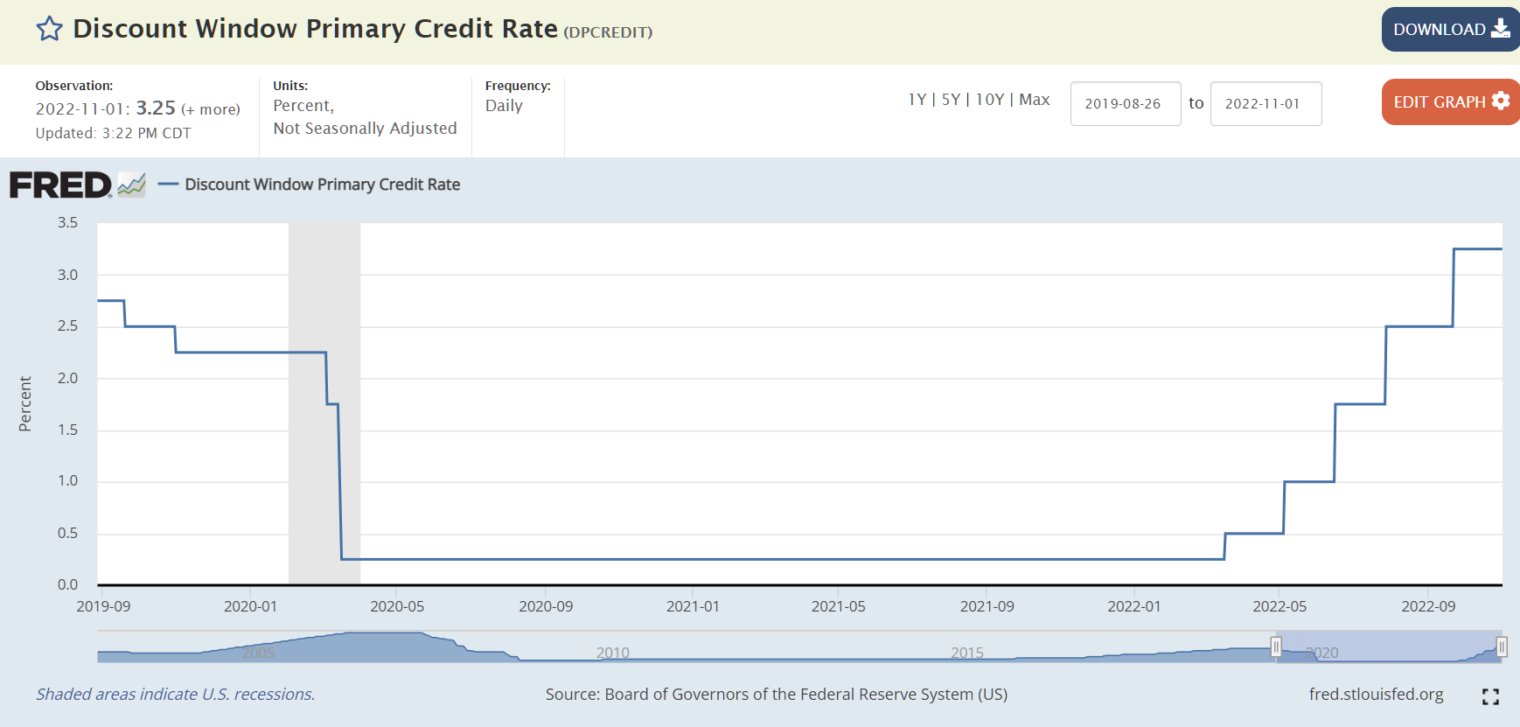

The Fed has raised its primary credit rate by 3 percent compared to the spring of 2022 (this chart doesn’t show today’s bump):

If the Fed recognized back in the spring of 2022 that low interest rates plus wild deficit spending was a toxic combination, thus leading to the 0.75 percent bump in June with forecast additional bumps, why didn’t it increase the rate to today’s level immediately? If you want to stop inflation, and convince markets that you’re serious about the effort, why keep lending money at an interest rate dramatically lower than the inflation rate?

The obvious answer is “Philip, you’re an idiot who took a few graduate level econ courses; Fed chair Jerome Powell is a brilliant macroeconomist who knows what he/she/ze/they is doing.” The problem with that answer is Wikipedia says that Mx. Powell has no formal training in economics. He/she/ze/they studied politics and then law. While it is still a safe bet that I don’t know anything about economics, it is also possible that Jerome Powell has no better insight into what will happen with inflation.”

