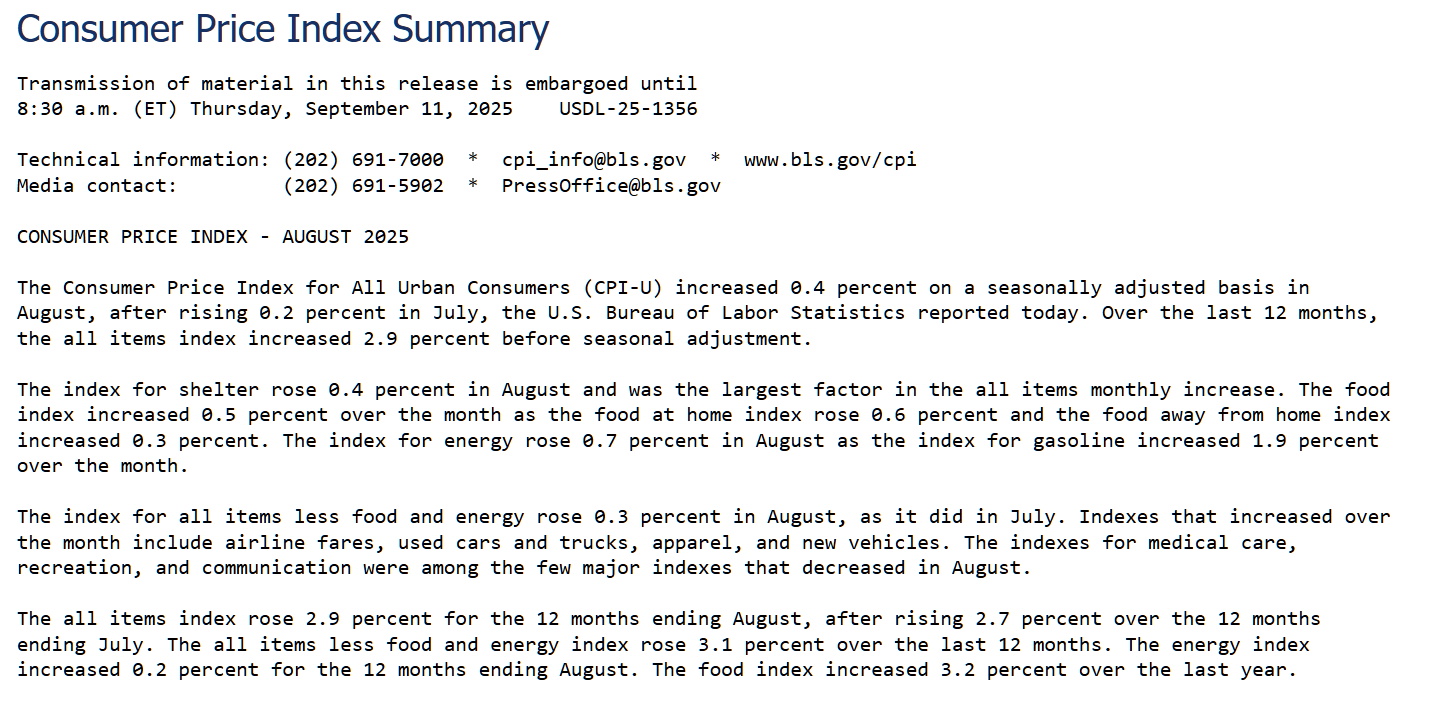

Inflation is currently raging at an annual rate of 4.8 percent (up 0.4 percent in the last month times 12) and is 2.9 percent if we look back to August 2024. From the BLS, yesterday:

High interest rates from the Fed haven’t slain the inflation dragon. My posts on this subject:

- Can our government generate its own inflation spiral? (2022)

- Could our epic deficits drive inflation no matter how high the Fed raises rates? (2022)

- Economist answers my question about high interest rates and high deficits (2022; answer to the above)

