I personally don’t think economic performance is relevant when evaluating coronaplague policy. In a world where people don’t care about anything other than Covid-19 death risk, what difference does it make if they’re getting richer or poorer? That said, unemployment and poverty do lead to poor health outcomes and death. It just takes a while. So there is also a health angle to economics (see this post from March: “If All Lives Have Equal Value, why does Bill Gates support shutting down the U.S. economy?”).

“‘Striking’ Crisis Gap Exposed as Swedish Economy Stands Out” (Bloomber, June 16):

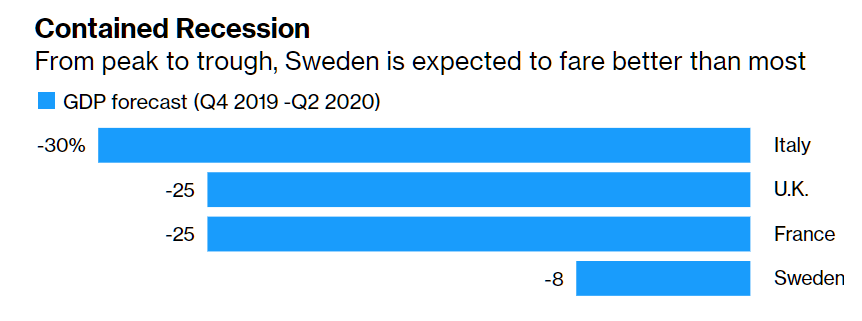

In a report on Monday, Capital Economics presented data that give Sweden an irrefutable edge. From peak to trough, Swedish GDP will shrink 8%; in the U.K. and Italy, the contraction is somewhere between 25% and 30%, according to estimates covering the fourth quarter of 2019 through to the second quarter of 2020. The U.S. is somewhere in the middle, it said.

Sweden has kept shops, gyms, schools and restaurants open throughout the pandemic. But the strategy, which the government says wasn’t shaped with the economy in mind, has resulted in one of the world’s highest mortality rates. Sweden’s state epidemiologist recently acknowledged he would have opted for a tighter lockdown with the benefit of hindsight.

(The article is written for American members of the Church of Shutdown, so the journalist points that Sweden has “one of the world’s highest mortality rates” without noting that the U.S. overall, in Month 4 of various degrees of shutdown, is only about 30 percent behind Sweden, that plenty of U.S. states have experienced higher death rates so far than Sweden, and that some countries that did shut down actually have higher mortality rates than Sweden. And, of course, Sweden is not actually planning on a “tighter lockdown” even when the inevitable second wave hits (Sweden’s latest plan).)

A figure from the article:

A gun enthusiast friend is able to say, in response to about 90 percent of news articles about companies or universities, “most gunshot wounds are self-inflicted.” These economic data from the Shutdown Karen countries add some ammunition to his theory!

(Again, since nobody cares about how poor they become, as long as they can be saved from the evil virus, I don’t think the self-inflicted impoverishment of the shutdown nations is relevant except that it will inevitably result in a shorter life expectancy and more deaths in the long run than any conceivable savings of Covid-19 deaths from the shutdown. See the Preston curve of life expectancy vs. per capita income.)

There might be some measurement errors for the U.S. A lot of our GDP for this quarter, for example, is going to be cleaning up cities after riots, the classic broken window fallacy. Also, people have been spending like crazy to try to adapt to the shutdown. Americans would prefer to go to a gym, but they’re buying home exercise gear as an interim stopgap. (Sweden’s gyms never closed, so they wouldn’t have as much of this type of no-added-value spending.) Americans would prefer to meet people in person, but they’re buying webcams for the Zoom sessions that they don’t enjoy. Ordinarily, Americans don’t need everything in the house or yard to be perfect, but as long as they’re locked into their houses why not fix everything up and tell the landscapers to go deluxe? (Anecdote: We had our shrubs mulched for the first time! I wanted to give Joe the Electrician some work, so we had him do a bunch of low-importance fixes (bad news for the Democrats who envision themselves as champions of the working American; like Joe the Plumber, Joe the Electrician is not easy to persuade: “The thing about Trump is that he does what he said he was going to do.”). Maybe all of this will cost $3,000 and add $500 in long-term value to the house?)

Full post, including comments