We are informed by the Biden-Harris administration and media allies (“America’s fight with inflation has been won”, noted the Guardian a few days ago) that inflation has been vanquished. I wonder if there is a significant “leftover inflation” yet to come, though, from companies and people who neglected to raise prices or who were locked into long-term agreements during the core years of Bidenflation. The guys who push buttons at container ports recently won a 62 percent raise (ABC). Boeing workers recently won a 43 percent raise (NYT). A friend who owns an expensive-yet-crummy compound of wooden structures in Vermont (and a Grenadier INEOS that he loves) and rents a cottage out was just hit with a 100 percent increase by his long-time cleaner. I myself was recently hit by a 33 percent increase by the cleaner of the Harvard Square condo that I still own and rent out via AirBnB (cleaning cost up 60 percent compared to 2019). AT&T workers recently won what might be a 30 percent wage increase (wages boosted plus health insurance contributions lowered; the union).

The above-cited increases in costs must eventually be reflected in higher prices to consumers for (a) goods that come in via container ports, (b) airline tickets, (c) vacation rentals, (d) Internet and cable TV service. And the higher costs faced by consumers should lead to demands for higher wages in a classic Jimmy Carter-era wage-price spiral (I always predict this and, until the Biden-Harris-Whoever-Has-Actually-Been-Running-The-Country administration, was always proven wrong).

Today the wise minds of the Federal Reserve who at least partially authored Bidenflation will set interest rates. Readers: Who wants to predict what they announce and, more important, what official inflation (which doesn’t include most of the stuff that you’d spend money on, e.g., buying a house) will be on July 15, 2025, by which time the rate set today might have had some effect.