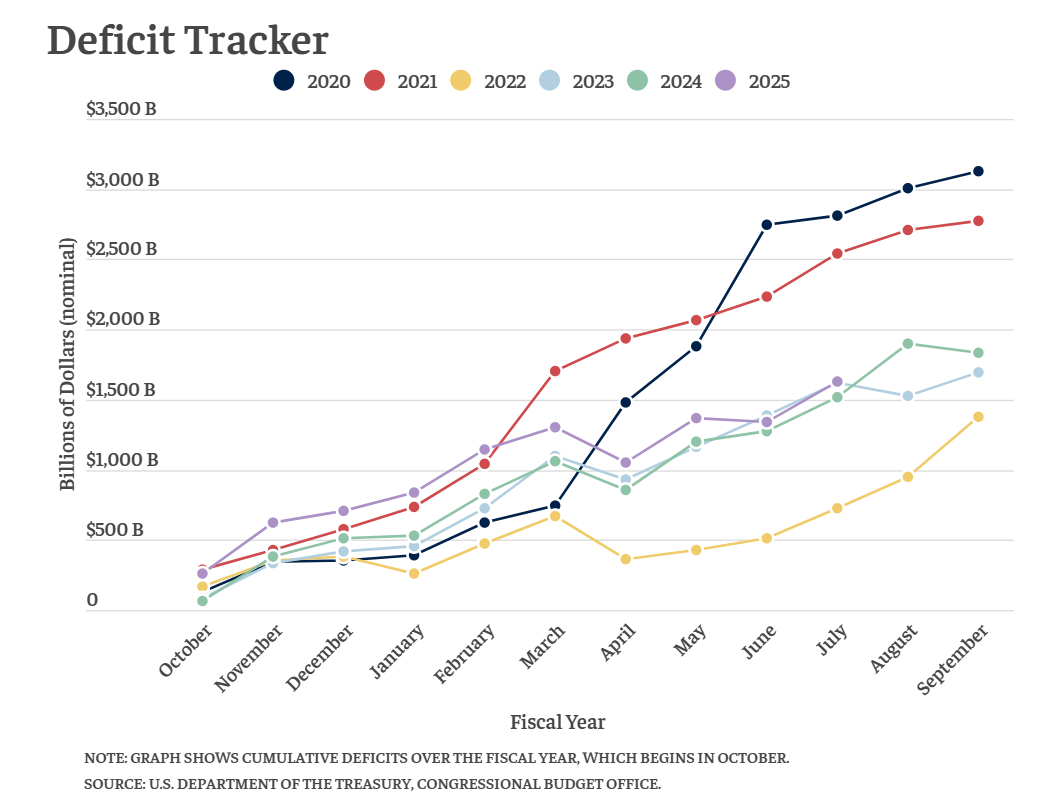

How eagerly/aggressively is Congress indulging in deficit spending right now? From the Bipartisan Policy Center (a “center” with two or three people in it?):

FY2025 (purple) is one of the most profligate years in U.S. history, but it doesn’t look that profligate because Congress was borrowing/printing money at an even faster rate during coronapanic.

