Immigration kills pride in paying income tax?

It’s National Immigrants Day, perhaps known to Native Americans as “National Steal All the Land Day”.

Before the personal income tax Americans enjoyed a feeling of pride in their private charitable and community efforts. When a natural disaster occurred (see Climate Change Reading List: Johnstown Flood for an 1889 example) people knew that there was no FEMA and therefore they voluntarily contributed money, materials, and time to relief efforts and felt pride in helping their fellow Americans. One of Aristotle’s criticisms of Plato’s “eliminate private property” proposal was that humans enjoy feeling generous and if you don’t have the option of voluntarily donating property then you are denied an opportunity to feel good.

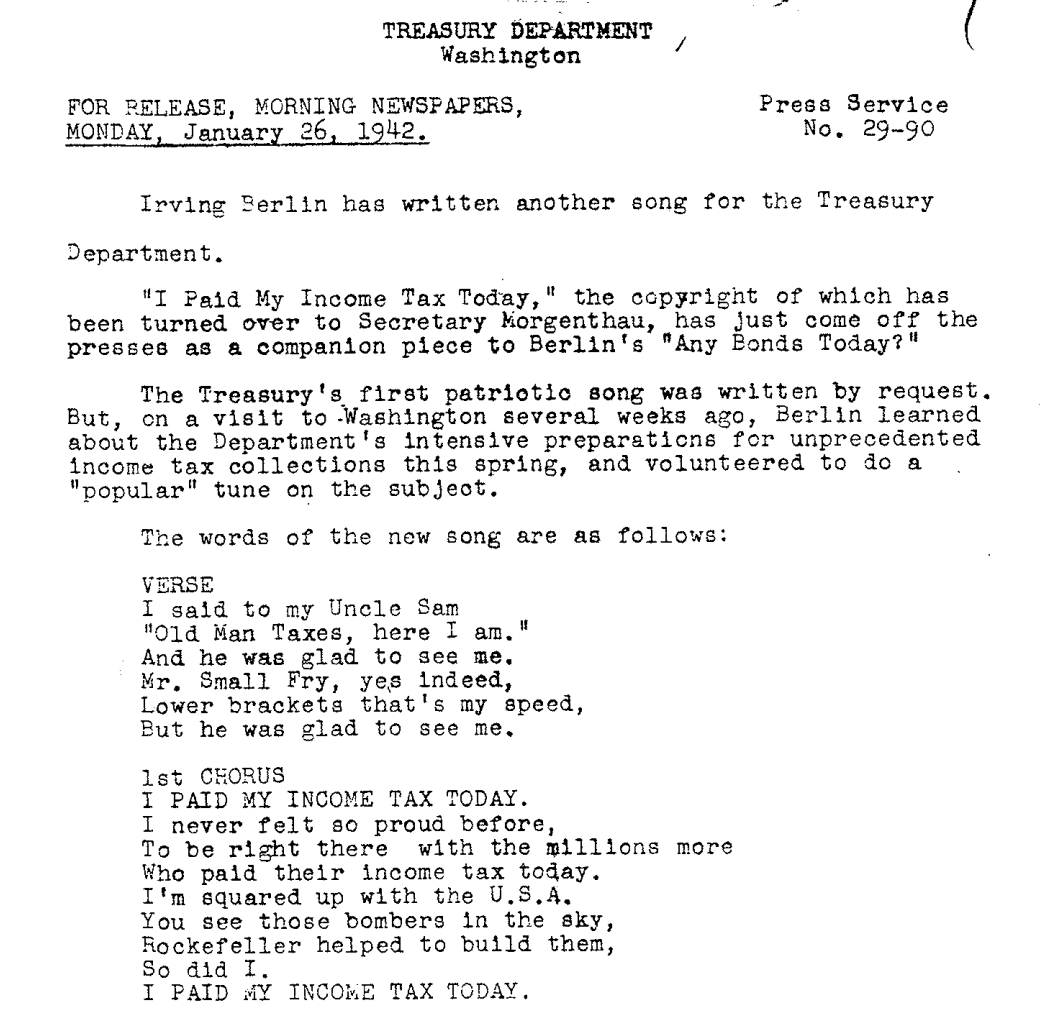

In the 20th century we switched to a system of forced extraction for good works, especially during the Lyndon Johnson administration when Medicaid, food stamps, and other cradle-to-grave welfare programs were introduced. To the extent that these welfare programs were being spent on people for whom a taxpayer had some fellow feeling it might have been possible to feel pride in paying tax. Irving Berlin was famous for enjoying his role in contributing to American society via paying tax and the Treasury Department promoted a song that he wrote on the subject:

Some of the lyrics that today’s pro-Hamas Americans might not appreciate…

You see those bombers in the sky,

Rockefeller helped to build them,

So did I.

