Why isn’t Cleveland gentrified?

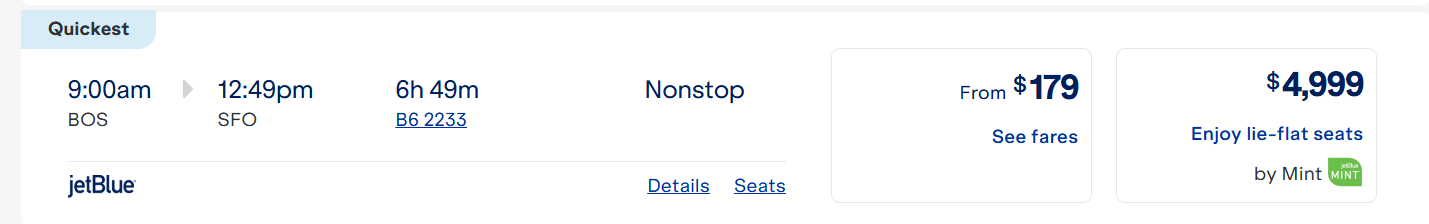

Some photos from a recent trip to Cleveland. Here’s some signage from the Cleveland History Center:

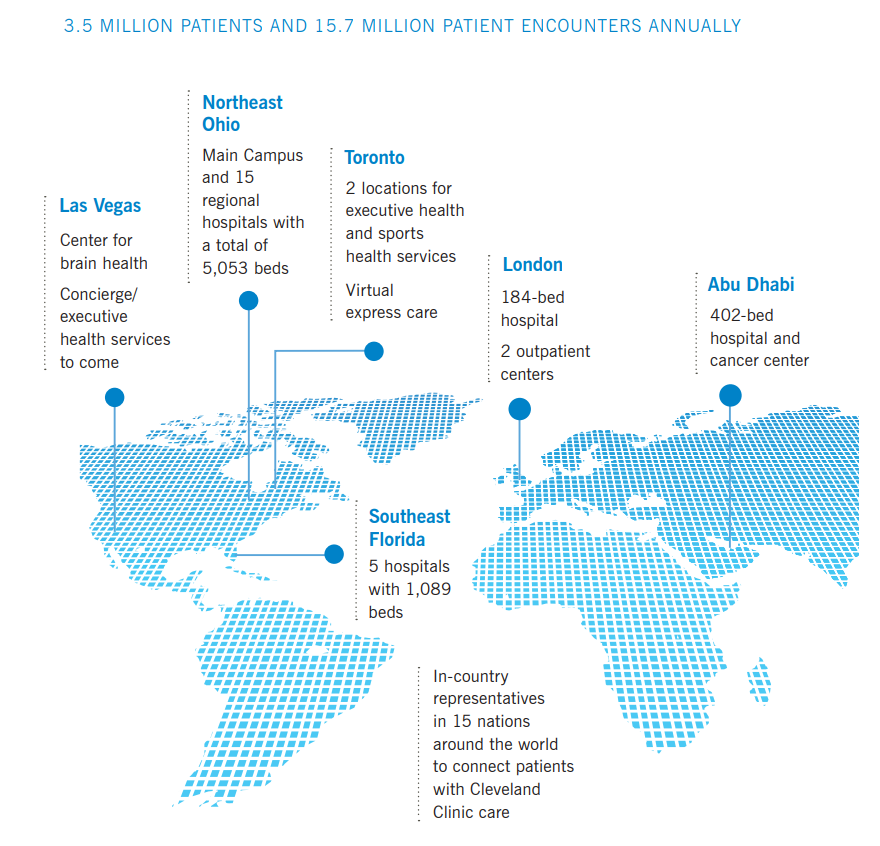

By 1920, according to the local history nerds, Cleveland was rich in precious immigrants, had achieved a dream level of diversity (30 different ethnic groups), and was “progressive”. Just a few years later, though, the economic and population growth was over. It doesn’t seem as though Cleveland per se has ever recovered even as many of its suburbs have prospered and even though Cleveland is home to one of the world’s most successful health care enterprises, the Cleveland Clinic.

