We are informed that income inequality is one of the biggest problems facing Americans, but I wonder if the activities of central planners is going to make it ever-tougher to get accurate measurements. Looking at gross cash income is relatively easy. Adjusting for federal, state, and local income taxes is also relatively easy. It gets tougher when we want to factor in the value of means-tested welfare programs such as housing subsidies from a housing ministry, Medicaid, SNAP/EBT, and Obamaphone, but some valiant attempts have been made in this area (see “Is rising income inequality just an illusion?” (The Hill, 2021) for a description of some of the efforts).

I’ve noted here that spending power for cultural activities is actually infinite in many states for those who are on welfare (see “Why you want to be on SNAP/EBT“) because the price of museum or garden admission, for example, is reduced to $0.

California’s central planners are adding an interesting wrinkle with income-based electricity pricing. “PG&E monthly bills could jump for many customers due to new state law” (Mercury News, April 12):

Customers for California’s three major power companies — including PG&E ratepayers — can expect to see some big changes in their monthly electricity bills in the coming years as compliance with a new state law begins to unfold.

PG&E, Southern California Edison and San Diego Gas & Electric, the three major California utilities whose services include electricity, have filed a joint proposal with the state Public Utilities Commission that sketches out proposed changes in monthly bills.

At present, those bills are primarily based on how much electricity and gas customers consume.

A new proposal would add a fixed monthly charge that would be based on the household income levels of the respective customers.

PG&E says many customers would ultimately pay less for electricity — although the distinct possibility remains that an unknown and potentially significant number of more affluent customers might wind up with even higher electric bills.

The new law creates a need for a new government ministry of income verification:

It also appears that a formal effort will be made by state officials to confirm the household income declarations of utility ratepayers.

“The proposal recommends a qualified, independent state agency or third party be responsible for verifying customers’ total household incomes,” PG&E said in an emailed statement.

California is usually the leader in new ideas for expanding government. As more states adopt programs like this, I wonder if it will become practically impossible for academics to estimate spending power inequality in the U.S. (the relevant measure; if you can spend $200,000 per year on housing, health care, food, etc., what does it matter if your earned income is $0?).

