There’s a sports car dealer next to our favorite taco place here in Jupiter. Their lot was jammed with cars, seemingly twice as full as in the summer. From their perspective, the car market turned about 30 days ago. They’re now paying only MSRP for nearly-new (500-mile) C8 Corvettes. What do they turn around and sell them for? It’s a little unclear because they say “We haven’t had a call for a Corvette in 3-4 weeks. The interest rates have killed demand.” (Note that this is contrary to my theory that we have enough deficit spending and inflation-indexed spending to have inflation even if nobody does any borrowing; see Can our government generate its own inflation spiral? and Economist answers my question about high interest rates and high deficits.)

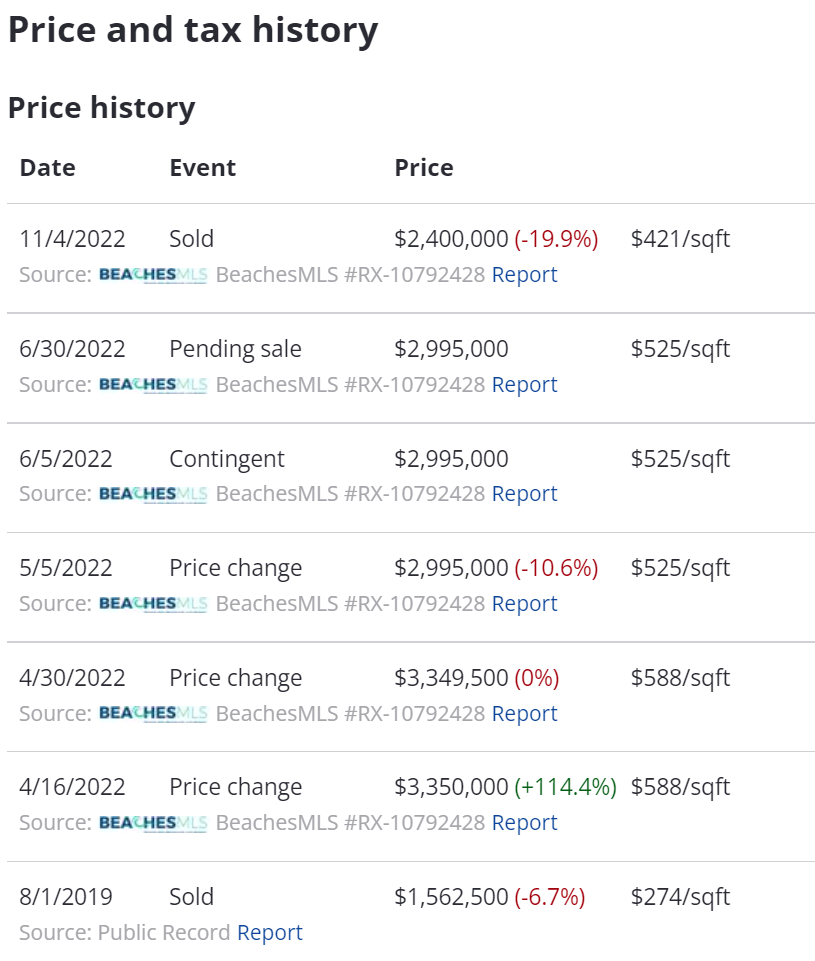

How about real estate? There’s a house in our neighborhood (built by the MacArthur Foundation for middle-class and upper-middle-class people!) whose $3.35 million asking price in April 2022 seemed aggressive, particularly since there was no pool and the new owner would have to lease it back to the sellers until October when the sellers expected their new-built house to be ready.