A thousand planes to bomb Berlin.

They’ll all be paid for, and I chipped in,

That cert’nly makes me feel okay.

Ten thousand more, and that ain’t hay!

I wonder if open borders has finished the process of killing any joy a typical American might feel in sending his/her/zir/their money to the IRS. Almost all of us agree that it is worth paying taxes to finance infrastructure construction, e.g., gasoline tax to build and maintain the Interstates. Some of us agree that it is worth keeping an American underclass on welfare for four generations or more. Very few of us, however, seem to be excited about providing migrants with taxpayer-funded housing, food, health care, etc. Some Americans would rather help the world’s unfortunate in situ at a vastly lower per-person cost (if we spend $1 trillion/year on welfare for immigrants and their descendants, for example, that’s $1 trillion that we can’t spend on relatively low-cost-per-person programs that would save vastly more lives if spent on poor people in poor countries). Some Americans are haters and don’t want to help foreigners other than via voluntary trade.

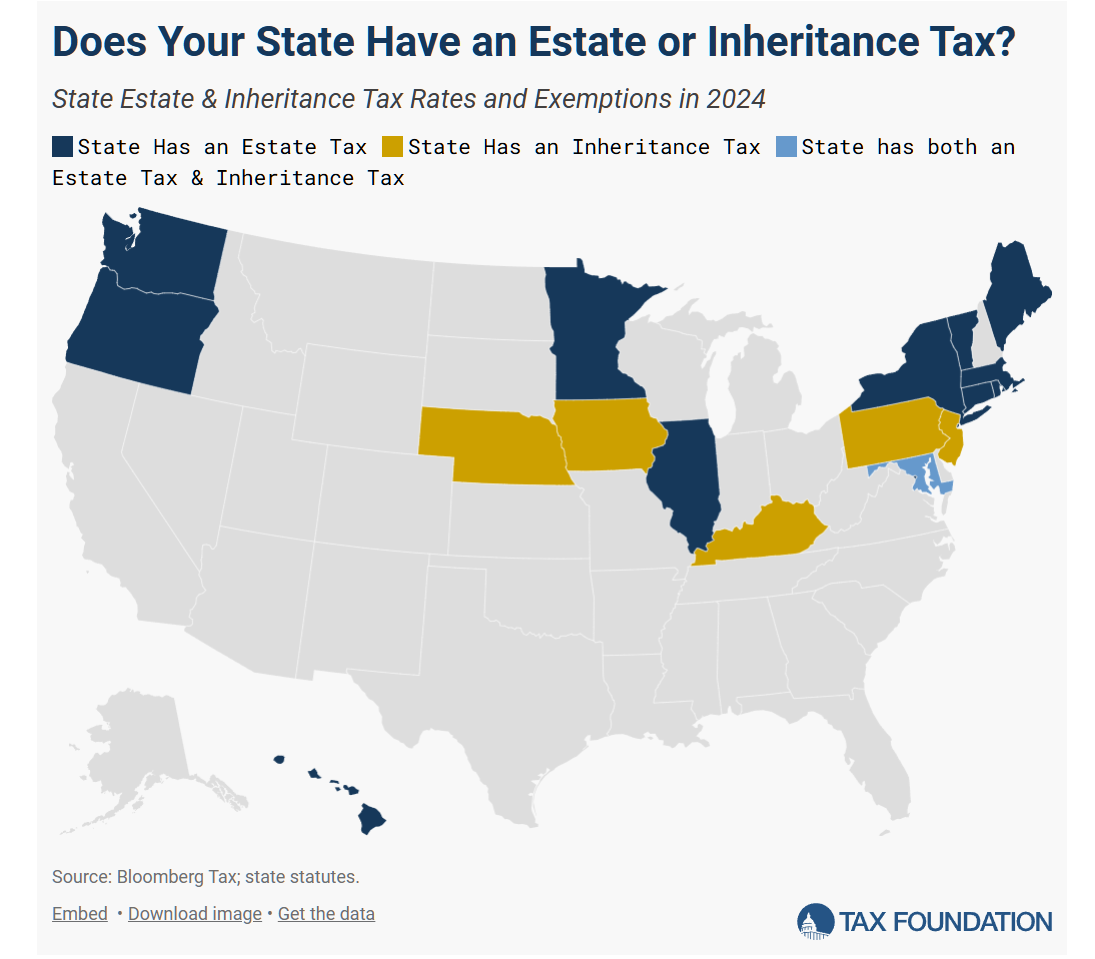

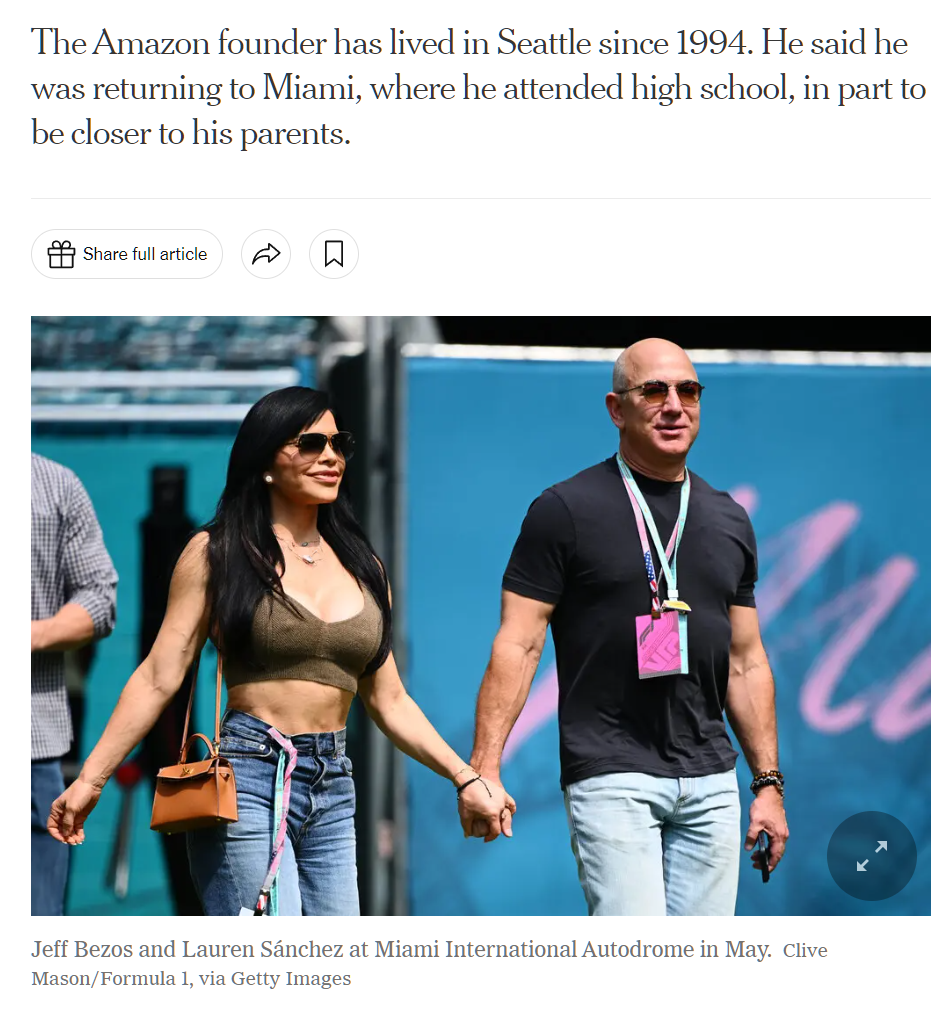

Lack of pride in paying taxes seems to be a factor in state-to-state moves. Quite a few of our neighbors say that they moved from California or the Northeast because they didn’t agree with what their state and local governments were spending money on, e.g., race discrimination (“DEI”), gender-affirming surgeries for teenagers, a fully funded work-free lifestyle for migrants, etc. Without taking the dramatic step of renouncing U.S. citizenship, though, and paying the associated exit tax, none of us can escape paying federal income tax (exception: moving to Puerto Rico). Therefore, the shift in government spending in favor of migrants wouldn’t motivate Americans to move but it could result in less life satisfaction.

