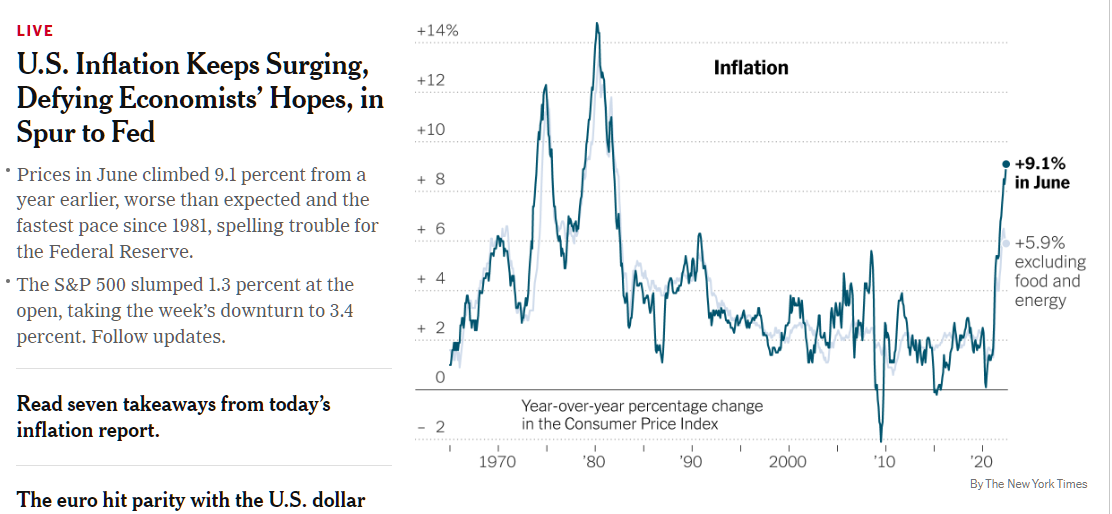

We’ve had runaway government borrowing and spending, plus money-printing by the Fed, for the past two years. Now we have runaway inflation, which has led to some eye-popping asset prices and a government eager to collect a share of these assets even before they’re sold (“unrealized gains”). See “Biden to Include Minimum Tax on Billionaires in Budget Proposal” (NYT, 3/26/2022):

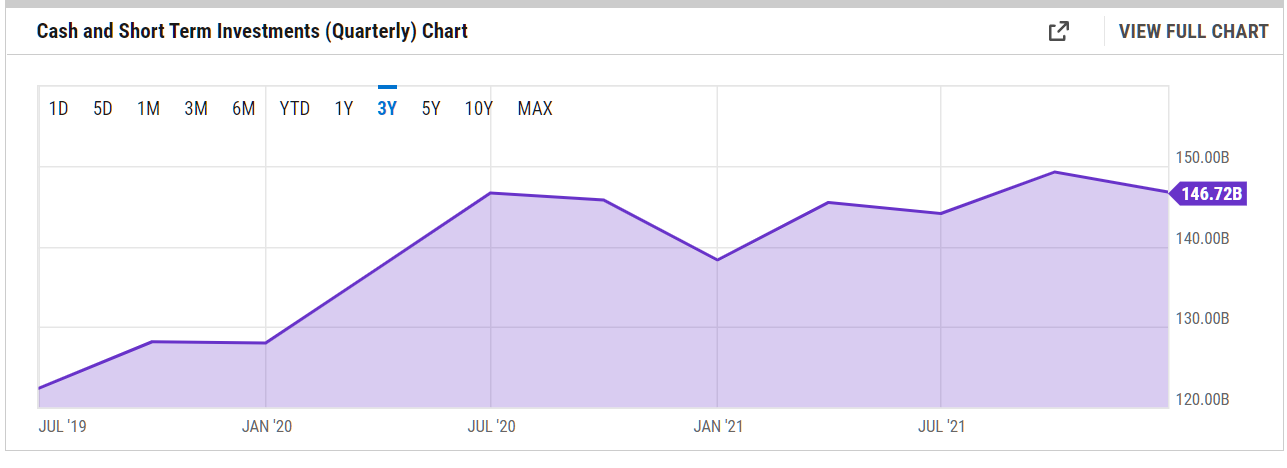

The tax would require that American households worth more than $100 million pay a rate of at least 20 percent on their income as well as unrealized gains in the value of their liquid assets, such as stocks and bonds, which can accumulate value for years but are taxed only when they are sold.

Legal questions about such a tax also abound, particularly whether a tax on wealth — rather than income — is constitutional. If Congress approves a wealth tax, there has been speculation that wealthy Americans could mount a legal challenge to the effort.

Due to the threshold of $100 million in assets, I’m a huge supporter of this bill! (though I’m concerned that it won’t be long before either the threshold is reduced or $100 million is the price of a Diet Coke). But it makes me wonder about whether the whole framework of capital gains is Constitutional.

Let’s ignore the mechanics of taxing someone on gains that exist only on paper and just focus on traditional capital gains taxes on realized gains (i.e., money received after an asset sale). The government is mostly in charge of what happens to the value of money because the government can decide interest rates, money printing rates, and how much the government will borrow and spend. The Sixteenth Amendment gives the government the power to tax incomes:

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

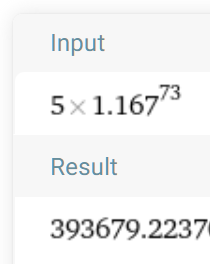

But it isn’t income when an asset goes up hugely in nominal dollars because dollars have been devalued by the government’s actions. This has been mostly ignored in U.S. history because mostly inflation hasn’t been too extreme (though, of course, for long-held assets, the cumulative effect could still be dramatic). Consider a person who hits 70 and sells some stocks purchased in 1972 to fund retirement. Let’s suppose that these shares were purchased for $10,000 in 1972 and sold for $65,000 today. According to the government’s own CPI calculator, the investor suffered a loss, not a gain, on these shares (no income). Yet, if he/she/ze/they lives in California, more than $20,000 in tax could be owed (20 percent federal long-term capital gains, 3.8 percent Obamacare federal tax, 13.3 percent state tax).

How has the current system persisted for so long without a serious Constitutional challenge?

Related:

Full post, including comments