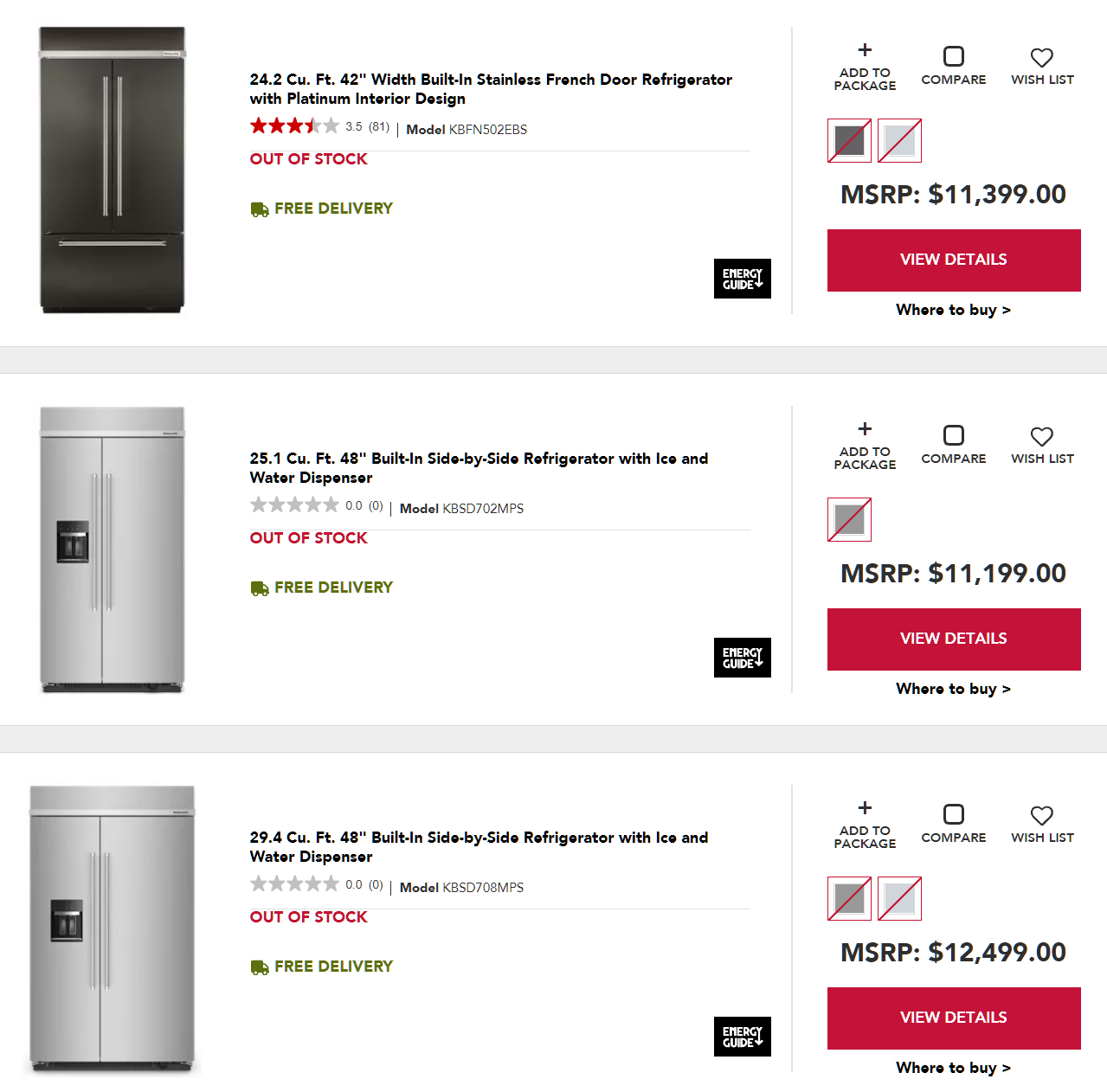

I think that there is plenty of room for continued inflation in the U.S. economy. Now that higher mortgage rates make buying a house more expensive, landlords shouldn’t feel dramatic pressure to cut rental rates (though, presumably, they did get a little ahead of the market in the spring). There should still be steady demand driven by immigration and the resulting higher rents will ensure the continued misery of the working class that was forecast back in 2016 by a Harvard economist. After rent, cars are a big expense for Americans. A neighbor shopping for a Honda was told that it would be $6,000 over dealer cost and that he might have to wait a month. Those aren’t better terms that what I learned about in the spring of 2022 when getting an oil change for our beloved Odyssey. Let’s look at appliances. We recently priced a Sub-Zero refrigerator to replace our dying 42″-wide KitchenAid. The Sub-Z is plainly underpriced at $14,000+ (including sales tax and installation) because there is a one-year wait (in 2019 it was a 7-10-day wait). Why not buy another 42″-wide KitchenAid and then wait for that one to die? The cost would be closer to $12,000, but they are also out of stock, which means the correct price is higher.