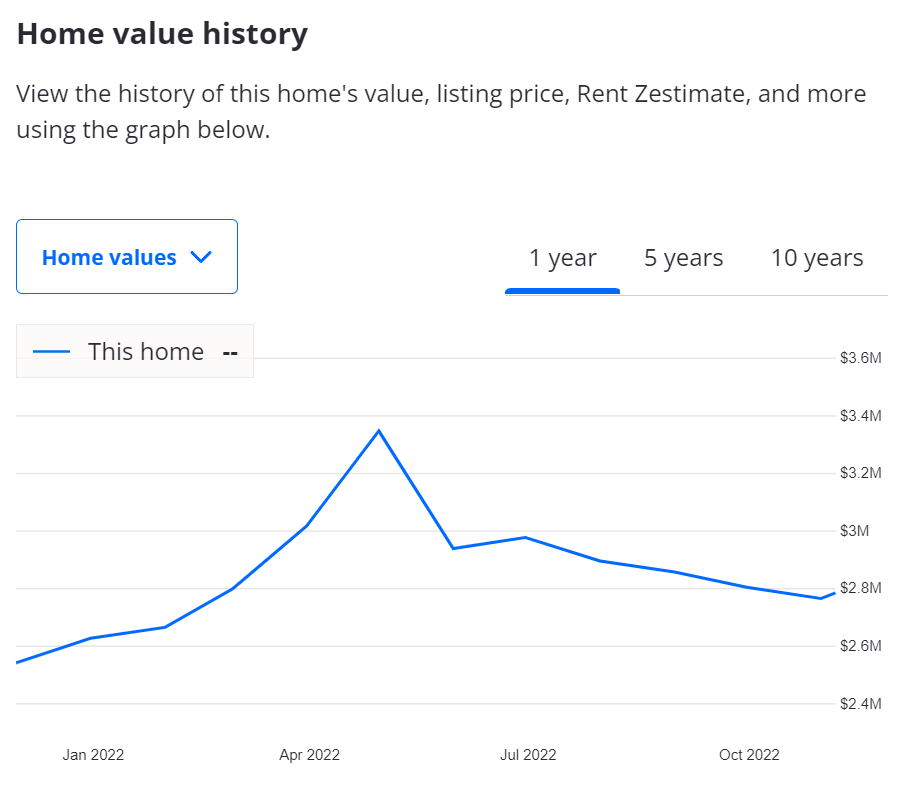

Here’s the “value history”:

In June 2022, there actually was a greater fool who agreed to pay $3 million for this albatross. But then it seems that this person disappeared or wised up and the closing price was $2.4 million (last week):

If you’re depressed because you forgot to sell all of your assets in March 2022, this message from the taco place might be useful:

If you’re depressed because you were dumb enough to buy a house early in 2022 at early-2022 prices (looking in the mirror is painful!), you can be comforted that you don’t live in San Francisco, which MSNBC uses as shorthand for a truly crummy and crime-plagued urban environment (the MSNBC interviewer says, regarding a higher-crime Manhattan, “We’re worried this could be San Francisco”):

Readers: What are you seeing? Did we run off the cliff a few months ago and not notice until now?

Here is SWFL things are in stasis due to the hurricane. Yet Zillow and Redfin continue to March upwards in their valuations. It’s possible the storm reduced supply enough to make an appreciable impact of some durability.

I moved to NW Florida in the spring. When looking at homes the only ones available where downtrodden or mega old. Any decent home would require fighting for with multiple offers. We ended up buying in a good neighborhood for kids off market.

Our immediate neighborhood has less homes than other areas, but you can still find homes. There is a glut of newer homes still priced like it’s May.

In the rest of the city the supply has exploded. The beach is the same. Where a large area would have one home, the same area has dozens. Some of the prices have come down from like 700-800k for 1200 sq ft to more like $580k. Long time residents say the prices in May were almost triple 2019. There are still 3500 sq ft homes listed for $1 million. I’ve seen some 5% reductions.

I got a 4% interest rate, much less than my 2.5% on my California home. Surely I lost money on the Florida home, but we made the difference on the California sell and it was worth it to pay to leave.

For the first time in almost two years a car dealership we’ve done advertising for in the past gave us a call three days ago, because they want to do a direct mail campaign within the next week. Too many cars, not enough customers, diametrically opposite the situation 6-7 months ago and ‘getting worse’ according to the Sales Manager. They are going to be aggressively marketing in every medium through the rest of the Holiday season.

More anecdotal evidence of the real estate market trending downwards:

I’ve been house hunting for the last 2 years.

In the last month I’ve received more calls from real estate agents trying to sell me on overpriced houses than in the two years before (more than 10 vs less than 5). They may actually have to do some work to earn their commission now!

WEC looked down about the end of the second quarter.