Starbucks billionaire advocates for higher tax rates and moves to Florida

Washington State moved to add to its portfolio of state income taxes yesterday by imposing a 9.9% tax on income over $1 million/year (“House passes millionaires tax 52-46 after day-long debate”). Also, yesterday, the Starbucks billionaire Howard Schultz announced his move to Miami:

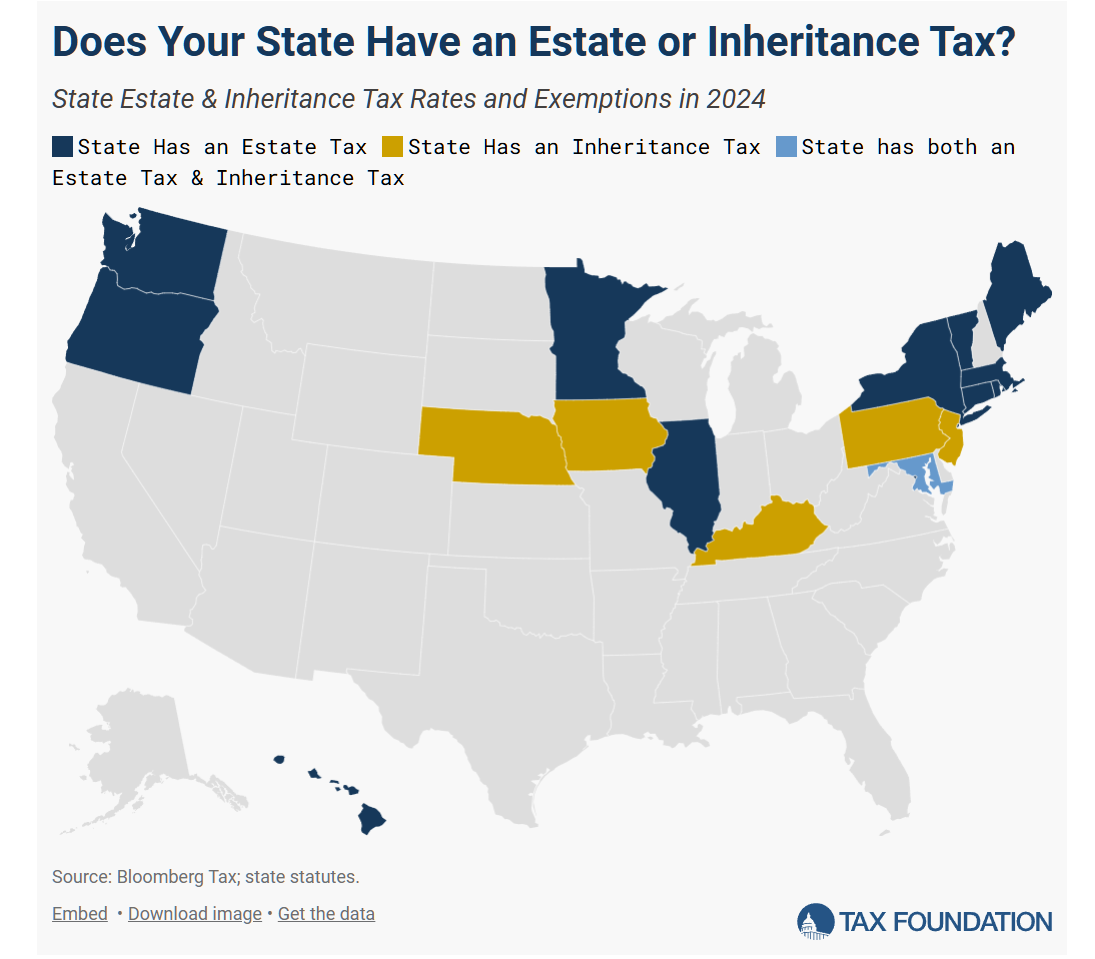

In 2022, Washington State imposed a 9.9% tax on the only income that a guy like Schultz is likely to have (capital gains). They also have a 35% death tax (estate tax). Moving to Florida will save Schultz and his wife more than $1 billion because the Florida income and estate tax rates are 0%.

Schultz says that he yearns to pay higher taxes:

(Taxing “all capital gains as [ordinary] income” would be truly epic given that capital “gains” aren’t calculated with respect to inflation, i.e., a person who sells a property or stock at a loss in real dollars may still owe capital gains tax due to the rise in nominal dollars.)

Also from 2019:

“I myself should be paying higher taxes — and all wealthy Americans should have to pay their fair share. I think we can all agree on that,” Schultz said at the university.

Maybe this is the explanation for why Howard Schultz won’t be joining Donald Trump in Palm Beach. From 2020:

“In my view, our choice this November is not just for one candidate over another,” Schultz wrote in a letter to supporters. “We are choosing to vote for the future of our republic.” Schultz went on to say, “What is at risk is democracy itself: Checks and balances. Rigorous debate. A free press. An acceptance of facts, not ‘alternate facts.’ Belief in science. Trust in the rule of law. A strong judicial system. Unity in preserving all of our rights of life, liberty, and the pursuit of happiness.”

Taking aim at President Trump’s repeated attacks on voting by mail – which many Americans feel is a safer option due to health concerns over in-person voting at polling stations amid the coronavirus pandemic – Schultz stressed that it’s “essential that Americans turn out to vote, that every American is able to vote safely, whether by mail or in person, and that every vote is counted. It would be a grave miscalculation to think this election is secured for a Biden victory.”