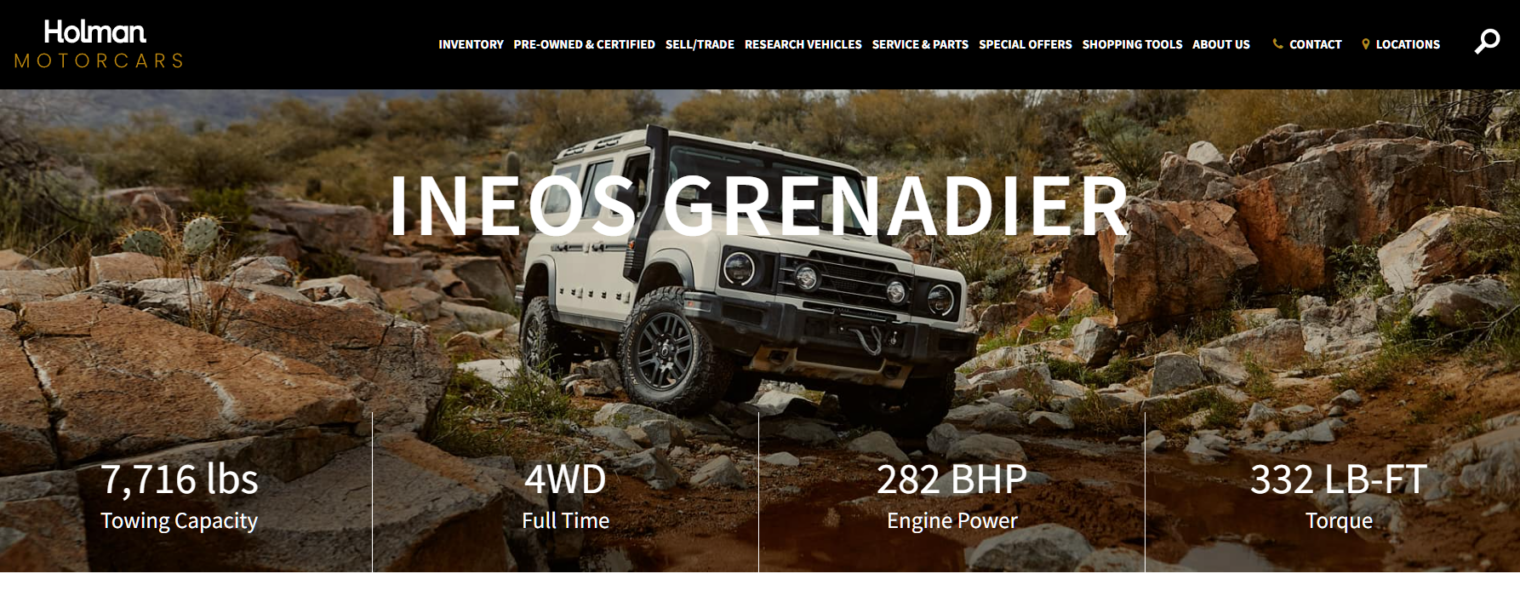

My prediction for the CPI released on July 15, 2025 is 3 percent. I’ll schedule a blog post to check this! Meanwhile, if you have 100,000 Bidies to spend on a 1970s tech Land Rover Series III-style vehicle made by a British billionaire who is a tax refugee living in Monaco… the Grenadier:

The above is the web site of the SE Florida dealer and features the rocky terrain that might be encountered on Ocean Drive in Miami Beach.

Update: The Fed did the expected thing and cut its rate by 0.25 percent.

Related:

@phil the 62 and 45 percent raise is for next 6 and 4 years. This is low compared what we(me and my wife) got in non unionized private companies for last 4 years. Now your guy Trump in office saying is going make prices go down(not the rate of inflation) we should be good going forward. He also said in his victory speech , paying down the debt and decreasing the taxes across the board which are really good for my net worth. May be you should start writing about these instead of looking back on Biden/Harris policies that led to Trump win.

Phil, can you walk me through the math/analysis in your 3% forecast for next July. And, which of the many “flavors” of the CPI (total, core etc.) are you forecasting?

Expecting the 1st $300 PG&E bill in the next year after it crossed $200 last year. 50% inflation is pretty normal now, but it’s all offset by falling used car prices.

Let’s drink liberal tears!

My prediction is that right-wing media (and blogs) will no longer care about inflation a year from now.

Under Biden, rising prices were a sign of terrible run-away inflation caused by reckless spending, bad policy, general stupidity, Kamala, etc.

Under Trump, the story will be rising salaries making everyone wealthy, and modest price increases will be small price to pay for everyone getting rich.

With so much winning, who cares about things being 3% more expensive?

However, everything changes if Trump actually implements the magical tariffs that he’s imagining, the broad tariffs paid for by entirely by China.

In that case, he’ll get a sudden lesson in economics and inflation will return until he realizes his mistake and reverses course.

https://www.statista.com/statistics/273418/unadjusted-monthly-inflation-rate-in-the-us/

@David, your prediction is probably spot on. However, if you believe this explains why Trump won the election and the popular vote — then you are still not getting it.

The key reason many Americans voted for Trump, despite the controversial statements he has made, isn’t because Americans belief that he will magically improve their lives. Americans voted for Trump, is a rejection of liberal policies and Democratic agendas. Americans have had enough of the “woke” ideas and Democratic overreach.

George — actually, I don’t think inflation is why Trump won the election.

Inflation was the #1 issue, but I don’t think this doomed them. It could have been overcome.

I think the 2 reasons are, very briefly:

– The Democrats have been insufferable the last 4 years wrt trans, the border, identity politics, going easy on crime, etc.

– Kamala was a terrible candidate

If you looked at the positions Kamala ran on, I think they were _mostly_ right. Pro-choice. Tight border control. Staying in NATO. Support for Ukraine. Support for Israel, but keeping their feet to the fire over civilian deaths.

But nobody believed she really believed them. I really have no idea what she really believes.

If they picked a center-left Governor who didn’t have Kamala’s baggage, and a normal human amount of sincerity, they would have won.

Democrats just needed someone who was savvy enough and skilled enough to think they could go on Joe Rogan and convince people they were right and not embarrass themselves.

This is the right story to read today: https://www.joshbarro.com/p/trump-didnt-deserve-to-win-but-we

Kamala lost the blue wall states by less than 2 points. If she won those, she would be president. Losing by 2% means you just need to change the mind of 1% of voters from Trump to you. A skilled candidate without woke baggage could have easily done this.

