Clubhouse is a greenfield for whitesplaining

In the department of what’s old is new and what’s new is old, I’ve used Clubhouse a bit more. It is hard to explain how it is different from old-school talk radio other than not being limited by spectrum and therefore able to handle an infinite number of channels. However, the same could be said about Zello, an app from 2007 that supports public channels. Clubhouse has a Follow button so it is easy to get into the same channel as your friends. Maybe Zello never had that?

Here’s a conversation that I couldn’t resist joining (as an audience member), “Black Voices for Trump 2024”:

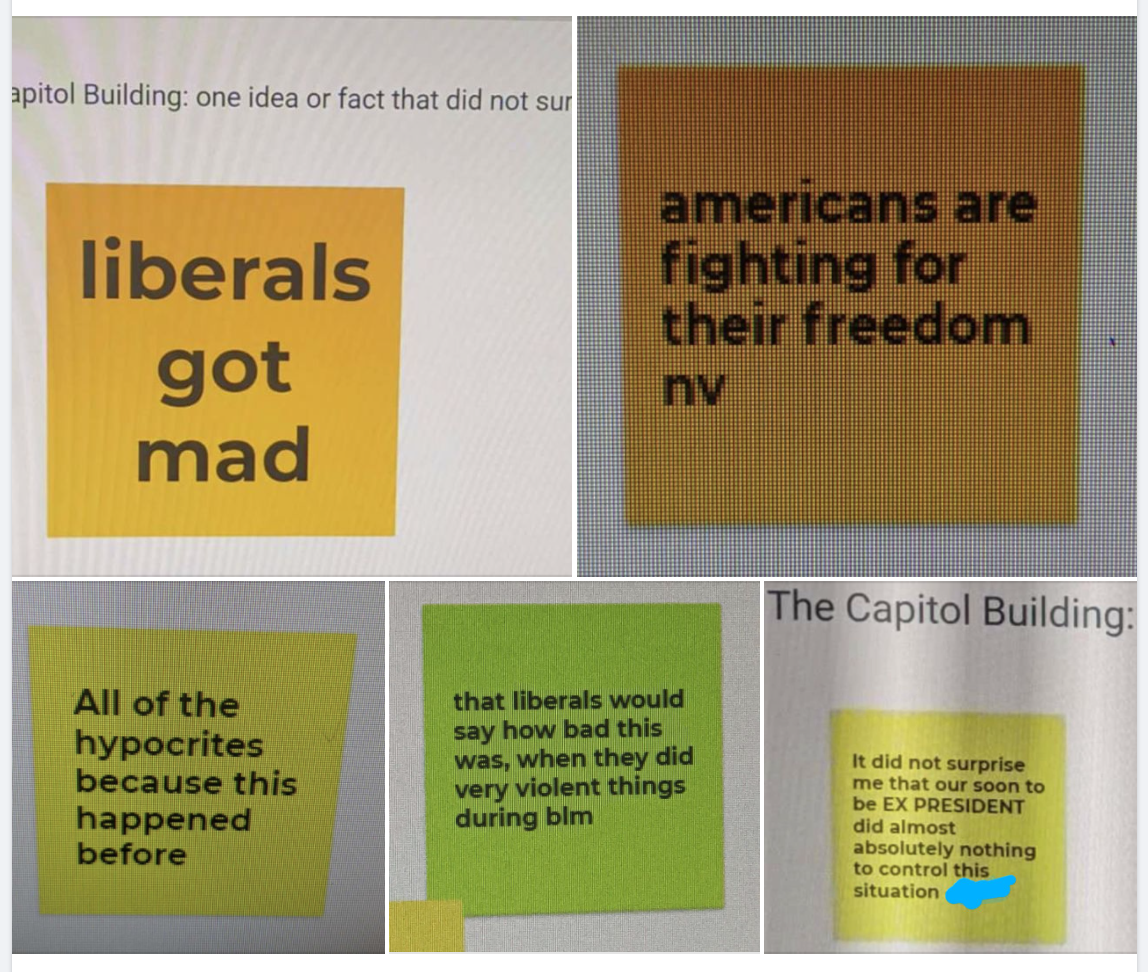

It was fascinating to hear how a substantial sized group of Black Americans process the messages being sent to them by the white elites with BLM signs on their lawns.

