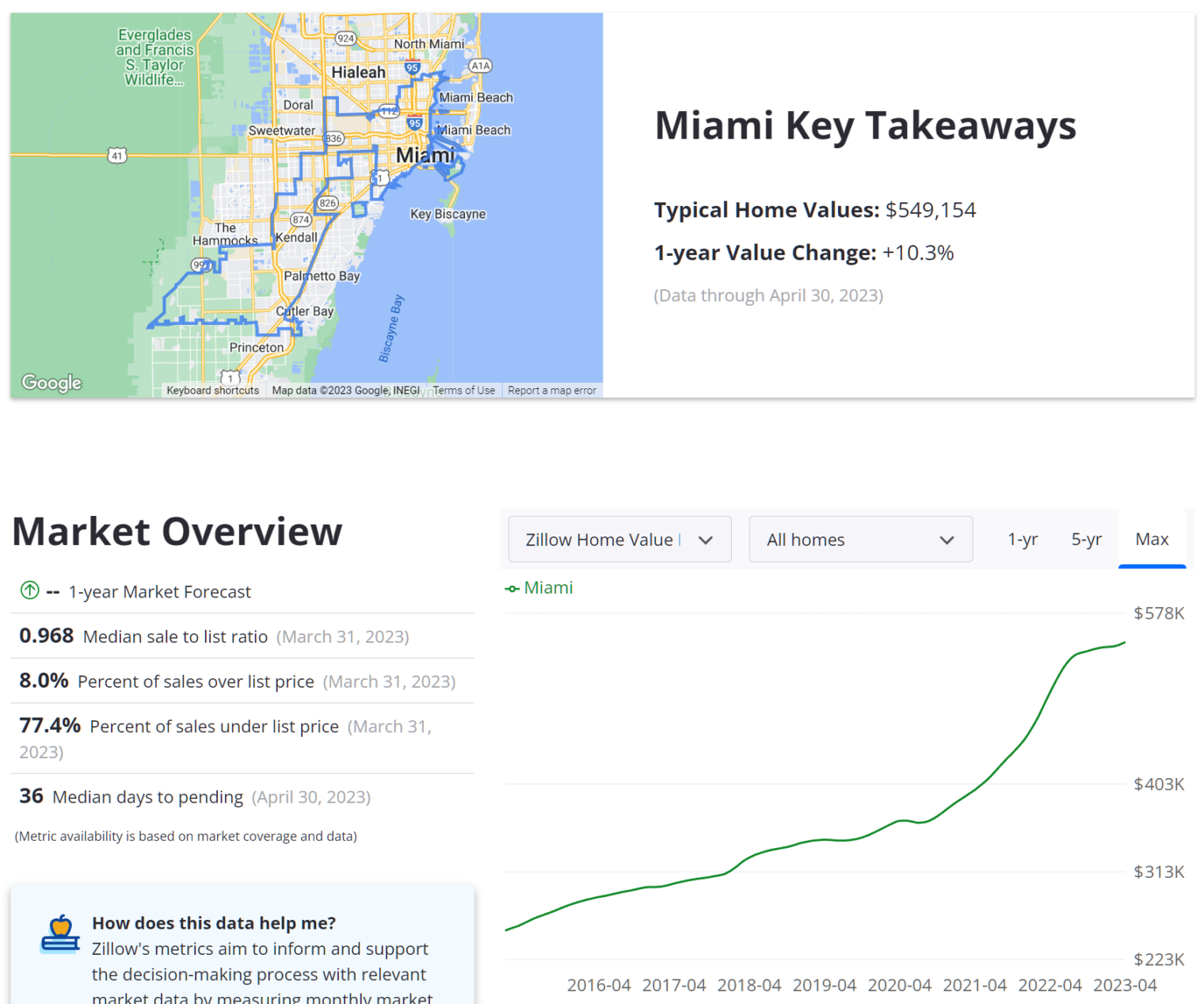

Let’s compare to Miami:

Owners can feel good about being 10 percent richer until they reflect that inflation in Florida has been far higher than 10 percent for almost everything!