I don’t know if this qualifies as a “right-wing blog”, but I was writing about inflation during the first Trump dictatorship. Examples:

https://philip.greenspun.com/blog/2020/08/23/covid-paranoia-will-lead-to-inflation/

and

https://philip.greenspun.com/blog/2019/04/09/disney-world-ticket-price-inflation/

Fox News is frequently characterized by Democrats as “right wing”. They were publishing negative stories about inflation in 2018, for example:

https://www.foxnews.com/us/consumer-prices-up-2-9-pct-leaving-americans-worse-off

David: I agree with you that inflation doesn’t seem likely as an explanatory factor. The worst inflation was a few years ago and Americans seem to have short memories. Nobody asked Kamala Harris, Joe Biden, or Donald Trump questions about lockdowns and school closures, as far as I can remember. Coronapanic was an all-consuming American passion in 2020-2021 and today people have zero interest in it. So the massive inflation of 2021-2022 might be mostly forgotten.

Not forgotten by me, and, even worse, inflation over here sure hasn’t stopped.

@PhilG I know you wrote about inflation in 2019 & 2020, but in those blogs you did not blame sitting president(No mention of Trump). Your blog posts after Trump you blame/mention Biden in your posts.

Anon: By current standards of inflation tolerance there was nobody to blame during the first Trump dictatorship because inflation was 2-3% and, for some reason, the target isn’t 0% as one might expect.

Although I was fond of the neologism “Bidenflation”, most of the blog posts here explicitly blame the technocrats at the Fed. Example: https://philip.greenspun.com/blog/2022/03/14/the-money-mandarins-are-responsible-for-our-debased-money/

@PhilG can you explain (I am low IQ person) why it is called “Bidenflation”. If you look at the Corona Pandemic Relief Programs

Under Trump

The Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020 (Total $7.8B)

The Families First Coronavirus Response Act (Total $15.4B)

The Coronavirus Aid, Relief, and Economic Security Act, (CARES Act) (Total $2.1T)

Paycheck Protection Program and Health Care Enhancement Act (Total $483B)

under Biden

The Coronavirus Response and Relief Supplemental Appropriations Act, 2021 Consolidated Appropriations Act, 2021 (Total $900B)

The American Rescue Plan of 2021 (Total $1.9T)

Inflation is almost always caused by a preceding set of government officials from those who get the blame. Lyndon Johnson is responsible for more spending than any other president so far (though maybe Biden will end up being comparable depending on how many generations of welfare the latest flood of migrants end up consuming). Johnson created Medicare and Medicaid, which fueled massive inflation in health care costs as a percentage of GDP. Johnson expanded welfare programs such as free taxpayer-funded housing. Johnson started an expensive war (Vietnam), maybe with a bit of help from Kennedy. But inflation didn’t really get cooking until the Nixon/Ford years and then exploded during the Carter years.

In my view, informed by some of the books that I’ve review on the site, what we call “Bidenflation” is mostly due to decisions made during the Obama years, notably the “quantitative easing” method of cheating our way to prosperity. See https://en.wikipedia.org/wiki/Quantitative_easing#History

A third round of quantitative easing, “QE3”, was announced on 13 September 2012. In an 11–1 vote, the Federal Reserve decided to launch a new $40 billion per month, open-ended bond purchasing program of agency mortgage-backed securities. Additionally, the Federal Open Market Committee (FOMC) announced that it would likely maintain the federal funds rate near zero “at least through 2015”. … On 12 December 2012, the FOMC announced an increase in the amount of open-ended purchases from $40 billion to $85 billion per month.

—————

Interestingly, the lag from Johnson decisions to the mid-1970s inflation was about the same as the lag from the QE programs to Bidenflation.

I don’t think “Bidenflation” is completely unfair because everything that Biden did or tried to do was inflationary, e.g., student loan forgiveness, the “Inflation Reduction Act” (borrow and spend $1.7 trillion)

Last month, the City Council in a nearby, mid-size (pop. 90,000) agreed to a 30% wage increase over three years for police and firefighters (both represented by unions). General employees (non-union) received a flat $3000 raise – which would be a 6% raise for an experienced Administrative Assistant or experience Water Plant technician earning $50K. 3% for a senior mid-level manager earning $100K.

Recently, oddly, the members of the City union for blue collar trade worker voted to dissolve the union. Toward the end, less than 10% of its members were paying the $20/mo. union dues.

Yes, my future employers are overdue for some inflation, as my purchasing power has not kept up with the pressures of the Trump/Biden inflationary era. (Especially if the labor market is about to contract)