He believes in Science, but voluntarily moves to a state that rejects Science and a city that rejected masks in favor of partying on?

Speaking of Science, what has the proud owner of a condo in a beachfront Four Seasons building (i.e., sea-level coastal exposure to Climate Change-caused hurricanes) said about Climate Change? In 2019, he said that he was “gravely concerned about our planet, climate change and things that we have to do” (though he wasn’t on board with Full AOC)

What does ChatGPT have to say about a guy who is moving within an easy drive of Alligator Alcatraz?

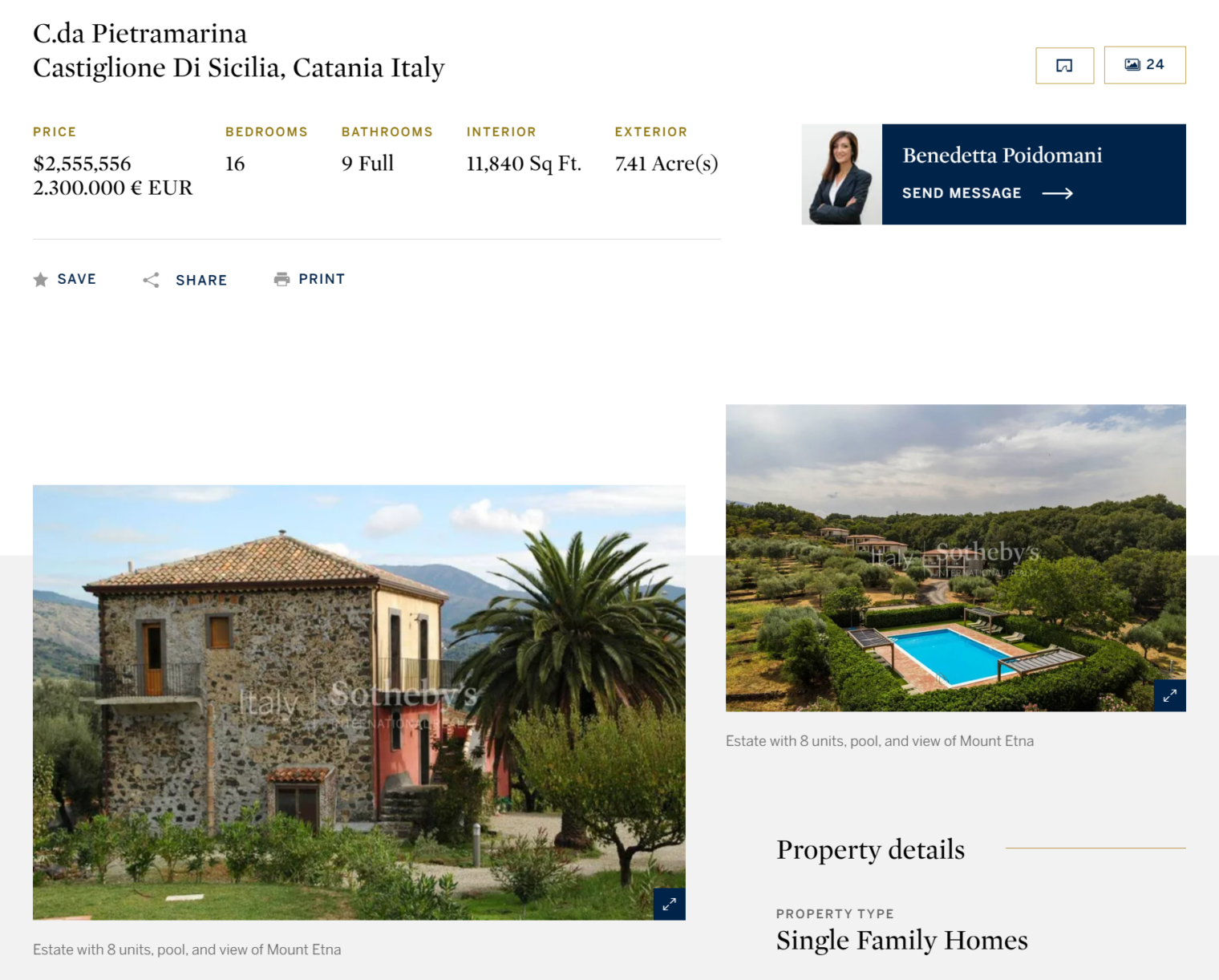

Schultz has also backed a legalization/citizenship approach on immigration. In his 2019 Purdue speech, summarized by GeekWire and OnTheIssues, he called for “common-sense immigration reform,” including “a path to citizenship for Dreamers” and broader legalization measures. Florida’s recent immigration policy has moved in the opposite direction: SB 1718 bars local funding for IDs for people without proof of lawful presence, invalidates certain out-of-state licenses issued to unauthorized immigrants, requires some hospitals to collect immigration-status information, and strengthens penalties tied to employing unauthorized workers.

What about the move to a state with the 14th Amendment’s Equal Protection guarantee is taken seriously?

Full post, including commentsSchultz’s race- and DEI-oriented corporate activism is also hard to square with current Florida policy. His “Race Together” initiative and his broader view that companies should engage on racial issues fit poorly with Florida’s anti-DEI direction. Florida’s Board of Governors regulation now bars state universities from spending state or federal funds to “promote, support, or maintain” programs that advocate DEI or engage in “political or social activism,” and the regulation defines DEI in part by reference to classifications based on race, gender identity, and sexual orientation. Florida law also restricts certain race- and sex-related instruction in education settings