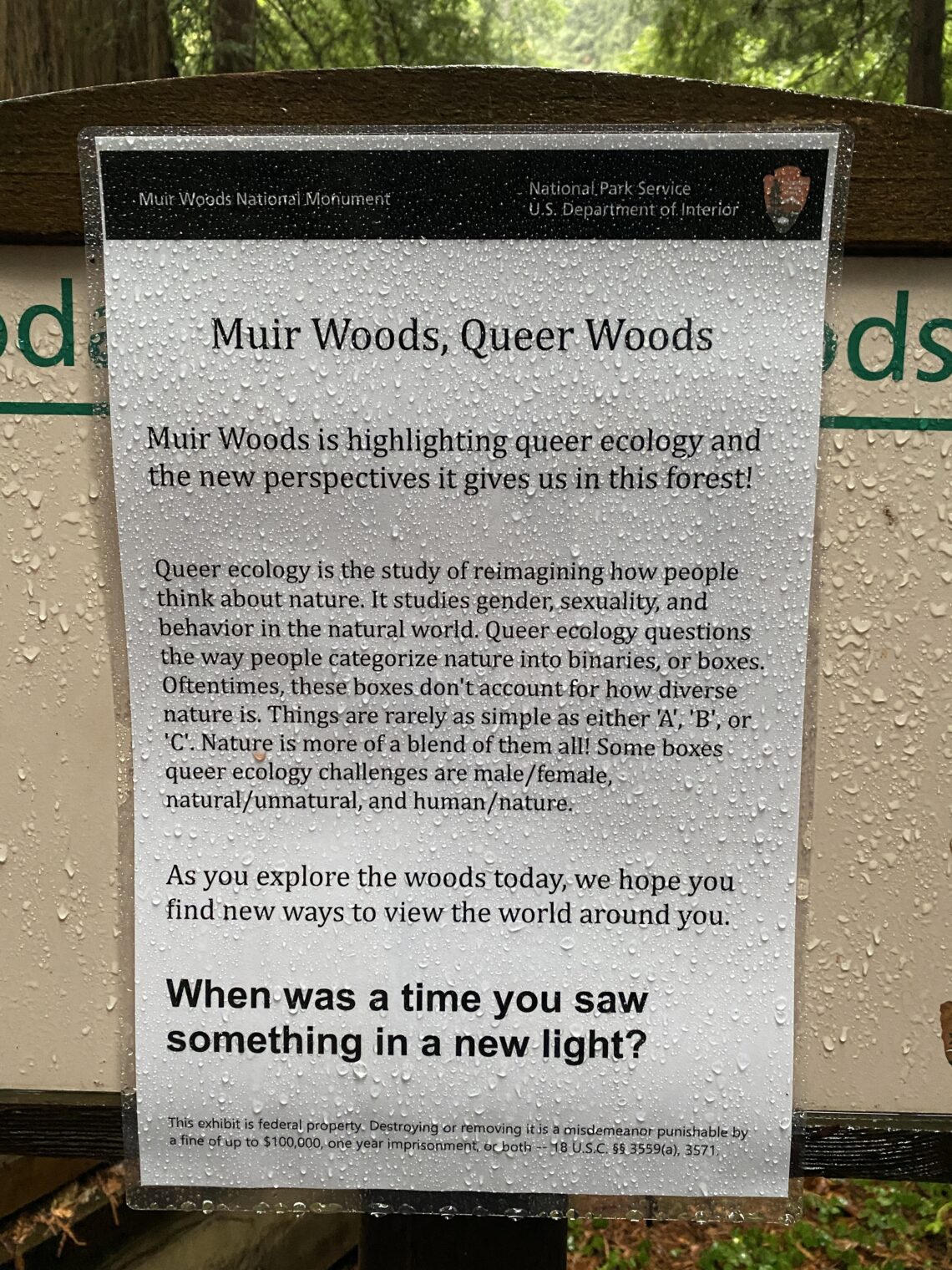

This reminds me to relive some happy California memories. From Queer Ecology at Muir Woods (November 2020; San Francisco schools were closed, but youngsters could go to the forest (reservations required) and learn):

San Diego trip report and Meet in San Diego tomorrow or this weekend? describe my June 2022 trip to the Golden State:

Related:

Wow. The Public Utilities Commission in California seems like the very definition of regulatory capture. Electricity in Northern California is 2-3X the US average.

Queer Ecology? Those people are certifiably insane.

averros: It’s not insane to collect a paycheck every week for writing about Queer Ecology!

First they hijack the rainbow, now the woods. Interesting that removing this pamphlet can result in a fine of up to $100,000 (now $50,000 after inflation).

Where does intergenerational income transfer fit into the income estimates? If mom and dad cough-up $300,000 for college (ignoring grad school for the moment) should that be treated as kid-income for statistical purposes? And if mom and dad then “invest” in a second home or college apartment in Austin, TX (tax deductable) with the kid’s name on the trust deed, then the kid can take the house with no tax consequences but with clear wealth consequences.

Intergenerational transfers are a big part of how my friends’ kids do well

Yeah, how would they even determine your income level? The government going to publish your W2? The lion kingdom sometimes makes 0 so that would be a 0. Do they require health insurance?

California does require everyone to have health insurance,. The price is also based on your income.

Why are you guys complicating this too much? Just say you are an undocumented, illegal immigrant, with zero income who speaks perfect English, and boom, you are all set. They cannot deport you for speaking English now can they?!

Income inequality is a serious problem especially in Mexico where MDs make on average 900 dollars a month. My brother in law, a dentist, spent an hour and a half ckenin my daughter’s teeth for 25 dollars. Dentists in the US&A don’t waste their time doing this. I lived in upstate BY where NYSE is actually Avangrid a subsidiary of Iberdrila from Spain. I have a love & hate relationship. I hate them because they charged more than a hundred dollars fir electricity in a 3-bedriom apartment. In Mexico I pay less than 8 dollars a month fir a two story house. I received a 400 dollar subsidy from NY because I was old and poor. My daughter had a welfare card because she studied at Cornell and worked there. (Study and work program). I used the card to buy European delicacies at Wegman’s. I paid at the sekf-check register to avoid insults from white intolerants. Government help is sometimes needed by people with eleven years of college like me.

Ifirgot to say I love I wrdrola because they gave my daughter a scholarship to study an MsC in data science at UofR , NY and a trip to Spain to receive the award from Queen Letizia.