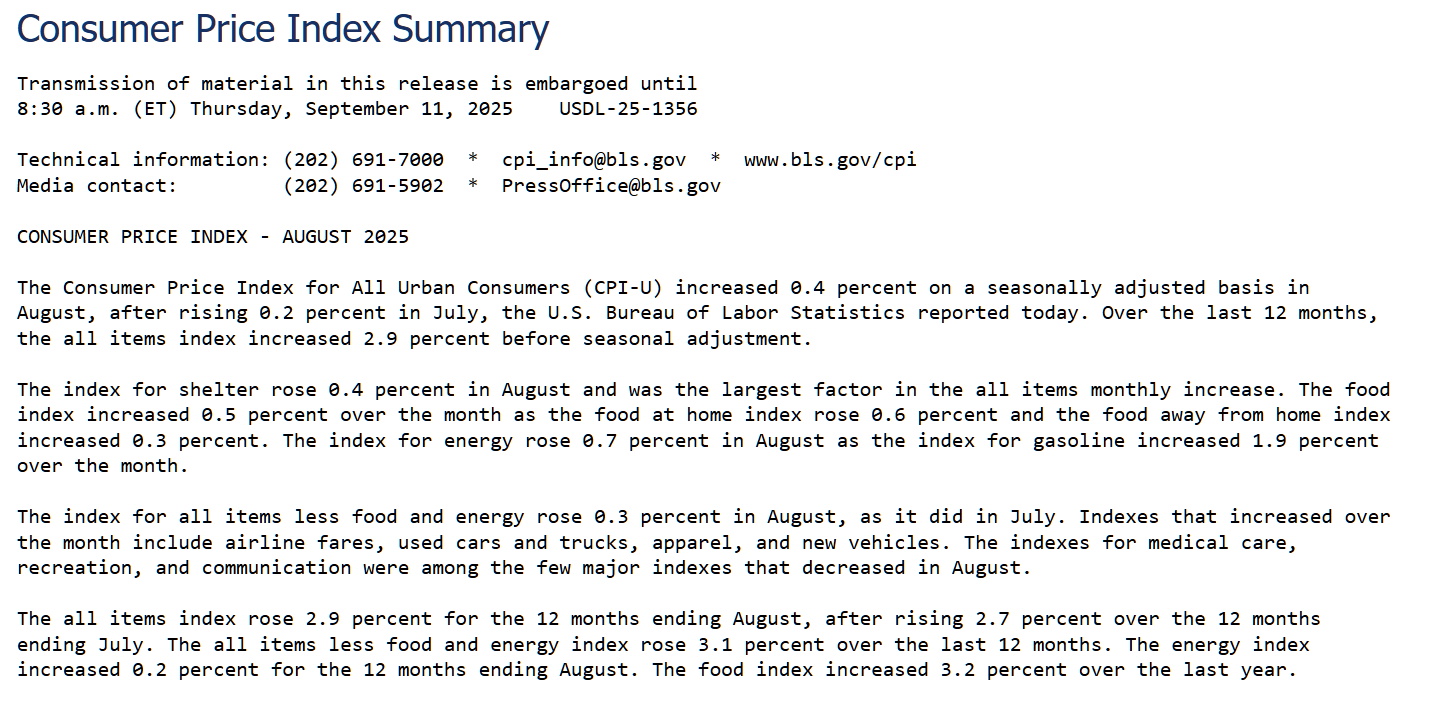

Inflation is currently raging at an annual rate of 4.8 percent (up 0.4 percent in the last month times 12) and is 2.9 percent if we look back to August 2024. From the BLS, yesterday:

High interest rates from the Fed haven’t slain the inflation dragon. My posts on this subject:

- Can our government generate its own inflation spiral? (2022)

- Could our epic deficits drive inflation no matter how high the Fed raises rates? (2022)

- Economist answers my question about high interest rates and high deficits (2022; answer to the above)