Some excerpts:

- “If you’re Black in America and put your mind to it, you can be whatever you want to be.”

- On how she talks to Black Democrat friends: “If Trump were impeached, how would it help your community?”

- “Biden has been issuing executive orders at a furious rate. What has he done for the Black community?”

- “Why are they trying to feminize all our men?”

- “Once all of the illegal immigrants are naturalized, the Democrats will never talk to us again. We will be behind Hispanics and Asians and won’t be relevant.”

- “Biden is cut from the same cloth as Strom Thurmond. Why would you vote for someone like that?”

- “Obama set off five proxy wars in Africa”

- “I’m finishing a PhD on the War on Drugs.”

- To a white participant: “You will never know what it’s like to be Black and I will never know what it’s like to be white. We just have to find common ground.”

- Woman: “I tell my white friends not to apologize to me for white supremacy because that makes me feel that they’re saying they are superior to me. I grew up in Alabama and my father had a third rate education, but he was able to raise us without my mother having to work and we never felt that there was something we couldn’t do.”

- Woman from Texas: Trump stopped the revolving door of illegal immigrants who would get deported and come back a few days later. Despite this, the Black neighborhoods of Texas continue to be wiped out via population replacement with Hispanic migrants.

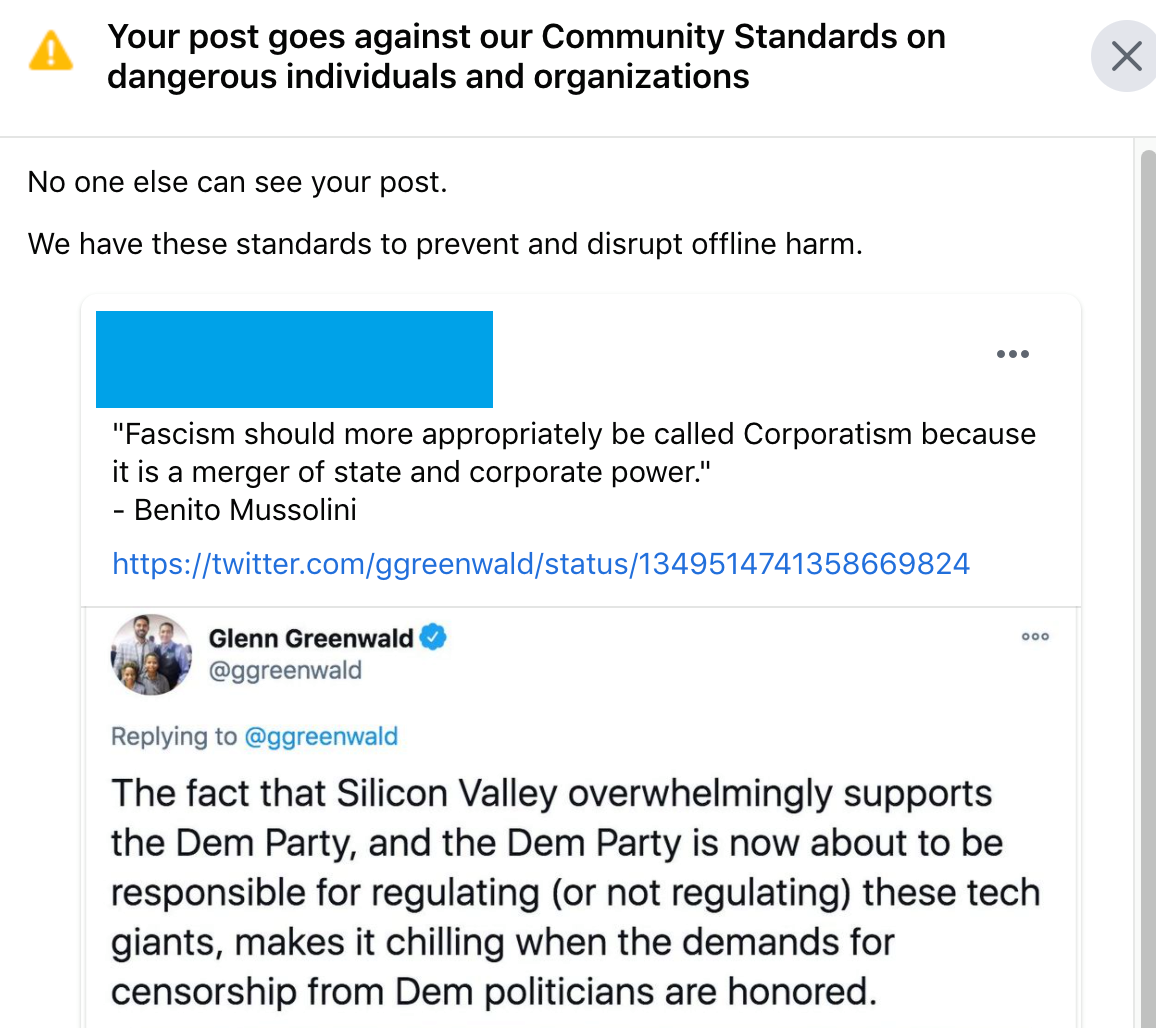

I posted these in real time to a Facebook post. In an aside, I noted “I am waiting for a platoon of white Democrats from San Francisco to set these folks straight regarding the proper way to be Black!” Right on cue…

- White-looking guy named Arjun: “I’m a multi-Ethnic person.” [But if you saw his profile photo you would likely say that he is white.] He thanks the group for their respect and humanity. Says he comes from a different place politically. Disproves the idea that white liberals offer Blacks empty words by speaking for about 2 minutes and saying nothing.

A bit later….

- Arjun is back. Talking about working at a farmer’s market in the Tenderloin and “genuinely perplexed” by the fact that only 10% of the customers at this farmer’s market are Black. “A true travesty”. He posits that maybe Black people don’t know how to cook.

(Arjun was right about one thing: when Trump haters showed up they were heard out in full, not interrupted, and responded to respectfully.)

The meeting continues…