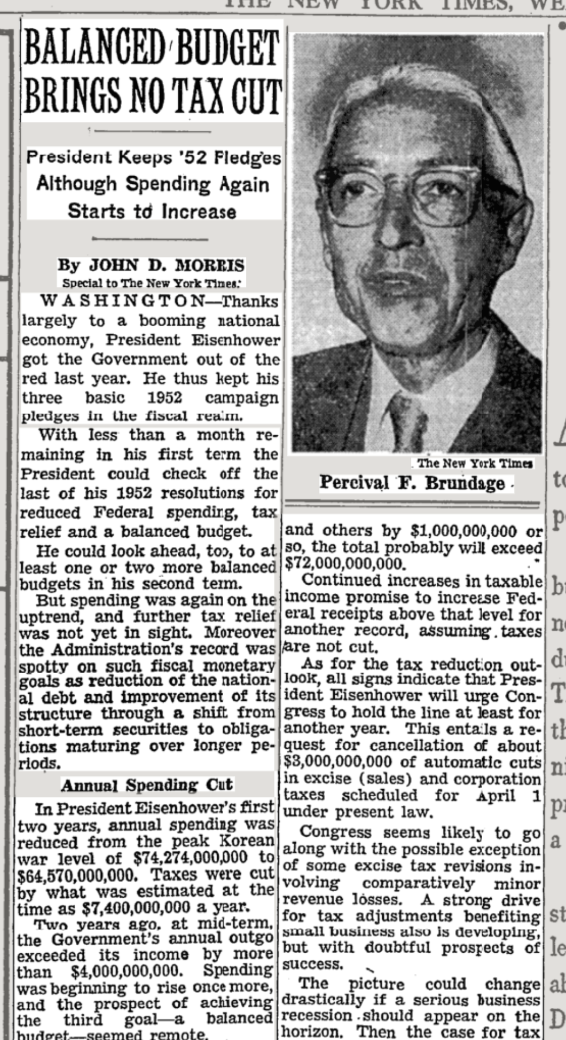

Flash back to January 2, 1957, in which the New York Times praises President Eisenhower for eliminating an astounding and upsetting $4 billion deficit for 1954 (adjusted for the inflation that the government assures us does not exist, this would correspond to a $48 billion deficit in 2025 (compare to the nearly $2 trillion deficit that Congress seems to have built into our economy and government; Eisenhower took strenuous action to eliminate a deficit that was 1/40th the size of today’s deficit)).

Interesting to see who owns the debt:

https://www.pewresearch.org/short-reads/2025/08/12/key-facts-about-the-us-national-debt/

> Interest on the national debt exceeds annual spending on Medicare, as well as national defense.

Credit card companies love it when that happens. I wonder what is considered “underwater” on our nation’s intrinsic value, especially by experts like Lisa Cook.

I seem to remember some of us gradually boiling frogs started noticing some heat, and our concerns were waved away with explanations like other nations’ debt-to-GDP were much higher (Japan comes to mind) and they were doing OK, right?

Did you get a picture of the National Debt Clock in NYC this year, Phil? (I can’t remember.)

https://en.wikipedia.org/wiki/National_Debt_Clock

1957 was also the year Rogers and Hammerstein, fine Columbia graduates, produced a TV musical of Cinderella with Julie Andrews viewed by over 100 million people. There probably is some analogy in that too.

Falling wages & electronics are subsidizing food & housing inflation once again. Food inflation is going to be 26% after the next rate cutting cycle, but it’s all going to be offset by falling wages.

$2T more new debt fuels inflation? It’s so obvious, you’d have to be an economist not to see it.

One problem is: no administration can afford to have allowed a deflationary period, because it will tank the economy, so the choices are either to somehow stay on the knife edge of low inflation, or to fall off into the inflationary spiral. That’s the best that can be done. The incentives are plain.

The good news is that we are positively loaded with debt, and inflation is good for debtors. Good for debtors and real-estate holders, and we are currently a society based upon real-estate-holding. Why build a factory if you can rent your parent’s house out to immigrants? The president himself is a real-estate-holder-in-chief.

SM: https://en.wikipedia.org/wiki/Money_illusion is powerful so you’re right that politicians need enough inflation to ensure that at least 95% of Americans who own stocks and real estate have a higher nominal portfolio value at each election. Even a house in Detroit today is worth more, in nominal terms, than a Detroit house was in the 1950s when Detroit was one of the richest cities in the world.

As I inch closer and closer to retirement, I need high inflation and the corresponding high wage increases to boost my average high-five annual salary and, ultimately, my government pension.

Inflation is caused by too much money being printed. Mostly to finance unpopular wars (Afghanistan and Iraq). But if you pay an economist or politician enough to deny it, he’ll be happy to claim it’s something else (corporate greed, interest rates, other countries, the list is literally endless).

What about the war on Covid? I think my free government “stimulus” checks would be worth more as collectors items than in the bank.