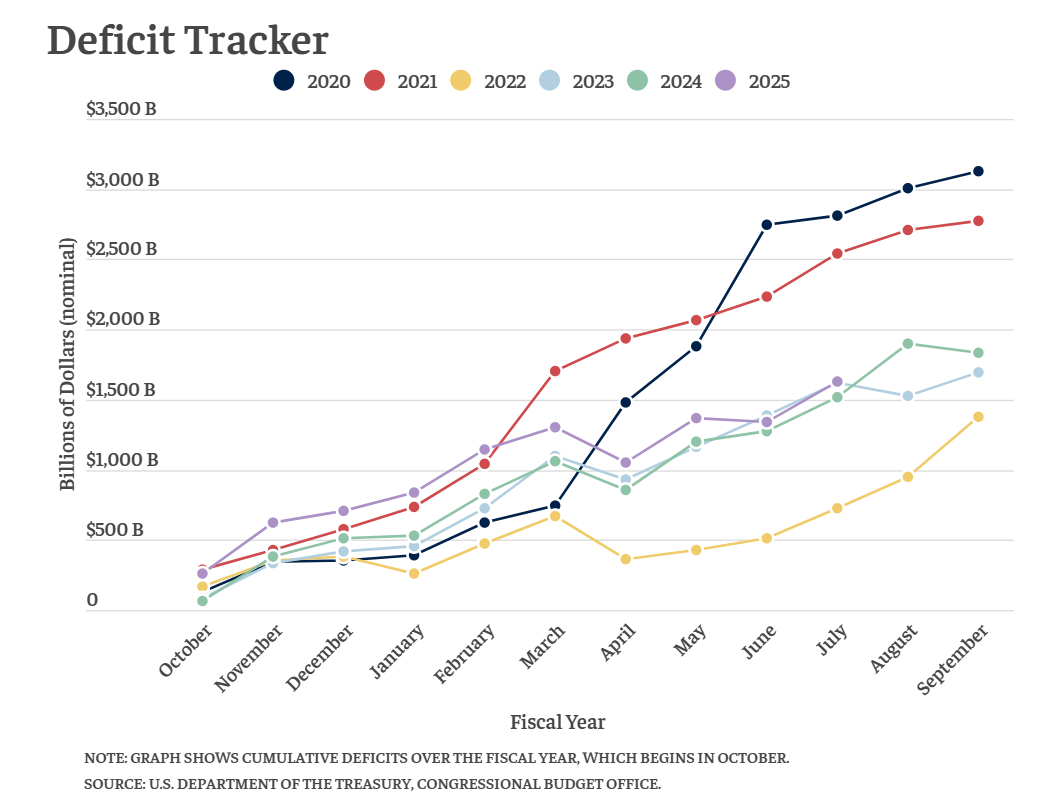

How eagerly/aggressively is Congress indulging in deficit spending right now? From the Bipartisan Policy Center (a “center” with two or three people in it?):

FY2025 (purple) is one of the most profligate years in U.S. history, but it doesn’t look that profligate because Congress was borrowing/printing money at an even faster rate during coronapanic.