- 35-year-old:: “I didn’t vote for Trump in 2016. Everything Trump was doing once in office was creating opportunity for me. So I voted for him in 2020.”

- Guy who went door to door in a white liberal neighborhood recounts all of the whites that told him that he shouldn’t be supporting Trump because he was Black. “Do you really need to know what Joe Biden’s policies are to vote Donald Trump out?” asked a white say-gooder. “Yes, ma’am, that’s what politics is about.”

- “White women are getting all of the contracts, jobs, and minority preferences set aside for Black people to make up for Jim Crow.” (Nobody chimes in to point out how difficult it is to be a white woman in North America.)

- LBJ’s welfare policies were a Trojan Horse because the welfare system’s incentives destroyed the two-parent Black family. We were rats in an experiment for the white liberals of the 1960s.

- “Didn’t nobody rob my mom’s liquor store in the ‘hood because she had a cross around her neck and her right hand on a Glock.” (What would Mom think about Uncle Joe’s latest call for commonsense gun control?)

Arjun can’t be in every room 24/7, so I think that means Clubhouse needs (nay, demands) an army of well-meaning white folks who can explain to these conservatives why they ain’t Black.

(Separately, one aspect of the room that was interesting was how much better informed and thoughtful regarding policy these folks were than my friends who are in the credentialed elite (tenured professors, management consultants, etc.). Where the credentialed elite expresses hatred for Trump either for personal reasons or because Trump does not give the credentialed elite sufficient respect, the Black conservatives were interested in the Trump administration’s policies, not in the personality of Trump-the-person.)

Related:

- First impressions of Clubhouse?

- Interview excerpts with Denzel Washington, who is in sync to some extent with the above folks.

- A Massachusetts Democrat on hearing about the above room: “Reminds me of the old (old) joke: The Massachusetts republican party will be meeting in the phone booth at the corner of Tremont and Clarendon this afternoon at 3 sharp.” When I told that there are 2,300 followers of the Black Conservatives club on Clubhouse, that hundreds were connected to the discussion for the 2+ hours that I listened, and that dozens spoke… “Ok, I wish them all well. I suppose it challenges the idea that blacks (et al) all think in one stereotypical way.” (who had this all-think-same “idea” other than him?)