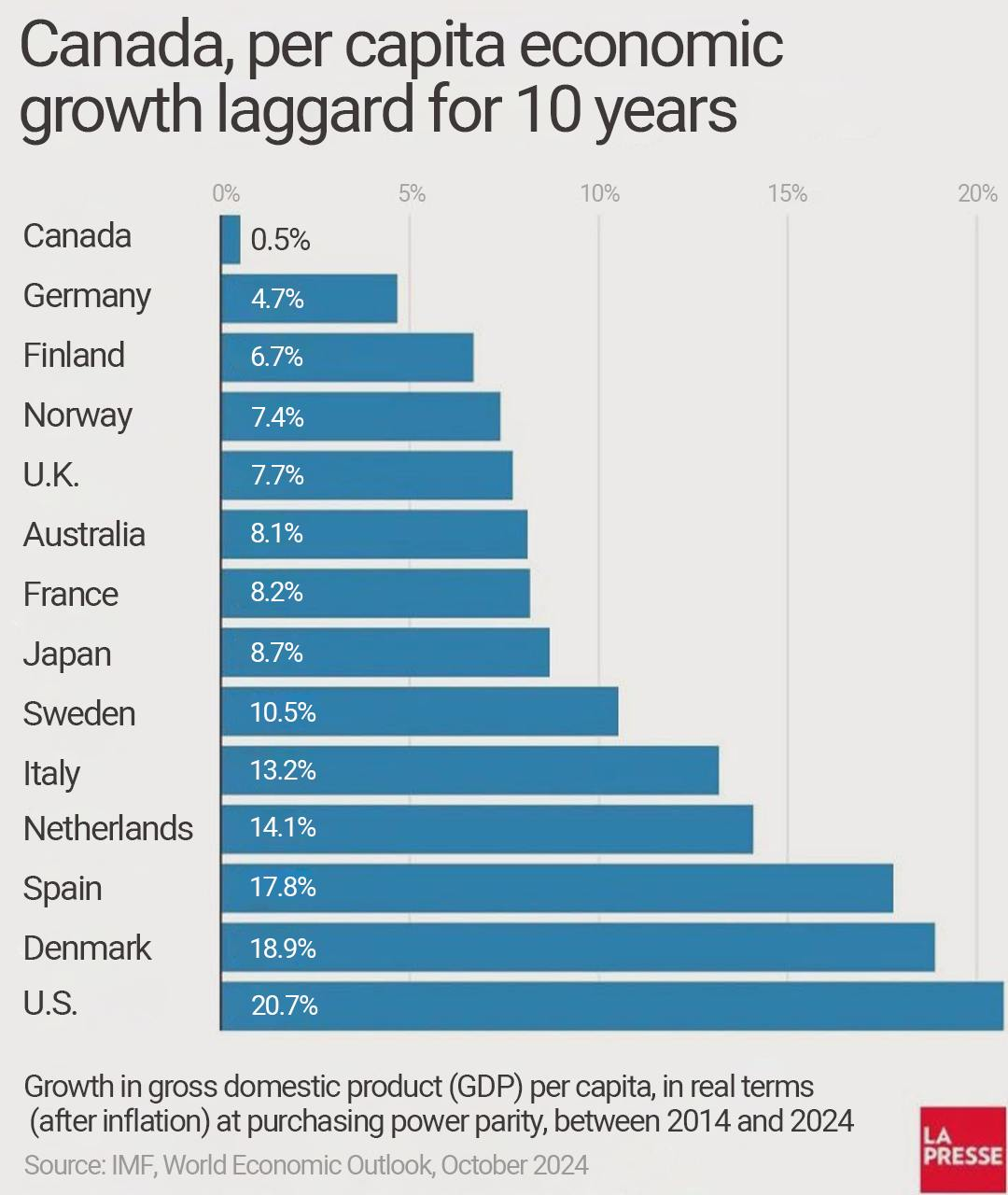

Nearly every other American downtown has become gold-plated. How did Cleveland manage to fail?