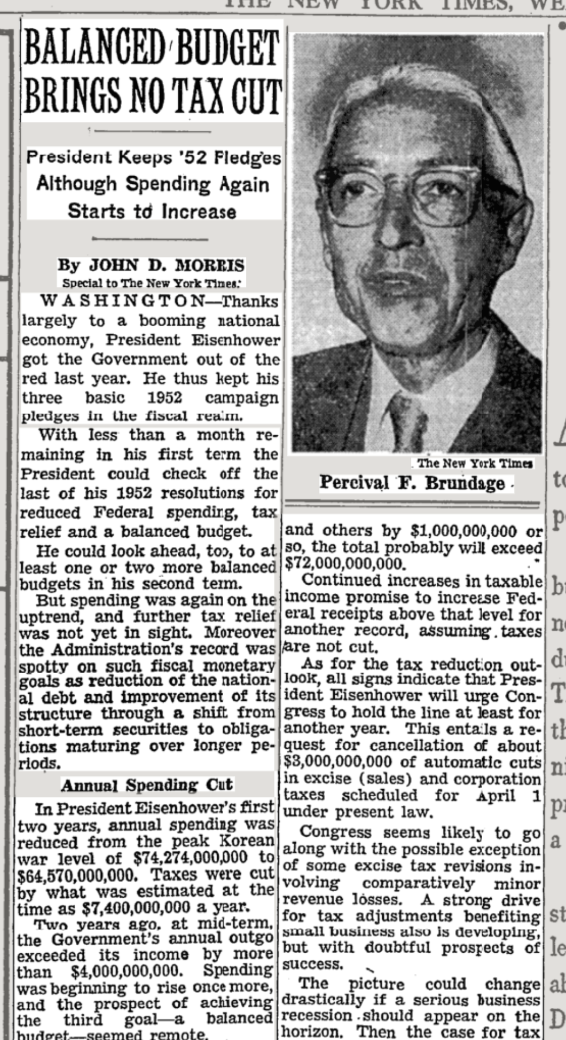

Flash back to January 2, 1957, in which the New York Times praises President Eisenhower for eliminating an astounding and upsetting $4 billion deficit for 1954 (adjusted for the inflation that the government assures us does not exist, this would correspond to a $48 billion deficit in 2025 (compare to the nearly $2 trillion deficit that Congress seems to have built into our economy and government; Eisenhower took strenuous action to eliminate a deficit that was 1/40th the size of today’s deficit)).

Interesting to see who owns the debt:

https://www.pewresearch.org/short-reads/2025/08/12/key-facts-about-the-us-national-debt/

> Interest on the national debt exceeds annual spending on Medicare, as well as national defense.

Credit card companies love it when that happens. I wonder what is considered “underwater” on our nation’s intrinsic value, especially by experts like Lisa Cook.

I seem to remember some of us gradually boiling frogs started noticing some heat, and our concerns were waved away with explanations like other nations’ debt-to-GDP were much higher (Japan comes to mind) and they were doing OK, right?

Did you get a picture of the National Debt Clock in NYC this year, Phil? (I can’t remember.)

https://en.wikipedia.org/wiki/National_Debt_Clock

1957 was also the year Rogers and Hammerstein, fine Columbia graduates, produced a TV musical of Cinderella with Julie Andrews viewed by over 100 million people. There probably is some analogy in that too.

Falling wages & electronics are subsidizing food & housing inflation once again. Food inflation is going to be 26% after the next rate cutting cycle, but it’s all going to be offset by falling wages.

$2T more new debt fuels inflation? It’s so obvious, you’d have to be an economist not to see it.

One problem is: no administration can afford to have allowed a deflationary period, because it will tank the economy, so the choices are either to somehow stay on the knife edge of low inflation, or to fall off into the inflationary spiral. That’s the best that can be done. The incentives are plain.

The good news is that we are positively loaded with debt, and inflation is good for debtors. Good for debtors and real-estate holders, and we are currently a society based upon real-estate-holding. Why build a factory if you can rent your parent’s house out to immigrants? The president himself is a real-estate-holder-in-chief.

SM: https://en.wikipedia.org/wiki/Money_illusion is powerful so you’re right that politicians need enough inflation to ensure that at least 95% of Americans who own stocks and real estate have a higher nominal portfolio value at each election. Even a house in Detroit today is worth more, in nominal terms, than a Detroit house was in the 1950s when Detroit was one of the richest cities in the world.

As I inch closer and closer to retirement, I need high inflation and the corresponding high wage increases to boost my average high-five annual salary and, ultimately, my government pension.

Inflation is caused by too much money being printed. Mostly to finance unpopular wars (Afghanistan and Iraq). But if you pay an economist or politician enough to deny it, he’ll be happy to claim it’s something else (corporate greed, interest rates, other countries, the list is literally endless).

What about the war on Covid? I think my free government “stimulus” checks would be worth more as collectors items than in the bank.