Maybe the downturn in real estate occasioned by these higher interest rates actually will do enough damage to the economy to stop hyperinflation for 2023. But that leads us right back to the question above: Why didn’t the Fed do a full 3 percent raise back in June and stop hyperinflation perhaps 6 months earlier? (Presumably we’ll still have inflation of at least 2 percent, just not hyperinflation!)

Related:

- Can our government generate its own inflation spiral? (since everyone in the government half of the economy gets an inflation-indexed paycheck, folks in the non-government half will need to be nearly ruined before inflation is whipped)

- “Why the Federal Reserve has made a historic mistake on inflation” (Economist, April 23, 2022): “America’s Federal Reserve has suffered a hair-raising loss of control. … the worst overheating in a big and rich economy in the 30-year era of inflation-targeting central banks.”

The Fed is run by macro-economists. The difference between micro-economists and macro-economists is that micro-economists are wrong about specific things, while macro-economists are wrong about things in general.

Powell’s no more a macroeconomist than you Phil — he is trained as a corporate lawyer and at some point worked at an investment bank. Looking at the world most favorably to Powell, there were lots of big name economists who said and continue to say that inflation was transitory and there is a lag between when the fed tightens and when the tightening is felt & tightening can cause recessions and in a democracy that means the voters are unhappy and politicians are voted out of office. So there is a general reluctance to tighten. And there are some who say that macro is pseudoscience with little or no predictive ability and that the predictions of I don’t know say Paul Krugman and Alan Blinder and Joe Stiglitz and Janet Yellin are no better than yours or anyone else’s — and a scorecard would probably show that they are worse.

Ricky: What you say makes sense, but even with the first 0.75% bump the Fed was saying that the next one was forthcoming and that a 0.75% rise wasn’t going to do anything when official inflation was nearly 10%.

The zinger of the day has shifted from inflation being transient to being the result of cumulative monetary policy having a lagging effect, so the bullshit rages on even after they flinched 6 times. They’re not trying to convince the market of anything.

Have you considered the possibility that unrestricted concentration by agglomeration of companies in almost all areas has meant that they can raise prices as much as they want because there is little or no competition. Corporate profits are at levels (percentage wise) are at the highest levels in 40 years.

Jack: I’m sure that big companies cheered when governors (except in South Dakota and, to a lesser extent, Florida and Texas) made it illegal for small companies to operate. And the US doesn’t bother to enforce antitrust laws (4 out of 5 of the world’s most profitable airlines are here! https://simpleflying.com/which-are-the-worlds-most-profitable-airlines/ ).

Maybe this can explain some of the inflation. https://www.economist.com/finance-and-economics/2022/08/30/vast-corporate-profits-are-delaying-an-american-recession shows that profits used to be about 6-9% of GDP but in the Era of Bigger Government (starting in 2009), they’ve trended to 9-12% (dramatic spike since the lockdowns).

There is an au courante idea that the antirust laws can cure some of society’s ills. The antitrust laws don’t make a lot of sense (it would take too long to explain that so just take it from Ricky) and lost intellectual respectability in the late 1970s when Richard Posner and the Chicago School showed they were nonsense & it is pure fantasy to think that the DOJ enforcing the antitrust laws will bring competition to say the airline industry. The antitrust laws were typically used to protect this company at the expense of that company. So remember how the antitrust division tied up that big bad monopolist IBM for close to a decade while Microsoft & Dell and others ate their lunch. And then there was the big, bad monopolist Xerox — like who under the age of 50 has ever heard of them? And now they are going after Meta or Facebook or whatever as that company seems to be in its death throes. The airline industry has been crappy for decades. The airlines make money in good times and lose money hand over fist when the pendulum turns. You really want Merrick Garland’s DOJ or the FTC’s Lina Kahn to protect your interests? Why would they do that?

Caution! Make sure you order the right size fridge. I am guessing your kitchen cabinets are designed for a specific sized fridge. In the screen capture you posted you are looking at both 48 and 42 inch wide fridges. To tie this into the topic at hand… Do you think Jerome Powell would order his own fridge and do you think he would get the correct size?

Thanks, TS. We have a 42″ KitchenAid and the cutout sizes for all 42″ fridges seem to be the same.

Philip — What makes you think this is caused by the Fed’s incompetence plus govt spending, and not by the world situation?

Looking at cars in particular, the story you’re suggesting is that people were given too much cash, and that caused massive demand for cars, and that drove up prices.

But we know there were supply chain problems, and scarcity drove up prices.

https://axlewise.com/car-sales-stats/

Did the Fed break our ability to make cars?