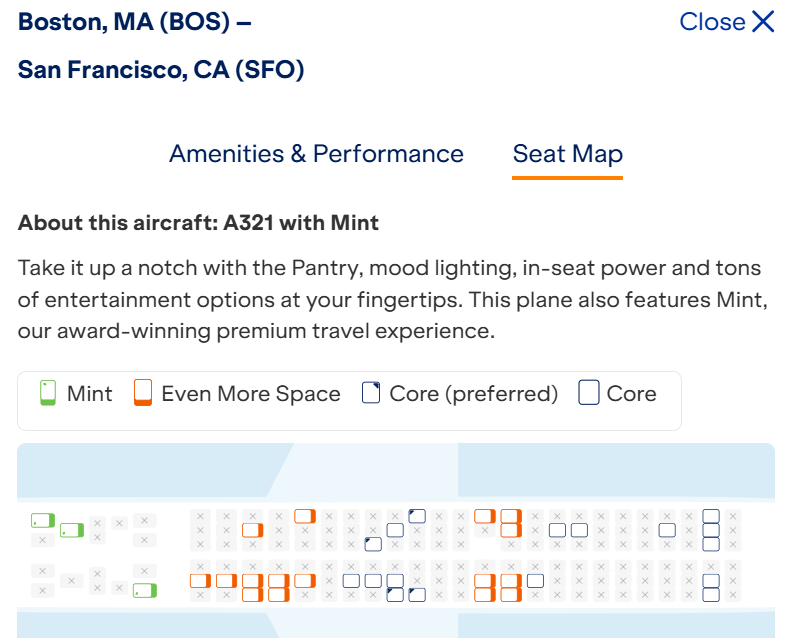

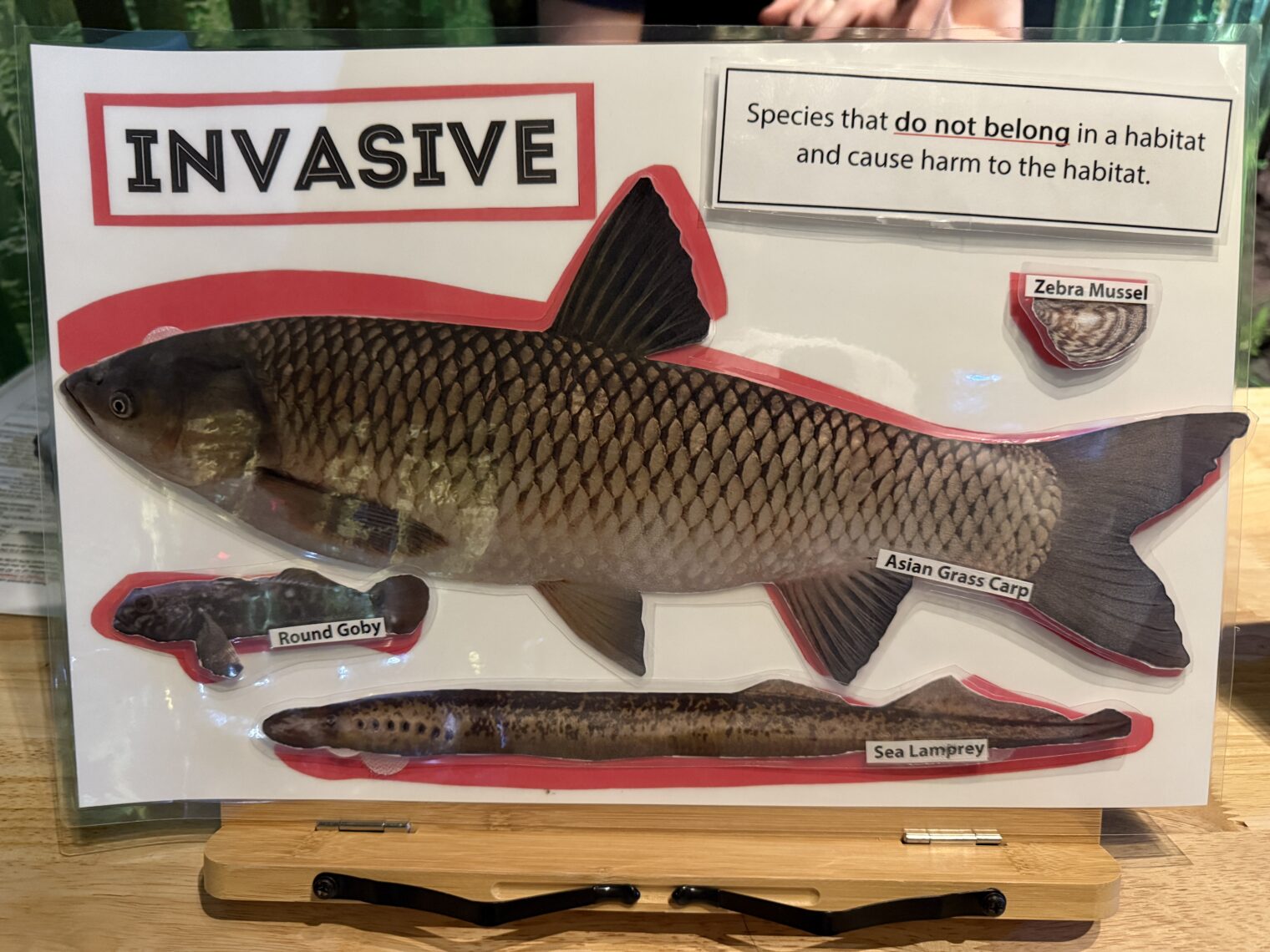

Across town at the Aquarium, the scientists say that immigrants “cause harm to the habitat”:

Back to the history center… It’s free to anyone who wisely refrains from work (EBT card) and they’ve preserved their COVID signage and mask-wearing habits:

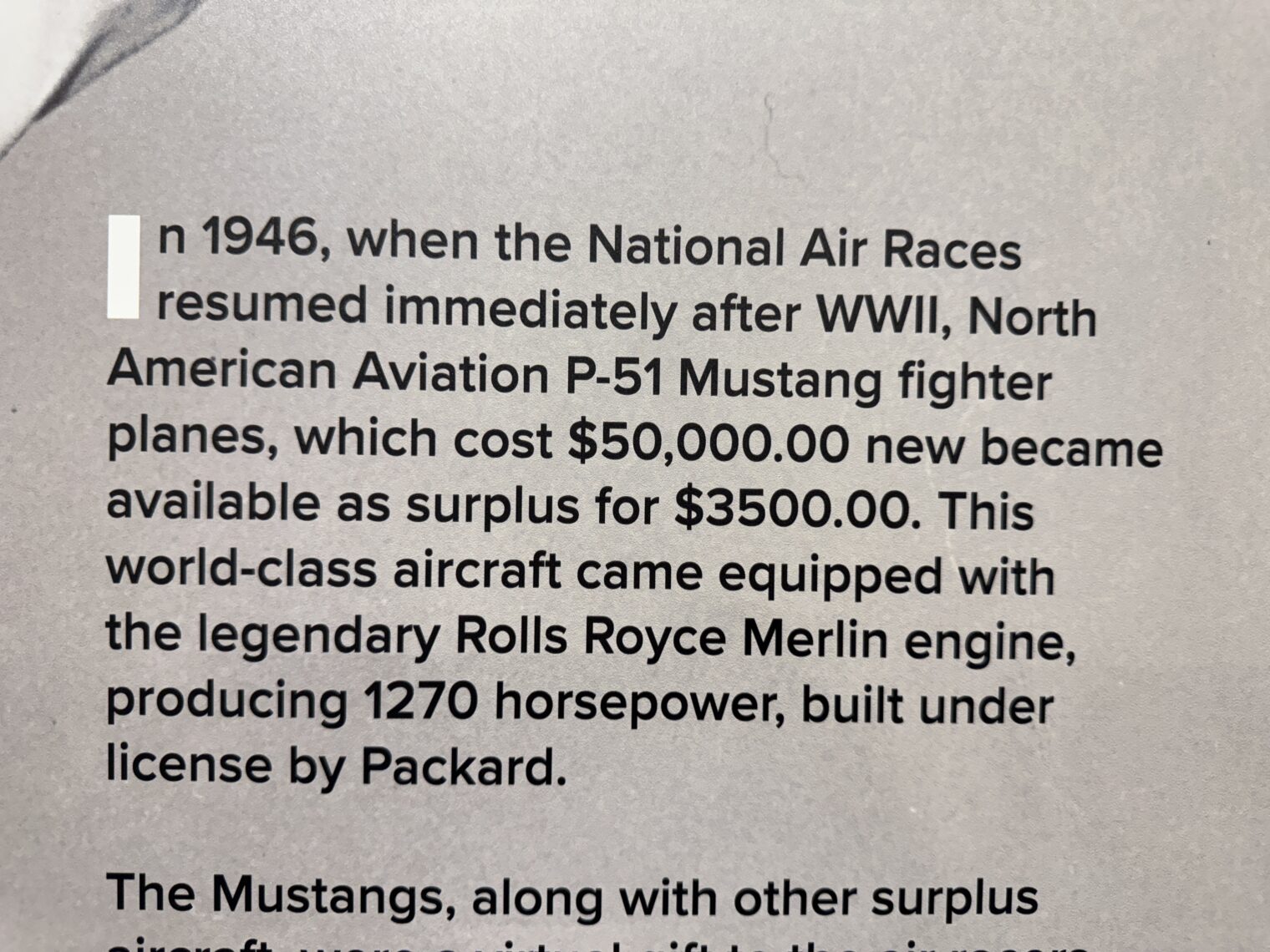

The museum reminds those who are buying Cirrus SR22 G7s at $1.4 million (now fully deductible in Year 1 due to the recent One Beautiful Bill) that we live in an inflation-free society. A P-51 Mustang that could take off at 12,000 lbs. and cruise at 315 knots cost $50,000 brand new or $3,500 lightly used:

If Tesla can get Optimus to work, how about a return to wood-sided cars? The robot can apply polish to the wood every week:

The museum’s collection is especially strong in hybrid and electric cars, some more than 100 years old. Visitors are reminded that Cleveland was at one time a close second to Detroit in mass production of automobiles (which raises the question of why Cleveland auto manufacturing faded into insignificance).

The museum was hosting a special show of Islamic-American fashion:

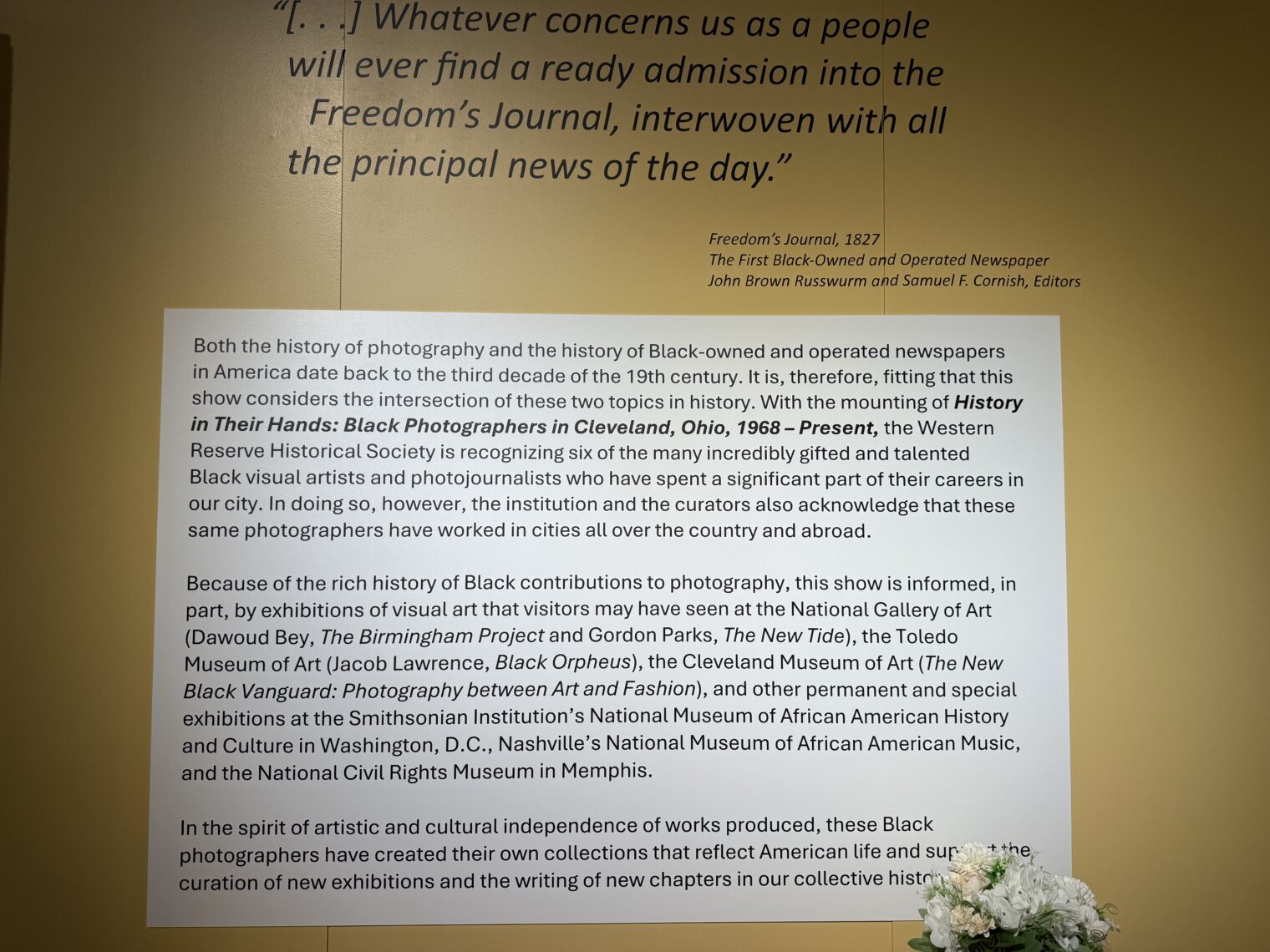

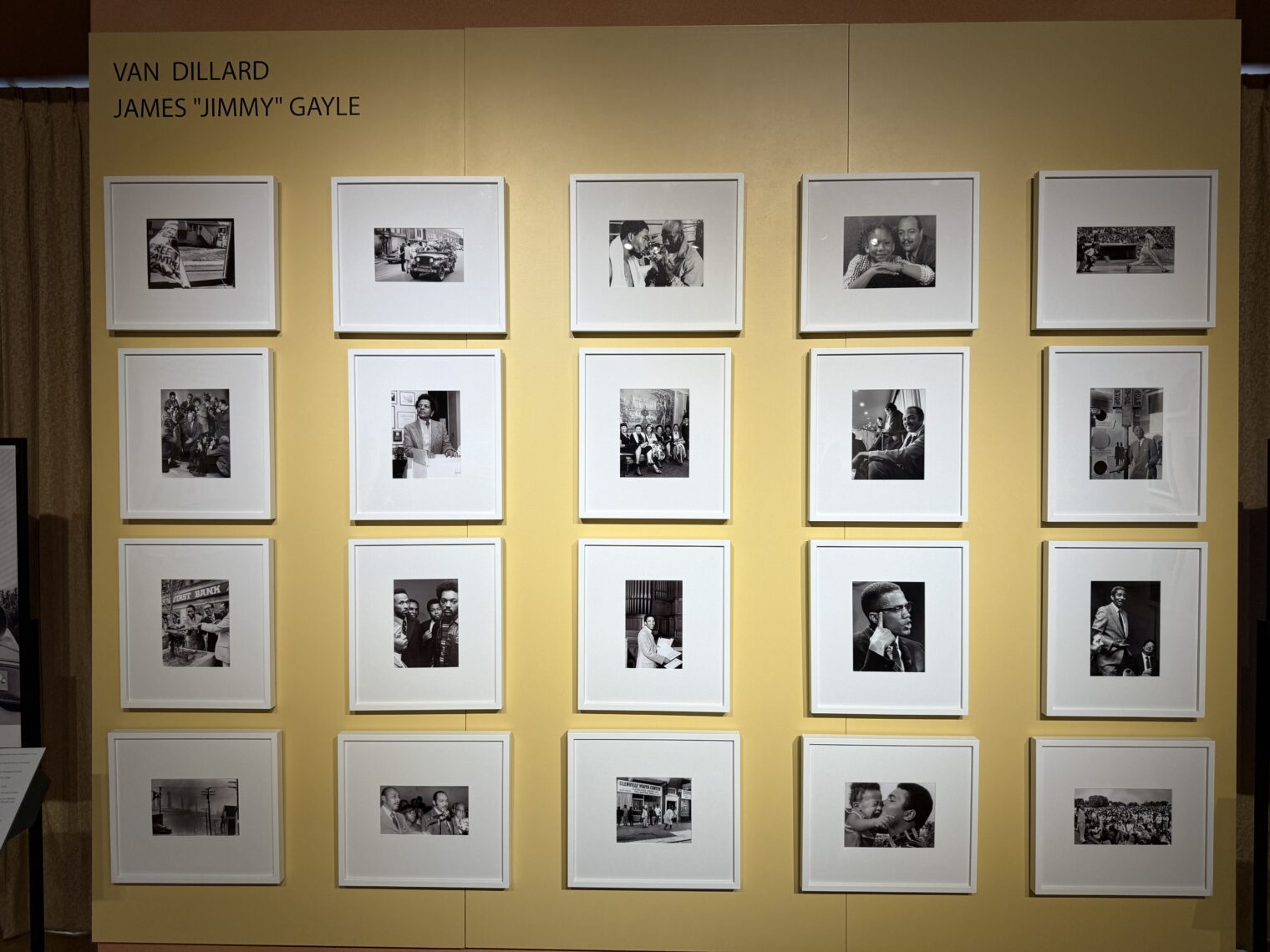

A temporary exhibition featured Black photographers and, as it happened, all of the photographs on display were of Black subjects (i.e., there weren’t photos of architecture, landscape, or nature taken by Black photographers, but only pictures of Black people by Black people):

(More than half of the money for any museum like this comes from taxpayers, either through deductibility of donations or from direct grants from the government. So taxpayers are funding exhibitions from which some artists/photographers are excluded due to skin color, apparently contrary to the Equal Protection Clause of the U.S. Constitution.)