@Anonymous Too: “What about the war on Covid? I think my free government “stimulus” checks”

It was way, way more than the measly $1600 stimulus checks(or whatever it was) that went out to eligible low-income workers. More so, it was the hundreds and hundreds of PPP, Covid, SBA, unemployment, business and student loan forgiveness, free money that went out, especially to all the scammers.

@DP

I guess I’ve doxed my anonymous self. (And who are you calling “low income”, Prole?) Married filing jointly, we got a handsome AGI-phased-out $50 from CARES under Trump, which bought 1 burrito from Chipotle, with delivery tip and chips but no guac, for our family to split. $450 from ACT, signed by Biden’s mechanical autopen, paid for a couple of screws, now rusting, on our $20,000 (Covid profiteering-inflated bucks) air conditioner. What was your point again? Oh, right, big mega companies rode the gravy train of corporate welfare too.

Genuine question- what’s the way out of this ?

Net Cash Flow = Cash Inflows – Cash Outflows

Lower outflows, or raise inflows, or both.

Genuine answer.

Willie Sutton said he robs banks “because that’s where the money is.” The only way out of our disastrous debt situation is to significantly increase taxes on millionaires and billionaires. Why? For the same reason Willie Sutton robbed banks. America’s debt situation, though, is quite unique. Never before in history has a great debtor nation ever owed its debt in its own currency. We are living in unprecedented times. How is all of this going to work itself out? Who the fuck knows!

Anon: It is impossible to run a modern welfare state by taxing only the rich. The European countries prove that because most started out with a “tax the rich” scheme and eventually had to resort to a massive regressive value-added tax (20% sales tax, essentially). The U.S. comes the closest to the dream world in which the rich people fund everything, but still the top 1% pay only about 40 percent of individual income tax.

The U.S. actually could get out of the current fiscal/debt bind with a combination of the following: (1) insane GDP growth due to AI or maybe just Nvidia selling chips to other countries hoping for an AI bump, (2) inflation that renders the current U.S. debt insignificant (has to be coupled with deficit reduction since we won’t want to pay 25% interest rate on new borrowing!), (3) cuts to the “means-tested everything” system (formerly “welfare”) that drive up labor force participation and reduce the deficit.

From yesterday:

https://www.foxbusiness.com/politics/federal-budget-deficit-grows-92b-nearly-2-trillion-even-trump-tariffs-increase-revenue

> Net Cash Flow = Cash Inflows – Cash Outflows

By all means, add 0.001%-ers to Cash Inflows, and remove them from Cash Outflows–you have my vote.

AT: If you really want to get money out of the 0.001%-ers the first step would be eliminating the charitable contribution deduction. That’s how Bill Gates and Warren Buffett, for example, are escaping taxation. Instead of paying capital gains on his Microsoft stock, for example, Bill Gates can give appreciated stock to his foundation, which then sells it tax-free and ships the proceeds to Africa.

AT: You’d also need to have the US divest itself of Puerto Rico or let Puerto Rico in as a state. Otherwise all of the rich people could escape any new federal or state taxes by moving to Puerto Rico and paying 4%. https://www.gq.com/story/how-puerto-rico-became-tax-haven-for-super-rich

@philg

My wife would *never* let me in that 53rd state (after Canada and Greenland), too many Chavs in U.S.A. flag bikinis. [On the downlow, is moving there really doable for a near prole American? Asking for a friend.] The Ivy Leaguers I knew officially thought PR was kind of low end. Smokescreen?

How about eliminating tax-exempt status for non-profits and churches and “churches”? Or, at least setting a tax rate at some number > 0.

Raging inflation and mounting deficits are not just problems in the U.S. –they are in Europe and many other countries around the world. The blame lies largely with bloated welfare systems and illegal migration. Meanwhile, we are constantly told that global warming will kill us, yet inflation and deficits are treated as an afterthought.

It is time for Greta Thunberg to take up the fight against inflation and deficits. Only then can we truly be saved!

If the monthly inflation rate turns out to be the trend rate, the Fed needs to set rates closer to 7%. Imagine how popular that would be in Pennsylvania Ave.