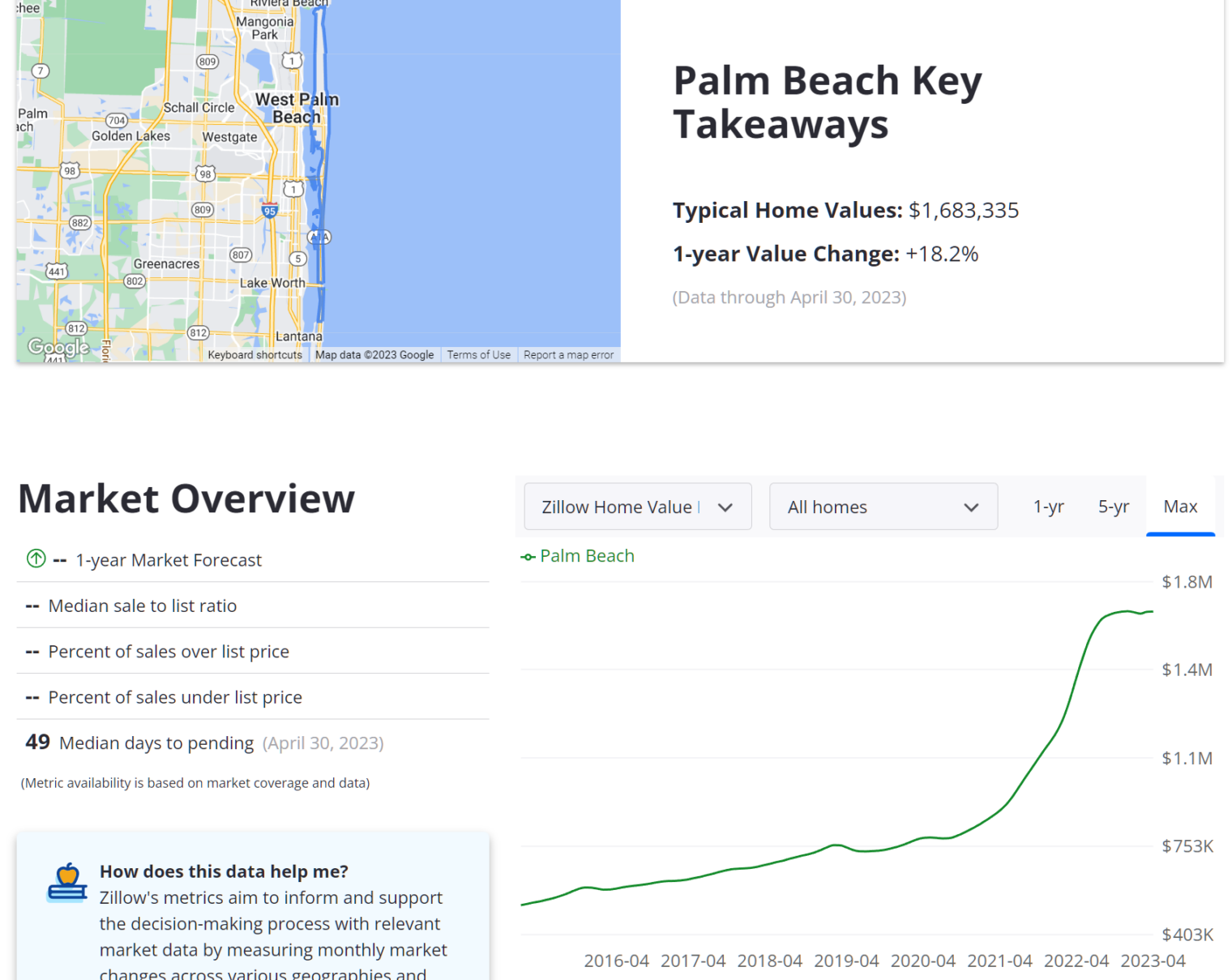

What about the rich? With a government by the elites and for the elites let’s hope that at least the rich can get richer. Here’s Palm Beach, up by 18 percent in fake dollars;

(The recent curve looks pretty darn flat to me, however, which means that it is trending down with Bidenflation.)

So… the real estate market suggests that San Francisco isn’t going to be quite as rich as previously expected, but it will still be an in-demand place to live. On the third hand, a friend who owns a three-story building in a tent-free neighborhood has been unable to find a tenant for a vacant apartment. He has a professional agent handling the listing and the asking price is set to what the agent says is the market price, but there have been no serious inquiries in months. One area of concern that my property-owning friend raises is that he believes commercial real estate pays the majority of property taxes in the city. With office building values coming down, the city will be starved of revenue and will have to try to find a way to get it from residential property owners. I’m not sure how his scenario plays out in the Proposition 13 world. Both commercial and residential property owners are paying tax based on whatever they paid for the building some years ago. The city’s property tax receipts, therefore, shouldn’t change much even if office building values fall by 70 percent because the typical owner bought in 10+ years ago at only a fraction of the 2020 value. Even with a dramatic collapse in value, there wouldn’t be that many buildings whose property tax payments would fall after a sale and valuation-for-tax-purposes reset.

Speaking of Proposition 13, I wonder if it explains the California elites’ fondness for deficit spending and the inevitable associated inflation. Peasant renters in California are subject to the market and, except in a few rent control paradises, fully exposed to the ravages of inflation. Elite property owners, however, cannot be taxed more than 1% of whatever they paid for a house, subject to an increase for inflation not to exceed 2% per year. Elite Californians, therefore, get a tax cut in every year that inflation exceeds 2%. Who will fund their services then? While professing to be progressive, they’ve hit their peasants with a regressive 10% sales tax (varies a bit by specific location).

(For comparison, in Deplorable Florida, with no personal income tax or estate tax and nobody professing to be a progressive, sales tax is just 6-7% (depending on county).)

Related:

- San Francisco happens to be one of the few rent control paradises in California. The economic planners allowed landlords to raise rents by 2.3% for March 2022-2023 and will allow 3.6% this year (rules). The ministers note that “A landlord must be licensed to increase rent” and “A landlord may increase a tenant’s rent by the allowed amount once a year provided they’ve obtained a current rent increase license by complying with the City’s Housing Inventory requirements.”

