Pravda says “The U.S. is now two years into abnormally high inflation“:

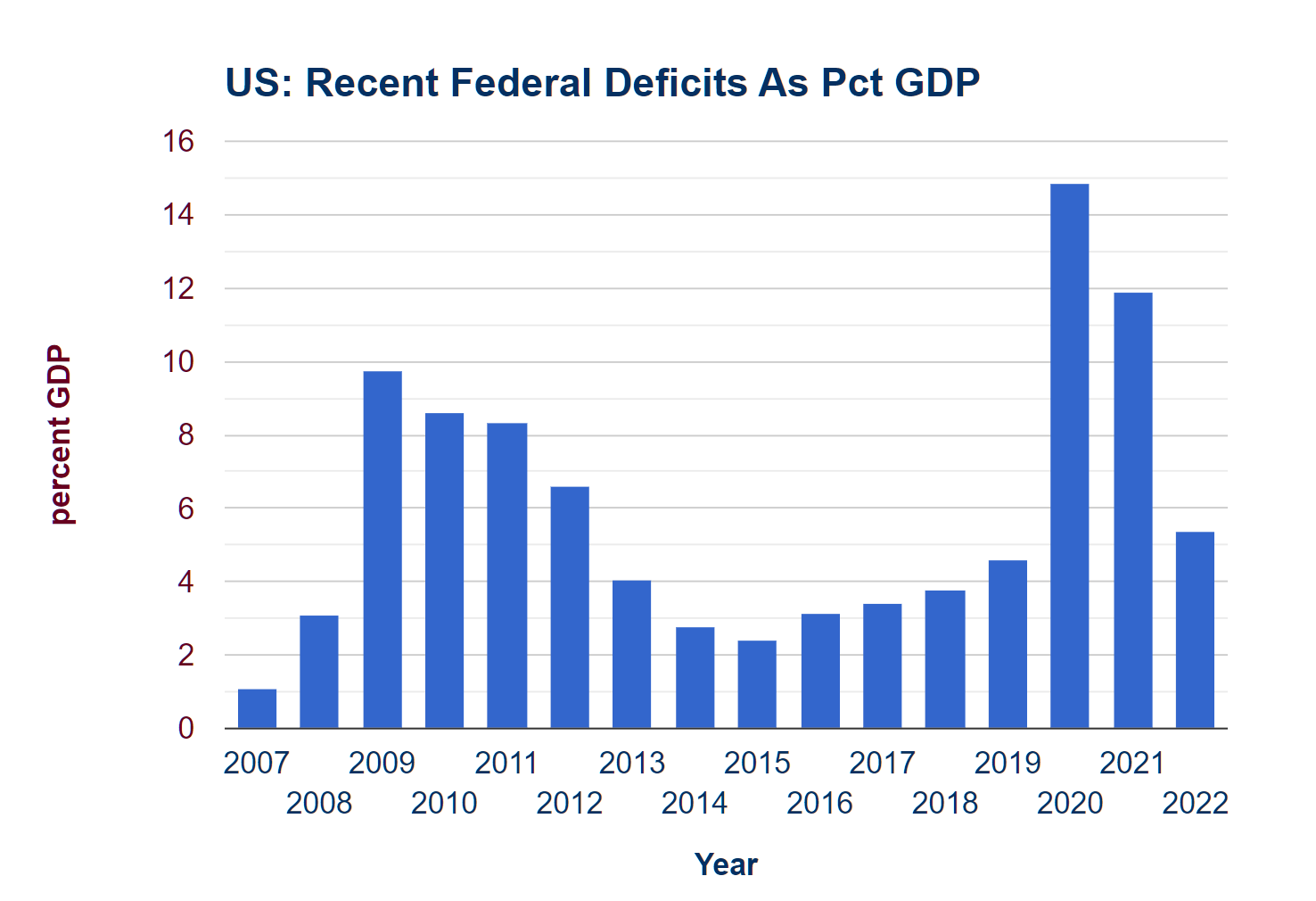

But wouldn’t it be more accurate to say that we have roughly the inflation that we should expect given the level of deficit spending that we voted for? To prevent runaway inflation, the EU established a deficit limit of 3% of GDP for member countries and a debt-to-GDP ratio of 60%. The US deficit has been 5-15% since 2020 and was higher than 3% before that:

U.S. debt-to-GDP is 115 percent, according to the World Bank (compare to 45ish percent in Germany and Korea and 92 percent in over-the-EU-limit France, the only country with a larger welfare state than the U.S. has).

What’s the news from the New York Times?

U.S. inflation today is drastically different from the price increases that first appeared in 2021, driven by stubborn price increases for services like airfare and child care instead of by the cost of goods.

We can buy as many DVD players as we want, in other words. It is only services that are going to be unaffordable to the non-elite. What percent of the economy is subject to a wage-price spiral, then? 77.6 percent.