Also, it shouldn’t be missed that the two bouts of inflation in the last 80 years coincide with oil price spikes:

https://www.in2013dollars.com/Gasoline-(all-types)/price-inflation

That’s too important to neglect, right?

David: China does not have hyperinflation, which suggests that the Economist is correct in identifying the Fed as incompetent. The U.S. idea, shared to some extent in Europe, seems to have been that governors could order shutdowns and people could be just as well off as if they had continued going to work. If true, state governors should have, many years ago, ordered 6-month annual paid vacations for everyone! Congress and the Fed were operating from the idea that clever government would render the lockdowns and forced business closures irrelevant from an overall wealth point of view.

So… the Fed didn’t order the lockdowns, but it did take the initiative to lower interest rates from 2.5% to 0.25% (see chart in original post) to coincide with state governors’ lockdowns. And then it kept the interest rate parked at 0.25% while Americans in the lockdown states pretended to work and study via Zoom for two years. That gets us back to Milton Friedman (“inflation is always and everywhere a monetary phenomenon”), as cited by /df.

Philip — Compare the US’ inflation rate to other countries: the UK (10%), France (6.2%), Germany (10%), Canada (6.9%), Mexico (8.7%), Sweden (7.3%)

Different countries with different level of govt spending, with a different degree of lockdown.

If the Fed had raised rates earlier, and more aggressively, do you think the US would be at 2% inflation now?

Btw, I don’t think “hyperinflation” means what you think it means.

When low end refrigerator prices gone up 2.5 – 3 times in couple of years (or since last time I looked at them) – I call it hyperinflation,

Same reason you don’t floor your car just because you intend 75 later on.

Also inflation is not just monetary and Powell wants supply matters to play out.

Instead of any of the disciplines at play, why aren’t central banks run by control theory engineers? Set a target inflation rate by government, 2% say, set interest rate at target + k * (inflation – target) + c with k ~ 1, c ~ 1%, or apply QE if rate < 0. Let the politicians handle the fiscal consequences. The whole point of an independent central bank is to decouple interest rates from short-term politics, but at least in US and UK the banks decided to become unelected politicians instead.

Or perhaps they're just using a five-year moving average for inflation?

Also, a welcome return by Prof Friedman (please tell me that he actually said that) and a reminder for @David of what he did say: "inflation is always and everywhere a monetary phenomenon".

It’s probably, at least in part, to accommodate Wall Street so they have time to adjust their bond portfolios, LIBOR-linked instruments, derivatives. It also gives time for other Central Banks to follow in Fed’s foot steps. USD was already very strong (on a relative basis) and the growing rate differential is making the divergence worse. Ultimately Fed seems to be raising rates at a moderate pace until something breaks, at which point they’ll have a bit of “ammunition” in the form of potential rate cuts.

Thanks, Gino! This makes a lot of sense.

From today’s WSJ:

“Central banks adhere to the Brainard principle, named for the economist William Brainard, which says that if you’re unsure how changes in the short-term interest rate affect the economy, go slowly. Tightening in three-quarter percentage-point increments made sense when rates were plainly far too low—like taking big strides on familiar terrain. But the higher rates get, the less certain the impact becomes. Downshifting to quarter or half-point increments gives the Fed more time to assess that impact, just as small steps in an unfamiliar place makes a wrong turn less likely.”

For the last year of his presidency Trump pressured the Fed to cut interest rates further, even in a booming economy. This is opposite of standard economic theory. My right-wing friends fully agreed — because of course Trump is a genius. In the same way they agreed that the 2017 GOP tax cuts would goose the GDP growth to 6% to offset lost revenue.

Sure, the economic idiocy is limited to Biden…

https://www.cnbc.com/2019/09/11/trump-says-fed-boneheads-should-cut-interest-rates-to-zero-or-less-us-should-refinance-debt.html

https://www.cnbc.com/2020/01/28/trump-says-the-fed-should-cut-rates-so-the-us-could-then-focus-on-paying-off-refinancing-debt.html

https://www.jec.senate.gov/public/_cache/files/4150f60c-56af-4b6a-8f0e-fb0b34aafed8/tax-cuts-fail-to-deliver-promised-economic-boost.pdf

Interest rates wee floored under Obama… Despite that economic recovery took very long into second Obama term and despite stock market taking off during late Obama presidency both interest rates and worker income growth were held at near zero, unlike surging inflation which was very significant but not like today hyperinflation… The history can not be changed even by money helicopter Colonel Earnhard recent Nobel.

Trump obviously knew inner workings of how economy really operates and had real world experienced economic team. Or whatever economic enlightenment that was sent him from above the clouds worked…