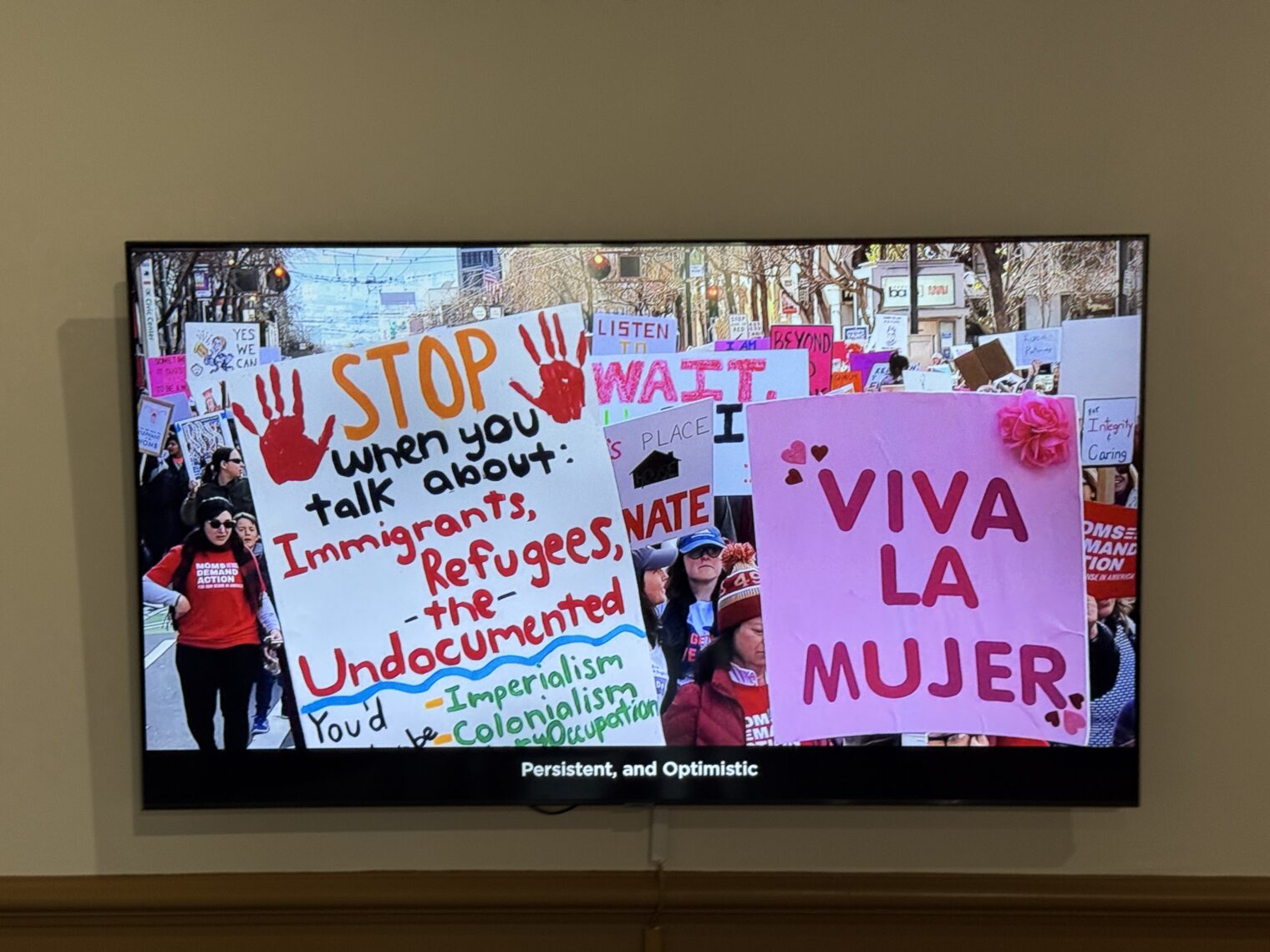

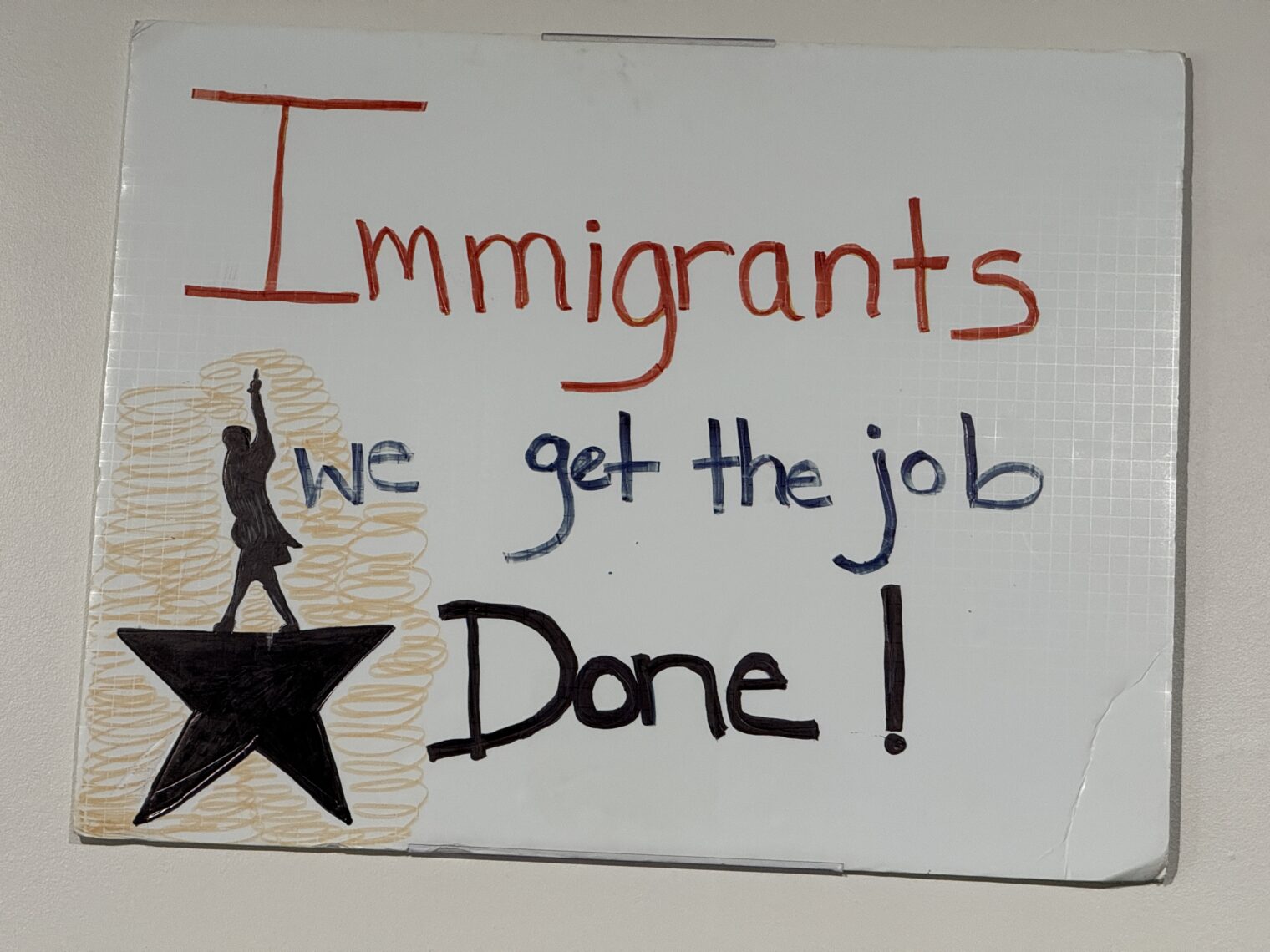

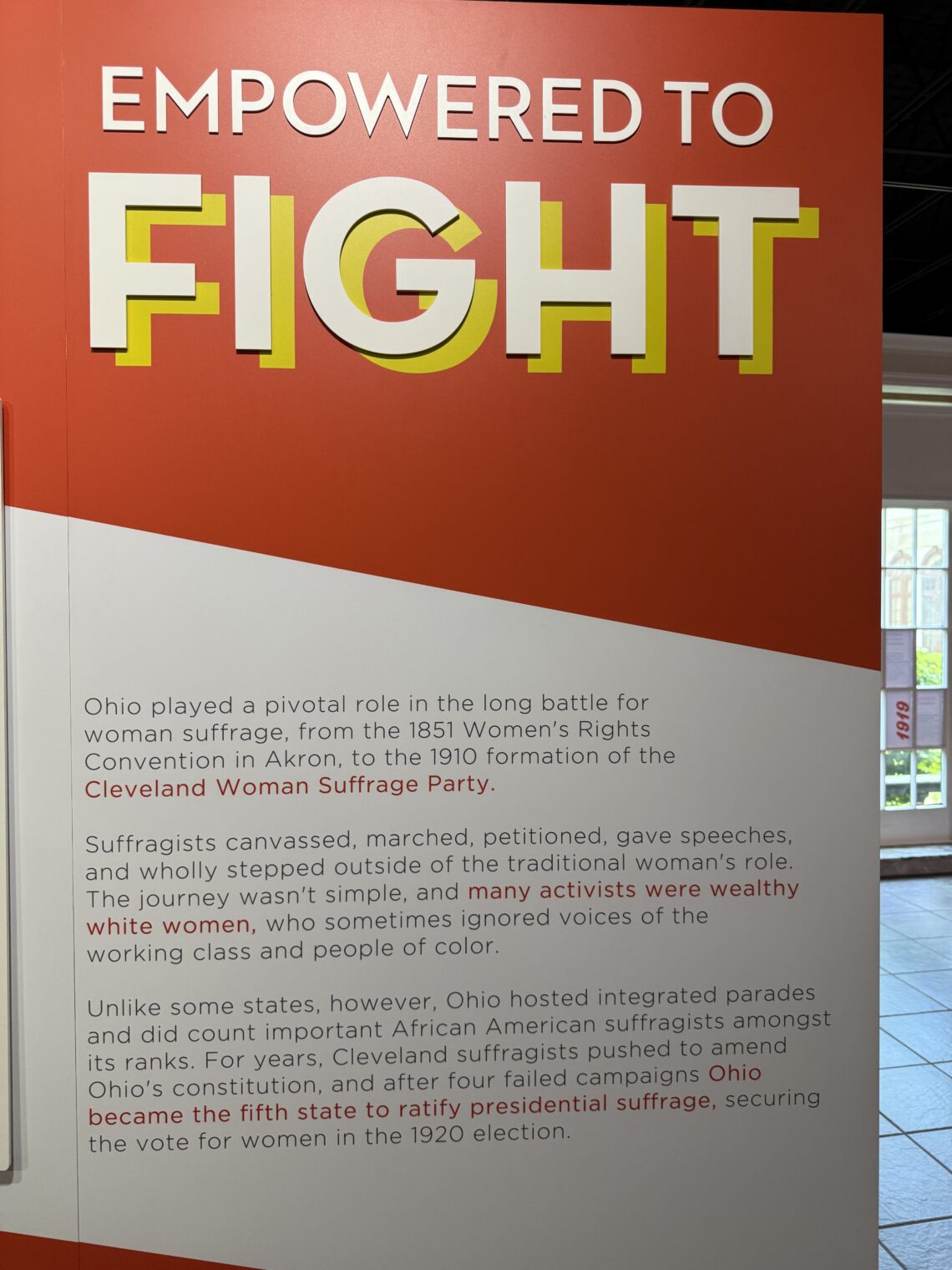

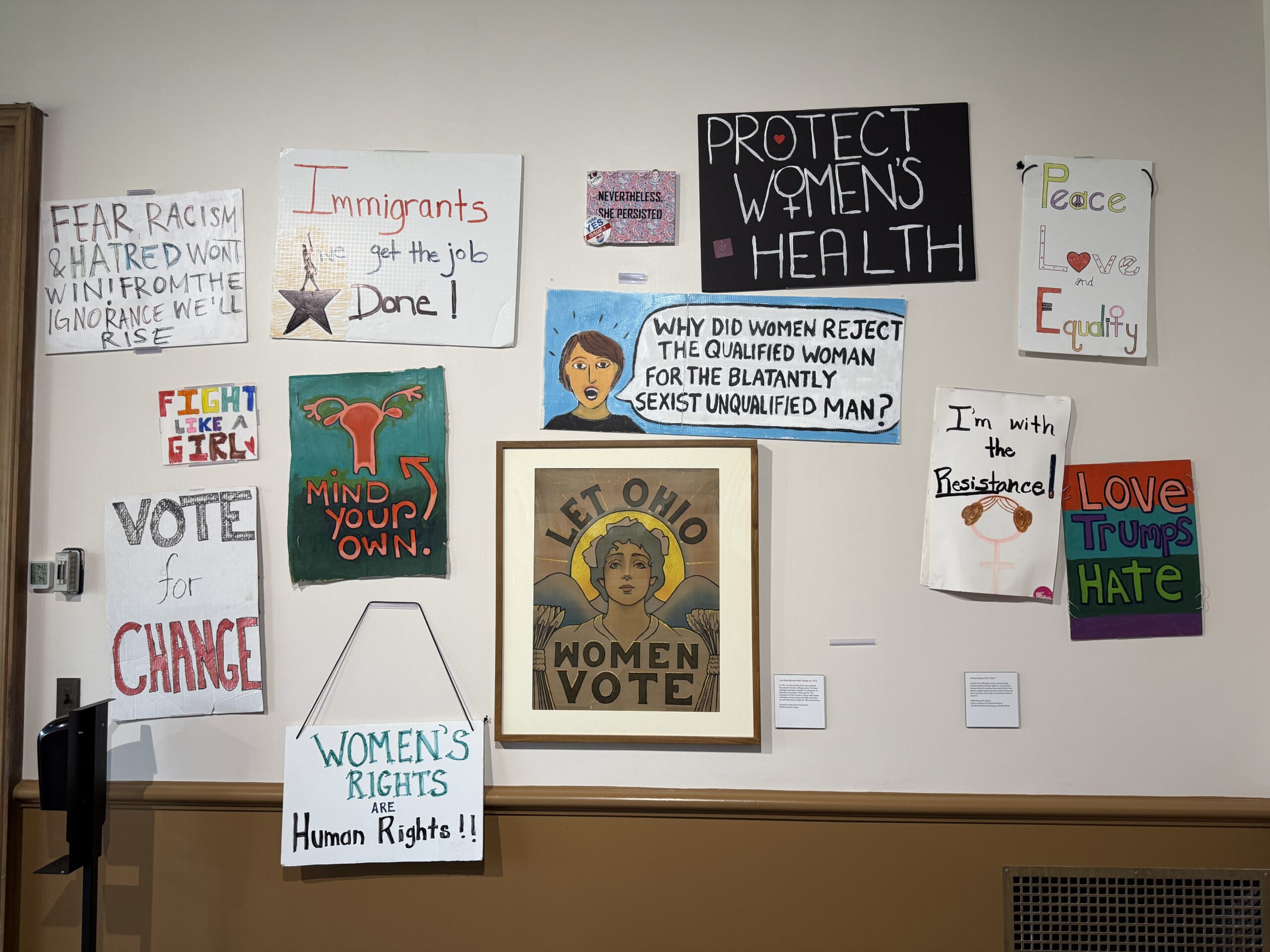

In a similar vein, the museum had a show devoted to women and politics, ignoring the other 73 gender IDs recognized by Science.

I wonder if nonprofit orgs are, after government and universities, principal sources of division in American society.

Circling back to Cleveland, though, why is this waterfront city such a spectacular failure?

Full post, including comments