- “The Biggest South Florida Housing Boom Is Near the Rail Stations” (Wall Street Journal): “While mass transit systems throughout the U.S. are suffering from decreased business as more people work from home, Brightline reported a 68% increase in ridership in March of 2023, compared with the same month last year. … Property values near the [Miami Brightline] station were up 83% in price over that period, compared with a 38% median increase for the Miami area. … Rent has also increased at a higher rate near the Brightline train stops. In Fort Lauderdale, rental premiums are up most, 28% higher than the market average, according to Tina Tsyshevska, an analyst at Green Street.”

The drivers of real estate prices are complex. Some are easy to identify, economic opportunity, weather, taxes… Some are a bit more subtle (proximity of people who think like you or that you like). Those subtle drivers of prices are difficult to analyze, but very real. Why is aPicasso more expensive, for now, than a Biden?

Is the real estate boom in Florida driven by the local economy or is more comparable to the cases of Monaco or Marbella? Are the workers of Florida (GDP per capita way lower than California) more productive than the ones in California? Lots of wealthy educated people are moving to Florida, but my guess is that the corresponding rise in real estate prices is going be make the life of no so wealthy Floridians more difficult (as is the case in many other places), and it could be like other forms of inflation, “transitory.”

Someone who an predict real estate trends can make a lot of money.

“Florida folks, land of perpetual sunshine. Let’s get the auction started before we have a tornado.”

Groucho Marx

Tl;dr: immigration increases real estate prices.

One of the major reasons that a Picasso is more expensive than a Biden is the expectation that someone in the future will pay more for a Picasso than a Biden, i.e. the current value of a Biden is probably largely a function of its current notoriety and that the buyer may by purchasing a Biden also receive some influence with the Big Guy, factors that will probably disappear once the Big Guy vacates the White House. Real estate probably has a large expectation aspect to its valuation — so in a bull market the certainty that someone will pay more in the future. And prices tend to be sticky because residential property is typically owned by amateurs so the reluctance to sell for less than what was paid – the sunk cost fallacy.

Phil- while in Montana check out Butte if you have never been there. It reached its apogee around 100 years ago. You could probably now buy whole city blocks there for what you are carrying in your wallet — though as we know, real estate can only go up because they are not making any more. Check out the acres of abandoned company homes for miners. Check out the grand hotel in the center and imagine what a glamorous place it must have been when the high rolling miners were looking for a good time on Saturday night. The hotel and most of the town is now basically deserted, probably more bars than residents, though the hotel still has a desk clerk and they exhibit menus from the good old days. There is a large used book store in town that makes its money by selling on line while probably paying close to zero in rent.

Pretty sure ruby on rails is going to save San Francisco. The future is ruby on rails!

Yes! And the iPod will save Chicago!

hmmm – ruby: japanese guy, rails: danish guy, ror: chicago product .

Can ChatGPT save San Francisco? No.

“Peasant renters in California are subject to the market and, except in a few rent control paradises, fully exposed to the ravages of inflation.” This is fake news. California now has statewide rent control. https://bungalow.com/articles/californias-rent-control-law-explained

TS: Interesting. I had no idea that the miracle of central planning had been extended to all of the 15-year-old-and-older buildings in the Great State. “AB 1482 restricts the allowable annual rent increase to 5% plus a local cost-of-living adjustment of no more than 5%, for a maximum increase of 10%.” is kind of ironic. This law went into effect in 2020, just in time for raging inflation well beyond the arbitrary 5% limit. They envisioned all possible futures except the one that actually transpired just a year later.

Rent control is the right thing to do, because housing, per the liberals, is a “human right”. But why stop at housing? Food is a human right, and so is healthcare, education, vacation, xBox, 80″ TV, Netflex, cell phone, cannabis, sex change, etc. Why isn’t the prices of those other “human rights” items being controlled like rent? We would not have inflation if our government did its job and everyone would be happy, no? Let’s see now, when and where was this tried? Right, USSR and Americas were against it, but now liberals want more government control. Go figure.

Phil, the 5% + inflation will be reduced to a hard cap of 3% very soon.

TS: My dream is that one day people will be in 2BR apartments in California for a monthly rent that is less than the cost of a Diet Coke.

With price controls on 2 bedroom apartments and none on diet coke that is the only logical conclusion.

George A. was most recently tried in Zimbabwe and didn’t work! https://www.reuters.com/article/us-zimbabwe-prices/zimbabwe-price-crackdown-moves-to-mugabe-heartland-idUSL1287321920070712

We are told that “AI” will replace programmers. If that happens, shouldn’t there be more homeless people in SF?

But they still can scan their eyeballs in exchange for some “worldcoin”, which is Altman’s other startup.

ChatGPT has apparently already learned to lie:

https://www.techspot.com/news/98860-chatgpt-found-guilty-fabricating-cases-citations-manhattan-lawyer.html

It should therefore continue to be useful to attorneys.