Speaking for myself, the taxes that I most enjoy paying are the following:

- property tax, despite the epic quantity, because Palm Beach County and Jupiter do great jobs with the schools, the roads, public safety, etc.

- aviation fuel tax because I love airports and air traffic control

- gasoline tax because I value being able to get from Point A to Point B on smooth roads without traffic jams (Florida accomplishes the smoothness, but nearly every part of the U.S. seems to be plagued with traffic jams)

I’m sure that there are some progressives in Maskachusetts who actually do love paying state and federal tax that funds a work-free lifestyle for migrants, but my suspicion is that overall our decision to open U.S. borders in 1965 was one that has made us significantly less happy with the 30-50% of our working lives that we spend working for the government’s benefit. Running an asylum-based immigration system has perhaps made the situation worse because tens of millions of the migrants currently resident in the U.S. never expressed any affinity for the U.S. or American culture. They just said that they were afraid of being killed or attacked in their home countries.

Related:

- “The downside of diversity” (New York Times, 2007): “the greater the diversity in a community, the fewer people vote and the less they volunteer, the less they give to charity and work on community projects. In the most diverse communities, neighbors trust one another about half as much as they do in the most homogenous settings. The [Harvard] study, the largest ever on civic engagement in America, found that virtually all measures of civic health are lower in more diverse settings.”