Related:

They just trade inflation of services against deflation of car chargers at dollar tree & come out with 2%, the same way peasants calculate capital gains tax.

It is not clear what debt to GDP really shows. I mean Japan has debt to GDP of over 260% and anyone who has been to Tokyo recently will see a city of 30 mil way more appealing that anything in the US. The real issue is the country’s ability to meet obligations as they come due and so far the bond markets seem to think Japan and the US are doing alright. So about $38.5 billion was spent today to buy US treasuries going for out for 7 years and yielding about 3.5% and the yield curve seems to indicate that the bond market thinks that inflation should be coming down quite soon. The bond market isn’t always right but it is people and companies betting with their own money. That Germany, Korea and France have much lower debt to GDP levels may indicate that the market sees these countries as less able to generate wealth so as to repay debt — given that Korea has about the worst demographics in the developed world and Europe is also seen as low growth. Where would you rather put your money the US or France? Which isn’t to say that the US under Trump and Biden paying people to stay home and watch Netflix and enjoy essential services and thereby runup US debt was a brilliant idea.

Yes, I also immediately thought about Japan as a counterexample of the “high deb to GDP ratio is bad”.

If Japan’s situation proves that debt-to-GDP of 220% (the number on the IMF map) is not problematic, shouldn’t the EU limit for member nations be 220% rather than 60%? (it looks as though some other sources say that the current debt-to-GDP ratio for Japan is 255% now and will be 266% by the end of 2023)

A few points to consider:

– Deficits ballooned during the 2009 crisis, but there was no increase in inflation.

– France had inflation well below the average of the Eurozone

– Japan has the highest debt, and lower inflation than the US, UK, Eurozone, and France.

https://www.ft.com/content/088d3368-bb8b-4ff3-9df7-a7680d4d81b2

David: So the Eurocrats are wrong? Should there be no limit on the size of an EU member nation’s deficit? If 2009 proves that deficits do not lead to inflation and Japan proves that high debt-to-GDP does not lead to inflation, why not party/borrow on?

Philip — I’m not in favor of running deficits over the long term.

But I’m claiming that if you looked at the last 20 (or 50) years, and compared deficit spending vs inflation across different times and countries, you would not find any support that deficit spending drove inflation.

In fact, you might even find the opposite, since deficits tend to increase in times of recession, which tends to drive inflation down.

The past few years has been unusual in that we’ve had supply chain shocks, farm supply shocks, and energy shocks alongside the increase in govt spending, so it can be hard to untangle it all.

The NYTimes article does a pretty good job at highlighting the issues.

* Does this target make sense for the Eurozone? Hard to say. I’m not sure what happens if one country manages itself badly while other countries keep themselves under control. I guess we saw that with Greece, and it seems like Greece suffered and everyone else was fine. I suppose Germany is afraid of a collection of countries acting badly, then they team up to do something the Germans don’t like.

Inflation figures in Europe are a lie. In large cities, people are paying up to 50% of their salaries for rent.

Since Bidenflation we also have shrinkflation and worse products. For example, the prime brand for Aluminum mesh sponges for cleaning disappeared since the Russia sanctions. We are now sold inferior replacements for the same price that are smaller and unusable.

No one can afford energy. Garbage disposal costs are sky high. The Green party is very happy about all this since it works for their agenda.

Euroanon: The brave Eurozoners have been busting their “bad things will happen limits” since 2020. Deficit spending has been higher than 3% and overall debt-to-GDP in the Eurozone is over 90%. So we could hypothesize that the European borrowing/spending spree led to the European inflation. On the other hand, the Europeans weren’t nearly as profligate as Americans and inflation is about as strong in both places. Do we have to adjust for the fact that the U.S. dollar is more of a reserve currency and a place for people to hide when worldwide coronapanic or similar sets in?

philg: I think it is difficult to separate various factors. Housing and healthcare inflation already started under the zero-new-debt Merkel government (the fact that we had millions of refugees since 2015 is never mentioned and cannot possibly be a reason …).

Healthcare inflation accelerated in 2020 due to COVID policies and money printing. Food/energy inflation definitely started after the Russia sanctions, but of course you could also attribute it to late effects of free COVID money.

It is hard to find unbiased sources on these issues. I agree that the U.S. probably benefits from the reserve currency status.

Doesn’t higher inflation make it easier for the government to pay off debt? I thought I read that somewhere in MMT mumbojumboland years ago. If so, our higher inflation would make us better lendees than the Japanese.

Sam: That’s a great point. If the government’s debt were all 30- or 50-year bonds, inflation would wipe it out. But it looks as though the average maturity is about 5 years. So cheating the suckers (bondholders) via inflation doesn’t work that well. Our government can’t afford to pay it all off within 5 years so new bonds will have to be issued and investors will demand a higher yield so that will drive up borrowing costs and… the deficit!